by William Smead, Smead Capital Management

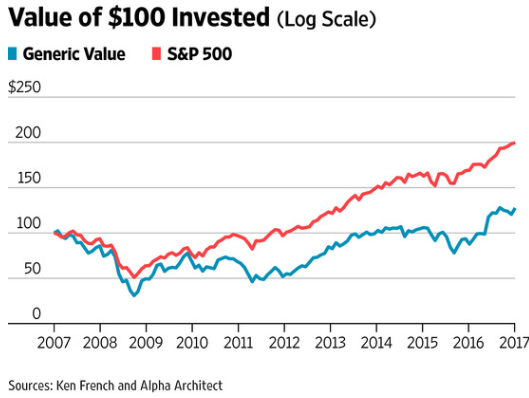

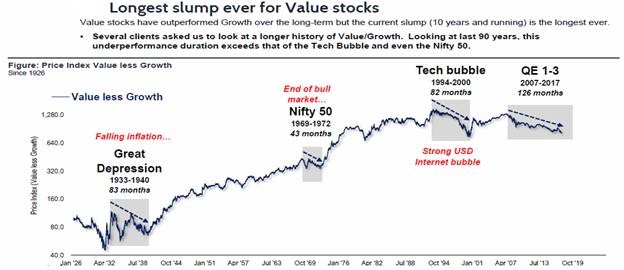

In the Bible, Jesus arrives to help his friend Lazarus a few days after he had already died. His friends Mary and Martha were very disappointed because they thought all hope was lost. As the story goes, Jesus raised Lazarus from the dead. We bring this up because of a recent blog post at The Wall Street Journal from Wesley Gray of Alpha Architect. He asked the question, “Is Value Investing Dead?” The centerpiece of the argument was the chart below which shows a dismal ten years for value investors:1

Since we have practiced our large cap value management discipline for nearly ten years, we thought it would be helpful to dissect and explain value investing’s difficult era and show where we fit into this discussion.

From a ten-year standpoint, the financial meltdown of 2007-2009 crushed low price-to-earnings ratio (P/E) and low price-to-book value ratio (P/B) stocks early in the period. Mathematically, value got off on the wrong foot early in the sequence and it was a deficit which could not be made up in the aftermath by low P/B stocks. In effect, value was in the tomb.

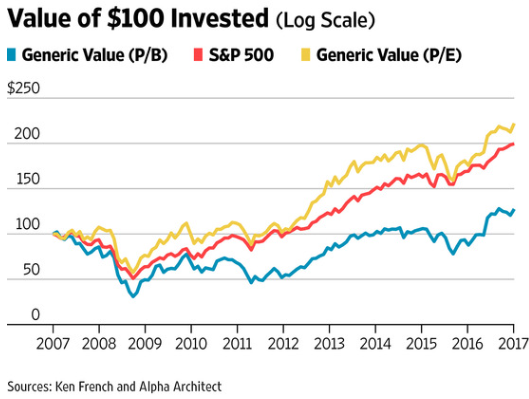

There has been a big differential in performance between measuring value by P/E versus measuring by P/B in the last ten years:1

Economic historians will most likely look back at the anemic nature of the economic recovery since 2009 and the resulting historically low interest rates as a driver of growth stock success. First, when growth in the economy is hard to come by, investors will pay up for any definable growth, even if it is profitless. Second, the best growth in the economy emanated from the technology sector of the S&P 500 Index, which historically trades at very high prices in relation to book value. Third, very low interest rates for a long stretch of time emboldens investors to over-pay for future growth and creates a psychological extreme. Lastly, commodity prices broke down beginning in 2011 decimating energy and basic materials company shares. These kinds of companies traditionally dominate the lowest P/B quintile and sealed the tomb.

As a firm, we have eight criteria for stock selection which lean toward the P/E side of the value equation. We aim to be a low turnover manager (approximately 16% on average over the last five years), meaning that we hold our winners a lot longer than most value managers. Historically, this has meant that we have allowed our holdings to remain in the portfolio long after leaving the lowest P/E quintile, keeping us very much alive.

We do this because of the qualitative characteristics we screen for in our eight criteria for stock selection. Effectively, the low P/E stocks we bought years ago and have held many years were more rewarding than trying to make lemonade out of each year’s low-price quintile lemons. Business hasn’t been good in the stock market graveyard.

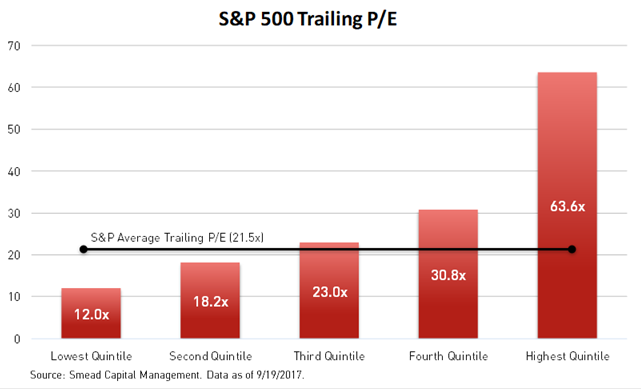

What has developed the last ten years is a very bifurcated market like the ones which existed in 1972 and 1999. High P/E stocks dwarf less expensive stocks in price and by market capitalization (see chart below):2

If Lazarus (value investing) wants to rise from his (its) tomb, some combination of the following must happen:

1. Energy and other asset-rich companies must do better in the lowest P/B quintile

2. Consumer discretionary stocks (retailer, auto, media, etc.) and financial stocks must do well in the lowest P/E quintile (61 out of 100 companies in the current list)

3. Stocks in the two highest P/E and P/B quintiles must do poorly in relation to average and inexpensive stocks

4. The economy must strengthen and/or interest rates must rise and normalize

This long-term chart shows the history of value beating growth and gives us clues on how this episode could play out:3

We believe the challenge for us as value investors with a qualitative bent is to beat the index the next ten years when value (especially low P/B value stocks) rebounds relative to the rest of the S&P 500. Some of the biggest and longest underperformance episodes for value have been followed by big stock declines in the aftermath of glamorous growth stock eras (1973-1974 and 2000-2003). Eras of anemic economic output like 1933-1940 and the recent episode from 2007-2017 would need to end for value to succeed. In our stock picking discipline, we welcome all environments and enjoy the challenge in whatever the future holds for common stock investors. We believe value investing never dies, but it does hibernate in the tomb longer than we and many value oriented Mary’s and Martha’s would like.

Warm Regards,

William Smead

1Source: The Wall Street Journal

2Source: Smead Capital Management

3Source: Fundstrat “Value continues to gain traction, Value Cyclicals leading turn” published September 22, 2017.

The information contained in this missive represents Smead Capital Management’s opinions, and should not be construed as personalized or individualized investment advice and are subject to change. Past performance is no guarantee of future results. Bill Smead, CIO and CEO, wrote this article. It should not be assumed that investing in any securities mentioned above will or will not be profitable. Portfolio composition is subject to change at any time and references to specific securities, industries and sectors in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. In preparing this document, SCM has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources. A list of all recommendations made by Smead Capital Management within the past twelve-month period is available upon request.

© 2017 Smead Capital Management, Inc. All rights reserved.

This Missive and others are available at www.smeadcap.com.