by Blaine Rollins, 361 Capital

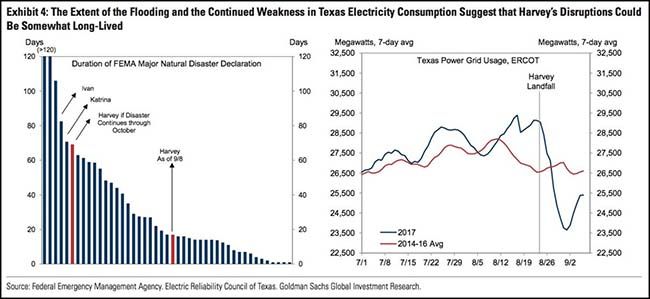

As if U.S. economic growth wasn’t difficult to predict, an economist’s job just became more difficult. Hurricanes Harvey and Irma will throw a wrench into the smooth patterns of forecasting for not only 2017, but well into 2018. If anyone in the market is looking for volatility, just take a look at your future GDP forecasts. The hits will be weighted in Q3 by Energy and Industrial shutdowns in Texas, and then in both Q3 and Q4 by more consumer-related activity in Texas and specifically, Houston. The next question is how quickly can the Florida tourism machine get back up to speed for the winter season. The current data is still very fluid and so guesstimates are just that. And are you keeping an eye on Hurricane Jose for this weekend?

To receive this weekly briefing directly to your inbox, subscribe now.

The economic data for 2017-18 is about to get very messy as you can see how quickly the Texas economy slowed after Harvey, and how damage estimates continue to rise…

@SoberLook: Harvey Damage Estimates Rose Sharply and Have Settled in the $60-100bn Range

(Goldman Sachs)

If the severity of storms is going to worsen in the future, maybe the auto manufacturers should bring back the Duck Boat…

Few American cities depend on cars as much as Houston. More than 94 percent of the city’s households have cars, second only to Dallas, the Cox Automotive consultancy says. Houston is even less amenable to walking, bicycle-riding and mass transit than freeway-mad Los Angeles, according to Walk Score, which promotes walkable communities.

Fourteen-lane highways link downtown Houston to its sprawling suburbs. Off-ramps are stacked five-high at some interchanges, inducing vertigo for motorists unschooled in driving Houston-style. Outside the city center, isolated islands of office towers are connected only by concrete and asphalt.

Cars are “everything here,” Hartmann says. “Cars are part of a person’s lifestyle. Most people in our area work 25, 30 miles from home.”

Houston is used to flooding. But it had never seen anything like Harvey, which dropped a year’s worth of rain onto the metro area. Flooded roads and neighborhoods left cars submerged and, in most cases, impossible to salvage.

“Almost every square inch of your vehicle has wires in it,” says Rebecca Lindland, executive analyst at Cox Automotive. “The materials are often flame-retardant, but they are not waterproof.”

(AP News)

Harvey has put the U.S. construction industry in a tight spot. Here are some numbers…

Before Harvey, construction workers across the U.S. were already in tight supply and material costs were rising. Houston is likely to face such a severe crunch that it could affect the national economy by pushing up material costs and driving down the U.S. unemployment rate for construction workers further, according to Robert Dietz, chief economist at the National Association of Home Builders. There were 225,000 unfilled construction jobs in June, near the recent high of 238,000 recorded in July 2016, according to a National Association of Home Builders analysis of Labor Department data.

In all, 10,000 to 20,000 workers could be needed to rebuild the homes damaged by Harvey alone, or 10% to 20% of the total number of residential construction workers in the Houston metropolitan area, according to the National Association of Home Builders.

(WSJ)

The Fed’s beige book noted certain tightness in the labor market last week. This will add to the challenge of rebuilding Houston and Florida…

Employment growth slowed some on balance, ranging from a slight to a modest rate in most Districts. Labor markets were widely characterized as tight. There were reports of worker shortages in numerous industries, most notably in manufacturing and construction. Firms in the Atlanta, St. Louis, and Minneapolis Districts said that they had turned down business because they could not find the necessary workers. Many Districts indicated that businesses were having difficulty filling openings at all skill levels. In spite of the tight labor market, the majority of Districts reported limited wage pressures and modest to moderate wage growth. That said, there were reports from firms in the Dallas and San Francisco Districts that labor shortages were pushing up wages.

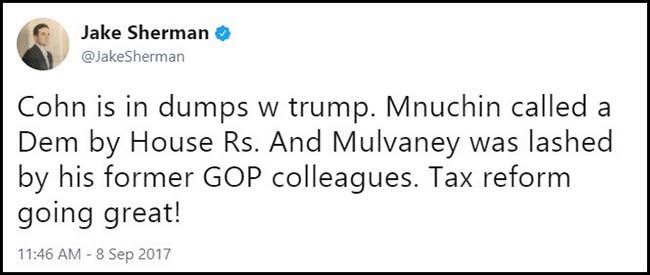

Meanwhile in Washington D.C., this about sums it up for the White House economic team…

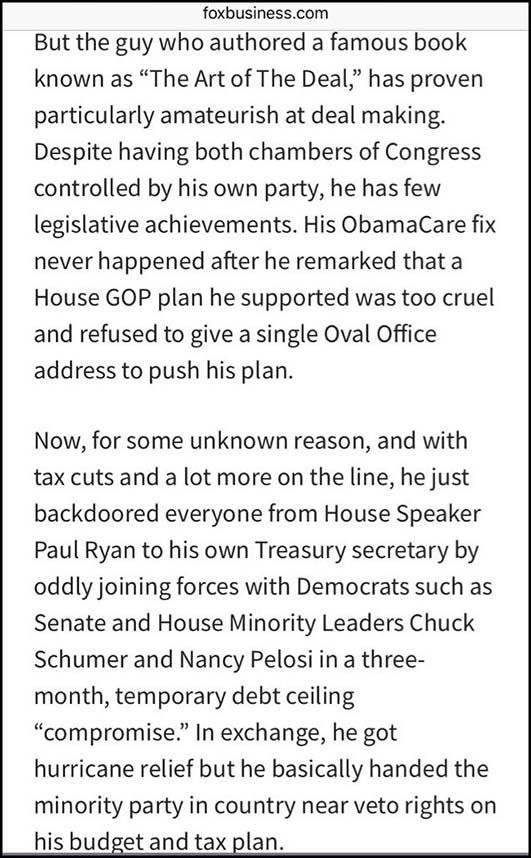

Charlie Gasparino even let his displeasure as to the week’s deal making fly…

(@CGasparino)

Washington’s problems bled over into further U.S. Dollar weakness…

This past week’s decline, however, was spurred in-part by a host of U.S.-centered issues, from political paralysis in Washington that has dented hopes that lawmakers will push through tax cuts anytime soon to uncertainty over who will next lead the Fed. Signs of tepid economic growth have also raised concerns the currency could be overvalued, while relief over a deal between Congress and the Trump administration to raise the debt limit has been tempered by the brevity of the three-month extension and worries that the relationship between the White House and congressional Republicans looks more strained than ever.

A continued dollar decline would signal “that investors are losing confidence in the direction the U.S. is going,” said Paresh Upadhyaya, a portfolio manager at Amundi Pioneer Asset Management.

(WSJ)

For the week, International Equities led Domestic; but Bonds and Gold were the best plays…

(9/8/17)

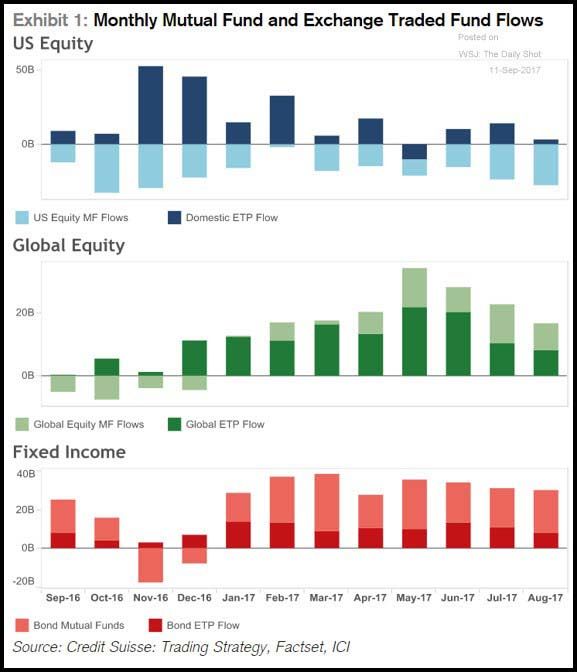

As performance would suggest, investors remain more interested in Fixed Income and International Equity funds over Domestic Equity funds…

(WSJ/Daily Shot)

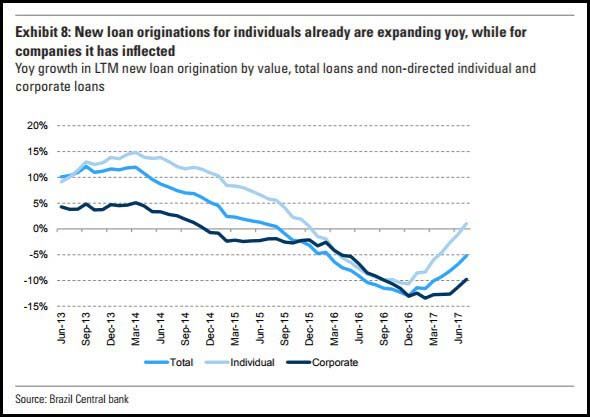

Brazilian loan growth has pivoted to the positive…

Individual originations are now positive year-over-year, while corporate originations are less negative. Combine this with stable-to-falling problem loans and you have the makings for not only an attractive banking sector, but also the backdrop for a much better economy.

(Goldman Sachs)

China moves one step closer to killing the internal combustible engine…

China will set a deadline for automakers to end sales of fossil-fuel-powered vehicles, becoming the biggest market to do so in a move that will accelerate the push into the electric car market led by companies including BYD Co. and BAIC Motor Corp.

Xin Guobin, the vice minister of industry and information technology, said the government is working with other regulators on a timetable to end production and sales. The move will have a profound impact on the environment and growth of China’s auto industry, Xin said at an auto forum in Tianjin on Saturday.

The world’s second-biggest economy, which has vowed to cap its carbon emissions by 2030 and curb worsening air pollution, is the latest to join countries such as the U.K. and France seeking to phase out vehicles using gasoline and diesel. The looming ban on combustion-engine automobiles will goad both local and global automakers to focus on introducing more zero-emission electric cars to help clean up smog-choked major cities.

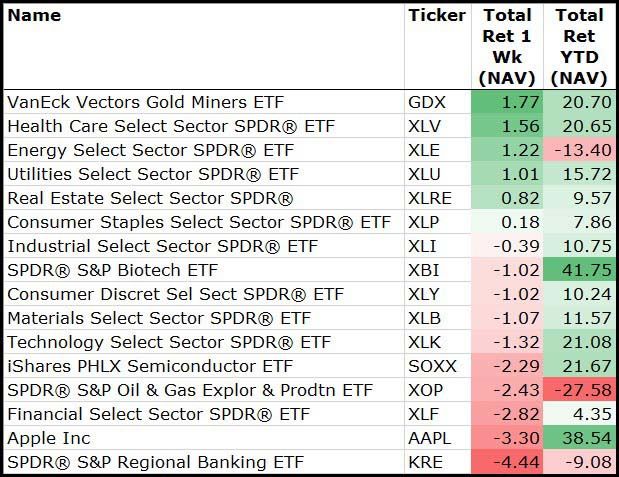

Looking at the U.S equity sectors last week, the Miners followed Gold into the top slot, while Health Care put in another strong effort…

(9/8/17)

Regional Bank stocks earned a rotten green tomato splat last week…

Post-election excitement surrounding an accelerating U.S. economy pushing both loan growth and net interest margins higher has hit the pavement. Now global investors are looking to Europe and Asia for bank stocks. The shine has worn off U.S. Bank stocks and they are now in full distribution by their owners.

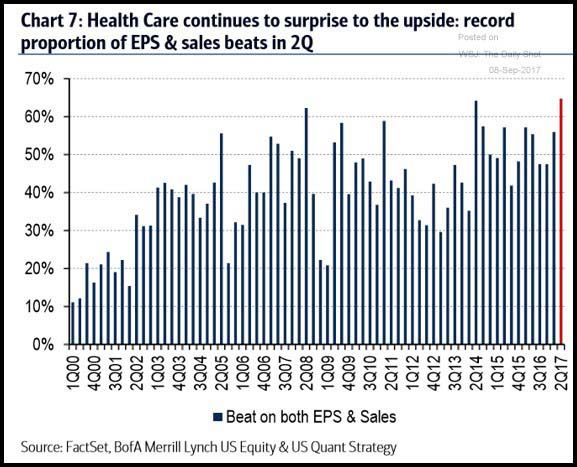

Why is Health Care one of the leading sectors in 2017?

Because stocks follow earnings. Better-than-expected earnings typically translates into better-than-expected stock price performance. Once again, if you are looking for a strategy to capture this effect, send me an email.

(WSJ/Daily Shot)

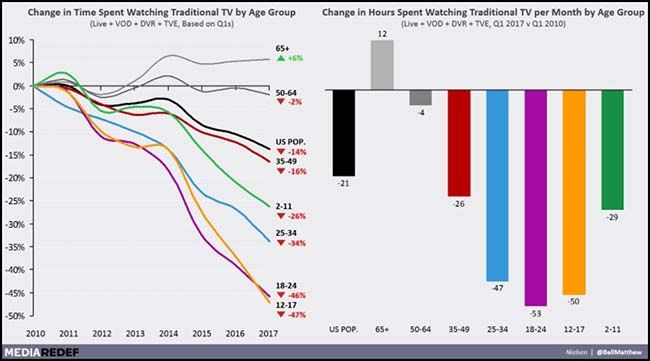

Football is back! (for the shrinking audience that’s still paying attention)…

The NFL kickoff game broadcast on Thursday night on NBC, a win by the Kansas City Chiefs over the New England Patriots, attracted 21.8 million TV viewers, down more than 13 percent from last year’s opening game, data from NBC and Nielsen showed.

Last year’s game between the Carolina Panthers and Denver Broncos, also on Comcast Corp unit NBC, drew 25.2 million TV viewers.

(Reuters)

Actually Football ratings are killing it (if you compare it against the broader TV population under the age of 49)…

@ballmatthew: Updated for Q1 2017: Decline of Pay TV usage by demographic. 12-24 down 47% (52 fewer hours a month), only 65+ is up. Very rough Q1.

Amazon is looking for a second headquarters. The New York Times crunched the data. Coloradans will like the results…

So Denver it is. The city’s lifestyle and affordability, coupled with the supply of tech talent from nearby universities, has already helped build a thriving start-up scene in Denver and Boulder, 40 minutes away. Big tech companies, including Google, Twitter, Oracle and I.B.M., have offices in the two cities. Denver has been attracting college graduates at an even faster rate than the largest cities. The region has the benefits of places like San Francisco and Seattle — outdoor recreation, microbreweries, diversity and a culture of inclusion (specifically cited by Amazon) — but the cost of living is still low enough to make it affordable, and lots of big-city refugees have been moving there for this reason. Amazon would be smart to follow them.

(NY Times)

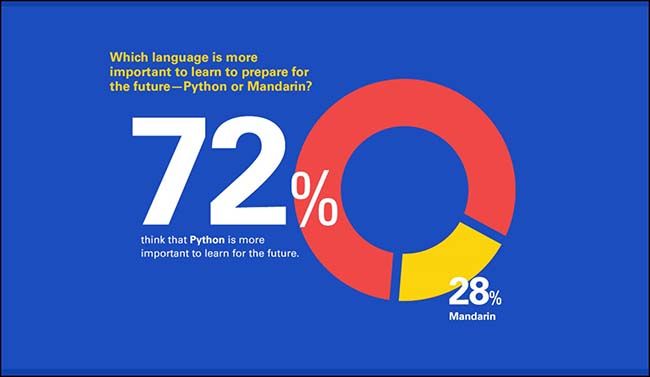

I wonder if more students in Colorado are studying Python over Mandarin…

Of course, it would be even better if they were becoming an expert in both languages.

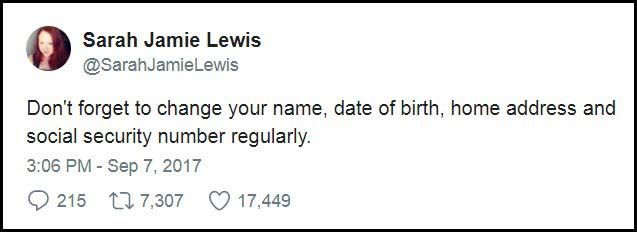

Finally, in the event that you were worried about the data breach at Equifax last week, here is the perfect solution to avoid identity theft in the future…

Copyright © 361 Capital