by Ryan Detrick, LPL Research

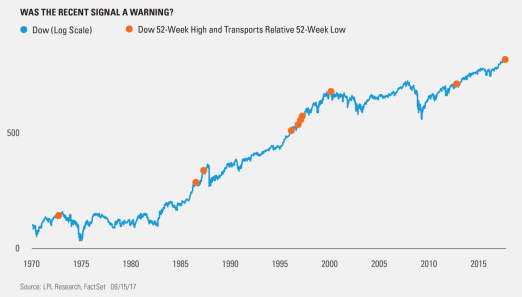

The Dow Jones Transports (transports) have been one of the weakest segments of the market since July. As Charles Dow suggested more than 100 years ago, for the primary trend to be in place we need to see the transports confirm the action in the Dow Jones Industrial Average (Dow). In other words, if the Dow makes a new high and the transports group doesn’t, that is a potential warning sign.

Well, on August 1, 2017 the Dow closed at a new 52-week high, yet the transports group closed at a new 52-week low relative to the Dow. In others words, the performance gap, or spread, between the two is at its widest over the past year. So it would seem transports aren’t carrying their weight; and the question is: Is this a major warning sign?

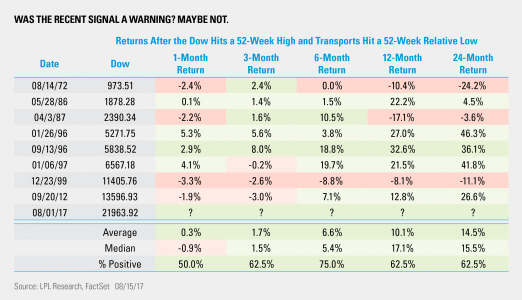

Per Ryan Detrick, Senior Market Strategist, “Going back in history, we have often seen the rare combo of a 52-week high in the Dow and a 52-week relative low in transports precede some tumultuous times. It took place ahead of the ‘73/’74 bear market, the ’87 crash, and the ’00 peak for starters, which makes the signal seen earlier this month something we aren’t taking lightly.”

Now here’s the good news: The track record of this rare signal is far from spotless. Per Ryan Detrick, “Although on the surface this sounds scary, looking at all the signals (to remove clusters, each instance must be at least three months apart to define a new signal) in which the Dow and Dow/transports spread hit new 52-week highs, the Dow has been up a median 17.1% over the following year. We’d still say the weakness in transports is a concern, but a bigger concern is that we’ve gone more than a year without a 5% correction, and there are multiple big events (think debt ceiling, tax reform, and infrastructure spending) out of Washington on the horizon that could trip up the market.”

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

The economic forecasts set forth in the presentation may not develop as predicted.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

Stock investing involves risk including loss of principal.

Because of its narrow focus, specialty sector investing will be subject to greater volatility than investing more broadly across many sectors and companies.

The Dow Jones Industrial Average Index is comprised of U.S.-listed stocks of companies that produce other (non-transportation and nonutility) goods and services. The Dow Jones Industrial Averages are maintained by editors of The Wall Street Journal. While the stock selection process is somewhat subjective, a stock typically is added only if the company has an excellent reputation, demonstrates sustained growth, is of interest to a large number of investors, and accurately represents the market sectors covered by the average. The Dow Jones averages are unique in that they are price weighted; therefore, their component weightings are affected only by changes in the stocks’ prices.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor

Member FINRA/SIPC

Tracking #1-634806 (Exp. 08/18)

Copyright © LPL Research