by Drew O'Neil, Fixed Income, Raymond James

When the Fed announced that they were raising the federal funds rates for the first time post-recession in December of 2015, many investors and market pundits proclaimed that this was the beginning of interest rates heading higher. This is a classic example of people connecting dots that should not necessarily be connected. When a headline proclaims that the Fed is raising “rates”, what that really means is that the Fed is raising the overnight rate, i.e. the shortest point on the yield curve. What they are NOT doing is raising yield for the entire yield curve. The rest of the yield curve is controlled by various global, macroeconomic factors, not the Fed. Making the assumption that just because the Fed is raising “rates”, the yield curve is headed higher is a common and possible costly mistake. Keep this in mind the next time you find yourself hesitant to invest in fixed income (or convince yourself that a short-duration portfolio is ideal) because of what the Fed may or may not do over the next few months/years.

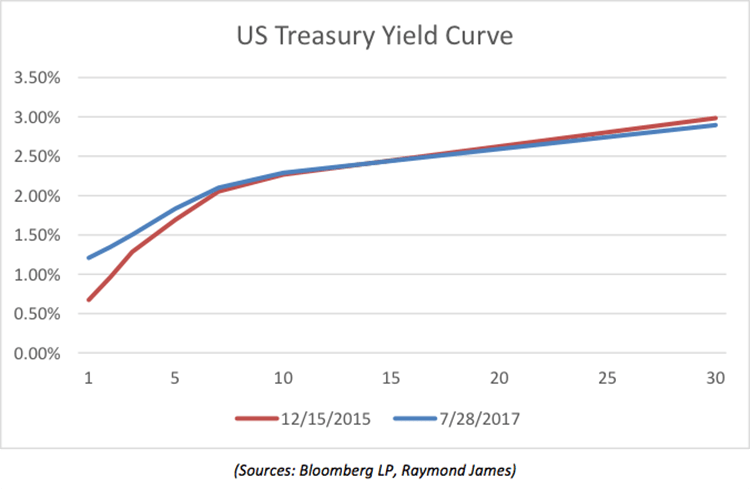

To illustrate this point, take a look at the graph below, which shows the yield curve on the day that the Fed began raising “rates” (red line) and the yield curve today (blue line). Over this time frame, the Fed has raised rates four times for a total of 100 basis points. Notice anything? Does the blue line look like it is 1% higher than the red line? Clearly, it is not. The blue line is higher on the short end of the curve, but for a vast majority of the curve, where most investors are actually investing their money, the yield curve is essentially identical (to slightly lower).

This might not make sense to a casual observer, but when you understand what drives interest rates, it is not surprising. The shape of the yield curve is determined by an endless number of factors; no single data point or entity (not even the Fed) can control the entire curve. It is impossible to point to a single factor to explain why interest rates have not changed much since December of 2015, but to highlight a few:

- Inflation: still below the Fed’s target and not showing signs of “running away” anytime soon. From last week’s FOMC statement: “overall inflation and the measure excluding food and energy prices have declined and are running below 2 percent. Market-based measures of inflation compensation remain low”

- Global interest rate disparity: The 10-year US Treasury is currently 2.30%. Compare this to Germany (0.56%) and Japan (0.083%). This drives foreign investors to seek the higher yields and safety of US Treasuries. Higher demand = higher prices = lower yields

- Indirect bidding in Treasury auctions (a gauge of foreign interest) remains historically high, in the 60-70% range

- Continued stimulative monetary policy by central banks (ECB, BOJ)

- An aging demographic driving more and more retirees into fixed income, increasing demand

- US GDP: slow and steady, not shooting through the roof but still better than many countries

Just a few things to keep in mind if you are sitting on the sidelines for the Fed to “create” higher interest rates before putting your fixed income dollars to work.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Copyright (c) Raymond James