by Lance Roberts, Clarity Financial

Janet Yellen, Federal Reserve Chair, recently stated;

“Will I say there will never, ever be another financial crisis? No, probably that would be going too far. But I do think we’re much safer and I hope that it will not be in our lifetimes and I don’t believe it will.”

That is a pretty bold statement to make considering that every one of her predecessors failed to predict the negative consequences of their actions.

Will there will be another “Financial Crisis” in our lifetimes?

Yes, it is virtually guaranteed.

The previous “crisis” wasn’t about just “an asset gone bad,” but rather the systemic shock caused by a “freeze” in the credit markets when Lehman Brothers filed for bankruptcy. Counterparties evaporated, banks froze lending and the credit market ceased to function.

Credit, not the stock market, is the “lifeblood” of the economy.

Of course, it is all good now because the Federal Reserve says so with Ms. Yellen placing a great amount of faith in the Federal Reserve’s own carefully constructing, and recently released results, of “bank stress tests.” Interestingly, EVERY bank passed with flying colors. In other words, the Millennial generation has now passed the baton of “Everybody Gets A Trophy” to the banking sector.

“Test results released by the Federal Reserve show that the 34 institutions under scrutiny have enough capital to make it through the two scenarios regulators posed — one akin to the financial crisis and another entailing a shallower downturn.

Under the scenarios, the banks tested ‘would experience substantial losses.’ However, in total, the institutions ‘could continue lending to businesses and households, thanks to the capital built up by the sector following the financial crisis.’

In the most severe scenario, bank losses are projected to be $493 billion. In the less severe, the losses were put at $322 billion.”

This passage of the “test” by every bank, of course, is based on several faulty assumptions including:

- FASB Rule 157 is still repealed allowing banks to mythically mark bad assets to “face value” which makes balance sheets stronger than they appear. So, how do you know what “toxic assets” still exist?

- There is roughly $2 Trillion of excess reserves supporting banks which will evaporate IF the Fed actually commences with shrinking their bloated balance sheet.

- The worst case scenario only accounted for a “doubling” of the unemployment rate, or 8.6% from current levels, despite the fact we have an exceptionally low labor force participation rate and a surge to more than 10% is quite likely in the next recession.

- With more leverage in the system than at any point any previous history, and banks inextricably linked to the financial markets, just how sensitive are the tests to another “worst case scenario?”

What was NOT included in the test was another “Financial Crisis” scenario which SHOULD be the baseline of the stress tests to begin with. Unemployment rates of 15% or more, asset price declines of 50% and default rates of 20% or greater on outstanding debt should be the baseline by which you stress test financial systems against another systemic shock.

The Federal Reserve is once again engaging in very faulty thinking by believing the system will operate normally during a more severe economic scenario. It isn’t just the losses projected on the banking sector in terms of defaulting loans that are the problem, but also the collapse in the asset markets when defaults ramp sharply as recessionary pressures build. Most assuredly, lenders will immediately shut off access to capital leading to another “freeze” in the credit system. (Not to mention the sharp losses in market capitalization due to share price declines.)

Here is why Janet Yellen is wrong in believing another “Financial Crisis” can’t occur.

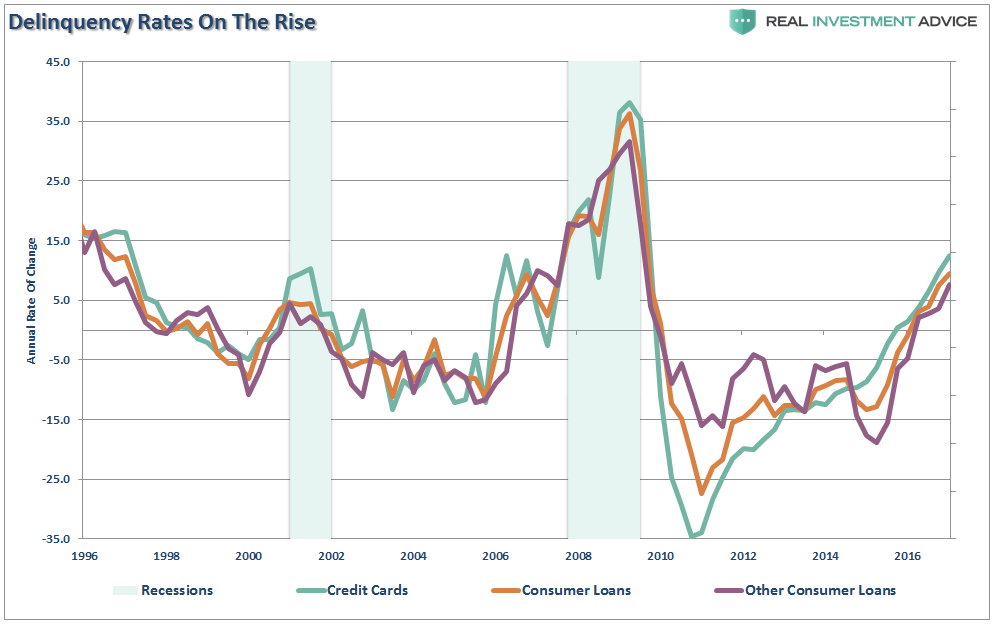

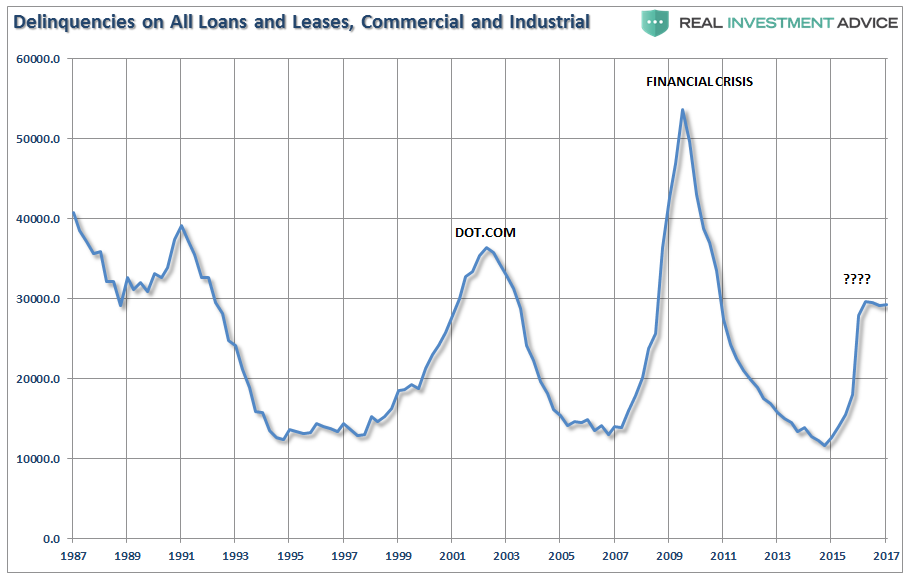

Catalyst 1: Delinquency & Defaults

We are already seeing the early warning signs with delinquency rates rising and commercial lending on the decline in both consumer and commercial and industrial loans.

Of course, as I noted above, once delinquency and default rates begin to rise, the first thing banks tend to do is to stop lending. Naturally, as banks shut off capital to businesses, private investment begins to slow which reduces employment and leads to slower economic growth.

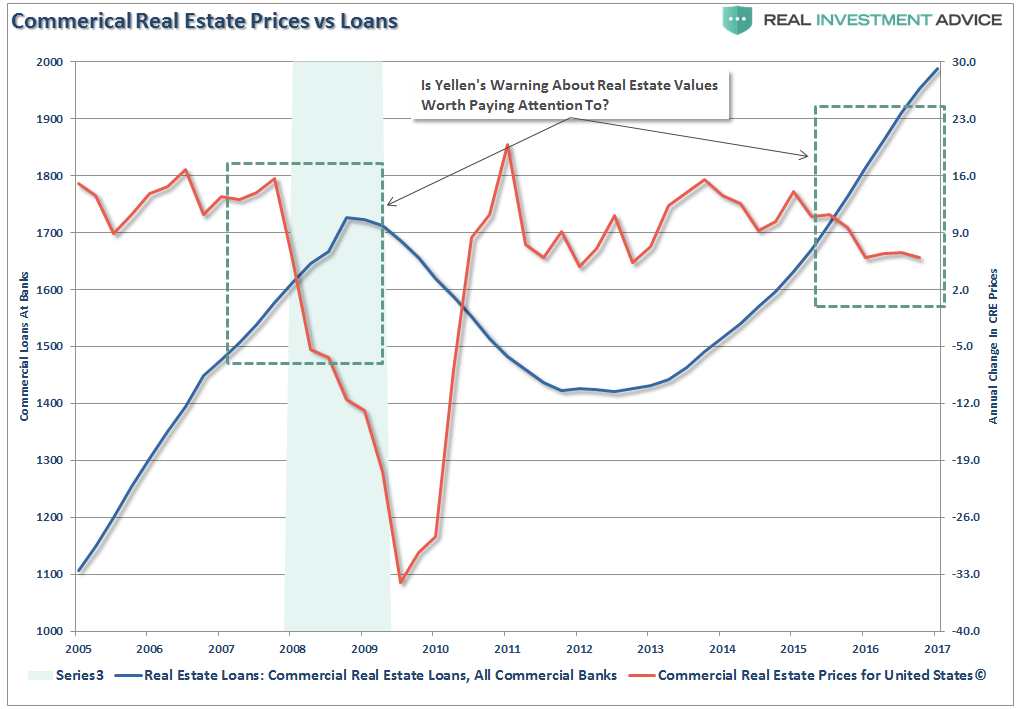

Of course, this also includes the credit problems of the collapse in Commercial Real Estate which is grossly leveraged at a time when prices have begun to stagnate with an oversupply of inventory sitting on the ground.

Catalyst 2: Leverage & Robots

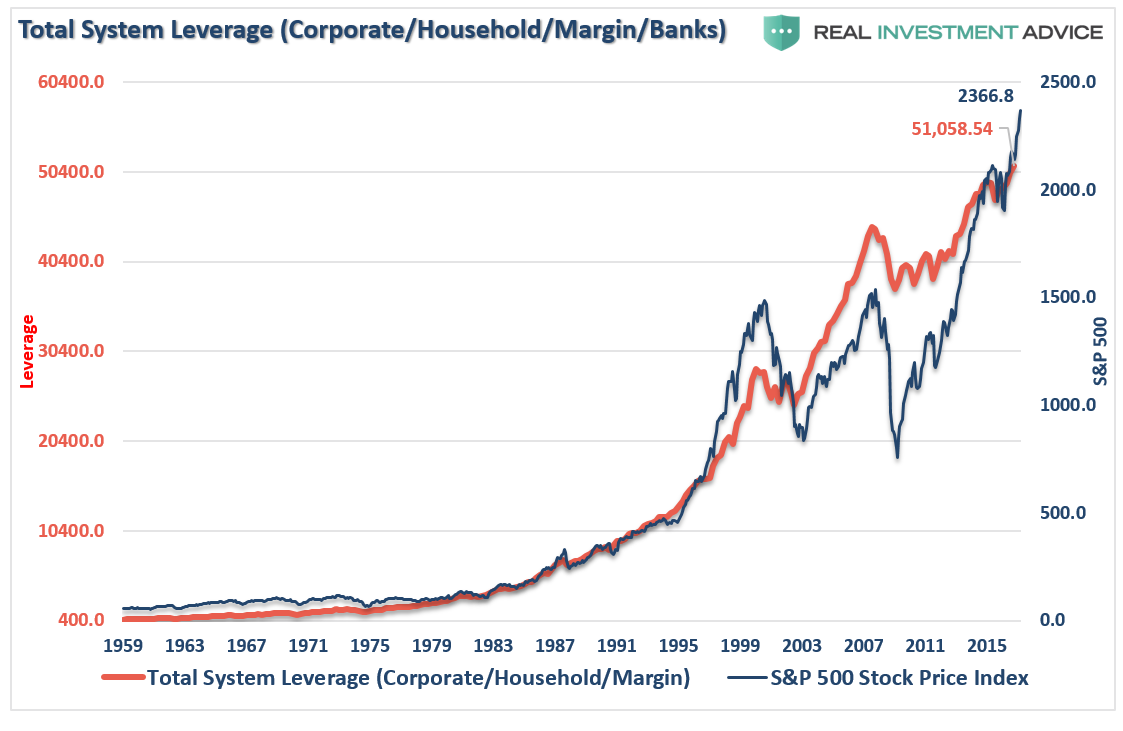

It isn’t just bank loans which will catalyze the coming financial crisis. It is also, be the massive surge in debt and leverage over the last eight years including student loans, credit cards, corporate debt and margin loans. As I discussed recently in the “Illusion Of Liquidity:”

“The illusion of liquidity has a dangerous side effect. The process of the previous two debt-deleveraging cycles led to rather sharp market reversions as margin calls, and the subsequent unwinding of margin debt fueled a liquidation cycle in financial assets. The resultant loss of the ‘wealth effect’ weighed on consumption pushing the economy into recession which then impacted corporate and household debt leading to defaults, write-offs, and bankruptcies.”

“With the push lower in interest rates, the assumed ‘riskiness’ of piling on leverage was removed. However, while the cost of sustaining higher debt levels is lower, the consequences of excess leverage in the system remains the same.”

You will notice in the chart above, that even relatively small deleveraging processes had significant negative impacts on the economy and the financial markets. With total system leverage spiking to levels never before witnessed in history, it is quite likely the next event that leads to a reversion in debt will be just as damaging to the financial and economic systems.

Of course, when you combine leverage into investor crowding into “passive indexing,” the risk of a “disorderly unwinding of portfolios” due to the lack of market liquidity becomes an issue. As Mark Carney, head of the BOE, recently opined:

“Market adjustments to date have occurred without significant stress. However, the risk of a sharp and disorderly reversal remains given the compressed credit and liquidity risk premia. As a result, market participants need to be mindful of the risks of diminished market liquidity, asset price discontinuities and contagion across asset markets.’”

At some point, that reversion process will take hold. It is then investor “psychology” will collide with “margin debt” and ETF liquidity. As I noted in my podcast with Peak Prosperity:

“It will be the equivalent of striking a match, lighting a stick of dynamite and throwing it into a tanker full of gasoline.”

When the “robot trading algorithms” begin to reverse, it will NOT BE a slow and methodical process but rather a stampede with little regard to price, valuation or fundamental measures as the exit will become very narrow.

Importantly, as prices decline it will trigger margin calls which will induce more indiscriminate selling. The forced redemption cycle will cause catastrophic spreads between the current bid and ask pricing for ETF’s. As investors are forced to dump positions to meet margin calls, the lack of buyers will form a vacuum causing rapid price declines which leave investors helpless on the sidelines watching years of capital appreciation vanish in moments.

Catalyst 3: Pensions

Lastly, and a point clearly missed by Ms. Yellen in her quest to dismiss financial crisis risks, is the $3 Trillion “Pension Crisis” that is just one sharp downturn away from imploding. The cresting of the “baby boom” generation now puts these massively underfunded pensions at risk of a “run on assets” during the next downturn which could send the entire system into chaos. Of course, this problem can be directly traced to the malfeasance of pension fund managers, and pension boards, which used excessively high return rates to lower costs of contributions.

“Pension computations are performed by actuaries using assumptions regarding current and future demographics, life expectancy, investment returns, levels of contributions or taxation, and payouts to beneficiaries, among other variables. The biggest problem, following two major bear markets and sub-par annualized returns since the turn of the century, is the expected investment return rate.

Using faulty assumptions is the lynch-pin to the inability to meet future obligations. By over-estimating returns, it has artificially inflated future pension values and reduced the required contribution amounts by individuals and governments paying into the pension system.

It is the same problem for the average American who plans on getting 6-8% return a year on their 401k plan, so why save money. Which explains why 8-out-of-10 American’s are woefully underfunded for retirement.”

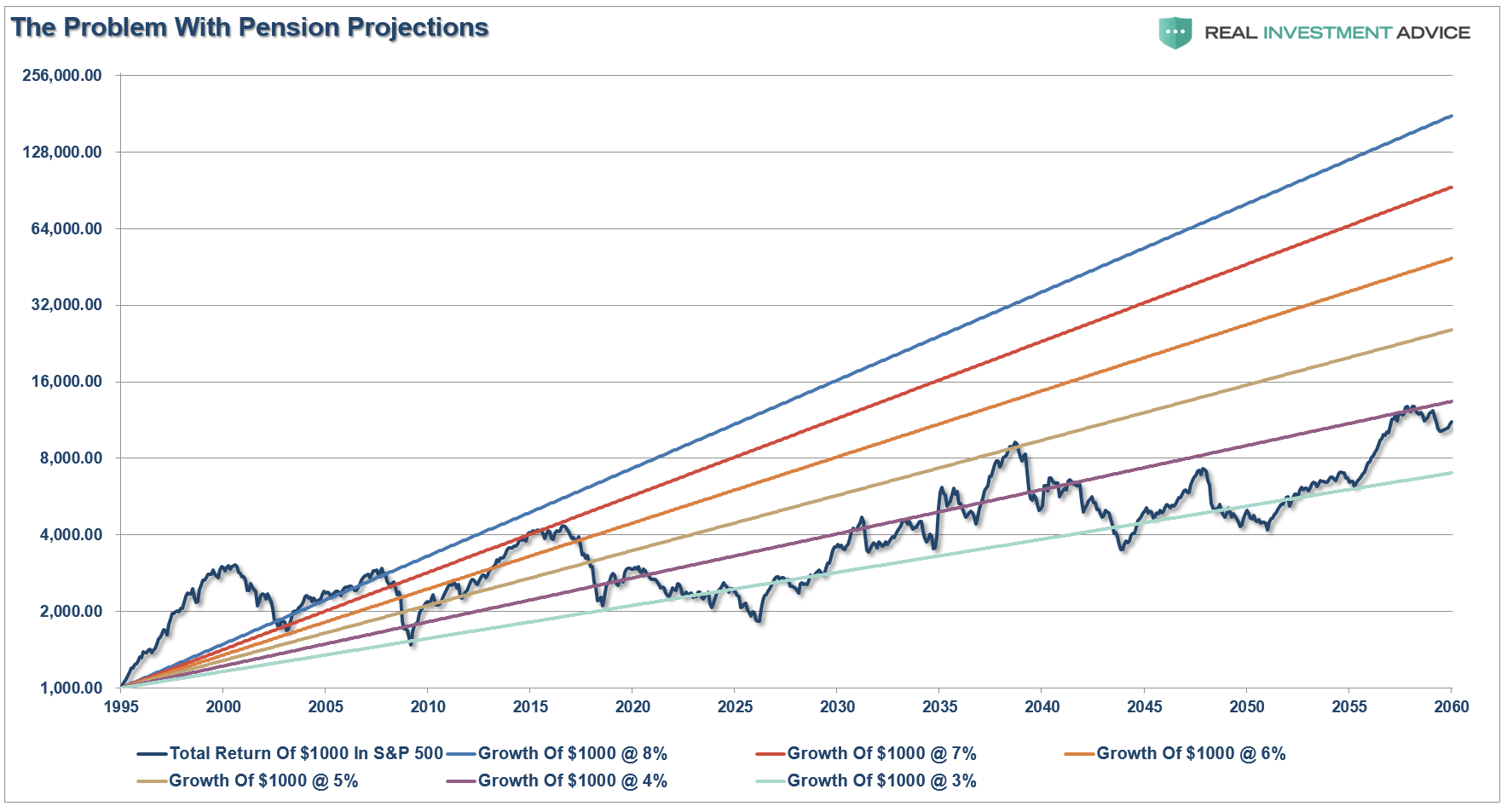

The chart below demonstrates the problem pensions face today. The chart shows a $1000 investment into the S&P 500 TOTAL return from 1995 to present. There is a substantial difference between a dollar-weighted outcome in markets versus just looking at a market-capitalization weighted index return. I have then projected for using variable rates of market returns with cycling bull and bear markets, out to 2060 along with projections of 8%, 7%, 6%, 5% and 4% average rates of return from 1995 out to 2060.

See the problem here. The average rate of return growth is far above what markets are expected to return over a long period of time. But this has not deterred pension funds from clinging on to exceptionally high return rates. According to a recent report from the Hoover Institution:

“Despite the introduction of new accounting standards, the vast majority of state and local governments continue to understate their pension costs and liabilities by relying on investment return assumptions of 7-8 percent per year. This report applies market valuation to pension liabilities for 649 state and local pension funds. Considering only already-earned benefits and treating those liabilities as the guaranteed government debt that they are, I find that as of FY 2015 accrued unfunded liabilities of U.S. state and local pension systems are at least $3.846 trillion, or 2.8 times more than the value reflected in government disclosures. Furthermore, while total government employer contributions to pension systems were $111 billion in 2015, or 4.9 percent of state and local government own revenue, the true annual cost of keeping pension liabilities from rising would be approximately $289 billion or 12.7 percent of revenue. Applying the principles of financial economics reveals that states have large hidden unfunded liabilities and continue to run substantial hidden deficits by means of their pension systems.””

If the numbers above are right, the unfunded obligations of approximately $4-$5 trillion, depending on the estimates, would have to be set aside today such that the principal and interest would cover the program’s shortfall between tax revenues and payouts over the next 75 years.

That ain’t gonna happen.

As Axel Merk recently penned:

“So while the banks may not need a bailout, I’m not so sure about pension funds or individual investors. Yet, ‘needing a bailout’ and actually getting one are different stories.”

Axel is right. When the next major bear market comes growling, the “financial crisis” won’t be secluded to just sub-prime auto loans, student loans, and commercial real estate. The real crisis comes when there is a “run on pensions” when the “fear” prevails that benefits will be lost entirely.

As George Will recently wrote:

“The problems of state and local pensions are cumulatively huge. The problems of Social Security and Medicare are each huge, but in 2016 neither candidate addressed them, and today’s White House chief of staff vows that the administration will not ‘meddle’ with either program. Demography, however, is destiny for entitlements, so arithmetic will do the meddling.”

Ms. Yellen is wrong about the next financial crisis. The only question is the timing and magnitude of its occurrence?

Lance Roberts

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of “The Lance Roberts Show” and Chief Editor of the “Real Investment Advice” website and author of “Real Investment Daily” blog and “Real Investment Report“. Follow Lance on Facebook, Twitter and Linked-In

Copyright © Clarity Financial