by Steve Blumenthal, CMG Capital Management Group Inc.

“Investors need risk management in bear markets, not in bull markets.”

“We are in the business of making mistakes. The only difference between the winners and the losers

is that the losers make big mistakes and the winners make small mistakes.”

“There are a lot of good ideas about how to invest and how to make money.

The one key problem is that when anything gets too popular it is going to hurt its effectiveness.”

— Ned Davis, Bloomberg Master in Business Interview (June 15, 2017)

This week, I’d like to draw to a conclusion my series of notes from Mauldin’s 2017 Strategic Investment Conference. The topics ranged from geopolitical to global macro to specific investment ideas. One of my all-time favorite economists is David Rosenberg. Today I offer my high-level bullet point notes from his presentation.

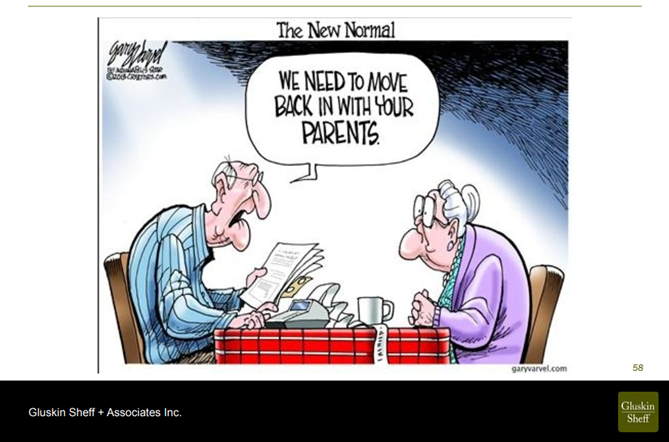

Rosenberg reminded the audience that, “[We’re] nine years into a cycle where everything is looking late cycle.” David Rosenberg is the Chief Economist and Strategist at Gluskin Sheff + Associates, where he provides a top-down perspective to the firm’s investment process and Asset Mix Committee. He, too, spoke about the challenges aging demographics present, compared Reagan’s beginning to Trump’s start and said that “the big elephant in the room is the Fed.” I found the following slide sobering (not your client, of course).

Prior to joining Gluskin Sheff in 2009, Mr. Rosenberg was Chief North American Economist at Merrill Lynch in New York for seven years, during which he consistently placed in the Institutional Investor All-Star rankings. I have great respect for David. He is humble, insightful and smart. You don’t become an All-Star by chance.

I really could stretch my conference notes out over several more letters but let’s draw to a close today. Before we jump in, I want to share a quick thought that I believe should be “on your radar.” Speaking of “big elephant,” the Fed is shifting gears. We should take note (as I’m sure you already have).

It’s all about the Fed! QE to QT

Post last week’s meeting, the Fed announced its plan to reduce the size of its $4.5 trillion balance sheet. This is a game-changer of sorts. Last week I shared a chart with you that showed how markets perform when the Fed is raising interest rates vs. lowering interest rates. But this time really is different.

When the Fed lowers interest rates, it is simulative for the economy and the markets. For investors, a golden rule is “Don’t fight the Fed.” Now, if the Fed is also in the mix printing and then buying investment securities (aka quantitative easing or “QE”), you really don’t want to fight the big guy. And when she tells us she is going to reverse course and sell the securities she owns (aka quantitative tightening or “QT”) well, you get the point. Stay mindful of risk.

Commenting on last week’s Fed meeting, Peter Schiff of Euro Pacific Capital wrote, “Here Comes Quantitative Tightening.” As you read these next few words, keep front of mind the impact liquidity injection had on inflating the markets and what the reverse of that might mean.

For the first time, the Fed set into motion firm plans to reduce the size of its $4.5 trillion dollar “balance sheet.” Such a process has been talked about for years, but many were convinced, myself included, that it would always just be talk. The balance sheet consists of Treasury and mortgage-backed bonds that the Fed amassed during the experiment with quantitative easing between 2009 and 2014. During that time, the Fed injected liquidity into the financial markets by creating money to purchase more than $80 billion per month (at times) of such securities. These efforts pushed down long term interest rates, drove up bond and real estate prices, and set the stage for a massive stock market rally that had little to do with underlying economic fundamentals. Despite several informal hints over the years that these stockpiles were being reduced through bond maturation, the war chest has not decreased in size by one iota. However, the Fed has admitted that these ponderous holdings will limit its ability to stimulate in the event of future recessions. As a result, it wants to shrink the balance sheet down to a more manageable size now, precisely so it can expand it again during the next recession.

To do this, the Fed must essentially perform quantitative easing in reverse. It must sell, or force the Treasury to sell, treasuries and mortgage-backed securities into the current market. This process will reduce the Fed’s balance sheet while drawing free cash out of the economy, thereby unwinding prior stimulus. The Fed even told us how large the reductions will be…and it’s a lot. Much in the way that the Fed “tapered” out of its QE program back in 2014, gradually reducing the $85 billion of monthly purchases by about $10 billion per month, the Fed anticipates a similar approach to what is, in effect, a “quantitative tightening” campaign, or QT for short. It will start by allowing its balance sheet to shrink by $10 billion per month (total) of mortgage and government bonds, and will gradually increase the reductions to $50 billion per month, or $600 billion per year. Those are very big numbers that will provide very real headwinds to the economy and the financial markets.

But it’s important to realize that the Fed envisions doing this at a time when Federal deficits are likely to be rising steeply. In the next few years, the Congressional Budget Office estimates that Federal budget gaps will be in at the $700 – $800 billion dollar range annually (hitting $1 trillion by 2021 or 2022). These assumptions of course do not factor in any potential any tax cuts, spending increases, or recessions (I think we are likely to get all three). So this means that in a few years, the Treasury will have to sell $600 billion of additional bonds into the market annually to repay the Fed while at the same time selling $800 billion or more to finance its current deficits. [Emphasis mine.] That may create some traffic problems. Should we assume that there are enough buyers to step up to the plate, especially if yields stay as low as they are? It’s not likely.

The Fed, as my dad would say, finds itself “stuck between a rock and a hard place.” We know the impact QE had on asset prices. We are entering a period of QT. Let’s be mindful that this is a totally different environment.

With that said, the trends for both equities and bonds remains bullish (as you’ll see when you click on the “Trade Signals” link below or here). Our models have and continue to signal “risk on.” However, my favorite equity indicator (the NDR CMG Large Cap Long/Flat Index) recently reduced exposure from 100% to 80% and the trend evidence continues to weaken. Valuations are high, the cyclical bull move is aged and the Fed is shifting gears. Risk is elevated.

Grab that coffee and find that favorite chair. Rosenberg didn’t disappoint. And have a great weekend!

Included in this week’s On My Radar:

- David Rosenberg — The Trials and Tribulations of Trumponomics

- Bob Farrell’s Famous 10 Rules of Investing

- Trade Signals — Fixed Income Remains in Buy Signal

- Concluding Thoughts – Opportunity Number Four

- Personal Note

David Rosenberg — The Trials and Tribulations of Trumponomics

I’m going to try my best to cut to the high level points. You can read the full transcript of David’s presentation here. It is worth the read.

Following are a few bullet points to give you a sense for what he is forecasting in the period ahead. There will be a few typos… I apologize in advance.

- David noted: “I am talking to investment managers or wealth managers that in the end were all risk managers and the role of the economist ultimately is not to give you some pointless point forecast but to really help identify when the sun is coming out and when the clouds are coming out.”

Much of his outlook can be captured in the following presentation titles he considered:

- I love alliterations so I call this presentation The Trials and Tribulations of Trumponomics. My hope is that in six months that it’s just not down to the word “trial.”

- I could have actually called this The Outlook in 3D, Debt, Deflation, Demographics.

- Or I could have called it Lessons in Investing Late in the Cycle.

David said: And, I’m going to cover all of those topics (and he did) but the first thing I want to discuss is this. Politics and investment is like oil and water. He shared this recent quote: “If you mix your politics with your investment decisions, you’re making a big mistake.” (Warren Buffett, February 27, 2017)

SB here: I can think of more than a few people to share that quote with.

On Fed tightening:

- He said he knows that the starting point of the funds rate was ultra-low, it’s always ultra-low and lower this cycle to be sure, but let me just say this thing, that there’s never been a Fed tightening cycle that did not expose and expunge the bubble of the day, whether that’s in subprime autos, commercial real estate, leverage ETFs, take your pick. I might be missing some.

- But, when the Fed is raising interest rates and these tightening cycles they always start off benign but they never finish benign.

- And, once again a sense of history, there have been 13 Fed tightening cycles in the post-World War II era, 10 landed us in an outright recession that the economists don’t see ‘til we were knee deep in it.

- And, there’s been three soft landings: The mid-60s, the mid-80s and the mid-90s. The mid-90s is what made Alan Greenspan into “The Maestro.”

- Take your pick though, growth is not accelerating.

- Let’s just say there’s never been a Fed tightening cycle that left the economy stronger than what it was when they started.

What I don’t quite understand is we peaked on nominal GDP growth cycle this cycle a couple of years ago at 4.9%.

- That’s never happened before. We’ve never peaked on nominal GDP growth year over year less than 5% until this cycle and now it’s 4%.

- You’ve got to start asking, where does nominal GDP, does it go negative again in the next cycle, and the next down cycle and what does that mean for profits?

The yield curve to me is still the best leading indicator.

- Every single cycle there’s reasons to ignore I say, ignore it at your peril.

- The 2s-10, you can pick whatever point of the curve you want to look at.

- The yield curve still is in my opinion the best leading indicator and it is flattening, the 2s-10 curve is already around 95 basis points which means, that we’re only four rate hikes away from the Fed actually inverting the curve yet again, like they’ve done so many times.

- And, every recession was touched off by an inversion of the yield curve which is the bond market’s way of saying, “Uncle!”

- We’re only four rate hikes away from that happening under the proviso that the 10-year remains close to where it is today.

- I’ve got no reason to think that it won’t. And, yet when you look at the dot plots you’re going to see that over half of the FOMC officials, and who knows where Janet Yellen is on this or who knows if she’ll even be around, over half of the FOMC officials on those dot plots actually want to raise rates at least four times between now and next year.

So, keep your eye on the yield curve if you’re managing a risk, which I’m sure most of you are.

Now, something else to consider is this, is where we are in the cycle.

- And, we are by definition of full year ahead from where we were the last time that we met. And, once again, it’s not Donald Trump’s fault that he comes in heading into the ninth year of a bull market in economic expansion.

- In fact, this is the curse of the Republicans, is they always seem to come in late in the cycle.

- Do you know that every single Republican president back to Grant, so I’m going back almost to the Civil War, had a recession in the first half of their first term? I can’t, you know, I can’t fathom that except that it’s just bad luck. Like George Bush, 41, George Bush, 43, both coming in late in a cycle with the Fed tightening.

- You actually want to come in, if you’re President and you want a real tailwind, you want to come in when Clinton came in. You want to come in when Obama came in, at the low point of the cycle with Central bank giving you a liquidity tail wind.

- Do you not see that we are nowhere near there? This already is going down as the third longest expansion, not just since the post-World War II era, but since the Civil War.

- Now, it might be true that cycles don’t die of old age but everything I’m seeing is smacking of late cycle.

On consumer confidence:

- If you are an investor, it’s not great news when consumer confidence is at a peak. You actually want to be bullish when consumer confidence is at a low.

- Do you know what it means as an economist looking at consumer confidence? What does it mean when you’re at a peak? And, why is it that the peaks tend to coincide within a year of a recession? Why is that?

- Because there is no more pent-up demand at the peak. Don’t you see? It’s like you just finished a five-course me You don’t want to buy the market or you don’t certainly want to be adding on risk at this time when everybody’s belly is filled with consumer products.

- You want to buy the market when the runway is long at the trough of consumer confidence, when there is insatiable appetite for consumption.

- We’re polar opposite of that right now, peak autos, peak housing, what else? Peak wages, everything I’m looking at is smacking of late cycle.

- I’m just not good enough to tell you exactly what inning that we’re in. We’re certainly not at the National Anthem, and we’re not in the third inning but we’re past the seventh inning stretch and you want to start investing around late cycle themes, which I’m happy to talk about later on.

What about inflation, the case for peak inflation?

- Inflation is peaking, core inflation actually peaked this cycle. Core inflation peaked this cycle, a double peak at 2.3%. We’ve never seen that before.

- This is the first cycle ever where core inflation peaked at such low a level and the peak’s getting lower and lower.

- Where’s it going to go from here? And, what’s really striking me is how the broad-based nature of either disinflation or deflation is taking hold.

- The relentless deflation we’re seeing in the good sector, in the stuff in the CPI. Not services, which is 60% of the index, but your suits, and your furniture, and your appliances, and we know what’s happening in automotive.

- Anything you can see, touch or feel is deflating. In fact, the core goods, the X energy, the X food, goods, CPI has been deflating now for 14 consecutive months, year on year, and 43 of the past 44, despite the fact that we’re in the ninth year heading in the ninth-year of an expansion.

- This is the sort of thing you’d be expecting in a depression. Ninth year of an expansion, you got to be thinking in the next recession, which I would will tell you is inevitable, it’s just about timing where are these inflation numbers going to go?

- We have never seen such a long stretch of negatives on the goods and now it’s bumping against a peeking out and rolling over of service sector inflation.

SB here – This is a big point from David (bold emphasis mine):

- So, we’ve seen a break in service sector inflation just at a time when we’re seeing continuously negative goods deflation and I think that at the inflation rate right now, which peaked at 2.7, the headline inflation rate is 2.2, I think within a year we’re going to be at zero.

- People won’t be talking about how expensive bonds are anymore at that point.

SB here – a continuing theme across conference presenters was lower interest rates and a coming recession. My bond models are bullish on bonds. I find myself in the same camp.

David went on to talk about technology, robots replacing workers and the Amazon effect on lower prices. He added,

- So, frankly I don’t see where the inflation is coming from. I can only see widespread deflation at the peak of the cycle wondering where it goes in the next economic downturn. Inflation expectations are only high among those people that like to short the bond market or reduce their duration.

He believes the Fed is missing the mark. Saying,

- They Wed to the Phillips Curve. That’s why they’re raising interest rates and that’s where the policy mistakes that we’ve seen time and again is going to occur.

- We just basically have never seen a situation going into a recession where measured rates of inflation and measured rates of nominal GDP growth were as low heading into the situation.

So, we talked about the deflation and part of the story is the debt. And it also helps to explain why interest rates are so fundamentally low and they can’t go up.

- After the crisis, the McKinsey people put out this wonderful report, cross-section of countries over long periods of time looking at what happens after you have a credit contraction and you have an asset collapse that we had go viral, and they came to the conclusion that once you get past the worst part of the crisis, you spend six to seven years in purgatory before you get to the next sustainable phase of growth inflation and higher interest rates, and higher interest rates are what everybody wants.

SB here: I’ll conclude the Rosenberg notes section with the following:

- Everybody wants higher interest rates but they don’t happen. I should say higher bond yields since the Fed does control the short end of the yield curve.

- Well, the McKinsey people said until we restructure the debt and get that debt ratio down 25%, until that happens, you don’t get that rebooting of the debt ratio to kick off the next sustainable economic expansion that doesn’t need the crutch of either fiscal or monetary stimulus.

- Well, the McKinsey people then revisited this and they concluded that well, the decline in that debt ratio never took place and, in fact, in many cases it got worse.

- So, why would anybody think that we’re going to have accelerating economic growth under any circumstance when the best we really did was level off that debt GDP ratio.

- We never took it down to the levels in the past that touched off a much more full-fledged and pronounced recovery, which was lacking.

- People are wondering, why has growth rate been so low?

- It’s been low everywhere, it’s been low everywhere, not just in the US and one of the reasons is there’s too much debt, we’re choking on it.

So, when you look at the US, you look globally, look in Canada, where the debt ratio is 290%. In the US it’s almost 250%, it’s actually leveled off, it has not come down. Global economy it’s 270%, over 300% in China.

- This is a constraint on global economic growth.

So, I’m not going to say it’s a ticking time bomb, it’s just a relentless constraint on growth. We should be working much harder to repair the national balance sheet and I mean that everywhere.

And, I’m not going to say that I’m a student of Kelvin or Kant and that, no, debt’s got to be zero. You can’t run a modern industrial economy without credit.

But, there is a sweet spot, you see, there is a sweet spot. The best growth for the United States was when that debt ratio was 125% to 175%, not 250% and rising. For the world, the best growth was 200% to 225%, not where we are today. This is like, treated as a future tax on growth. That’s how you have to look at it. And, that’s what I was saying to the people that believe that, oh, it was great news to have this new Trump team, one party government in Washington. It finally means that we’re going to be able to take the baton from monetary policy to fiscal policy. That was never going to happen and it’s not going to happen. There’s no baton to be passed. There is no torch to be passed.

Fiscal policy, writ large, is as tapped out as monetary policy is. We all know at the zero bound, central banks are hamstrung. QE has very marginal impact, negative interest rates were a disaster. And, of course, it comes down to the first thing you learn in economics which is the law of diminishing returns, diminishing utility. It’s like I tell university students; think about it, your first two beers at the pub, they’re great, but it’s number 12, 13 and 14 that don’t feel so good, especially the next morning. It’s the laws of diminishing utility. There’s such a thing as too much of a good thing and we’re seeing that in monetary policy. It’s the same with fiscal policy. It’s not linear, the impact you get on fiscal stimulus, and Japan’s been a great example, is incrementally very small.

SB here: Let’s conclude the Rosenberg notes now. I know I need a cold beer after reading this. But please don’t get economically depressed. Keep Ned’s opening quote in mind. “Investors need risk management in bear markets, not in bull markets.”

We are just nearing a point where some very hard things need to be resolved. We don’t yet know what that looks like. My personal view is we have to reset the debt. Burn the tally sticks? Maybe a partial burn of say 25% of the debt.

Unfortunately, it will likely take a crisis to get the lawmakers to a point where decisions can be made. Risk will show up again soon. Volatility will spike.

Keep Ned’s opening quote in mind: “Investors need risk management in bear markets, not in bull markets.”

Bob Farrell’s Famous Ten Rules of Investing

I thought it would be a good time to re-read Bob’s famous rules. (Emphasis mine.)

- Markets tend to return to the mean over time.

- Excesses in one direction will lead to an opposite excess in the other direction.

- There are no new eras – excesses are never permanent.

- Exponential rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways.

- The public buys most at the top and the least at the bottom.

- Fear and greed are stronger than long-term resolve.

- Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names. (Sound familiar? Can you say FAANGs?)

- Bear markets have three stages: sharp down, reflexive rebound, and a drawn-out fundamental downtrend.

- When all the experts and forecasts agree, something else is going to happen.

- Bull markets are more fun than bear markets.

Trade Signals — Fixed Income Remains in a Buy Signal

S&P 500 Index — 2,437 (6-21-2017)

Notable this week: The NDR CMG U.S. Large Cap Long/Flat Index remains in a partial sell signal. It moved from 100% S&P 500 Index exposure to 80% S&P 500 Index exposure (with the 20% balance in T-Bills) on Tuesday, June 13, 2017.

80% exposure is bullish, yet there is reason to take note. The Index is signaling weakening market momentum (trend) and market breadth. Bonds remain in a buy signal. The Zweig Bond Model remains in a buy signal and the High Yield trend model remains bullish. The CMG Tactical Fixed Income Strategy remains invested in EM and muni bonds.

The short-term gold trend indicator remains in a buy signal, suggesting some portfolio exposure to gold. Investor sentiment is Extremely Optimistic, which is S/T bearish for equities but, while that suggests caution, the major cyclical trend for equities remains bullish. Inflationary pressures are high. Risk of recessions in the U.S. and global economies is low.

Click here for the charts and explanations.

Concluding Thoughts

“Bull markets are born in pessimism, they rise on skepticism, they mature in optimism and they die on euphoria.”

— Sir John Templeton

We have reached euphoria. Perhaps the early stage but euphoria nonetheless. Make sure you are mindful of risk. I see great opportunity ahead but I see a -50% to -70% equity market correction on the way to that opportunity.

My two cents is to utilize trading strategies that diversify to different asset classes that incorporate risk management processes. Use trend following and set stop-losses firmly in place. For me, our equity market and fixed income models continue to advise risk on. I’m sticking to the drill.

I was in NYC on Wednesday and spent some time with a good friend, Dave Underwood. Dave is former Co-Chief Investment Officer of the State of Arizona Retirement System and a forward thinking maverick in the business. He is quietly behind several of the factor-based ETFs we all have access to today. He’s sharp.

We were meeting with a research company that has an investment weighting methodology that keeps you from overweighting your stock holdings to “related business risks.” Much more on that company in future posts, but the skinny is that they improve conventional cap weighted index returns by 200 to 400 basis points. Think in terms of 2% to 4% per year over your S&P 500 Index by owning the exact same 500 stocks. Not cap weighted, nor equal weighted, nor fundamentally weighted… better. Put this on the good news side of the ledger.

During the meeting, Dave asked, “How do you roll a 7 in a 4% return world?” And then added, “It’s not going to happen.” Though picking up an extra 2% to 4% on stocks is helpful.

Opportunity Number Four!

Over the last number of weeks, I’ve shared ideas from the conference. EM and India look far more attractive than much of the developed world. I have some stocks on my shopping list of sorts. But I want to be a buyer when everyone else is a seller. Not in the current state of investor euphoria. I want to plant an idea in your head.

I believe we should start thinking about the coming opportunity in high yield. Our HY strategy dates all the way back to 1992. Twenty-five years and still going. I’ve witnessed and successfully traded three opportunities in my long career trading the HY bond market trends.

They occurred in 1992, 2002 and 2009. The key to return opportunity was in avoiding the crises that created the opportunities; recession and the collapse of Drexel Burnham (Michael Milken) in the early 1990s, recession and the tech wreck in the early 2000s and the great recession/financial crisis in 2008. Yields were over 20% on high yield bonds in early 2009. Talk about opportunity.

The next one, too, will present in recession. Current 5% yields on HY bonds will spike towards 20%. Defaults will set records (due to the massive funding of junk companies that the chase for yield has enabled), prices will fall and you’ll want to be a buyer when everyone else is a seller. Think annualized returns north of 20%. I’m looking forward to “opportunity number four.” Use trend following to help you avoid and take advantage of the opportunity. I sit patiently excited. No guarantees of course!

Personal Note

A quick note on Susan’s knee replacement progress. She’s made the turn. Rehab has started and while painful, better days are ahead.

Father’s Day couldn’t have been better. Golf with my daughter, Brie, and son, Matt. Great fun! Here is a shot of us at one of my favorite places – Stonewall Golf Club.

When the kids were young, we’d fish in the pond you see in the background. It is loaded with bass. The first time we put worm to hook, the plan was to fish for about an hour then hit the local Chickie’s and Pete’s. It was like shooting fish in a barrel. Every other cast hooked a decent sized fish. Four hours later my friend, Wade, yelled to the kids, “The next one to catch a fish gets this gold dollar coin.” Seconds later Kyle held the coin. It was dark when we finished. What a nice memory for me. I’m sure you share many similar memories.

Blink and six-year-old Matthew is now 19. On Sunday I’m driving him to Penn State. His freshman year begins, as does a wonderful new adventure. Don’t drink, study hard and make a difference. The world needs you… and so do I. Time is moving way too fast.

Have a great weekend. Hug your kids and try your best to stay in the moment. I’m working hard at that one… Wishing you much joy in your life!

I hope you find On My Radar helpful for you and your work with your clients. And please feel free to reach out to me if you have any questions.

If you find the On My Radar weekly research letter helpful, please tell a friend … also note the social media links below. I often share articles and charts during the week via Twitter and LinkedIn that I feel may be worth your time. You can follow me on Twitter @SBlumenthalCMG and on LinkedIn.

If you are not signed up to receive my weekly On My Radar e-newsletter, you can subscribe here.

With kind regards,

Steve

Stephen B. Blumenthal

Executive Chairman & CIO

CMG Capital Management Group, Inc.

Stephen Blumenthal founded CMG Capital Management Group in 1992 and serves today as its Executive Chairman and CIO. Steve authors a free weekly e-letter entitled, “On My Radar.” Steve shares his views on macroeconomic research, valuations, portfolio construction, asset allocation and risk management.

The objective of the letter is to provide our investment advisors clients and professional investment managers with unique and relevant information that can be incorporated into their investment process to enhance performance and client communication.

Click here to receive his free weekly e-letter.

Social Media Links:

CMG is committed to setting a high standard for ETF strategists. And we’re passionate about educating advisors and investors about tactical investing. We launched CMG AdvisorCentral a year ago to share our knowledge of tactical investing and managing a successful advisory practice.

You can sign up for weekly updates to AdvisorCentral here. If you’re looking for the CMG white paper, “Understanding Tactical Investment Strategies,” you can find that here.

AdvisorCentral is being updated with new educational resources we look forward to sharing with you. You can always connect with CMG on Twitter at @askcmg and follow our LinkedIn Showcase page devoted to tactical investing.

A Note on Investment Process:

From an investment management perspective, I’ve followed, managed and written about trend following and investor sentiment for many years. I find that reviewing various sentiment, trend and other historically valuable rules-based indicators each week helps me to stay balanced and disciplined in allocating to the various risk sets that are included within a broadly diversified total portfolio solution.

My objective is to position in line with the equity and fixed income market’s primary trends. I believe risk management is paramount in a long-term investment process. When to hedge, when to become more aggressive, etc.

IMPORTANT DISCLOSURE INFORMATION

Investing involves risk. Past performance does not guarantee or indicate future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by CMG Capital Management Group, Inc. or any of its related entities (collectively “CMG”) will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. No portion of the content should be construed as an offer or solicitation for the purchase or sale of any security. References to specific securities, investment programs or funds are for illustrative purposes only and are not intended to be, and should not be interpreted as recommendations to purchase or sell such securities.

Certain portions of the content may contain a discussion of, and/or provide access to, opinions and/or recommendations of CMG (and those of other investment and non-investment professionals) as of a specific prior date. Due to various factors, including changing market conditions, such discussion may no longer be reflective of current recommendations or opinions. Derivatives and options strategies are not suitable for every investor, may involve a high degree of risk, and may be appropriate investments only for sophisticated investors who are capable of understanding and assuming the risks involved. Moreover, you should not assume that any discussion or information contained herein serves as the receipt of, or as a substitute for, personalized investment advice from CMG or the professional advisors of your choosing. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisors of his/her choosing. CMG is neither a law firm nor a certified public accounting firm and no portion of the newsletter content should be construed as legal or accounting advice.

This presentation does not discuss, directly or indirectly, the amount of the profits or losses, realized or unrealized, by any CMG client from any specific funds or securities. Please note: In the event that CMG references performance results for an actual CMG portfolio, the results are reported net of advisory fees and inclusive of dividends. The performance referenced is that as determined and/or provided directly by the referenced funds and/or publishers, have not been independently verified, and do not reflect the performance of any specific CMG client. CMG clients may have experienced materially different performance based upon various factors during the corresponding time periods.

NOT FDIC INSURED. MAY LOSE VALUE. NO BANK GUARANTEE.

Certain information contained herein has been obtained from third-party sources believed to be reliable, but we cannot guarantee its accuracy or completeness.

In the event that there has been a change in an individual’s investment objective or financial situation, he/she is encouraged to consult with his/her investment professional.

Written Disclosure Statement. CMG is an SEC-registered investment adviser located in King of Prussia, Pennsylvania. Stephen B. Blumenthal is CMG’s founder and CEO. Please note: The above views are those of CMG and its CEO, Stephen Blumenthal, and do not reflect those of any sub-advisor that CMG may engage to manage any CMG strategy. A copy of CMG’s current written disclosure statement discussing advisory services and fees is available upon request or via CMG’s internet web site at www.cmgwealth.com/disclosures.

Copyright © CMG Capital Management Group Inc.