For this week’s edition of the Equity Leaders Weekly, we are going to look at two important relationships which can be impacted due to the recent comments from the Central Banks on both sides of the border. We will revisit the recent movement of the USDCAD relationship as well as the relationship between Canadian Long-term Bonds vs. Short-term Bonds.

United States Dollar/Canadian Dollar (USDCAD)

We have recently heard comments from both the Central Banks both in Canada and in the US this week. Some interesting comments were made by the Bank of Canada Senior Deputy Governor Carolyn Wilkins earlier this week stating first quarter growth had been “pretty impressive” and that signs of Canada’s economic growth was broadening. Stephen Poloz, the Bank of Canada Governor, followed up with comments the day after stating their 2015 interest rate cuts “have largely done their work.” Both of these rather hawkish comments have the markets wondering whether the Bank of Canada will be increasing the current low rates sooner than expected which led to increased volatility in favor of the Canadian Dollar this week.

We also heard from Janet Yellen of the US Fed who, as expected, announced another quarter point increase in the Fed Funds rate to the 1.00 to 1.25 range. Even though the Fed noted inflation has declined recently and will fall short of its 2 percent target this year, it still foresees one more rate increase this year. With the below target inflation number and the recent weak retail sales numbers that came out this week, the Fed has indicated that “near-term risks to economic outlook appear roughly balanced, but the committee is monitoring inflation developments closely.” Given this roughly balanced economic outlook, it will be interesting to see what transpires with the US economy in the coming months and how it may affect their stance on their view of future rate increases. Also, as expected, the Fed will gradually begin the process of letting its balance sheet portfolio run off by paring down its bonds holdings which could cause long-term rates to rise. As the markets continue to digest the news of the Fed’s forward-looking rate increase guidance, the details of its run-off program and its post meeting comments, let's examine how these comments have affect the in the USDCAD currency relationship.

Looking at the attached comparison chart, we see that since we last spoke of this relationship about 2 months ago, a 3-box reversal has appeared. It has now moved down to near-term support at the 1.3113 level. The next level of support is at 1.2854. Resistance can be found at the 1.3781 level and, above that, the 1.40 area. With an SMAX score of 7, near term strength still favors the USD at this time, but it will be important to monitor this currency to see if the current support level holds or if it bounces off this support to challenge new year highs.

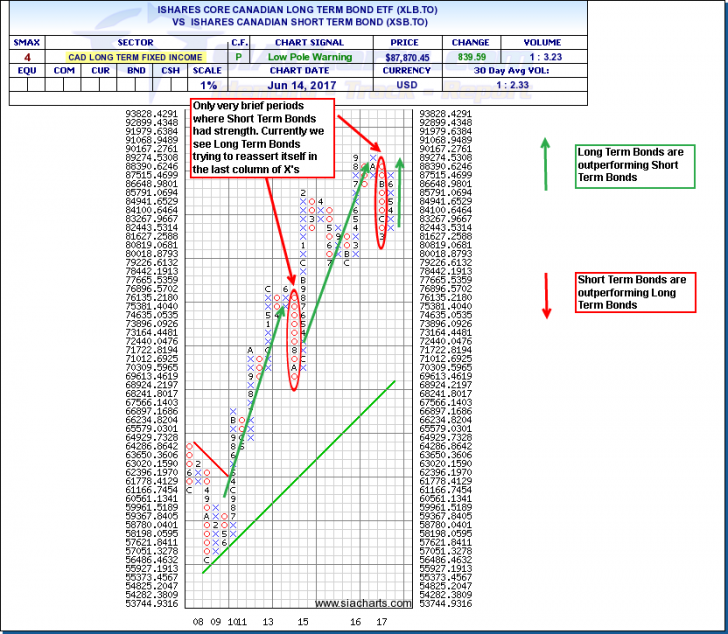

iShares Core Canadian Long Term Bond ETF (XLB.TO) vs. iShares Canadian Short Term Bond ETF (XSB.TO)

Let's now look at the comparison chart for the iShares Core Canadian Long Term Bond ETF (XLB.TO) vs. iShares Canadian Short-Term Bond ETF (XSB.TO). This comparison chart can give us insight in the market's risk appetite in fixed income securities as longer maturities generally have higher risk in a rising interest rate environment. With the Bank of Canada taking a somewhat cautiously hawkish view on the economy of late, the long-term government bonds have moved relative to short term government bonds rallied back into a column of X's but haven't overtaken the Short-term Bonds strength at this time.

Looking at the attached chart, let's focus on what has been occurring since the market meltdown of 2008. As a reminder, a rising column of X’s indicates Long-term Bonds are outperforming Short-term Bonds and a declining column of O’s indicates Short-term Bonds are outperforming Long-term Bonds. As you can see since June of 2009, Long-term Bonds have outperformed Short-term Bonds for the most part in an upwards trend. There was a brief period where Short-term Bonds outperformed its long -term counterparts in August to October of 2014 but that brief out-performance was followed by another strong column of X’s where Long-Term bonds regained leadership. In looking at last 6 months, we see a column of O’s materialize starting in November of 2016 up until March of this year which may be an indication the market was expecting a rising interest rate environment to materialize in the Canadian Markets. However, most recently, the trend reversed and a new column of X’s has formed indicating, once again, Long-term Bonds are outperforming their short-term counterparts, but haven't fully recovered this column of O's yet as the relationship has a VS SMAX score of 4 out of 10 favoring Short-term Bonds at this time slightly.

It will be interesting to see going forward how the markets will digest the recent comments made by the Bank of Canada regarding their stance on the Canadian Economy and their monetary policy going forward and what effect it will have on this relationship.

SIACharts.com specifically represents that it does not give investment advice or advocate the purchase or sale of any security or investment. None of the information contained in this website or document constitutes an offer to sell or the solicitation of an offer to buy any security or other investment or an offer to provide investment services of any kind. Neither SIACharts.com (FundCharts Inc.) nor its third party content providers shall be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon.

For a more in-depth analysis on the relative strength of the equity markets, bonds, commodities, currencies, etc. or for more information on SIACharts.com, you can contact our sales and customer support at 1-877-668-1332 or at siateam@siacharts.com.

Copyright © SIACharts.com