by Blaine Rollins, CFA, 361 Capital

Who Pulled the Plug?

You would have thought the world of technology stocks had entered a recession after reading the weekend press and blogs. Friday was an interesting day with the Goldman FAAMG piece dampening enthusiasm for large cap tech stocks and several large sell programs rippling through the markets (maybe Viking? or someone who has borrowed against their Uber stake?).

Even with the large volume selling on Friday, the trend in the Nasdaq 100 still looks good for now. It is still trading above its 50-day and 200-day moving averages and significantly outperforming the market YTD. I still think the bigger risk to tech growth stocks is an acceleration in USA GDP and a second coming of the cyclical stocks. But with U.S. GDP growth looking to slowdown from its previous expectations, I would have a difficult time flipping all of my growth stocks for value and cyclical shares right now.

That said, this will be an important week for the markets. Let’s see if participants step up and buy some names that were hit on Friday or see if they decide to build up some cash for the summer months. We get a Fed rate decision this week (likely another 25bp increase). But in the meantime, short-term yields and credit spreads continue to express signs of a solid economy with few signals of distress. This week should dictate a lot about the next market move. So, stay plugged in.

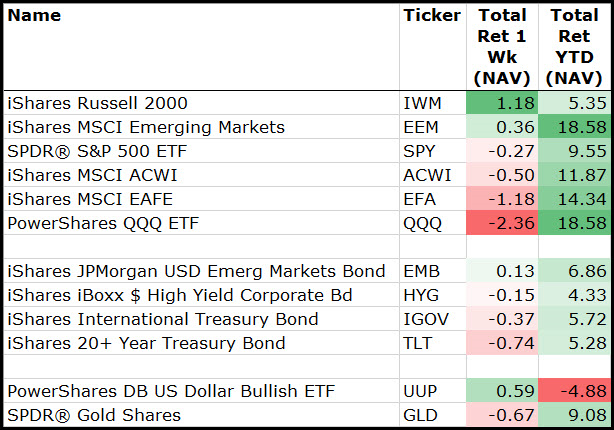

It was a complete inversion last week. Small caps jumped to the top while the Nasdaq 100 and EAFE dove to the bottom….

Ditto for the sectors where Banks and Financials jumped, and Tech dove…

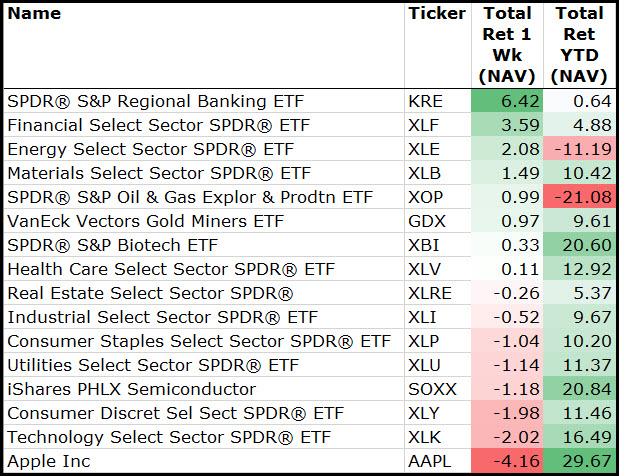

SocGen had an even better analysis of the performance reversion on Friday…

The sell-offs themselves are not particularly unusual, but the uniformity of the prices moves all on the same day indicates a market driven by price chasing momentum, with investors heading for the door all at the same time. Indeed, those S&P 500 stocks which sold-off on Friday were almost all from the strongest performing decile over the previous 12 months (the r-squared on the S&P 500 line in the chart below is 85%). Within Nasdaq the relationship is even stronger at 95%. Such a uniform sell-off strikes us as systematic, especially as the relationship weakens once you look at the broader and less liquid Nasdaq composite. For price chasing investors, Friday’s plunge serves as a warning; when it’s time to head for the door, you better move fast. (SocietyGenerale)

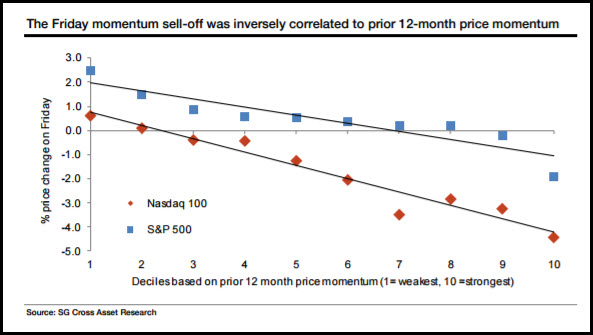

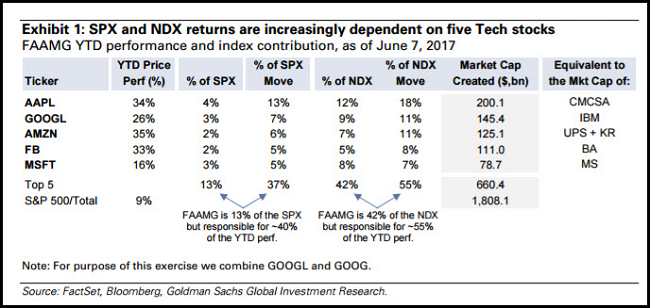

It was as if Goldman rang the bell on Thursday night with their FAAMG note detailing the outperformance of large cap tech…

Bespoke highlighted that the top five stocks in the S&P 500 cost the index almost $100b on Friday…

@bespokeinvest: The 5 largest stocks in the S&P lost $97 billion in market cap on Friday, while the rest of the index actually gained $74 billion.

Eric Peters reminds you that you haven’t even come close to seeing a bubble…

Advances: “The generals march until they die,” said the CIO. “And when the generals die, we all die.” The bull market that peaked in 2007 was led by financials. “Goldman bottomed in 2004 and rallied 4x through November 2007. The S&P 500 rallied 2x. When Goldman declined, the market died.” From the low in 2009 the S&P 500 is up 3.5x. Google is up 6x and Amazon 12x. “Technology names are todays generals. Rotation to a different sector will not prolong this bull market. Nothing will prolong this rally other than the continued advance of the generals.”

Advances II: “Microsoft was the general in the tech boom and became overvalued in 2000,” continued the same CIO. “It’s net enterprise value was 35x ebitda.” It took until 2014 for Microsoft to regain its 2000 price high, as earnings caught up to that multiple. “Cisco traded at roughly 80x in 2000, and that was a real company, that wasn’t a sock puppet.” Today Cisco trades 7x, having tripled its ebitda over the past 17yrs. “Google’s net enterprise value is roughly 12x its ebitda today. Apple is less than 8x. Facebook is roughly 13x. Expensive but not bubbles.”

Advances III: “At the 2000 highs Yahoo’s $115bln net enterprise value was 350x its $328mm ebitda,” said the same CIO. That’s what a bubble looks like. “Tencent trades at 20x. Alibaba trades 15x today.” Expensive for sure, and no doubt vulnerable, but there’s plenty of two-way risk at these valuations. “Technology companies are earning absurd amounts of money today. Many of them are virtual monopolies. And provided they continue marching higher, the bull market is intact.” The only question we should ask is when and why will our generals die?

(Eric Peters/Wknd Notes)

This three-month yield chart strongly suggests that another rate hike is coming on Wednesday…

@charliebilello: US 3-month yields at 8-yr high heading into next week’s FOMC meeting. Market: >99% chance of a hike to 100-125 bps.

Has your cab/Uber driver recommended Bitcoin to you yet?

The increasing interest in bitcoin is getting too loud. If someone tries to sell you on it, ask them about Ripple Labs?

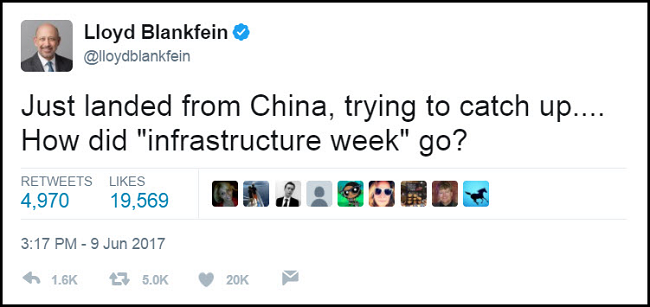

How to epically troll your former subordinate…

If anyone has a pic of Lloyd typing this tweet into his cellphone, please do share.

Finally, a great effort in Detroit by Facebook…

Facebook will fund the training of 3,000 Michigan workers for jobs in digital marketing over the next two years, the social media giant’s COO Sheryl Sandberg announced Thursday during a visit to Detroit.

Grand Circus, a computer coding training firm that’s part of Dan Gilbert’s family of companies, will offer the 10-week training courses in Detroit and Grand Rapids in partnership with Facebook.

Sandberg told Crain’s that the Menlo Park, Calif.-based company’s funding of the training is designed to help fill a growing shortage of computer coding jobs and develop talent for a future possible expansion into Michigan.

“Auto is a very important industry for us,” Sandberg said in a interview with Crain’s. “This is a growing part of our business and we’re hoping we can expand here because our business will demand it.”

Copyright © 361 Capital