by Jeff Hussey, Russell Investments

Active or passive? We’re past that binary decision by now, aren’t we?

When it comes to achieving outcomes, we believe there is no purely passive approach to an investment strategy. We’re all active investors. We all make choices, saying yes to some exposures and strategies and no to others. That’s why, at Russell Investments, we believe in active AND passive investing.

Decades of expertise in asset allocation help us objectively recognize that there are appropriate situations, market cycles, and circumstances for both approaches in an investment strategy.

We also believe that investors who take advantage of the wide-and-deep toolkit that multi-asset investing provides can help to improve their odds. And we believe the best plan is not to follow trends but to focus on proven, research-based strategies that potentially give investors a higher likelihood of reaching their outcomes.

One of the strategic decisions most investors have to make is: What’s the right mix of active and passive investing within their portfolio? Passive is cheaper—at least on the surface. Active may have higher fees, but it also can help to provide the potential for beating passive market index benchmarks, net of fees.

Active AND passive: The case for both

There’s no disputing that passive strategies typically have lower fees and have often done a good job of beating below-average active managers. But that doesn’t necessarily make them more successful.

The intention of active management is to outperform a passive market index benchmark. At Russell Investments, we believe that potential for outperformance can often help to pay off over the long-term. But there’s no one right way to invest for everyone. Each investor has a unique set of goals, real-world constraints and risk preferences. And actively managed investments do have risks.

A new look at risk preference

When we talk about risk preference, investors might often think about the mix of stocks and bonds in a portfolio and ratios like 60/40 or 70/30. But another preference may be just as important: the risk preference that embraces the potential for active management outperformance, even when that outperformance is not guaranteed.

Many investors recognize the importance of long-term investing. And we believe, over the long term, that active and passive management combined within a multi-asset portfolio will demonstrate value versus a passive-only portfolio.

Helping an investment strategy to achieve outperformance from active managers requires the ability to find outperforming managers. Because of our decades of experience in manager research, we know it is possible to find firms who specialize in finding and combining “best-of-breed” managers—firms that dynamically manage multi-asset exposures to suit many investors’ goals, constraints and preferences regarding risk.

High-conviction active investing can help to improve returns. But different investors have differing levels of willingness to take on the interim cost and variability required to reap those benefits.

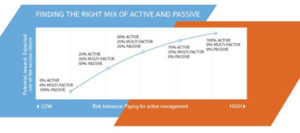

The chart below shows an illustrative way to approach this challenge of finding the right mix of active and passive, based on an investor’s risk profile. For investors with a low risk-tolerance, during periods of active management underperformance, more passive exposure might make sense for them, even if that approach eliminates the possibility of outperforming passive benchmarks. For investors who have a higher risk-tolerance, more active exposure might be the best approach. Of course, many investors will find their place somewhere along the spectrum.

At Russell Investments, we believe that investors who get past the binary decision have greater potential to achieve their outcomes. It’s no longer a question of active OR passive. For just about any investor, active AND passive likely makes the most sense.

*****

Disclosures

These views are subject to change at any time based upon market or other conditions and are current as of the date at the top of the page.

This material is not an offer, solicitation or recommendation to purchase any security. Nothing contained in this material is intended to constitute legal, tax, securities or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type.

The general information contained in this publication should not be acted upon without obtaining specific legal, tax and investment advice from a licensed professional. The information, analysis and opinions expressed herein are for general information only and are not intended to provide specific advice or recommendations for any individual entity.

Please remember that all investments carry some level of risk, including the potential loss of principal invested. They do not typically grow at an even rate of return and may experience negative growth.

Russell Investments’ ownership is composed of a majority stake held by funds managed by TA Associates with minority stakes held by funds managed by Reverence Capital Partners and Russell Investments’ management.

Frank Russell Company is the owner of the Russell trademarks contained in this material and all trademark rights related to the Russell trademarks, which the members of the Russell Investments group of companies are permitted to use under license from Frank Russell Company. The members of the Russell Investments group of companies are not affiliated in any manner with Frank Russell Company or any entity operating under the “FTSE RUSSELL” brand.

Copyright © Russell Investments 2017. All rights reserved.

This material is proprietary and may not be reproduced, transferred, or distributed in any form without prior written permission from Russell Investments. It is delivered on an “as is” basis without warranty.

UNI – 11026

Copyright © Russell Investments