Is the Reflation Trade Alive? Yes and No...

An asset class outlook based on potential tail gains and losses

The market has been flip-flopping recently about whether the reflation trade is "alive." From the perspective of accelerating growth, yes, we see the trade alive and well. Yet, from the perspective of inflation, we don't see the trade alive, but tepid and subdued.

Continued upside to growth is the key dynamic we see unfolding in the financial markets. But unlike the past, we do not see this growth accompanied by large inflationary pressures, but rather by upward pressure on real rates. We call this the "real-growth" trade – in other words, a pickup in growth from real economic activity, not just inflation.

Following the recent sharp rise in inflation expectations and inflation prints, the Federal Reserve (Fed) is on watch, and it's not very easy for inflation to evade a vigilant Fed. It will be very challenging for inflation to rise significantly higher. As a result, our proprietary model suggests the risk to bonds has moderated.

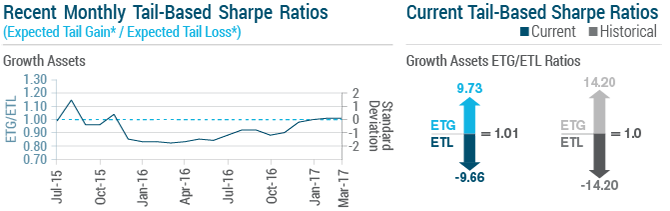

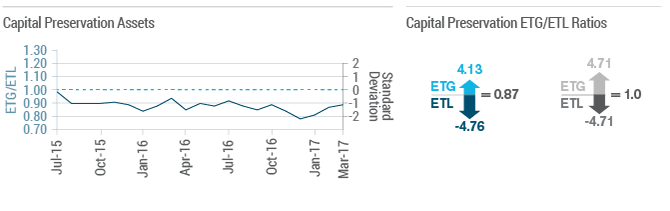

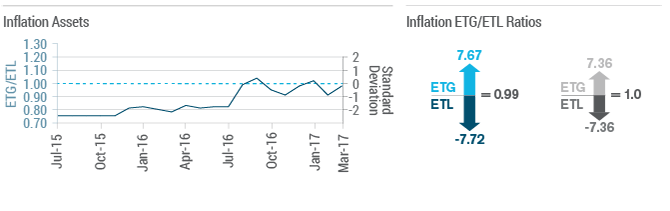

*We define ETG and ETL as the 1-in-10 expected best and worst two-month return for an asset class.

Beginning in August 2016, the tail-based Sharpe ratios have been normalized to 1.00 to allow for easier comparison across the three macroeconomic asset categories.

Normalization is on its way and inflation was the first step: global inflation expectations are rising, and in the U.S., hitting the Fed's 2% target. But normalization of real interest rates is far from complete. In fact, it really hasn't started, with global real rates well below GDP growth, well below zero for much of the developed world, and just above 40 bps in the U.S. Normality suggests the real rate will anchor to real GDP. But with GDP in the U.S. near 2%, real rates have a long way to go. We see this second, and arguably final, leg to normalization just getting underway.

The good news is we anticipate this second phase – or real rate normalization – will be much smoother than the first leg because real rates are generally easier to control than inflation, thereby mitigating the risk of shock. The second piece of good news is that economic conditions are still very supportive to growth, namely, normal inflation encourages spending and investment and low real rates keep the cost to finance this spending/investment low. As a result, we maintain our robust outlook to global equities based on what our proprietary signals indicate.

We feel the "real-growth" trade is safer than the reflation trade as inflation risks tend to take the form of tail risk, whereas real rate risk does not – assuming that hawks don't circle in on the Fed.

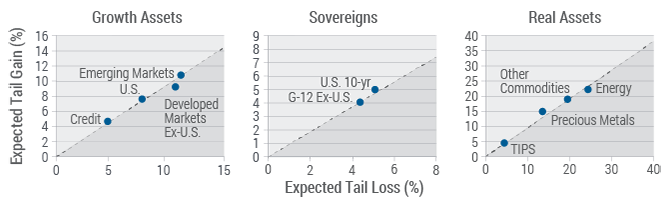

In addition to our outlook on broad asset classes, Janus' Adaptive Multi-Asset Solutions team uses option market signals to provide insights into specific markets. The following caught our attention:

- Growth Assets: U.S. and EM equities offer the best expected risk-reward. U.S. growth is alive and well according to our signals and EMs will benefit from this. Peripheral Europe, in particular Italy, offers attractive opportunities. The resurgence of the center-right in Europe and their pro-growth policies cannot be ignored.

- Capital Preservation: We see U.S. rates and developed non-U.S. rates, particularly Germany, following a path of convergence. With inflation pressures mounting in Europe and the yield differential still very wide, we are near a tipping point where European yields need to catch up with U.S. yields.

- Inflation: The risk-reward to Treasury Inflation-Protected Securities is nearly equal to that of nominal bonds. This suggests risk is driven by real rates, which affect both equally, and not inflation, which only affects nominal bonds. In the commodity space, our signals suggest a pullback in oil, which currently offers the lowest expected "tail-based Sharpe ratio" within the commodity complex.

Tail-Based Sharpe Ratio

(Expected Tail Gain* / Expected Tail Loss*)

*We define ETG and ETL as the 1-in-10 expected best and worst two-month return for an asset class.

Beginning in August 2016, the tail-based Sharpe ratios have been normalized to 1.00 to allow for easier comparison across the three macroeconomic asset categories.

Copyright © Janus Capital Group