Interest-rate outlook: The aftermath of Trump’s win

by Brian Schneider, Senior Portfolio Manager, Head of North America Rates, Invesco Fixed Income, Invesco Canada

Canadian government yields have remained under the same upward pressure felt globally in the aftermath of the U.S. presidential election which boosted expectations of higher growth and inflation fueled by U.S. fiscal stimulus and tax cuts. The Bank of Canada meeting in January recognized that Canada’s economy has shown some improvement, but emphasized there was more work needed to reduce excess capacity as inflation remains very low.

Below is an overview of the Invesco Fixed Income team’s outlook for interest rates in key world economies:

United States

We expect U.S. government interest rates to remain range bound in the near term. The agenda for U.S. tax reform and infrastructure spending under the Trump administration, which has been the major driver of yields, is unlikely to become clearer in the next several weeks. Economic data is likely to point to a U.S. economy near full employment. The U.S. Federal Reserve (the Fed) is unlikely to hike rates at its March meeting, however, it may begin to signal a potential hike at its May meeting.

Europe

In its latest meeting, European Central Bank (ECB) President Draghi indicated that the ECB is not confident that higher Q1 eurozone inflation will be sustained. Having said that, imported inflation measures have crept up and manufacturing surveys remain strong. This could undermine support for never-ending quantitative easing from some members of the governing council, which could, in turn, undermine investor confidence in bunds1. We also believe that political risks are overstated and that the impact on markets may be more localized. We would underweight bunds relative to U.S. Treasuries, given valuations and cyclical dynamics.

China

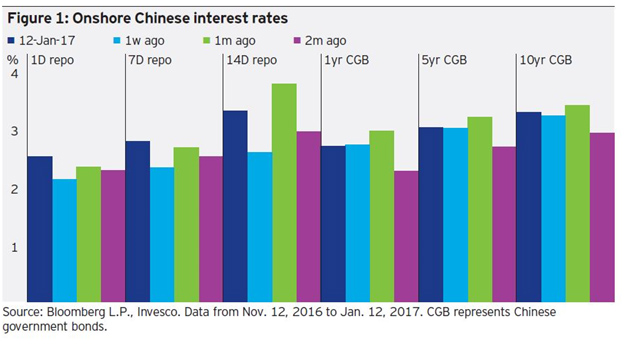

Onshore government bond yields, especially short-term yields, have retreated sharply from high levels reached in mid-December 2016. Lower short-term yields have been attributable to looser liquidity after a period of seasonal year-end tightness. Longer-term yields have been stickier, however, and remain at elevated levels, as onshore investors have been expecting higher inflation pressures in the first half of 2017.

Money market rates, on the other hand, have been much more volatile. The recent spike in money market rates was driven by (1) Chinese New Year-related seasonal demand for cash (2) corporate tax payments and (3) tightening by the central bank via bank regulatory measures. Capital outflows, albeit slowing, have also contributed to tighter liquidity conditions in money markets.

Although money market rates and short-term bond yields were expected to decline post-Chinese New Year, tax payments and the central bank’s tightening stance remain. Therefore, we expect short-term interest rates to remain pressured upward in the month ahead and long-term yields to be well supported at current elevated levels.

Japan

10-year Japanese government bond yields continue to trade in a tight range “around zero,” suggesting that the Bank of Japan continues to have control over the yield curve. We do not expect any near-term change in policy from the central bank as a result. However, a significant strengthening in the value of the yen could bring about a change in mindset, in our view.

U.K.

Brexit discussions will likely continue to drive market sentiment through 2017, with European Union (EU) negotiators facing a particularly challenging time. They will likely be seeking to ensure that the terms of any deal with the UK are punitive, so as to dissuade other EU countries from considering an exit from the union. The U.K. government is not in a weak negotiating position, however. It has control over its own currency, growth indicators remain solid and it has the capacity to (and has warned it could) lower its corporate tax rate to maintain its competitiveness. EU breakup concerns could increase as the year progresses.

Australia

The Reserve Bank of Australia (RBA) did not meet in January, thus the policy rate remains at 1.50%.2 The next meeting is scheduled for February 7th. While strong growth and improving inflation should give the RBA no reason to move the policy rate anytime in the near future, the December unemployment rate at 5.8% is a point of concern to the RBA.3 We expect Australian rates to be range bound in the near future and we maintain a neutral stance versus U.S. rates.

With contributions from Rob Waldner, Chief Strategist, James Ong, Senior Macro Strategist, Sean Connery, Portfolio Manager, Scott Case, Portfolio Manager, Josef Portelli, Portfolio Manager, Ken Hu, CIO Asia Pacific, Yi Hu, Senior Credit Analyst, Alex Schwiersch, Portfolio Manager

This post was originally published at Invesco Canada Blog

Copyright © Invesco Canada Blog