by Don Vialoux, Timing the market

Pre-opening Comments for Friday February 10th

U.S. equity index futures were higher this morning. S&P 500 futures added 3 points in pre-opening trade.

The Canadian Dollar moved higher following release of Canada’s January Employment report at 8:30 AM EST. Consensus was no change in employment versus a gain of 46,100 in December. Actual was a gain of 48,300. Consensus for the January Unemployment Rate was unchanged from December at 6.9%. Actual was a drop to 6.8%.

Sears Holdings jumped $2.46 to $8.00 after announcing plans to restructure the company.

Interpublic gained $0.72 to $23.99 after announcing a 20% dividend increase and a $300 million share buyback program.

Intel slipped $0.19 to $35.27 after Canaccord downgraded the stock to Hold from Buy.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2017/02/09/stock-market-outlook-for-february-10-2017/

Note seasonality charts on the Retail industry, Initial Jobless Claims and Wholesale Inventories.

Observations

Dow Jones Industrial Average, S&P 500 Index and NASDAQ Composite Index moved to all-time highs following Trump’s comment that his tax cut proposals will be released in “2-3” weeks.

Encouraging technical action by the Shanghai Composite Index!

StockTwits Released Yesterday

Nike $NKE, a Dow Jones Industrial stock moved above $54.12 extending an intermediate uptrend.

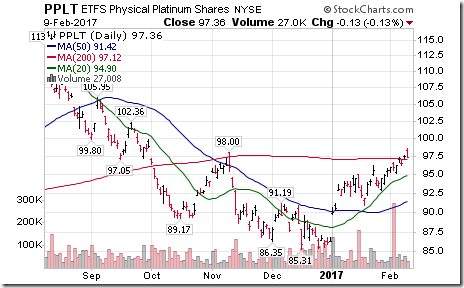

Platinum ETN $PPLT moved above $98.00 extending an intermediate uptrend.

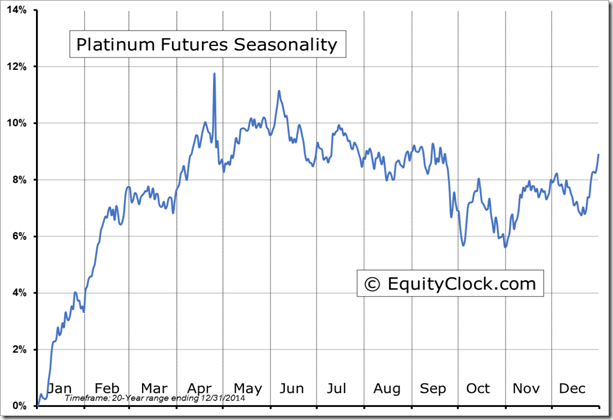

‘Tis the season for Platinum to move higher to late April! $PPLT

Technical action by S&P 500 stocks to 10:00: Bullish. Breakouts: $NKE $K, $AON, $BF.B $HRL $PXD, $ALLE. Breakdowns: $CINF, $DNB, $MAS

Editor’s Note: After 10:00 AM EST, breakouts included GT, CAG, AMG, EXPD, DG, PRU, RF, PDCO, IR and CTSH. No breakdowns.

United Kingdom iShares $EWU moved above $31.81 extending intermediate uptrend.

‘Tis the season for strength in the London FTSE Index to early May. $EWU.

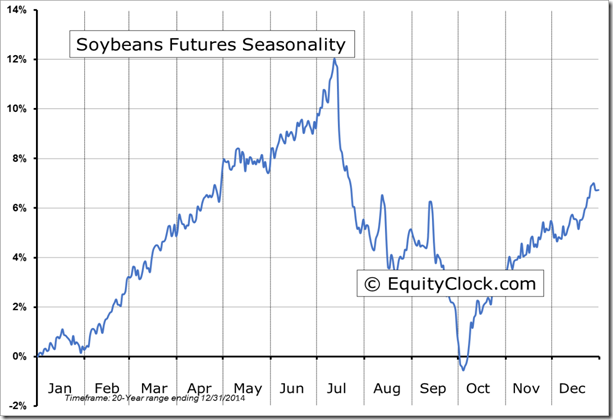

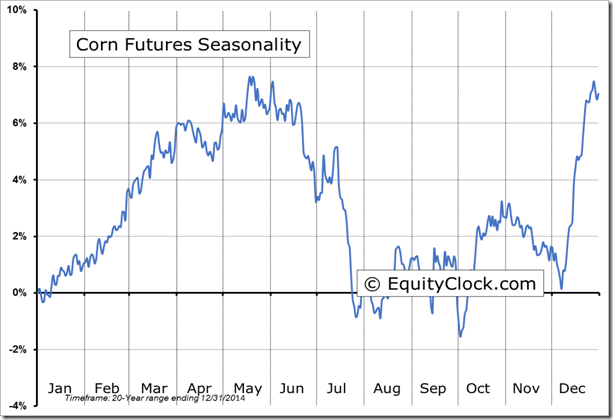

Grain ETN $JJG moved above $30.08 extending intermediate uptrend.

‘Tis the season for corn and soybean prices to move higher into May! $JJG $CORN $SOYB

Trader’s Corner

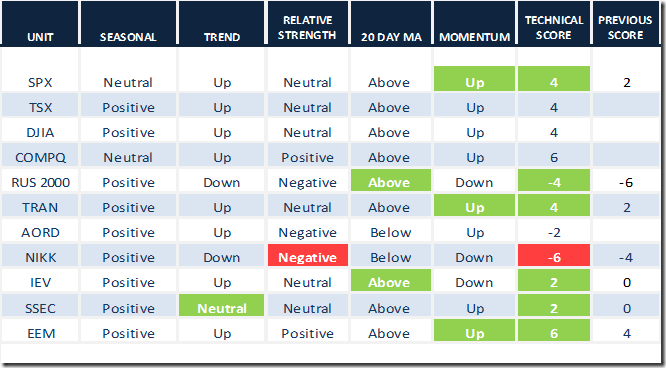

Daily Seasonal/Technical Equity Trends for February 9th 2017

Green: Increase from previous day

Red: Decrease from previous day

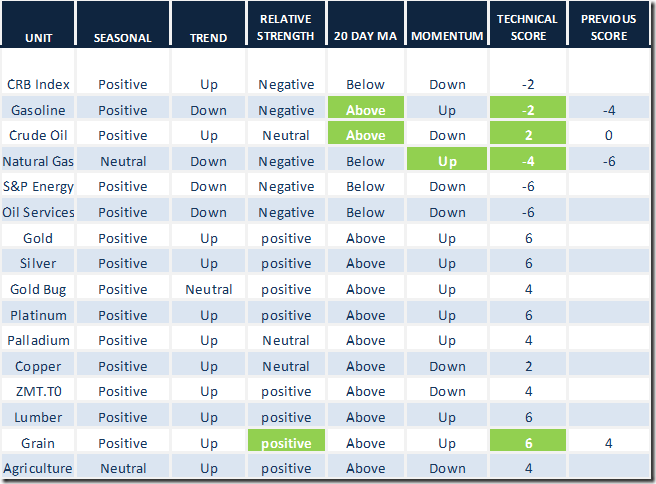

Daily Seasonal/Technical Commodities Trends for February 9th 2017

Green: Increase from previous day

Red: Decrease from previous day

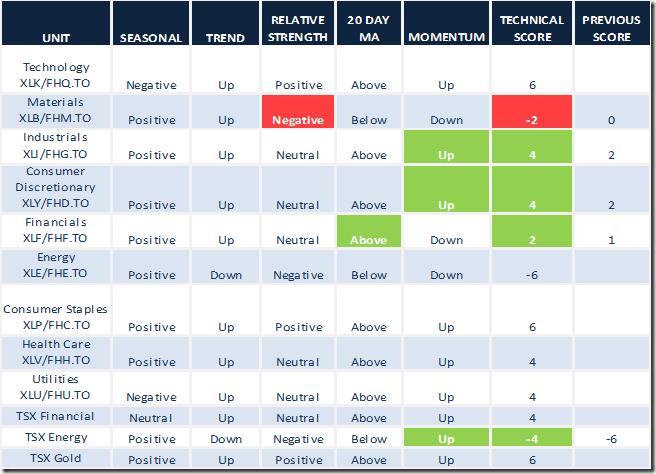

Daily Seasonal/Technical Sector Trends for February 9th 2017

Green: Increase from previous day

Red: Decrease from previous day

S&P 500 Momentum Barometer

The Barometer jumped 10.46 to 67.70 yesterday. It remains intermediate overbought.

TSX Momentum Barometer

The Barometer jumped 3.78 to 62.60 yesterday. It remains intermediate overbought.

Disclaimer: Seasonality and technical ratings offered in this report and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © Timing the market