by Kurt Reiman, Chief Investment Strategist, Canada, Blackrock

When it comes to market and economic surprises, 2016 was a banner year. Kurt Reiman weighs in on the potential surprises 2017 could bring, if reality diverges from expectations.

When it comes to market and economic surprises, 2016 was a banner year. Some of the outcomes we feared would most disrupt stock markets—including a UK vote to leave the European Union and a Donald Trump presidential win—actually materialized. Yet perhaps the biggest shock of them all was the resilience of financial markets in the aftermath of both the Brexit vote and Donald Trump’s U.S. election victory.

BlackRock’s base case for 2017 is that U.S.-led global reflation will accelerate, bond yields will gradually move higher and returns will remain low, as we write in our 2017 Global Investment Outlook. Against this economic backdrop, we believe developed market stocks will advance and investors will be rewarded for moving up the risk spectrum into equities, credit and alternative asset classes. Still, it’s always fun to think about how reality in 2017 could diverge from expectations.

BlackRock strategists and portfolio managers recently discussed this topic in online responses to questions floated at the BlackRock Investment Institute’s daily global videoconference dedicated to debating market trends.

- Equity market returns are significantly lower than the low returns already expected.

- Economic growth is slower than expected.

- Risks in China (like excessive debt) are more troublesome than expected.

Equity markets bounced back quickly after the negative shocks of 2016, but it isn’t clear such resilience will be repeated in 2017.

The three outcomes above would be surprises given consensus long positions in U.S. stocks and other economically sensitive assets, such as industrial commodities and corporate credit. What could be the catalyst for some of these negative surprises? Central bank policy mistakes or faster-than-expected rises in interest rates and the U.S. dollar were on our list.

Investors have been increasingly anticipating an extension of the bull market and better nominal economic growth in 2017, with consensus for 2017 now squarely centered on reflationary outcomes. Moreover, exposures that could mitigate the risk of an unexpected downturn in stocks, the economy or China, such as defensive stock sectors and longer-maturity government bonds, are presently out of favor. These assets could stage a comeback in a risk-off scenario.

A growth breakout, finally?

Despite these concerns, we also entertained the notion that things could turn out surprisingly well—even better than our cautiously optimistic view on the outlook. One such surprise we discussed: If U.S. fiscal policy comes sooner or turns out to be more effective than expected.

A solid dose of deregulation, tax cuts and infrastructure spending in the U.S. could be just the tonic to boost animal spirits, earnings and return on equity. If this were to happen, our return forecasts for risk assets this year may have been too timid.

That said, fiscal policy could be a double-edged sword for investment performance. The 1986 U.S. tax reforms, which are credited with boosting productivity and growth in the 1990s, are also viewed by some as having precipitated the U.S. savings and loan crisis. Today’s discussion of “border adjustments”—which would effectively tax U.S. imports but exempt exports—and removal of interest expense deductibility stand out as having the potential to create similarly large unintended consequences.

Uncertain uncertainties

Other potential surprises raised in our debate would have a differentiated impact across asset classes. Some of us noted, for example, that inflation could move higher than expected. We see persistently higher prices in “stickier” components of inflation, firming commodity prices, plenty of monetary juice in the system and the potential for a boost from fiscal policy and deregulation in the U.S.

Inflation-protected securities would likely outperform nominal government bonds amid higher-than-expected U.S. inflation, but stocks might not easily stomach a sharp upturn in interest rates or Federal Reserve (Fed) hawkishness. Higher-than-expected inflation is also a potential risk for emerging markets where central banks have less sophisticated policy tools than the Fed for combatting higher inflation. Conversely, an unanticipated overshoot on inflation in Europe and Japan, where expectations are still very low relative to central bank targets and deflation, could turn out to be a positive for stock markets.

Unknown unknowns

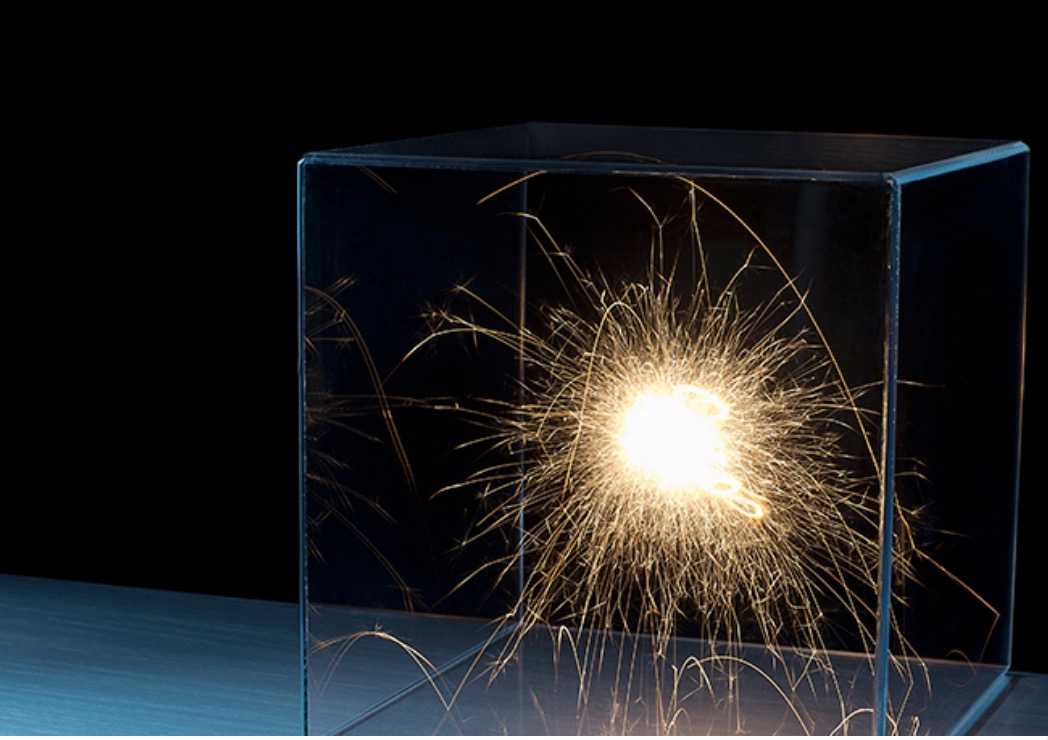

We know by the nature of the question that a list of potential surprises will never be exhaustive. If we take “surprise” as literally being a bolt out of the blue, then the biggest surprise in 2017 is unlikely to even appear in this blog post. That said, the nuclearization of the North Korean peninsula, trade wars, militarization of the South China Sea and the possibility of destabilizing political events bear close watching. Those surprised by the lack of volatility in 2016 could prove to have just been a little early if the positive outcomes currently expected fail to materialize and some of these more troubling events do.

Notwithstanding episodic spikes, stock market volatility was surprisingly low during much of 2016 given unusually high uncertainty. The big surprises of 2016 did trigger sharp moves in currencies (especially the British pound and Mexican peso) and rates (particularly U.S. 10-year yields), but they failed to derail the stock market advance because the real economy kept chugging right along at its steady, albeit sluggish, pace. There was also a fair amount of bad news baked into the price of stocks at the beginning of 2016 that never materialized (a U.S. recession, Chinese yuan devaluation and crash in oil prices, for instance). But given today’s already rosy expectations for reflation and stretched valuations, particularly in U.S. stocks, equity markets could be less immune to any negative surprises.

Kurt Reiman is BlackRock’s Chief Investment Strategist for Canada and contributed to this blog post.