by Jeffrey Saut, Chief Investment Strategist, Raymond James

We have often written that when everyone is asking the same question, it is usually the wrong question. However, I have also found the converse to be quite true – if no one is asking a question, it is probably one that you want to at least ask yourself just in case. For this reason, my attention was drawn to a blog post by Peter Lazaroff of Plancorp last week that asked several big name financial commentators like Barry Ritholtz, Ben Carlson, and Josh Brown the following question: What issue in the world of finance isn’t getting enough attention? Naturally, with so much focus on the U.S. political landscape recently, I expected to see responses about such under-the-radar topics as European banks, emerging markets, or the need to raise the debt ceiling once again in March. Yet, to my surprise, most of the answers were about more fundamental personal finance themes such as low savings rates, the amount paid in fees, and the switch to passive investing, all of which likely have a bigger impact on an investor’s long-term returns than just some transitory news headlines.

Retirement savings, in particular, received quite a bit of real estate on the blog, with Isaac Presley of Cordant Wealth Partners pointing out that “the median retirement savings for individuals aged 55-64 is just over $100,000, good for roughly $4,000 in annual spending” (per the Government Accountability Office). That is a frighteningly low number for people who should be nearing or entering their retirement years, especially when modern medicine and a renewed focus on health keeps extending our life expectancy upward. According to the Social Security Administration’s actuarial table, a current 65 year-old female is expected to live another 20 years (to approximately 85), but one thing that is often overlooked about aging is that the older you get, the longer you are expected to live compared to the average life expectancy. For example, while that 65-year-old woman is currently expected to live to 85, a woman who has enjoyed enough good health to live to be 80 is then expected to live another 9.64 years, to the age of almost 90. The point is, there is a very good chance that retirees will require income for longer than they anticipate, and the average person is woefully unprepared.

I mention this fact because I am often asked how the stock market can keep going up now that all these baby boomers are in or entering their retirement years and are presumably switching out of riskier equities to move into bonds and cash. Well, that is definitely happening to some extent, but based on these retirement savings numbers and anecdotal evidence I have gathered from meeting with perhaps hundreds of Raymond James clients over the years, very few people can afford NOT to invest in stocks to help fund their retirements, especially with rates as low as they are currently. And sadly, the situation appears to be even worse for the younger generation that is just now starting to enter the period of their lives where they are expected to heavily invest in the stock market. According to a recent report by Young Invincibles, a D.C.-based think tank, Millennials have earned a net worth of just half of what their Boomer predecessors earned at the same age, making it even more important that they start investing for the long run NOW. Millennials cannot yet make up the difference if every Boomer decides to shun stocks and switch entirely to fixed income, but I do not think that is happening or is going to happen unless interest rates really shoot up over the next few years to provide a strong enough reason to sell stocks. Even with Social Security, $100,000 in savings is just not enough to fund a possible 30+ year retirement for most people, which means the upside potential of stocks should continue to have a place in almost all portfolios.

Of course, we firmly believe that stocks will remain good investments for the next several years, and the earnings data, so far, does seem to be supporting our view that we have entered an earnings-driven stage of the bull market as opposed to one primarily fueled by low interest rates. It is still very early in earnings season, with only about 15% of S&P 500 companies having reported, but the blended bottom-up operating earnings number, which includes actual operating earnings for companies already reported and the estimates for those which haven’t, is on pace to see 9% growth over the fourth quarter of 2015 (per data from S&P). That would be the best annual increase on a quarterly basis since the third quarter of 2014, and the growth has a good chance to improve even more if the pace of earnings beats continues. As we have written, this strengthening earnings landscape should not only help satiate those investors who still just don’t believe that conditions are getting better, but it also has a chance to greatly improve the valuation picture if earnings outpace price appreciation.

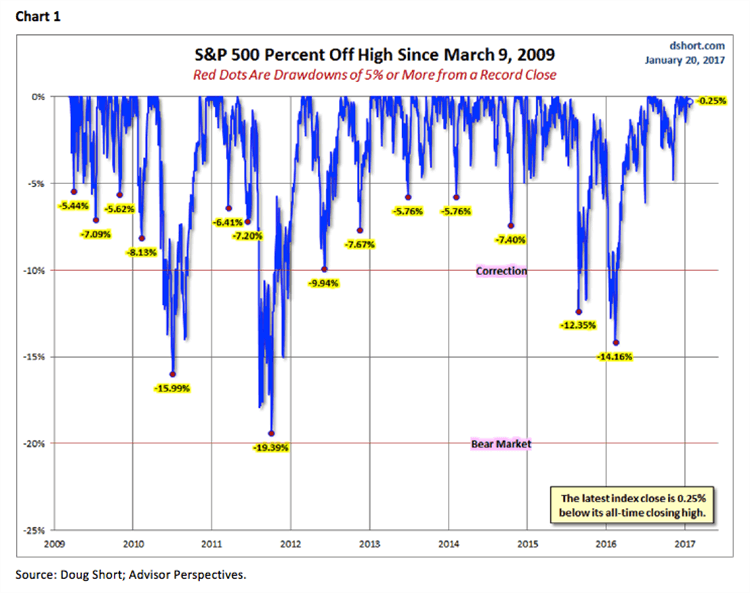

Our models and indicators continue to suggest, too, that some weakness may be on the horizon, which may help valuations look a little better sooner rather than later. We have said for weeks now that we were targeting late-January for the next patch of volatility, so we have taken our foot off the pedal a bit just in case. A strong earnings season may help limit the downside, and, again, we are not expecting anything like we got this time last year, but we do appear to be due for some market declines. Based on this great chart from Doug Short (Chart 1), it looks like this is the longest we have gone since the bull market began in 2009 without at least a 5% dip from a previous closing high (the last dip being February 2016). What’s more, the first 30 day period of a new presidential administration has a fairly mixed history, with seven out of the last eleven presidents seeing declines in the month after they took office. Interestingly, the best 30-day period for a new president going back to Eisenhower was actually when President Kennedy was assassinated and Lyndon Johnson took over during one of the darkest periods in American history (the S&P 500 gained 6.03%). If you remove that outlier, though, the average decline in the first 30-days has been -2.66%, with both Barack Obama and George W. Bush greeted with dips between 4-5%. Still, we continue to see higher prices in the intermediate and long run, an opinion echoed again last week by Warren Buffett during a CNBC interview on the eve of President Trump’s inauguration. "It doesn't work all the time perfectly," the billionaire investor and philanthropist said, "but you just look at where we go, milestone after milestone. Never bet against America. [I don’t know where the stock market will go in the next] 10 days or a year or two years, [but] it's going to be higher 10 years, 20 years from now."

The call for this week: It will, of course, be President Trump’s first full week in office and much of the attention will remain on him, his cabinet nominees, and what will be done during the first 100 days of his administration. However, it will also be an extremely busy week for earnings releases, with 70 S&P 500 companies reporting, including 12 of the 30 Dow components. Investors will not only be watching for continued signs of improving sales and earnings, but also will closely analyze just what management teams are saying about their outlook for their businesses under the new administration. Again, it is still early in the season, but so far the big policy topics cited on earnings calls have, not surprisingly, been tax policy and regulation, with 11 and 8 mentions, respectively, per FactSet data (Chart 2). There has also been double the amount of positive guidance issued than negative guidance, which is a favorable departure from the last few quarters where negative guidance dominated, and this trend will hopefully continue. We will also get the first estimate for 4Q GDP on Friday, and though this number will be revised several times in the future, it always draws plenty of attention. So, there is plenty to watch this week and plenty of news flow to finally break the market out of its slumber, but, of course, the market has also stayed plenty stubborn recently. There is still a chance with Dow 20,000 just sitting there right above us that the market rallies just enough to take that out, but we continue to believe stocks may have limited upside without some sort of pullback first. Therefore, remain careful and cautious and don’t forget to save for retirement!

Copyright © Raymond James