Equity markets have priced in a new regime as we head into 2017. Will it materialize?

by Jurrien Timmer | Director of Global Macro | Fidelity Global Asset Allocation Division | @TimmerFidelity

Key Takeaways

• Investors resigned to more years of secular stagnation were stunned by an unexpected re- gime shift that resulted from the U.S. election.

• This regime shift is toward an inflationary “boom” or at least something growthier and more inflationary than the post-2008 secular stagnation era.

• Now that the stock market has been dramati- cally re-rated for this new regime, the question for 2017 is whether the reality will live up to the hope…or live down to just hype.

• One thing seems clear: With the economy at full employment, it won’t take much for infla- tion to accelerate if GDP growth picks up.

Many investment outlooks tend to feature predictions about how various asset categories (U.S. and foreign stocks, bonds, etc.) may perform in the new year. While such conjecture can be interesting, I believe a more helpful forecast includes an analysis of the investment environment one is likely to encounter. That’s what’s most likely to influence market performance. With that in mind, here are my observations as we prepare to cross the threshold into 2017.

The “melt-up” (rally) for risk assets that began after the U.S. elections could continue through year-end and into next spring. That’s great news for equity investors. Just keep in mind that the more that stocks rally (along with bond yields and the U.S. dollar), the higher the risk that “hope” may turn into “hype.” Even if it doesn’t, there’s a risk the economy (which is already eight years into an expansion and now at full employment) may overheat and cause the U.S. dollar to soar, amid a backdrop of low unemployment and expectations for rising interest rates and stronger economic growth. Add in a Federal Reserve (Fed) that may be forced to turn more hawkish, and you get a recipe for financial conditions to seize up.

But these are scenarios for six to 12 months from now, if not beyond. For now, we have a bullish trifecta of an unexpected regime shift from secular stagnation to inflation boom, a reversal of the $150 billion that has flowed from equities to bonds over the past few years, and bullish end-of-year seasonals. It all spells “melt-up.”

Nevertheless, my sense is that the markets have fully priced in this new regime of higher inflation, a stronger U.S. dollar, a tighter Fed, and U.S. economic dominance. So, any further re-rating will likely be momentum-driven and, therefore, subject to a reversal in the New Year. You can see it in the way the markets have re-rated since the election. Small-caps have trounced the large-cap S&P 500 Index, reversing a year-over-year excess return of -12.5% to +11.2% in just six months. Meanwhile, the U.S. dollar recently hit a new cycle high, the market is pricing in two more rate hikes in 2017, and bond yields are way up, with the 10-year Treasury note reaching 2.5% last week.

Questions for 2017

The markets’ re-rating reflects a regime shift from secular stagnation to inflation boom (or, at least something with more growth and inflation than we’d had). But will the reality meet investor expectations? Or have the markets risen too far too fast?

The answers to these questions depend on three things. First, how much of the priced-in growth from expected tax reform and deregulation will actually materialize once we get to the congressional sausage-making phase, especially with the economy at full employment and real GDP growth at a low-speed rate of about 2%?

Second, it’s plausible that even with Republican control of Congress, there will be enough internal opposition from fiscal conservatives that the hoped-for deficit spending boom will not materialize, or that it won’t have the growth multiplier that’s currently being priced in. While Reagan- era comparisons are compelling, the country is in a far different place today than in 1980. Debt levels are much higher, interest rates are much lower, equity valuation is on the north side of the typical 10x-20x range, and we are at the tail end of a demographic boom rather than at the beginning. Yes, the tax and deregulation analog is there, and the renewal of hope after years of stagnation also has a similar ring to it, but that’s about it.

Third, to what degree will the Fed feel compelled to lean into this expected positive growth shock with a pre-emptive monetary offset? If the Fed believes the economy is at full employment, then it will likely conclude that any additional real GDP growth (say, north of 3%) will be inflationary. This suggests the Fed could aim to soften the expected growth shock through more aggressive tightening (that is, unless productivity improves.)

On the other hand, if the Fed decides to let the economy run hot for a while, we could see a classic overheating. Then the question is at what point will the Fed have to catch up to an overheating economy, a scenario that could lead to a classic end-of-cycle recession in, say, 2018.

We now know more about the Fed’s mindset after its December 14 meeting. Like most, I expected a 0.25% increase with no material change in forward guidance, i.e., a “dovish” hike. Instead we got a slightly more hawkish tilt, with the Fed (through its dots) signaling one additional rate increase (three hikes in 2017 instead of two) for the remainder of the cycle. This shouldn’t be a big deal, but it does put the market on notice that the Fed is not going to sit idly by and let the economy run hot. As the Fed chair said in a post-hike press conference, a fiscal boost would have been more welcome a few years ago when the economy had more slack.

Let go, or stay in?

“Fade or follow” refers to whether one should let go of (sell into) the post-election rally, or continue to participate in it. “Fading” (in trading jargon) means taking the other side of the move. So, investors must decide whether to “fade” the post-election’s upward moves in equities, interest rates, and the U.S. dollar, or to “follow” the rally in hopes that it might continue. There are arguments to be made on both sides.

For stocks, the good news is that U.S. earnings growth bottomed in the first quarter of 2016 and has continued to grow. Year-over-year growth in Q3 earnings rose to +3.3% (from -7.1% in Q1 and -2.3% in Q2). So, the fundamentals were improving well before the election. Earnings could accelerate higher if the plans to lower corporate taxes and loosen regulations boost corporate America’s profit margins (or, at least offset lower profit margins caused by higher inflation).

That said, policy uncertainty and higher inflation may cause valuation headwinds in 2017. The stock market is currently priced at around 19x trailing earnings. Using the consensus earnings estimate of $131 for 2017, at 18x the S&P 500 would be worth more next year than it is now, but at 16x it would be worth less than where it is today.

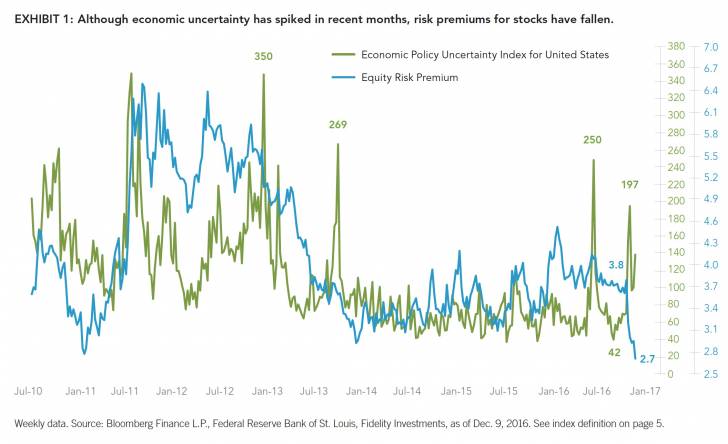

History shows that periods of greater policy uncertainty tend to produce a higher risk premium for both equities and credit. For stocks, policy uncertainty can lead to a lower price-to-earnings (P/E) multiple; for corporate bonds, it suggests a wider credit spread. The Economic Policy Uncertainty Index has risen sharply of late, from 41 in early September to 197 on December 7 (Exhibit 1).

However, contrary to how it typically behaves amid policy uncertainty, the risk premium for equities has actually fallen considerably, from 3.8% before the election to 2.7% as of December 9 (Exhibit 1). Why has this historical relationship become inverted? To make up for the spike in the 10-year Treasury yield. However, a falling risk premium amid such uncertainty seems unsustainable, and may increase the probability of a valuation giveback once the current rally runs its course.

I expect that the dynamic between earnings growth and valuation will be a tension point for markets in 2017. In addition, the risk of an overshoot in rates and the U.S. dollar will be important to watch for in 2017.

Bullish on equities for 2017

Despite potential valuation headwinds, I’m bullish on stocks based on where we are in the earnings cycle. But I don’t expect a sudden boom in merger-and-acquisition (M&A) activity or stock buybacks resulting from foreign cash repatriation by the new administration. Share buybacks are now near levels last seen in 2007, shortly before the financial crisis, but they’ve largely been funded by cheap debt. In 2017, with yields higher and foreign cash coming in, I expect buybacks and M&A to continue on pace, but that the funding will switch from debt to repatriated cash.

Finally, as I think about the current rise in equities and the U.S. dollar, I’m struck by the trifecta of bullish magazine covers I’ve seen in the span of just two weeks. First, it was the “Mighty Dollar” cover of The Economist, then came Trump as Time Magazine’s Person of the Year, and now we have Barron’s boldly proclaiming Dow 20,000 (actually, that could be just a few good trading days away). In my experience, magazine covers can be contrarian indicators. In this case, they may suggest that sentiment is becoming a bit too exuberant.

So, that brings us back to the original question: Fade or follow? While there appears to be good opportunities for growth in 2017, it would be unwise to overlook the enormous amount of uncertainty that overhangs the markets and economy. A new administration is coming in with a very different agenda than the one of the past eight years. Global markets are very nervous about potential trade policies the U.S. may adopt. And it’s unclear how stocks will react to an environment of higher interest rates and potentially higher inflation. We simply don’t know what we don’t know.

What does seem clear is that this will not be a “just close your eyes and buy” market that we’ve seen in the past. It‘s a more challenging and tactical environment in which there is still upside potential, but also more downside risks. To me, this kind of regime shift should be an ideal opportunity for active management.

Author

Jurrien Timmer l Director of Global Macro, Fidelity Global Asset Allocation Division

Jurrien Timmer is the director of Global Macro for the Global Asset Allocation Division of Fidelity Investments, specializing in global macro strategy and tactical asset allocation. He joined Fidelity in 1995 as a technical research analyst. Fidelity Thought Leadership Vice President Matt Bennett provided editorial direction for this article.

For Canadian investors

For Canadian prospects and/or Canadian institutional investors only. Offered in each province of Canada by Fidelity Investments Canada ULC in accordance with applicable securities laws.

Information presented herein is for discussion and illustrative purposes only and is not a recommendation or an offer or solicitation to buy or sell any securities.

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market and other conditions. Unless otherwise noted, the opinions provided are those of the author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.

Investment decisions should be based on an individual’s own goals, time horizon, and tolerance for risk. Nothing in this content should be considered to be legal or tax advice and you are encouraged to consult your own lawyer, accountant, or other advisor before making any financial decision.

Stock markets are volatile and can fluctuate significantly in response to company, industry, political, regulatory, market, or economic developments. Investing in stock involves risks, including the loss of principal.

Investing involves risk, including risk of loss.

Past performance is no guarantee of future results.

Diversification and asset allocation do not ensure a profit or guarantee against loss.

All indices are unmanaged. You cannot invest directly in an index.

Index definitions

Standard & Poor’s 500 (S&P 500®) Index is a market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance. S&P 500 is a registered service mark of The McGraw-Hill Companies, Inc., and has been licensed for use by Fidelity Distributors Corporation and its affiliates.

The Economic Policy Uncertainty Index reflects the frequency of roughly 12,000 articles in 10 leading U.S. newspapers that contain the following triple: “economic” or “economy; ” “uncertain” or “uncertainty;” and one or more of “congress,” “deficit,” “Federal Reserve,” “legislation,” “regulation,” or “White House. ” The index historically spikes at times of such events as tight presidential elections, Gulf Wars I and II, the 9/11 attacks, the failure of Lehman Brothers, the 2011 debt-ceiling dispute and, other major battles over fiscal policy. Third-party marks are the property of their respective owners; all other marks are the property of Fidelity Investments Canada.

If receiving this piece through your relationship with Fidelity Institutional Asset ManagementSM (FIAM), this publication may be provided by Fidelity Investments Institutional Services Company, Inc., Fidelity Institutional Asset Management Trust Company, or FIAM LLC, depending on your relationship.

If receiving this piece through your relationship with Fidelity Personal & Workplace Investing (PWI) or Fidelity Family Office Services (FFOS), this publication is provided through Fidelity Brokerage Services LLC, Member NYSE, SIPC.

If receiving this piece through your relationship with Fidelity Clearing and Custody Solutions or Fidelity Capital Markets, this publication is for institutional investor or investment professional use only. Clearing, custody or other brokerage services are provided through National Financial Services LLC or Fidelity Brokerage Services LLC, Member NYSE, SIPC.