by Tim Duy, Tim Duy's Fed Watch

In the most recent Summary of Economic Projections, Fed officials penciled in three 25bp rate hikes for 2017. The reality, however, could be very different. We all remember how “four” became “one” in 2016. The median dots are neither a promise nor an official forecast. As 2016 progressed, forecasts associated with a lower path of SEP “dots” evolved as the consensus view of policymakers. Will the same happen this year? I don’t think so; it is hard to see the Fed on pause for another twelve months.

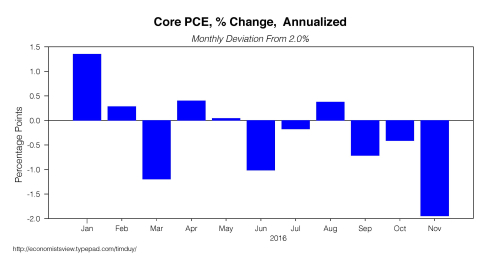

As a starting point, I think it best to assume the US economy is near full-employment. But the US economy was near full-employment at this time last year as well. I think the key difference between then and now is that then the after-effect of the oil price slide and dollar surge placed a drag on the US economy sufficient to ease hiring pressure. At the same time, labor force participation perked up, setting the stage for a flat unemployment rate for most of the year. Inflationary pressures eased as well; the January inflation pop proved to be short-lived:

In effect, the US economy settled into a nice little equilibrium in 2016 that obviated the need for additional rate hikes. To expect a repeat scenario in 2017, one would need to assume that the US economy does not pick up speed and threaten that equilibrium by pushing past full employment.

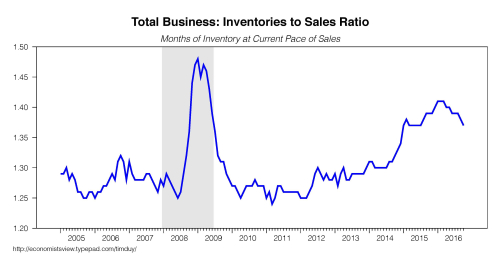

Evidence, however, piles up suggesting that the slowdown of the past year is drawing to a close. ISM manufacturing and nonmanufacturing surveys are stronger, temporary help employment is heading up again, new manufacturing orders for nondefence, nonair capital goods have flattened out, and the broader inventory overhang is easing:

All of this occurs in the context of an unemployment rate that suddenly dipped toward the lower end of the Fed’s estimates of the natural rate of unemployment. And if the demographic forces reassert themselves, there is likely to be further downward pressure on the unemployment rate – job growth is well above estimates necessary to hold unemployment constant.

But would a total of 75bp of hikes be necessary to hold inflation in check? That depends in part the sensitivity of inflation to greater resource utilization. Greg Ip of the Wall Street Journal noted last week:

Unlike in 2009, this fiscal stimulus will be hitting when the economy is close to full employment with far less spare capacity. Yet it’s premature to assume inflation will therefore jump. In the last decade inflation, excluding swings due to energy, has proven surprisingly inertial, barely moving in response to high unemployment. The same is likely true if unemployment drops further below its “natural” level.

It is true that inflation is fairly inertial, although some policymakers will dismiss the lack of response to high unemployment as a consequence of downward nominal wage rigidity. Moreover, others will claim the reason for inertial inflation is that the Fed has properly responds to weak or strong economic conditions to hold inflation and, importantly, inflation expectations, in check. In other words, you won’t see inflation if the Fed acts preemptively.

Still, the broader point remains true that while further declines in unemployment will pressure the Fed to hiking rates more aggressively, low inflation like seen in November will temper that response.

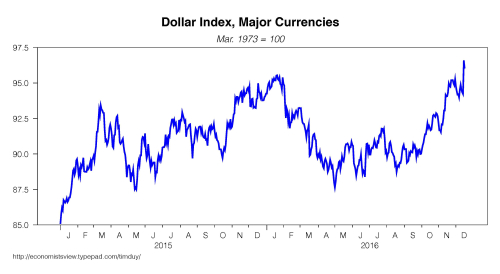

In addition, policy going forward depends on the relative tightness of financial markets in general, and the dollar in particular. And the dollar has been on a tear in recent weeks:

The dollar serves as a break on the US economy. If activity expands as I anticipate, and the economy is near full employment as I believe, then some demand will be offshored as the rising dollar prompts the trade deficit to widen. Consequently, the Fed needs to be wary of feedback effects from the dollar as they tighten policy.

Bottom Line: The economic situation on the ground is very different from December of last year. Whereas the decision to raise rates at that time looked ill-advised, this latest action appears more appropriate given the likely medium-term path of the US economy. Assuming the US economy is near full employment, that path likely contains enough upward pressure on activity to justify more than one more rate increase in 2017. Three I think is more likely than one. That said, the change in administrations and the path of fiscal policy creates uncertainties in both directions.

Copyright © Tim Duy's Fed Watch