by Jeffrey Saut, Chief Investment Strategist, Raymond James

As we enter 2017, we expect the current economic rebound to continue suggesting GDP growth will likely move toward the 3% level by the end of the year based on less monetary stimulus, more fiscal stimulus, a reduction in the corporate tax rate, and deregulation. Our S&P 500 price target for the year is 2450, but we believe the S&P 500 may actually exceed that level as earnings growth ramps. We think the post “Trump Trades” will continue to have “legs.” Our team favors small capitalization names over large caps and value over growth. We also urge investors to overweight Financials and underweight bonds, bond proxies, Consumer Staples, and Utilities. In our opinion interest rates have bottomed, deflationary trades are wrong-footed, inflation is rising, “real assets” names should be bought, the U.S. dollar probably trades a little higher, the labor market continues to tighten, wages rise, and business investment improves.

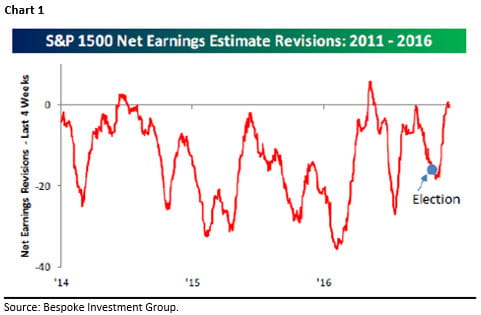

To be sure, yearend letters are always hard to write because there is a tendency to discuss the year gone by, or worse to predict what is in store for the new year. Quite frankly, how many pundits predicted Brexit, or a Donald Trump victory? Certainly it wasn’t Andrew Adams or I. Yet, we think by far the biggest message as we prepare to enter 2017 is that the equity markets are transitioning from an interest rate driven bull market to an earnings driven bull market. This is being reflected in the analysts’ earnings revisions, which have taken a decidedly upward turn (Chart 1). Currently, the S&P 500’s bottom up, operating earnings estimate for 2017 is around $131. That leaves the S&P 500 trading at a P/E ratio of ~17x forward earnings. However, Thomson Reuters notes that for every 1% decline in the corporate tax rate it “hypothetically” generates an additional $1.31 in earnings for the S&P 500. If President-elect Trump can get his envisioned 15% corporate tax rate that would imply another ~$26 in earnings for the S&P 500 (20 x $1.31 = $26.20). Accordingly, if you hold the P/E constant at 17x, and add another $26 to the $131 estimate, it yields an earnings estimate of $157 leaving a forward price target for the S&P 500 of ~2670 ($157 x 17 = 2669). Yet, getting corporate tax rates down to 15% could prove to be difficult. Still, a 25% tax rate would produce an earnings estimate for 2017 of ~$144. Again holding the P/E ratio constant at 17x gives us a price target for the S&P 500 of roughly 2450 in the new year. In either event, we believe stocks are going to trade substantially higher over the next few years. Will there be pullbacks? You bet there will, but in our view pullbacks are for buying. Going into the presidential election our models suggested the equity markets were set up for a decent rally no matter who won the election, although we have to admit the Trump win clearly accelerated the envisioned rally. Bingo, because the S&P 500 futures have rallied over 200 points from their November 8 overnight lows. From those lows our models forecasted the S&P 500 would grind higher into late-January/early-February; and, they remain in that rally mode. In the very short term those same models called for a trading peak the week of December 11, 2016, followed by a pause and/or an attempt at a minor pullback into this week. So far that has been a pretty good “call.”

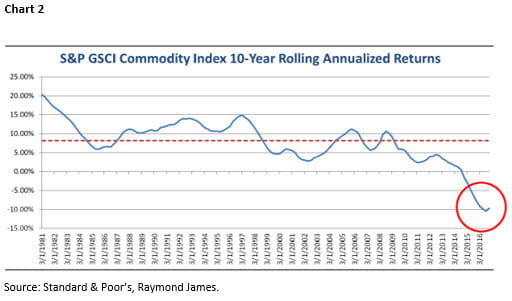

Speaking to the fixed income markets, a pickup in GDP growth combined with reflationary pressures and potentially a more hawkish Federal Reserve suggest a higher interest rate environment is sustainable. These metrics also are supportive of a stronger U.S. dollar, which will likely cause the euro to trade to par in 2017. While this represents headwinds for commodities, over the past few months we have been recommending the return to “stuff stocks” given the fact the price of real assets, assets relative to financial assets, is at historic lows (Chart 2). Looking at the charts of the U.S. dollar, commodities, bonds, stocks, etc. show that volatility is here to stay. We believe political risk could amplify this “episodic volatility,” especially as deepening populism potentially gains traction around the world.

Looking at valuations, using trailing 12 month figures leaves the equity markets trading at historically lofty valuations. However, as my friends at Bespoke Investment Group point out:

Already, there has been increasing chatter in the last several days that the rally since the November election is based on hype and sentiment and nothing concrete. We will be the first to admit that we have no idea how the next four, or possibly longer, years will ultimately turnout, but one thing we would stress is that if you are in the business of investing and haven’t realized that the market is forward looking, you are in the wrong business.

It is our belief the equity markets are looking forward to a huge rebound in earnings. As another friend writes (Rich Bernstein of Richard Bernstein Advisors):

One of the things that has scared people away from equities is high P/Es (Price to Earnings Ratio). People have said, “When P/Es are high, your returns have to be low.” That's not always true. Where it's not true is in what's called an “earnings-driven” market. There have been many earnings-driven markets through time, but it's funny how people think the only way the market can go up is by interest rates falling and multiples expanding. That's not true. That's an interest-rate-driven market, but there're also earnings-driven bull markets. The early 2000’s bull market was an earnings-driven market. One of the reasons people got trapped at the end was that they forget they'd started with a very high P/E and ended with a low P/E. When you had the low P/E, people said, “Look how cheap equities are.” And they missed the fact that it was an earnings-driven market, and you sell an earnings-driven market when the P/E is low, much like a deep cyclical stock. You buy a deep cyclical stock when the P/E is high, and you sell it when the P/E is low. That's what we think is going on for the whole economy. That's been our story, that, yes, the multiple is high, but we think we're entering an earnings-driven market. So the bull market will be accompanied by shrinking P/Es.

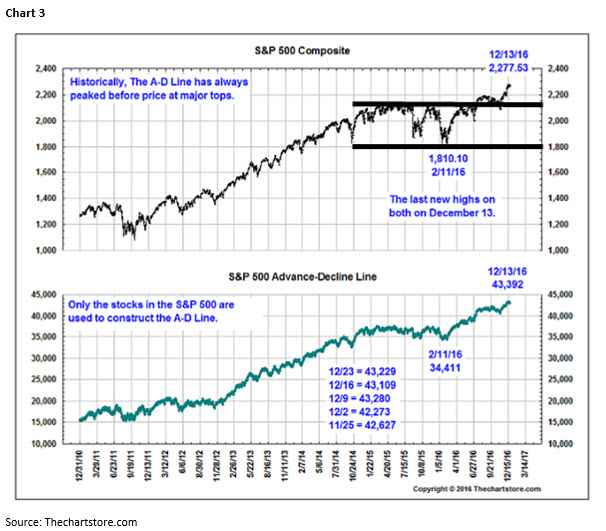

The call for this week: For almost two years the S&P 500 (SPX/2263.79) was locked in a trading range (Chart 3) as many pundits proclaimed a “top” was being formed, a crash was coming, etc. We, however were steadfast in the belief all that was happening was an upside consolidation building the base for another leg to the upside in this secular bull market. In August of this year the SPX broke out of that trading range and subsequently gained over 100 points, Q.E.D.! Plainly, the equity markets are seeing that something “good” is coming. Again as Bespoke notes, “If you are in the business of investing and haven’t realized that the market is forward looking, you are in the wrong business.” And maybe, just maybe, the market is realizing that for the most part deal maker businessmen, who know how to get things done, will be running the government for the next four years (just a thought). This week participants will be watching for the fabled Santa Rally, which occurs between Christmas and New Year’s. To wit, according to the Stock Trader’s Almanac:

Since 1969 the Santa Claus rally has yielded positive returns in 34 of the past 45 holiday seasons — the last five trading days of the year and the first two trading days after New Year’s. The average cumulative return over these days is 1.4%, and returns are positive in each of the seven days of the rally, on average.

Following that folks will be watching the January Indicator, while we will be watching the January Barometer. More on those two indicators in days to come . . .

Copyright © Raymond James