By Todd Mattina, Chief Economist and Strategist, Mackenzie Asset Allocation Team

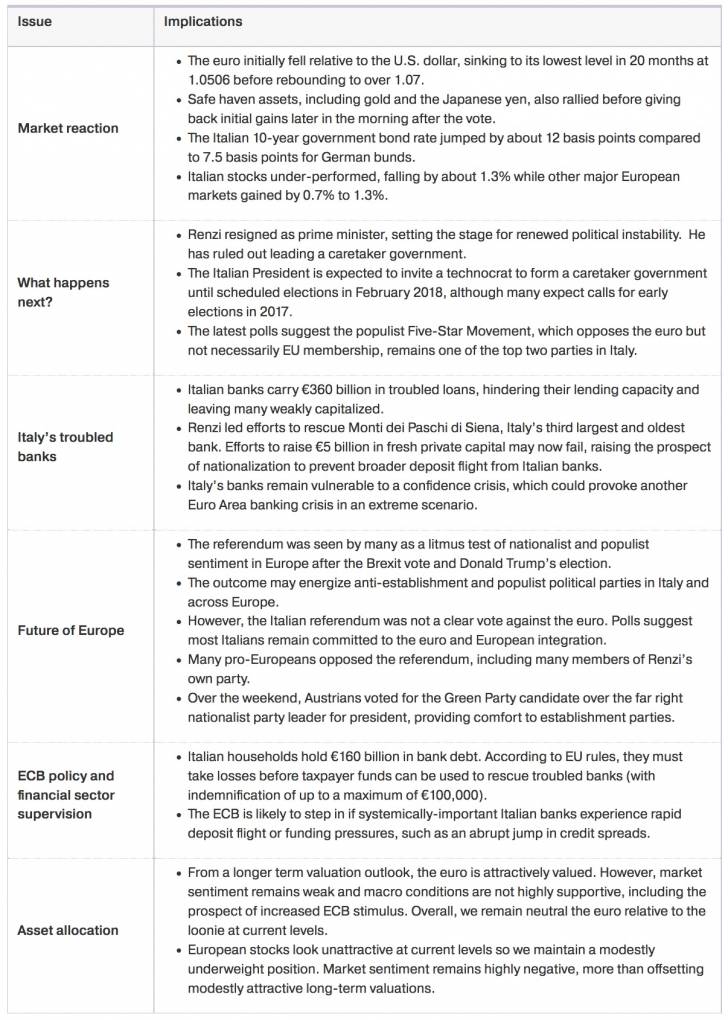

On December 4, 2016, Italians voted ‘No’ in a constitutional referendum that many voters interpreted as a vote of confidence in Prime Minister Matteo Renzi’s government and Italy’s place in the Euro Area. Renzi resigned after approximately 60% of Italians rejected constitutional reform. The resounding defeat sets the stage for heightened political uncertainty in Italy, the Euro Area’s third-largest economy.

The ‘No’ vote shines a light on Italy’s troubled financial sector and highly indebted public sector with total debt of about 135% of GDP. The increased political uncertainty risks sidelining urgently needed reforms, such as recapitalizing the banking system and modernizing the sluggish Italian economy.

Markets quickly recovered losses after an initial selloff and flight to safe haven assets, as the referendum outcome was widely anticipated. The negative economic fallout from the ‘No’ vote is expected to focus mainly on Italy at this stage, with limited international spillovers. Looking ahead, we remain neutral on the euro relative to the loonie and modestly underweight European stocks relative to Canadian equities.

In the immediate aftermath of Italy’s referendum, here is our analysis of several key issues for Italy, Europe and global financial markets:

Important Disclaimer

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

This document includes forward-looking information that is based on forecasts of future events as of December 5, 2016. Mackenzie Financial Corporation will not necessarily update the information to reflect changes after that date. Forward-looking statements are not guarantees of future performance and risks and uncertainties often cause actual results to differ materially from forward-looking information or expectations. Some of these risks are changes to or volatility in the economy, politics, securities markets, interest rates, currency exchange rates, business competition, capital markets, technology, laws, or when catastrophic events occur. Do not place undue reliance on forward-looking information. In addition, any statement about companies is not an endorsement or recommendation to buy or sell any security.

The content of this commentary (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

Copyright © Mackenzie Investments