via Zero Hedge

It was about a year ago when, in a note brimming with optimism, Goldman Sachs (which had just released its Top 6 trades for 2016, 5 of which would close out at a loss just two months later) predicted that the Fed would hike rates 3 times in 2016, a year in which the economy was expected to storm higher. It has yet to hike them once (although the market is 90%+ convinced this will happen next month) even as the economy has done virtually nothing, and some can argue contracted further for most of the world class leading to Donald Trump's "surprise" victory.

Fast forward one year when here we are again, a few weeks ahead of the Fed's December hike (which probably will happen now that everyone is freaking out about the Trumpflation tsunami even though nobody has actually seen any detail thereof), and out comes Goldman - like clockwork - with another report in which it forecasts the same as it did a year ago: namely three Fed hikes in 2017 after the December one; in other words, Goldman believes that by the end of next year, the Fed Funds rate will be around 1.50%, or where the 10Y was just two months ago.

Good luck, and we say that because a closer read of the Goldman report reveals that while Jan Hatzius lays out all the optimistic highlights that have been factored in by stocks and bonds as of this moment, he proceeds to highlight in extensive detail why not only Trump's policies may not be largely implemented, but why the market could be significantly disappointed.

Here are some of the highlights from the Goldman notes penned by chief economist Jan Hatzius:

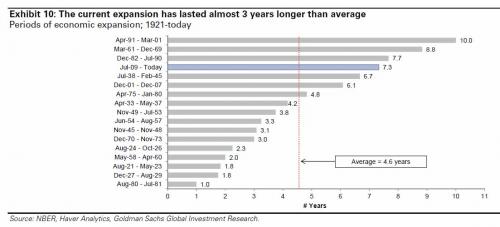

Donald Trump will take office next January in what is likely to be the 91st month of the current expansion—already the fourth longest in US history. At the start of his term, he will be supported by Republican majorities in both houses of Congress— just as President Obama presided over unified Democratic control in 2009-10—which should make it easier to shape government policy through appointments and legislation. Taken together, the prospects for significant changes in policy and an economy moving into the later stages of the business cycle will mean higher uncertainty—making for an especially interesting US economic outlook this year

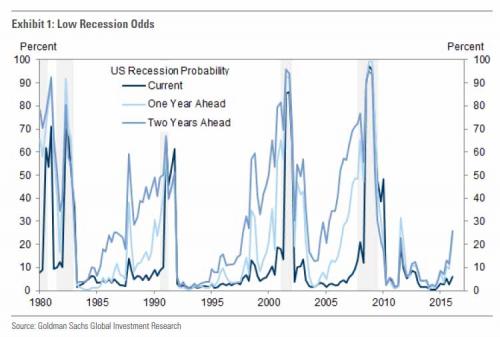

However, despite the aged-nature of the economic cycle (assuming such a thing even exists in a centrally-planned world), Goldman is optimistic. Either that, or it still has a lot of risk to sell to retail in what is now a clear bloff off, euphoric top for stocks, coupled with a great rotation out of bonds and into equities. As a result, Hatzius only sees a 21% probability of a recession in 2017.

Despite the mature expansion, Mr. Trump can probably count on continued growth in the early part of his new administration. Our research suggests that economic expansions have no fixed timeline—they do not “die of old age”—so there is no reason to expect a downturn simply because of the long stretch of growth. In developed market economies, the unconditional odds that an economy will fall into recession in any given year are about 10-15%, implying that the economy has a 70- 80% chance of avoiding recession for the next two years. Our formal recession probability models are similarly benign, showing odds of a downturn over the next year of 21%, and over the next two years of 26% (Exhibit 1).

However, as Goldman hinted previously, the biggest risk to the near-future is als the same wildcard that has given markets so much optimism: what exactly will the final shape of Trump reforms be. Here Goldman is once again, less enthusiastic.

First the good news:

Any fiscal stimulus from the next administration would be an added tailwind for 2017 growth. At this early stage there is still a wide range of possible outcomes for fiscal policy (see here for our detailed analysis). Our current working assumption is that the next Congress will pass a fiscal package totaling $150bn per year, or 0.8% of GDP. Of this total, we expect $100bn in tax cuts ($70bn for individuals and $30bn for firms), and a $50bn net spending increase ($40bn for infrastructure and a net $10bn for other programs). We estimate that these policies would have a weighted average multiplier of 0.8. Thus, all else equal, a fiscal expansion of this size would increase the level of real GDP by about 0.6%—or a 0.3pp boost to growth per year if phased in over a two-year period.

Now, the bad:

While we see substantial support in Congress for proposals to cut taxes and reform the tax code, our current impression is that market expectations of quick fiscal expansion may be running ahead of political and legislative realities. For example, the federal fiscal position is much less favorable than at the time of earlier tax cuts, in 1981 and 2001. As a share of GDP, federal debt held by the public is expected to be 76.6% in fiscal year 2017, compared to 25.1% in 1981 and 31.4% in 2001. Moreover, the Congressional Budget Office (CBO) projects a budget deficit of 3.4% of GDP over the next five years, compared to projected budget surpluses of 2.0% in 1981 and 3.3% in 2001 (Exhibit 4). Given this fiscal backdrop, many members of Congress may be hesitant to support large deficit-financed tax cuts.

Some more bad news for stocks which are pricing in not only a second US golden age, but surging inflation:

In addition, a number of Mr. Trump’s campaign proposals would weigh on growth if enacted, including (1) tariff increases and other trade restrictions, (2) immigration reform which reduces labor force growth, and (3) hawkish appointments to the Federal Reserve. As with fiscal policy, it is difficult to have confidence about what changes will eventually occur, and some of the most adverse proposals from the campaign will likely be watered down. However, if followed to some degree, these aspects of the administration’s agenda could offset the positive effects of fiscal stimulus. On net, we think Mr. Trump’s policies could boost growth in 2017 and 2018, but are likely to weigh on growth thereafter if trade and immigration restrictions are enacted or if Fed policy turns more restrictive. We could envision both more favorable and more adverse outcomes, depending on the specific policy changes.

And then the last bit of bad news:

A final reason for only qualified optimism about the US growth outlook is the economy’s limited supply potential. Since 2010, real GDP growth has averaged just 2.1%, but the unemployment rate has fallen by 5.1pp. This implies that potential growth has declined to exceptionally low levels by historical standards. Our statistical estimates suggest that measured potential growth has averaged just 1.1% since 2010; the CBO is only slightly more optimistic, with an estimate of 1.4%. We expect productivity and potential GDP growth to eventually pick up—with potential growth rising to 1.75% in our forecasts—but would not count on fiscal policy or regulatory changes to revitalize productivity right away.

Because of slow potential growth, the economy is already operating close to full capacity despite low top-line GDP growth during the expansion: we now see an output gap of only -0.5% to -1.0%. After a recession, above-trend growth can be easier to come by as firms have ready access to underutilized labor and capital. With the economy closer to full employment, higher demand can result in supply bottlenecks, resulting in more limited gains in growth and higher inflation.

Ah yes, inflation: coming at a time when the potential growth of the economy "has declined to exceptionally low levels", there is a better word for what will happen shoudl Trump's policies unleash higher prices at a time when the economy is barely treading water: stagflation. However, unlike its report from a week ago, Goldman has refrained from using that particular word in its benchmark economic outlook (for obvious reasons).

In any case, the topic of inflation brings us back to what the Fed - badly behind the curve already - will do to limit any surprises. Here is Goldman's take:

With the economy approaching full employment and inflation moving towards target, the FOMC will be motivated to continue raising the funds rate next year. We see a high probability (90%) of a rate increase at the upcoming December meeting, and forecast three hikes during 2017, putting the funds rate range at 1.25-1.50% by the end of next year. In contrast, markets currently discount a 1% funds rate by end- 2017, and 1.4% by the end of 2018. Even under our projections for the funds rate, we forecast that the economy will moderately overshoot the Fed’s employment and inflation goals. In our view, the market-implied path for the funds rate would result in too little tightening of financial conditions and a significant overshooting of the FOMC’s objectives .

In other words, if Goldman is right, the market will scramble to catch up with a Fed that will have to hike far more often that is currently expected, resulting in a big squeeze in financial conditions, i.e., coordinated asset selloff.

On the other hand, even Goldman admits that the biggest risk is that it is, once again, wrong in its optimism:

The risks to our forecasts again looked titled moderately to the downside, and for the same reasons that derailed our forecast this year. First, we have found some evidence that the FCI has been more sensitive to funds rate shocks in the “global divergence” environment of the past few years. A higher sensitivity of the FCI to funds rate changes would imply fewer rate hikes for the same economic outcome. Second, the FOMC may tolerate a more meaningful overshooting of its 2% inflation objective than we expect. The potential benefits of such an approach include 1) a reversal of some of the supply-side damage from the recession and 2) perhaps a firmer anchoring of inflation expectations, which some policymakers believe are at risk of slipping below 2%. Partly offsetting these concerns, a larger-than-expected fiscal boost would be a source of upside risks to our funds rate call.

Ah yes, nothing like the Fed "overshooting" inflationary expectations on tens of millions of angry replorables whose cost of living is about to soar, simply hoping that a spike in consumer prices translates into higher wages.

What can possibly go wrong? Well, lots of things, as the market and the economy will find out in the coming year, as One River's Eric Peters dramatically predicted this morning.

But what about Goldman? How does this note, which is really nothing more than a bearish wolf in an optimistic sheep's clothing, end? Here is the answer:

The US economy has come a long way since President Obama took office, in the thirteenth month of what would become the eighteen-month-long Great Recession. At that time policymakers were focused solely on kick-starting a recovery, whereas today they also must consider the risk of overdoing it. Fed Chair Yellen touched on this point in Congressional testimony this week, telling lawmakers: “In contrast to where the economy was after the financial crisis, when a large demand boost was needed to lower unemployment, we’re no longer in that state.” She interpreted the market reaction to the election results as indicating that policymakers “will ultimately choose a fiscal package that involves a net expansionary stance of policy, and that in a context of an economy that’s operating reasonably close to maximum employment, with inflation heading back toward two percent, that such a package could have inflationary consequences that the Fed would be — have to take into account in devising policy”.

And the punchline:

Given above-trend growth, and with the prospect of fiscal stimulus, we see the US economy moving into modest disequilibrium over the next 1-2 years, with an unemployment rate falling below its long-run sustainable rate and inflation rising above the Fed’s target. From the perspective of the financial crisis and slow recovery that followed, this outcome looks like a big victory. But looking ahead, overshooting means that the economy could begin to develop imbalances, increasing the odds of another downturn further into the forecast horizon.

Translation? The Trumpflation bounce may last briefly, call it a year or two, at which point fiscal policy will be tapped out as a result of never before seen levels of debt, leading to the next major economic crisis, one which will promptly bring the Fed out of hibernation, and lead to what will very possibly be the final episode of quantitative easing, at which point the scenario envisioned by Oswald Gruber kicks in, central banks lose credibility, and the very long overdue global crash finally takes place.