Opportunities in a Changing World

by Paul Kornfeld, President, SIA Charts

Trump is elected the 45th President of the United States, and with change there is opportunity.

Looking at history, we see little correlation between who sits in the White House and equity market returns. According to Vanguard, the average annual return based on a White House under Republicans is 10.5%, while the average annual return under Democratic administrations is 10.7%, since 1853. In the near-term and since the election in 1952, the final two months of the year have historically returned 2.6% with a Republican win and 2.4% when a Democrat win. But this isn’t necessarily true when you dive deeper into the U.S. economic sectors. There are opportunities going forward to follow the money flows that will help identify the strongest sectors.

One of our recommendations to help you navigate this transition going forward is to look at the SIA Stock Sectors Report (SEE APPENDIX) and the SIA U.S. Equity Specialty Report both on a long-term basis to understand the longer-term moves. You can also copy these universes into your portfolios to run them on a shorter time frame to see the faster transitions from a relative strength viewpoint. The SIA

- ETF Sector Report (which compares all the U.S. ETFs against each other!) is also a useful report to monitor during this time (both from a short and long-term viewpoint) to understand any macro transitions and new opportunities as they arise. There is a need for cash flow analysis during times of uncertainty like this.Trump has said his protectionist policies will keep “jobs and wealth inside the United States.” He has argued for US Protectionism towards the economy, trade agreements, etc. during his campaign which leads us to believe that future policy may affect US trading partners, especially the neighboring countries of Canada (U.S.’s largest trading partner) and Mexico. This could affect the Canadian economy in many ways:

- Energy: Trump could influence the energy sector by increasing their domestic energy infrastructure focus and drilling. Keystone XL was blocked by the Obama administration and could also be back on the table as he was quoted to “absolutely approve it, 100%.”

- Trade: The 10-year old Softwood Lumber Trade agreement between US and Canada that removed U.S. duties on Canadian lumber imports just expired. This could affect the Canadian forestry sector if this agreement changes more in favor of the U.S. lumber industry. Trump has also come out strongly against NAFTA, which has a 6-month notice for withdrawal, to renegotiate this agreement to have a more protectionist stance for Americans. 23% of Canadian GDP is derived from exports of goods and services to the US alone and ~2.5 million Canadian jobs are dependant on trade with the U.S.

- Interest Rates: Most economists are expecting a rate hike in December by the Federal Reserve regardless of who was elected President, but more uncertainty has now entered the equation. Yesterday’s money flows showed long-term bond yields up dramatically. Safe-haven currencies, like the US Dollar, could also see increased strength both near-term and long-term because of US protectionist policy.

- Sector Opportunities: Transitioning from a Democratic President to a Republican President with a Republican majority in both the House and the Senate may not matter so much overall for the economy, and generally hasn’t historically, but a situation of this nature has shown to affect different sectors like Healthcare/Biotech, Energy, Defense, Banking, Infrastructure, etc. from changes in policies. Also, multi-national organizations could be affected more than local, smaller cap companies with protectionist philosophies.

To elaborate on point 3 above, a distinct difference over recent presidential terms is Trump will have the opportunity to nominate 4 members of the 12-person Fed committee during his term (as opposed to the usual 2), with Federal Reserve Chair, Janet Yellen, and Fed Vice Chair, Stanley Fischer, terms both expiring in February of 2018. So, although the Fed is an independent organization, Trump will have an unusual degree of influence over the future composition of the Fed's committee, which directly affects the direction of the central bank and monetary policy, impacting the U.S. and Global economies.

It is undeniable change is upon us, and with that change opportunity is sure to present itself. One thing that is sure, market participants will be paying close attention to the new President elect and any impending policy changes and their inherent implications. In our appendix below, we review a few areas of interest.

APPENDIX

SIA Stock Sector Report run on a Short-Term Outlook

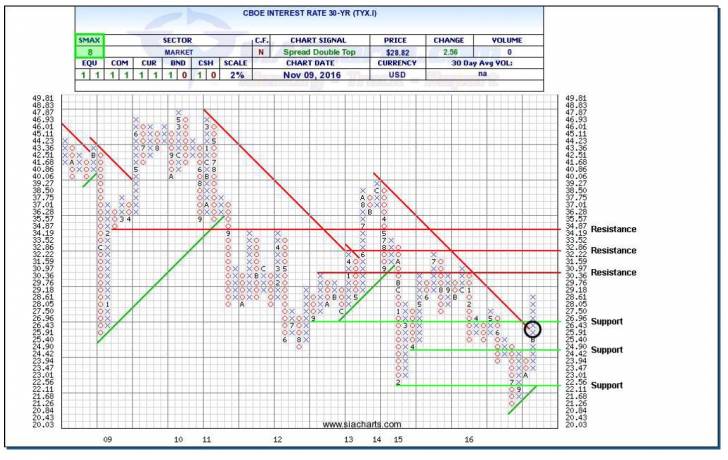

CBOE Interest Rate 30-Yr (TYX.I)

We last looked at Treasury yields just two weeks ago, but after the Presidential vote, U.S. interest rates rose sharply driving down bond prices. The 30-Yr U.S. Interest rate (TYX.I) had its biggest day-to-day increase since August of 2011. The 10-year Treasury also had its biggest one-day increase since July of 2013. Investors are digesting the fiscal implications of what a Trump presidency might mean and the short-term reaction has been negative for bond prices going forward on the idea of Trump's potential fiscal policy changes taking some of the weight off monetary policy. The implications going forward will have major influences not only on the 30-year interest rate yield, but also the relative strength rankings of various duration and credit quality fixed income investments both within the US universe but also on an international scale.

This new rally we're witnessing in the 30-year yield has made its way all the way up and now through the downtrend line which began in late 2013. Resistance levels are now found above at around 3.1% and 3.29%, which is the high from 2015. Support to the downside is found at 2.696% and at 2.442%.

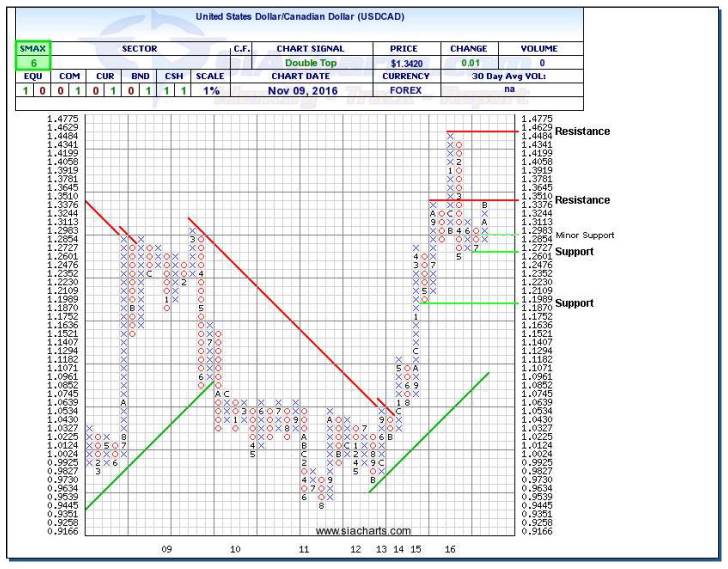

United States Dollar/Canadian Dollar (USDCAD)

The independent US Federal Reserve will unlikely let politics or a political party outcome affect their plan moving forward for potentially raising rates at the beginning of December, but the implications going forward will have major influences not only on this currency pair, but also the relative strength rankings of Canadian equity versus US Equity. The next significant resistance level is seen at the $1.35 level which if broken could open the possibility to again seeing the $1.40 levels. However, to the downside, immediate support if broken at the $1.26 level could allow for further US dollar weakness below $1.20.

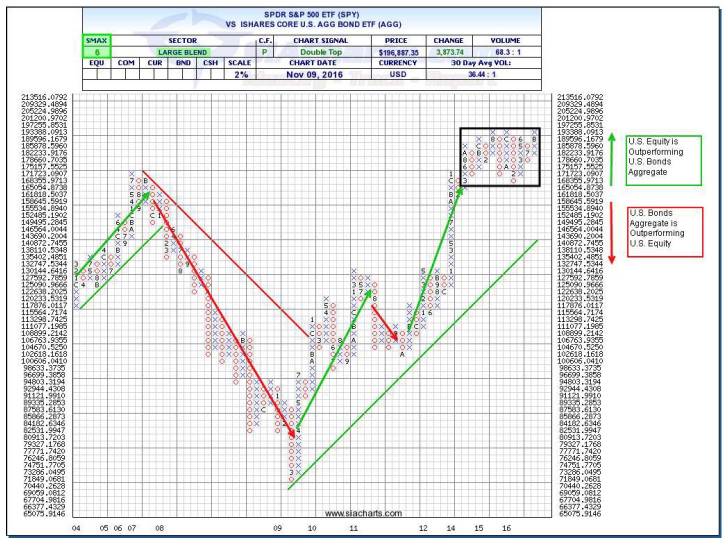

U.S. Equity vs. U.S. Aggregate Bond Comparison Chart (SPY vs. AGG)

The comparison chart between the U.S. Equities and the Bonds continues to be an important comparison to monitor as the markets move forward. When the chart is moving upwards, this tells us that U.S. Equities are outperforming Bonds (shown with the green arrow). When the chart is moving down this indicates that Bonds are outperforming U.S. Equities. The relationship between these two asset classes has not been directional since the middle part of 2015 and has been range bound for much longer as shown by the black box. This back and forth battle is why we don’t see a clear leader in the Asset Class Rankings with Bonds and Equities trading blows. This back and forth battle though still trends upwards and slightly favors Equities given the Green EAC. This crossroad is potentially coming to a head from recent movements with a break above the current range a positive indicator for equities moving forward.

Within the U.S. Equity and Fixed Income asset classes, important battles are also going on right now as the election results have given some initial potential direction for different stock sectors and different bond types. The best way to measure these new trends and money flows is through relative strength analysis looking at both the short/medium term outlook and the long-term relationships moving forward.

Copyright © SIA Charts