by Lance Roberts, Clarity Financial

Over the last several months, in particular, the number of articles discussing the shift from “active management” to “passive indexing” have surged.

I get it. The market seems to be immune to decline.

It is effectively the final evolution of “bull market psychology” as investors capitulate to the “if you can’t beat’em, join’em” mentality.

But it is just that. The final evolution of investor psychology that always leads the “sheep to the slaughter.”

Let me just clarify the record – “There is no such thing as passive investing.”

While you may be invested in an “index,” when the next bear market correction begins, and the pain of loss becomes large enough, “passive indexing” will turn into “active panic.”

Sure, you can hang on. But there will be a point where your conviction will eventually be broken. It is just a function of how much loss it takes to get there.

Over the last four years, as the Central Bank fueled surge in asset prices has climbed relentlessly higher, the psychological shift from active to passive management has gained ground. Unfortunately, this is a result of a psychological bias where recent performance is extrapolated indefinitely into the future. This is known as “recency or anchoring bias,” and is one of the primary factors that has the greatest effect on investor returns over time. As stated previously:

“However, in order to judge today’s market level, it is desirable, perhaps essential, to have a clear picture of its past behavior. Speculators often prosper through ignorance; it is a cliché that in a roaring bull market knowledge is superfluous and experience a handicap. But the typical experience of the speculator is one of temporary profit and ultimate loss.”

Yes. “YOU are a speculator.”

You have none, zero, nada, no control over the direction of an individual company, the index or the fund manager. You are simply SPECULATING on the price you paid for an asset that you HOPE to sell at a higher price to someone else in the future. That is, in its most basic form, a speculation.

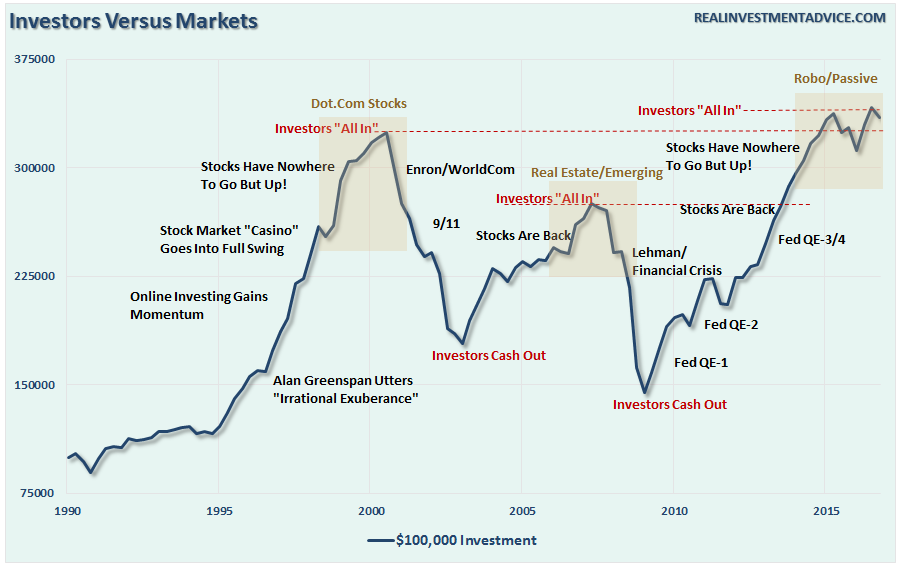

The importance of that statement is that most individuals extrapolate past performance indefinitely into the future and become extremely complacent in managing for risk. This tendency is what leads investors to “buy high and sell low.” This psychology is displayed in the following chart.

The question that must be answered is whether this is just a bull market, or some sort of “new market” that will defy all previous experiences?

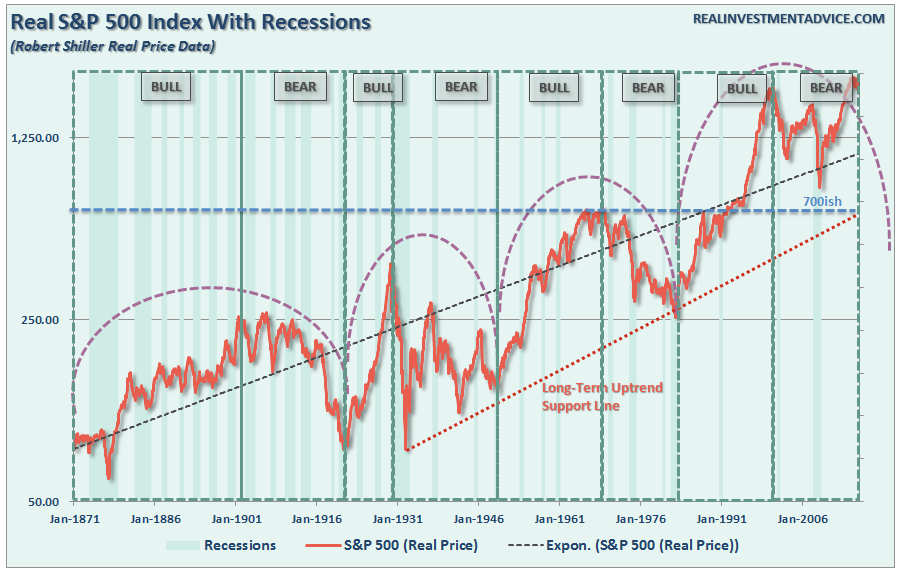

If this is just a bull market, then the term itself suggests that it is just the first half of a full-market cycle and eventually a bear market will follow. The chart below shows the history of full market cycles going back to 1900.

Historically, full market cycles have finished when prices complete a “mean reverting” process by falling well below the long-term mean. Since the beginning of the secular bull market in the 1980’s the full “mean reverting” process has not yet been completed due to the artificial interventions by Central Banks to prop up asset prices.

There is an argument to be made that this is could indeed be a “new market” given the continued interventions by global Central Banks in a direct effort to support asset prices. However, despite the coordinated efforts of Central Banks globally to keep asset prices inflated to support consumer confidence, there is plenty of historic evidence that suggests such attempts to manipulate markets are only temporary in nature.

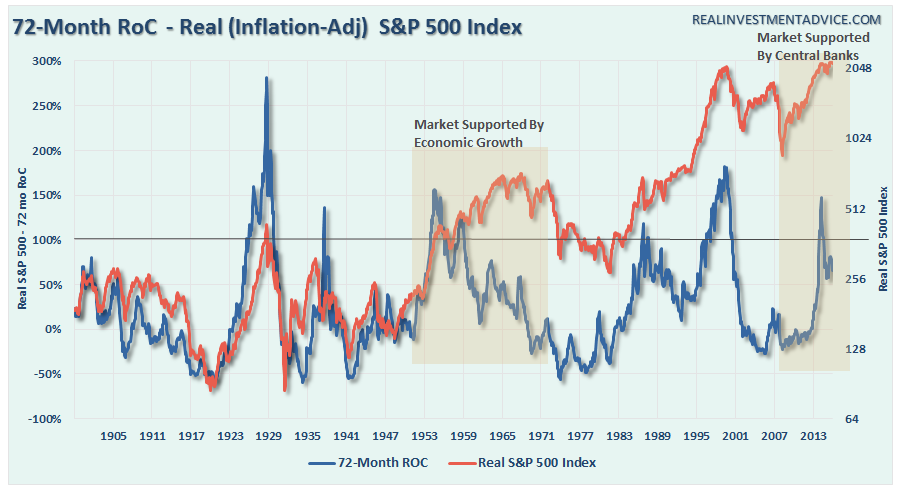

This can also be seen by looking at the rate of change in the S&P 500 index over a 72-month period. The chart below shows the rate of change the real, inflation-adjusted, return of the S&P 500 index from 1900 to present. I have also overlaid that with the actual real S&P 500 index (log-2 basis). This more clearly shows that from current peaks of the long-term rate of change in the index, forward market returns have become less desirable.

The conclusion is quite simple. The current rate of change is in extreme territory and is exceeded only by five other market up-moves: the roaring bull market of the twenties leading into the Great Depression, the bull market of the fifties and the technology boom. Further, the trajectory of the up-move is similar to that of the market leading into the highs of 1929 and the highs in 1983. The spike in the ROC coming off the secular bear market lows of 1974, ended with the crash of 1987.

Such extreme movements in prices over a relatively short period, regardless of underlying circumstances, have all had similar outcomes. Consequently, investors should expect a similar outcome in the future. However, in the short-term psychology tends to overtake more logical thought processes as the “need for greed” keeps investors at the table long after the “cards have turned cold.”

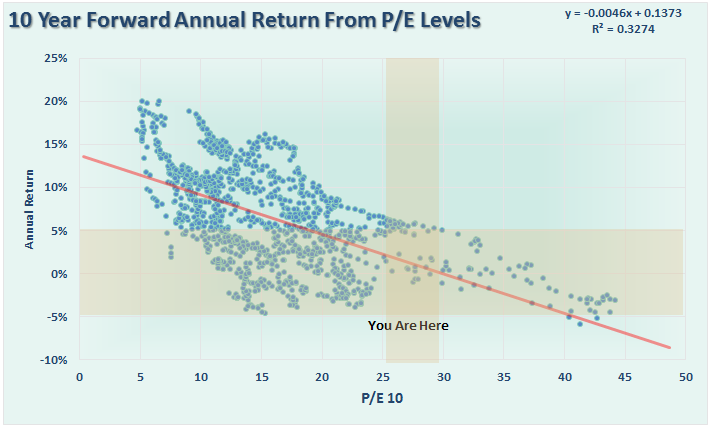

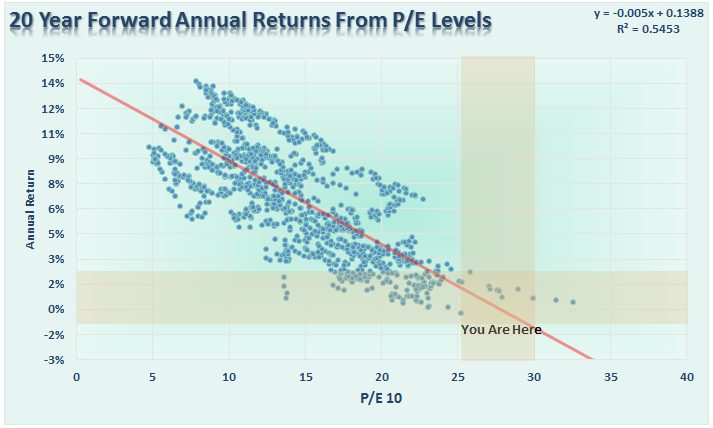

Valuations also provide similar evidence that the current market is most likely no different than previous bull market cycles. The forward price/earnings (PE) ratio — the price of the S&P 500 divided by the expected earnings of those S&P 500 companies — is probably the most popular way to measure value in the stock market.

In theory, it tells us if the market is cheap or expensive relative to some long-term average. Unfortunately, since P/E’s are terrible at predicting short-term outcomes for the market, investors tend to quickly dismiss them as “being wrong this time.” Such attitudes have historically not worked out well for individuals.

The series of charts below show what valuations tell you about what should be expected as investors with respect to their longer-term investment goals. The charts below are the total dividend reinvested returns of the inflation adjusted S&P 500 index.

Not surprisingly, the expected total inflation-adjusted returns from currently high levels of valuation have historically been disappointing relative to what investors had witnessed previously.

Importantly, the charts above DO NOT mean that EVERY year will be a low return. What history suggests is that forward returns will be much more volatile with periods of significant drawdowns which will comprise a total long-term return at lower levels. Unfortunately, most investors will not survive to see that outcome.

The problem with the “passive indexing” argument is that it is primarily based on flawed assumptions of “average” returns over a period of time. However, the validity and dependability of this rosy view cannot be conclusive, because NO prediction, whether of a repetition of past patterns or of a complete break with past patterns, can be proved in advance to be right.

Nevertheless, past experience does have some things to say that are at least relevant to our problem. Optimism and confidence have always accompanied bull markets. This must be so otherwise the bull market could not have existed. Irrational exuberance, willful blindness, and overconfidence are the fuel which propels “bull markets” to their dizzying heights.

Unfortunately, exuberance and complacency are replaced by distrust and pessimism when bull markets eventually collapse.

As the evidence suggests, the current bull market is likely not a “new market” but just the first half of a full market cycle. Eventually, the cycle will complete itself as price goes through a mean reverting event. This is not a BEARISH prognostication but a simple reality. Nothing more. Nothing less.

As Adam Butler, Mike Philbrick and Rodrigo Gordillo penned back in 2013:

“Portfolio growth is governed by the mathematics of compounding, which means that, for example, a 100% gain is erased by a 50% loss, and a 50% loss requires a 100% gain to get back to even. Applying the same principles to where we are in the current bull/bear cycle is illuminating.

If we assume that the next bear market will deliver losses in-line with what we have experienced from bear markets through history, then at the bottom of the next bear market investors will have lost 38% of their portfolio value. The question is, how much must current investors expect stocks to gain before peaking to justify owning them here instead of waiting to purchase them in the next bear market?

The most unbiased estimate of the magnitude of the next bear market is the historical median of 38%. Using the math of compounding, we can determine that a 38% loss requires a 61% gain to break-even [1 / (1 – 38%)]. Logically then, and by extension, investors who choose to hold stocks today must expect gains of at least 61% in order to rationalize their investment; otherwise they would eliminate the anxiety of riding the equity roller-coaster and simply invest in cash, waiting to pounce on stocks at equivalent or lower value at some point during the next bear market.”

In the near term, over the next several months or even couple of years, markets could very likely continue their bullish trend as long as nothing upsets the balance of investor confidence and market liquidity. However, of that, there is no guarantee.

As Ben Graham stated back in 1959:

“‘The more it changes, the more it’s the same thing.’ I have always thought this motto applied to the stock market better than anywhere else. Now the really important part of the proverb is the phrase, ‘the more it changes.’

The economic world has changed radically and will change even more. Most people think now that the essential nature of the stock market has been undergoing a corresponding change. But if my cliché is sound, then the stock market will continue to be essentially what it always was in the past, a place where a big bull market is inevitably followed by a big bear market.

In other words, a place where today’s free lunches are paid for doubly tomorrow. In the light of recent experience, I think the present level of the stock market is an extremely dangerous one.”

He is right, of course, things are little different now than they were then.

What is important to remember is that for every “bull market” there MUST be a “bear market.” While “passive indexing” sounds like a winning approach to “pace” the markets during the late stages of an advance, it is worth remembering it will also “pace” just as well during the subsequent decline.

Oh…so you say you’re going to “sell” those “passive ETF’s” before that happens?

Well, then you are not so “passive” after all.

Lance Roberts

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of “The Lance Roberts Show” and Chief Editor of the “Real Investment Advice” website and author of “Real Investment Daily” blog and “Real Investment Report“. Follow Lance on Facebook, Twitter and Linked-In

Copyright © Clarity Financial