by Blaine Rollins, 361 Capital

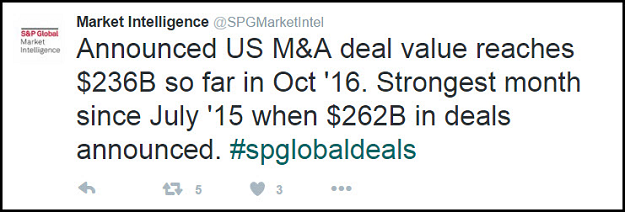

Two Saturday weddings? When was the last time that M&A lawyers, bankers and journalists had their weekend plans shattered like this? You might think that it was just a coincidence until you saw the other corporate weddings booked over the weekend. If you wanted to get a big deal done this month, you might have been forced to find another law firm to work with given all this activity. So, what is causing the googly eyes in the boardrooms? Start with some increased signs of certainty. The election outcome in the White House now looks certain and you probably know how Congress will fall. So, you can now bet that tax rates will be going higher and that a cash repatriation plan will happen in 2017 to bring some of that $2 trillion back to the U.S. The markets continue to nudge up longer term interest rates so if you want to lock in cheap money, don’t wait. This is also a seasonally strong time of the calendar for equities, so those waiting to pull the trigger might have to pay more. Of course, if you are paying with stock or need to raise some equity, the window is open for you. Heck, there is liquidity everywhere. The Saudi’s are tapping it, energy companies are grabbing it, and someone is even going to use it to save Banca Monte dei Paschi. So keep your shoes shined and an extra tux shirt in the closet because it could be a festive year end.

Aside from a busy weekend in corporate mergers and acquisitions, it was also a very busy week in corporate earnings…

According to Bespoke, the season-to-date figures show the earnings beat rate running at 68% which puts it at the best in seven years. You have seen some stocks react violently to their reports. On the positive side: Netflix, Paypal and American Express. To the downside: eBay, Union Pacific, Intel and Travelers. There are still two very heavy weeks of earnings releases to follow but it’s nice to see that the early read is a positive one.

Speaking of great Q3 earnings, Domino’s Pizza had no excuses about weather, food prices or the elections. They just crushed it…

Once again, it was a busy Friday, Saturday and Sunday…

@WSJbreakingnews: AT&T reaches deal to buy Time Warner for more than $80 billion

@DanaMattioli: Rockwell Collins announces $6.4B deal to buy B/E Aerospace, confirming WSJ scoop

@CNBC: JUST IN: Genworth Financial to be acquired by Beijing-based China Oceanwide for approximately $2.7B

@WSJbreakingnews: TD Ameritrade to acquire rival brokerage Scottrade in a cash and stock transaction valued at $4 billion

@rpgrattan: American Midstream Partners to buy JP Energy for $2 billion

@WSJbreakingnews: British American Tobacco proposes to buy stake in Reynolds it doesn’t own for $47 billion

…and still one week left in the month of October…

A flashback weekend for me…

My largest position in the Janus Fund in January 2000 was Time Warner. While we all knew that ‘content was king’, the AOL bid back then was a surprise. That was a very fun week. Of course in retrospect, I wish that I would have rang the bell of my many media positions on that day and run off to buy single digit multiple Financial and Defense stocks. For Time Warner owners today, there is probably less of an urgency to ring the bell this time, but just know that these very large mergers will not go smoothly and you might have opportunities to trade around your position before the deal is eventually closed and the synergies are realized. But if AT&T screws up ‘Game of Thrones’, their castle will burn down.

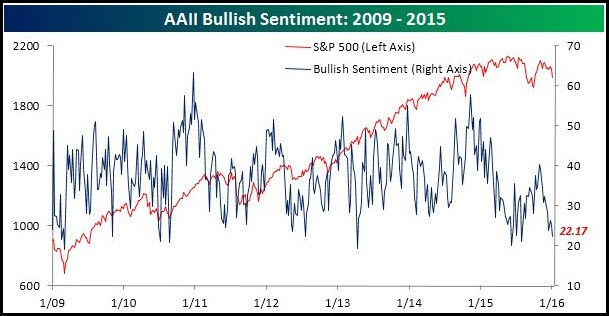

While the market remains close to its all-time highs, the individual investor survey is still quite negative…

@bespokeinvest: Bullish sentiment is now the lowest it has been since the Brexit vote. #AAII

One who is not negative is Norway who is looking to significantly increase their equity weighting. Next question, Active or Passive?

Norway’s $880bn oil fund is being urged to invest billions of dollars more in equities and take on more risk in what would be a big shift in its asset allocation away from bonds.

The world’s largest sovereign wealth fund should invest 70 per cent of its assets in shares, up from today’s 60 per cent, at the expense of bonds, according to a government-commissioned report on Tuesday.

The move is highly significant for global markets as the oil fund owns on average 1.3 per cent of every single listed company in the world and 2.5 per cent in Europe.

The report is the latest salvo in a debate on how much risk the long-term investor should take and comes amid growing warnings of dwindling returns for government bonds in particular. The allocation to equities was increased from 40 per cent to 60 per cent in 2007.

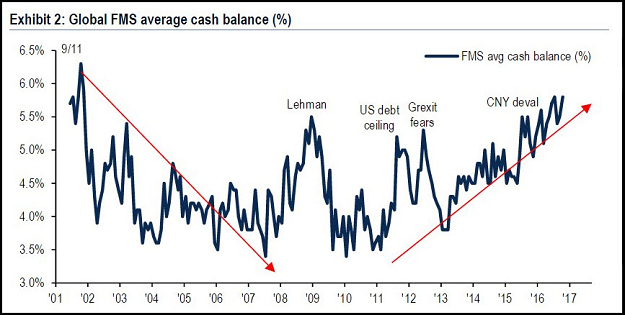

BofA Merrill Lynch notes in their last survey that portfolio managers are loaded to the gills with cash…

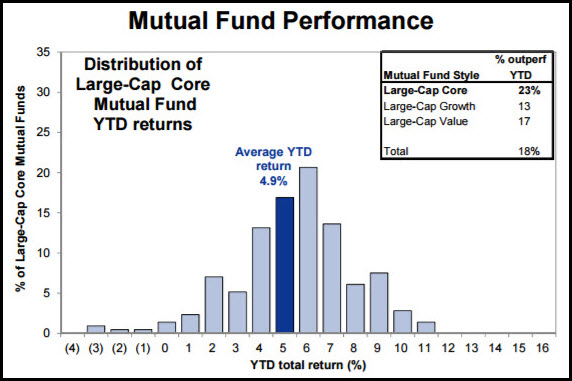

The extra cash helps to explain the anchor on Mutual Fund performance…

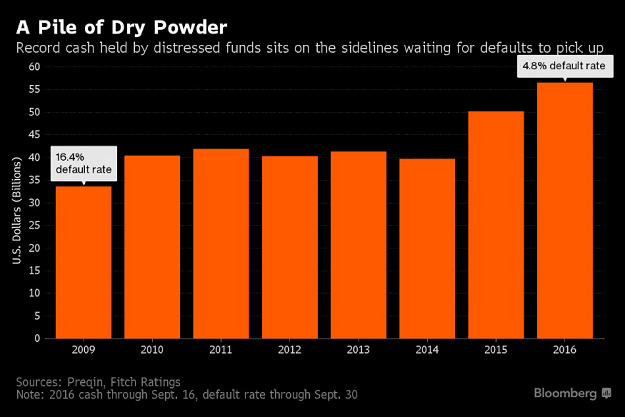

Over in world of distressed investing, cash is also a major problem…

They raised the money, and now they have few places to put it.

U.S. distressed debt managers have $56 billion to invest, the most dry powder for the industry ever, according to research firm Preqin. But there just aren’t enough bad loans and bonds for them to buy: the amount of outstanding troubled debt has fallen by more than two-thirds since peaking in March, Bank of America Merrill Lynch index data show.

Supply is low in part because of rebounding prices for commodities including oil, boosting revenue for energy companies that would have otherwise gone broke. And the Federal Reserve is expected to keep rates lower for longer than investors planned, which is making it easier for distressed companies to refinance.

Too much cash will soon become an even bigger problem…

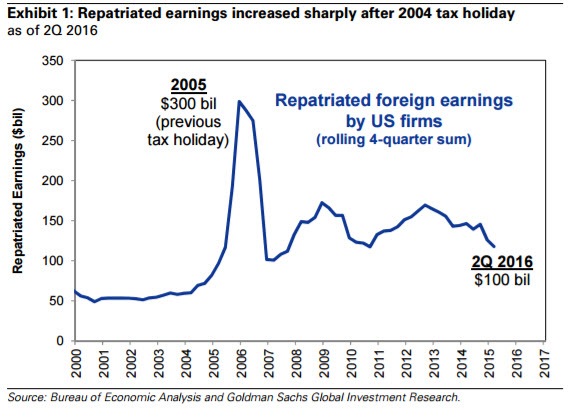

Especially if the new White House and Congress find a way to get the $2-3 Trillion in idle U.S. company foreign cash back to the United States. The last tax holiday was in 2005 when $300 million returned to the U.S.

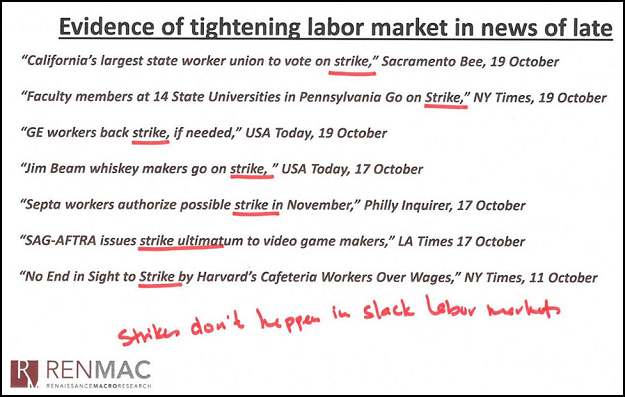

A good observation by RenMac on the confidence in workers to ask for more…

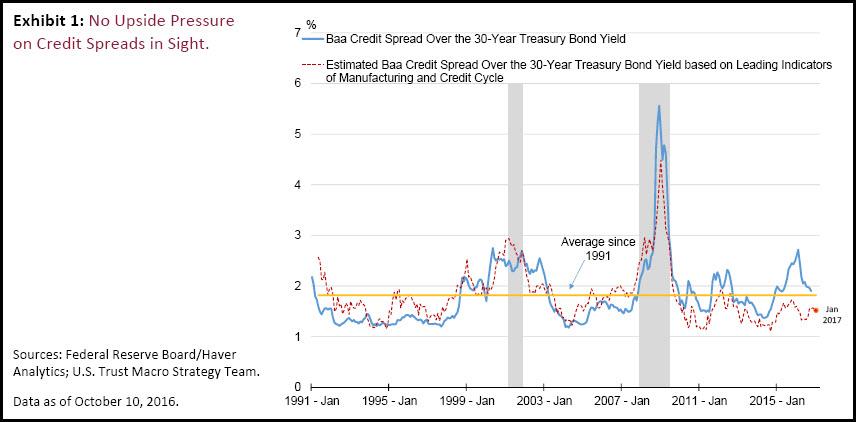

While credit spreads have tightened, U.S. Trust thinks that they can fall even further based on the current manufacturing and credit cycle…

As we had expected, given the temporary nature of the U.S. soft patch and positive leading indicators of credit conditions, credit spreads have narrowed more over the past month and leading credit indicators do not signal worsening credit conditions yet, as they would in an approaching recession environment.

(U.S.Trust)

Of course healthy credit markets add liquidity which the still wobbling Energy sector loves…

“There is a lot of positive things happening in energy right now. Prices have been stable. Capital markets are improving. Asset sales remain very robust. We’re getting a lot of pay downs on our criticized credits and of course this quarter our charge-offs where down as well.” —Comerica CEO Ralph Babb (Bank)

Higher oil prices continue to assist higher junk bond prices…

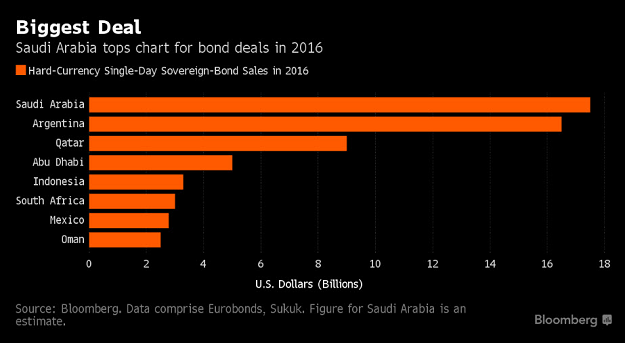

Speaking of oil and bonds, the Saudi Arabia deal was three-times oversubscribed. So, expect more oil-centric emerging market bond deals hitting the market…

Saudi Arabia’s record debut international bond sale is shifting the ground across Middle East debt markets, fueling price gains and stoking speculation of more borrowers to come.

The bonds of Qatar, Bahrain and Dubai are rallying in the wake of the kingdom’s $17.5 billion transaction that was completed yesterday. The offering, the biggest by an emerging-market nation, is being hailed as a likely spur to other Saudi companies in coming weeks and months.

(Bloomberg)

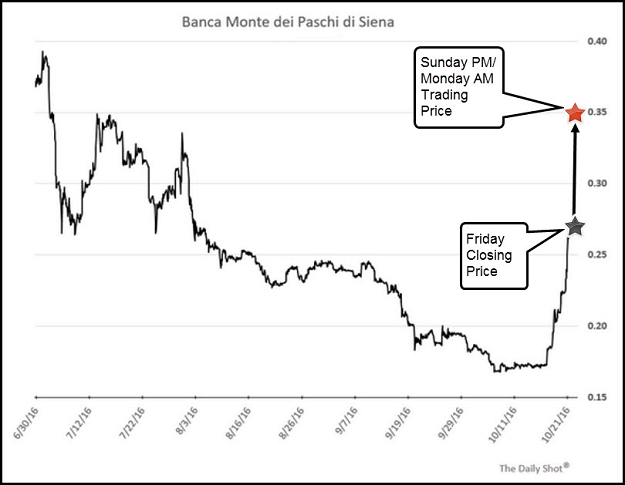

Europe and Italy’s most troubled bank has now doubled in a week…

Safe to guess that a fix is on. Erase this problem asset from Europe and it removes an ongoing headache.

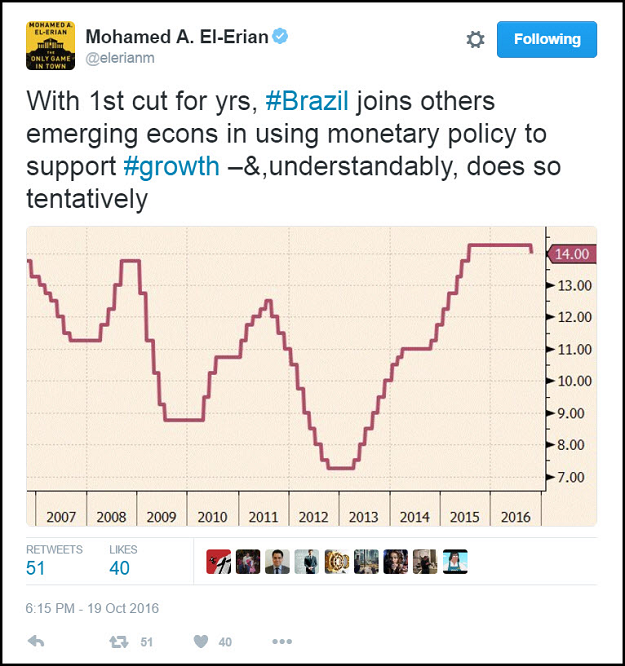

With high inflation now in retreat, the Brazilian Central Bank moved to cut rates for the first time in five-years last week…

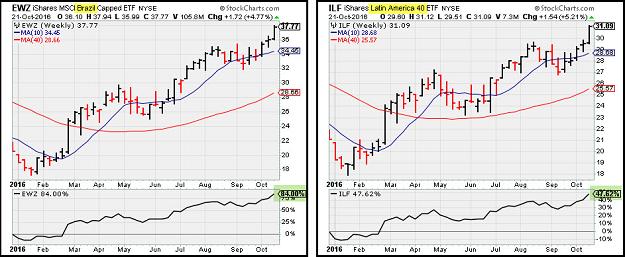

The Brazilian market anticipated the rate cut but still rewarded its market with further gains…

I also charted the Latin American 40 ETF below, which consists of 58% Brazilian exposure.

China becomes one less worry to EM investors if their real estate prices remain firm…

@SoberLook: China new housing price month-over-month change

Regarding Europe, Bridgewater is worried about an ECB tapering and puts pencil to paper to estimate what it could look like…

“The question of what the ECB monetary policy past March will look like is growing in importance as we move closer to that date,” the note said. “Though Mario Draghi understandably side-stepped the question, it is the growing elephant in the room.”

Bridgewater, the world’s biggest hedge fund firm, estimates that a reduction of the ECB’s bond purchases to zero over a year would reduce gross domestic product growth by about 1%. A taper would be the same as raising interest rates by about 1.25%, according to the note. The ECB would usually only raise interest rates when it’s trying to contain a fiery economy and inflation.

If the ECB tapers its bond buying, the euro would gain by between 5% to 10%, and inflation would fall by about 0.3% from about 1% today, the note said.

“These figures are approximate,” the note said. “Nonetheless, it’s clear that it would lead to big, bad outcomes.”

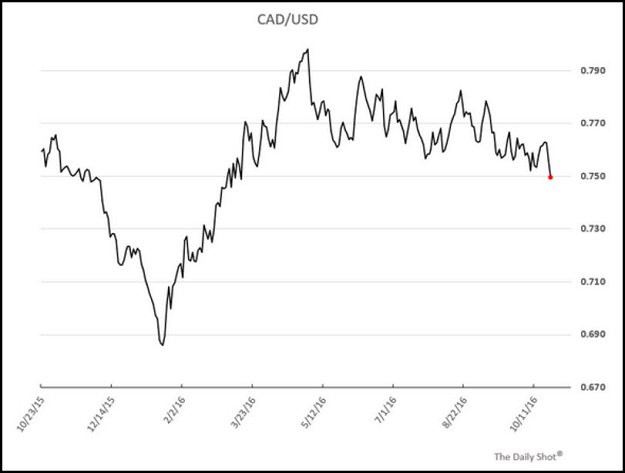

And north of the border, the Canadian dollar is beginning to break for several reasons..

…weakening retail sales, falling inflation, a breakdown in the EU trade talks, Bombardier layoffs and the popping Vancouver real estate bubble. Be careful if you have revenues in Canada with costs in the U.S.

If you are in charge of buying Halloween candy this week and you want to impress, here is your key…

And some final words from Yvon Chouinard of Patagonia…

“A master in the art of living draws no sharp distinction between his work and his play; his labor and his leisure; his mind and his body; his education and his recreation. He hardly knows which is which. He simply pursues his vision of excellence through whatever he is doing, and leaves others to determine whether he is working or playing. To himself, he always appears to be doing both.”

Copyright © 361 Capital