by LPL Research

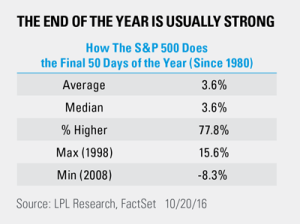

Yesterday kicked off the homestretch of 2016, as there were 50 trading days left in 2016. The good news is historically the end of the year has been strong for equities. In fact, going back to 1980, the S&P 500 was up 3.6% on average and higher 77.8% of the time during the final 50 days of the year.

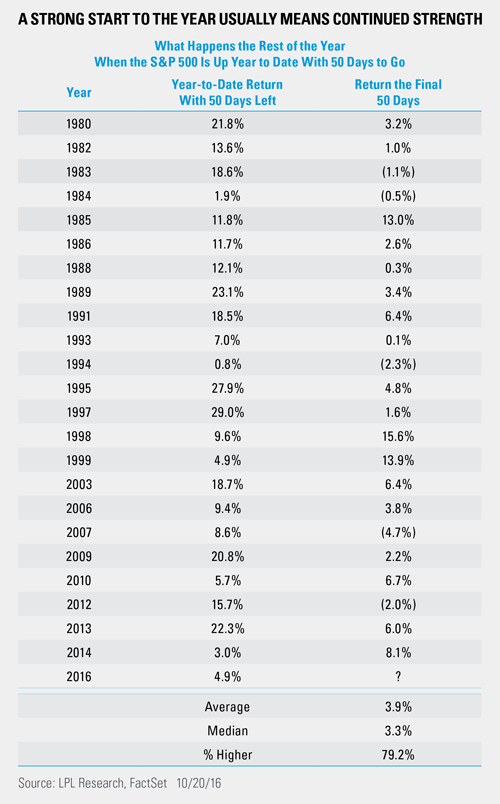

Does it matter how the year is doing up to this point? In other words, if the S&P 500 is higher or lower year to date with 50 days to go, does that tell us anything about what could happen in the rest of the year? Since 1980, the S&P 500 was up year to date with 50 days to go 24 times, and the rest of the year was up 3.9% on average and higher 79.2% of the time. In other words, a slightly better than the average return. With 2016 up 4.9% year to date with 50 days to go, that could be a good sign for the bulls to end the year.

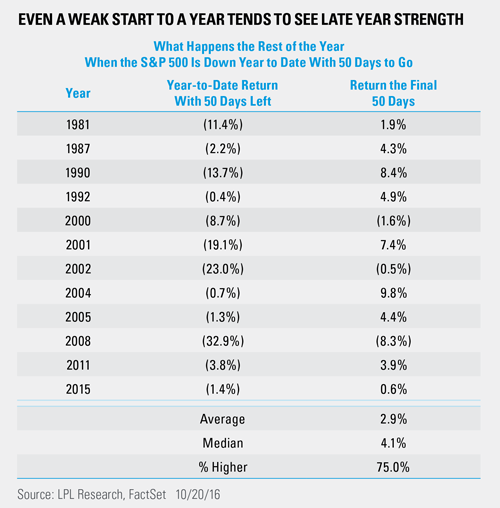

What about if the year is down with 50 days to go? All in all, not too bad, as the only three times it was lower to end the year, the market was already in a bear market and/or recession (2000, 2002, and 2008). The median return was a very impressive 4.1%, which is much better than the average return of 2.9%. This is because the huge drop in 2008 skewed things significantly.

All in all, the final 50 days of the year are still strong if the S&P 500 is down coming into the last 50 days of the year, as long as the economy isn’t in a recession or equities in a bear market. Obviously neither of those conditions applies now.

One caveat to all of this is the last two election years (2012 and 2008) were actually lower during the final 50 days. In fact, going back eight years, these were the only two times the S&P 500 was lower during the final 50 days. With this being an election year, be aware the recent history isn’t so strong.

Ryan Detrick, Senior Market Strategist, sums it up: “The end of the year historically has been the feel-good time of the year and the last 50 days have a nice track record for higher equity prices, as long as the economy isn’t in a recession. With the earnings recession showing signs of ending this quarter, the economy is on firmer footing, which could lead to your typical end of year strength in 2016.”

***

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results.

The economic forecasts set forth in the presentation may not develop as predicted.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

Indices are unmanaged index and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking # 1-547908 (Exp. 10/17)

Copyright © LPL Research