by LPL Research

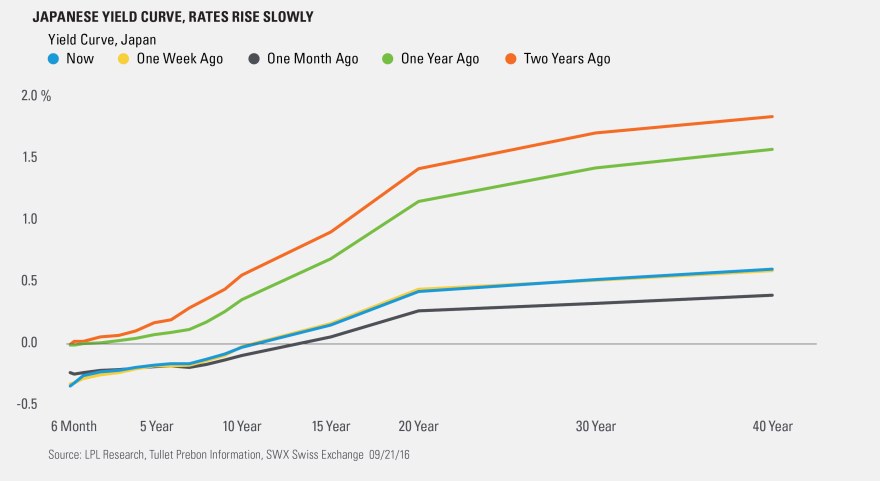

The Bank of Japan (BOJ) made a major announcement yesterday, though it is hard to fully understand the implication, and perhaps even what its end game is. Over the years, BOJ policy has become increasingly aggressive, perhaps even desperate, if one is feeling uncharitable. In an attempt to generate inflation and weaken the yen, the BOJ has kept interest rates low, more recently driving them negative. It has also engaged in buying bonds (quantitative easing) and, more recently, buying stocks and real estate investment trusts (REIT). Bond yields have been low (see the figure below) and inflation has been flat, or even negative. More recently, the Japanese yen has been appreciating, despite BOJ policy. This led to the BOJ announcing a review of its policies at its last meeting on July 29, 2016.

The BOJ did not lower interest rates yesterday, nor was there an announcement of overall expansion of its quantitative easing program. Instead, the BOJ announced two changes in policy tools. First, the BOJ agreed to try to overshoot the bank’s 2% inflation target, which seems odd given that it has been unable to achieve anywhere near that level of inflation. Second, it announced a policy to manage the Japanese yield curve, steepening the curve to improve the profitability of Japanese banks and to increase inflation. Specifically, the BOJ targeted keeping the yield on the 10-year bond at zero. Once again, this decision is somewhat confusing, given that yield on the Japanese 10-years bond is currently very close to zero, up from nearly -0.3% at the end of July.

The message of these moves is clearly dovish, suggesting that the BOJ is consistent in its belief that it can manipulate the bond market to achieve its macroeconomic aims. What is much less clear is if these policies will be any more effective than previous attempts. The market is clearly not convinced. After initially depreciating following the announcement, the Japanese yen has appreciated and is now at its highest levels since November 2014. Japanese bond yields also increased after the announcement. The BOJ’s actions represent the next phase of intervention, but not a change in policy direction.

****

IMPORTANT DISCLOSURES

The economic forecasts set forth in the presentation may not develop as predicted.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor

Member FINRA/SIPC

Tracking # 1-538162 (Exp. 07/17)

Copyright © LPL Research