by Benjamin Streed, CFA, Fixed Income, Raymond James

September 6, 2016

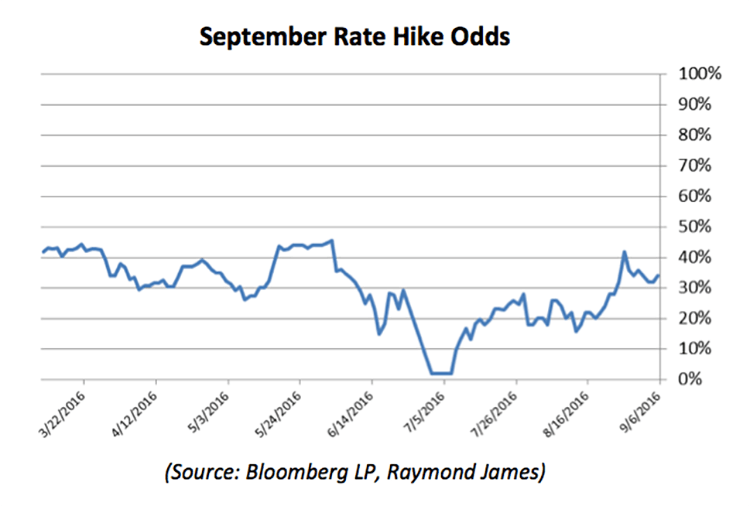

Here in the US we find ourselves faced with an odd scenario of being the proverbial “best house on the block” as we are chugging along a decent clip, creating jobs and have a healthy consumer to keep things moving in the right direction. To borrow a word from Alan Greenspan, here’s the big conundrum: do we raise rates later this year (September, November or December) or do we remain “data dependent” and allow ample time for the Fed’s chosen metrics to comply with their own stated goals/thresholds? With the assumption that the data would beat expectations, Friday’s jobs report was supposed to be the “all clear” signal for the Fed to go ahead and raise rates for the second time. Whoops. The data missed at +151k, expected +180k while average hourly earnings growth remains muted, stifling any hopes that inflation is just around the corner. Bloomberg futures data show that Friday’s jobs report did little to move the odds for a September hike as it remains in the ~30% range and December sits at ~60%. Looking at the chart below, it appears as if the markets are a bit exhausted over “Fed speak” and don’t appear convinced another hike is imminent.

Whether the Fed “doves” or “hawks” win the next battle, the committee finds itself in the unenviable position of having convinced us that another hike is around the corner while ongoing economic data continue to paint a less rosy picture. The US economy is in no way performing poorly, but instead is continuing to show slower growth than many had hoped or planned for. This isn’t necessarily a bad scenario; it’s just not as robust or as broad as many had anticipated going on eight years since the Great Recession first hit. This is especially true when considering the state of much of the developed world that continues to battle with aging demographics, low or negative interest rates amidst some combination of disinflationary (slowing inflation) price pressures, weak jobs growth, or even deflation (falling prices) which can pose a very real challenge for monetary policy.

What’s it going to take to see higher rates here in the US? Further positive economic data? Signs of imminent inflation or rampant wage growth? Or will any move by the Fed simply be an act of desperation as it simply feels the need to do something, anything, to continue towards normalization? Hard to tell, but the markets think that although September is possible it remains unlikely. Even so, as the Fed is no longer engaged in active/expanding monetary easing it can influence the short end of the yield curve, but longer-term rates will be directed by the global financial markets. As we’ve written many times before, yields in the US continue to offer value relative to the rest of the world, with corporate bonds looking very attractive compared to their peers overseas (many of which are subject to central bank purchase programs). 2016 marks a new global record for monetary stimulus, with ~$160 billion in bonds being purchased by central banks every month and is expected to increase next year to ~$180 billion.

How does this affect the US? According to Bloomberg index data, global investors seeking high quality sovereign debt that yields > 2% will have only a few places to look: the United States, or one of the following: Greece, Portugal, Australia, Singapore, Italy, Spain or New Zealand. Of this universe, the US represents 83% of the available securities on the planet. Staying with the same yield bogey, for those willing/able to invest in corporate debt with at least and ‘A’ rating, the US represents ~80% of all available securities. Federal Reserve data show that $400 billion of US corporate debt is being purchased by overseas buyers, helping keep a lid on yields here at home. Given what’s going on overseas and the truly global nature of the bond market one question remains: when it comes to longer-term US yields, does it even matter if/when the Fed hikes?

Copyright © Raymond James