Has Investment Diversification Alone Had its Day?

by Glenn Dial, Allianz Global Investors

The idea that investment diversification can enhance returns and lower risk hasn't played out as planned in post-crisis markets. This may come as a surprise to retirement investors, who should now consider a more dynamic approach according to Glenn Dial.

Modern portfolio theory as relic of the past

In 1952, economist Harry Markowitz published his seminal work on modern portfolio theory (MPT), which showed that investors could increase their return potential and simultaneously lower their risk profile by investing in a diversified range of assets. MPT revolutionized the way that investors invest, especially retirement investors, many of whom built their retirement savings on the tenets of diversification over the course of decades.

MPT has become so prevalent and well known that it seems to have moved past being a theory and into being an actual fact. But like so many other ideas that got swept up and exposed during the financial crisis, MPT hasn't fared as well in the post-crisis world. Asset classes once thought to be complementary showed remarkable correlation as bonds, stocks, emerging markets and even many alternatives became all bunched-up on the efficient frontier. And as the recovery from the financial crisis continues apace, investment assets continue to show much closer correlations than in the past.

RiskMonitor measures the hazards of 2016

Close correlations among asset classes were most recently evident in the aftermath of the Brexit vote—an event risk—when global markets plunged in unison and caused many investors to question their diversification strategies yet again. Add to that a recent string of deadly terrorist incidents, ongoing geopolitical concerns, and a US presidential campaign unlike any other in history. All-in-all, event risk looks to be an ever-present concern for the remainder of 2016.

This is the thinking of many institutional investors as shown in the recently released AllianzGI RiskMonitor 2016, a worldwide survey of 755 institutional investors, including some of the world's foremost pension funds, banks and sovereign wealth funds. When asked what the biggest risk is for 2016, 75% of our respondents named event risk, which is the possibility that an unforeseen event will negatively impact a country, company or industry. This is up significantly from last year's survey, which showed event risk ranked at the very bottom of institutional investor concerns.

The 2016 RiskMonitor also shows that diversification, despite its shortcomings in recent years, still ranks as the No. 1 way for investors to combat volatility. This is above other well-known risk management techniques such as increased allocations to fixed income or defensive equity. It's a good bet that if the RiskMonitor survey included financial advisors and plan sponsors, their answers would be remarkably similar, showing once again that risk doesn't discriminate.

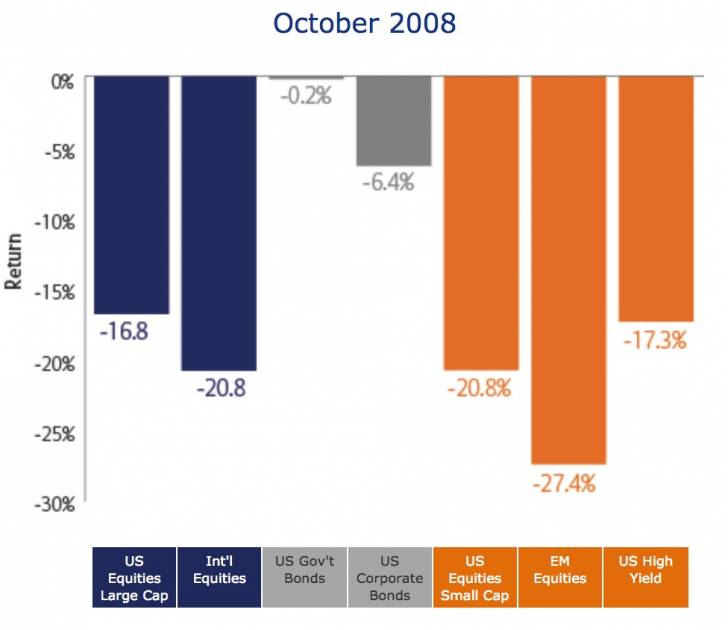

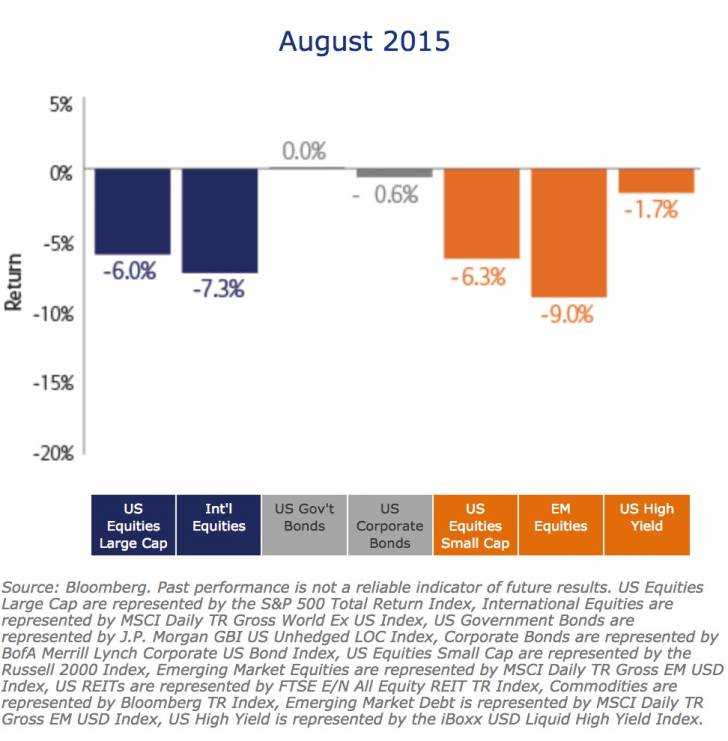

For a look a closer look into how diversification has failed to live up to its promise, consider two particularly volatile months in global markets as shown below. October 2008 was the height of the financial crisis, leading to steep declines across most asset classes. It's been estimated that 401(k) and IRA investors lost approximately $2.4 trillion in aggregate value during the final two quarters of 2008. Fast forward to August 2015—while not as dire as the financial crisis, the month nonetheless featured pronounced fears of a China economic slowdown and worsening Greek debt woes. And just like in October 2008, most asset classes fell in unison and showed the shortcomings of diversification.

The Limits of Diversification:

It fails when you need it most

A dynamic approach can deliver

The 2016 RiskMonitor also points to missed opportunities with potentially devastating consequences. Eight years out from the financial crisis, our survey shows that risk management practices have changed very little. This comes despite nearly half of our respondents admitting their current risk strategies provided too little downside protection, while almost 60% would sacrifice upside potential for added protection against volatility.

One of the biggest changes the 2016 RiskMonitor found in terms of pre- and post-crisis risk management is institutional investor use of dynamic asset allocation strategies, which increased from approximately 40% pre-crisis to 50% post. Institutional investors are coming to realize that a dynamic approach can exploit the cyclicality of asset-class returns and achieve a meaningful, positive impact on a portfolio's risk/return profile.

The big idea behind a dynamic approach is that asset classes exhibit both "trending" and "mean-reverting" return patterns, the cyclicality of which can be captured by a sophisticated combination of trend-following and mean-reverting allocation responses. By combining them, the resulting allocation seeks to balance "as many return-seeking assets as possible" with "as many safe assets as necessary."

At the core is a rules-based, repeatable process that can "up-risk" or "de-risk" according to changing market conditions. The dynamic process also drives decisions about when to take profits and when to re-enter markets. If the rules are effective, and a dynamic risk-mitigation strategy is successfully implemented, an investor can participate more fully in rising markets and preserve capital to a greater degree in declining ones. And in the current low-growth, low-rate environment in which retirement investors must contend, a dynamic approach could make all the difference in ensuring a rewarding retirement.

*****

The material contains the current opinions of the author, which are subject to change without notice. Statements concerning financial market trends are based on current market conditions, which will fluctuate. References to specific securities and issuers are for illustrative purposes only and are not intended to be, and should not be interpreted as, recommendations to purchase or sell such securities. Forecasts and estimates have certain inherent limitations, and are not intended to be relied upon as advice or interpreted as a recommendation.

Copyright © Allianz Global Investors