by Don Vialoux, Timingthemarket.ca

Editor’s Note: Next Tech Talk report is released on Tuesday August 2nd. Monday is a holiday in Canada.

Mr. Vialoux on Michael Campbell’s National Radio Program

Interview will be approximately at noon Toronto time on Saturday. Link to Michael’s program is

http://www.cknw.com/money-talks/

StockTwits Released Yesterday

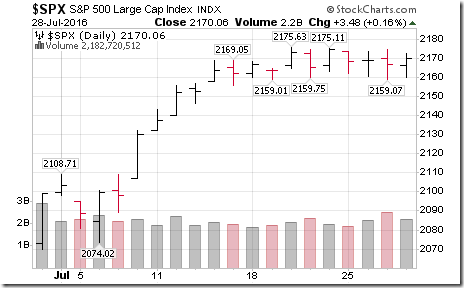

S&P 500 Index remains in tight trading range following FOMC.

Technical action by S&P 500 stocks to Noon: Bullish. Breakouts: $TRIP, $STT, $XL, $ABT, $HOLX, $ADSK, $APD. Breakdowns: $MUR, $NOV.

Editor’s Notes: After Noon, breakout included Best Buy, Celgene, Vulcan Materials and Whirlpool. No breakdowns.

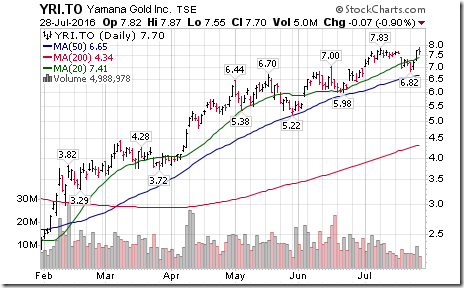

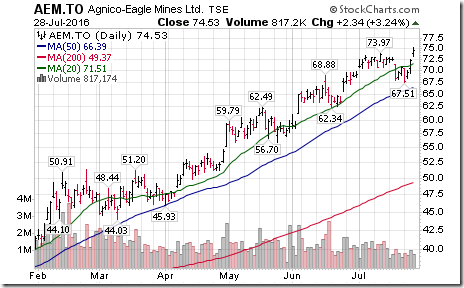

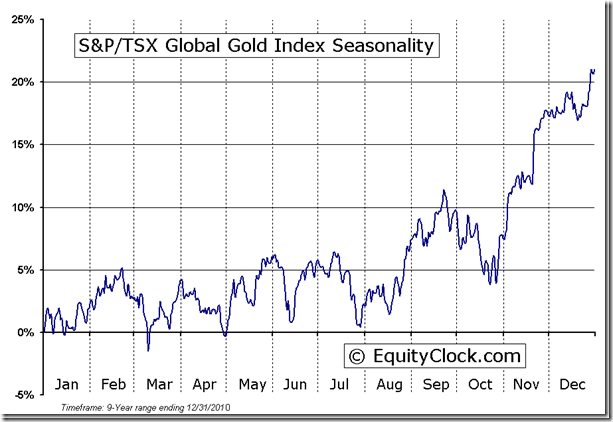

More gold producer stocks breaking resistance extending intermediate uptrends: $YRI.CA, $AEM

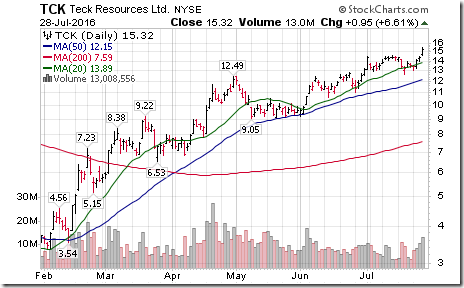

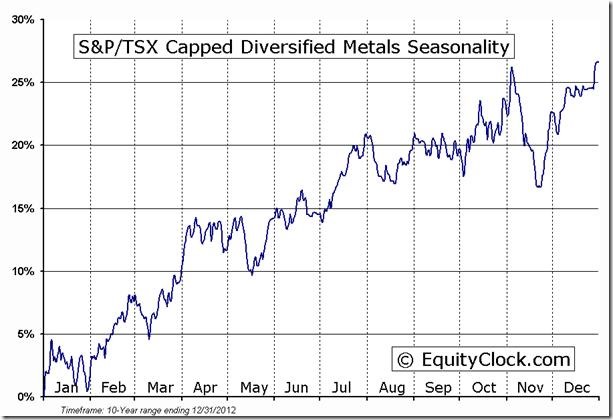

Nice breakout by Teck Resources $TCK $TCK.CA above resistance extending intermediate uptrend.

Editor’s Note: Base metal stocks such as Teck reach the end of their period of seasonal strength at the end of July. Technicals for Teck and the sector remain positive. Stick with Teck and other base metal stocks until short term momentum indicators (Stochastics, RSI, MACD) roll over from overbought levels and begin to trend down. Currently, their short term momentum indicators are overbought but continue to trend higher.

Silver stocks also breaking resistance extending intermediate uptrends. $SLW $HL

Trader’s Corner

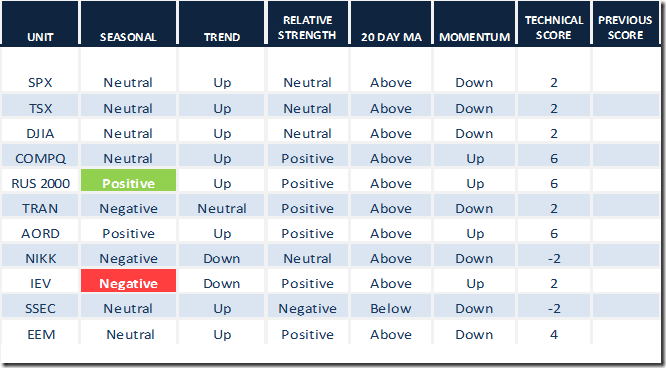

Daily Seasonal/Technical Equity Trends for July 28th 2016

Green: Increase from previous day

Red: Decrease from previous day

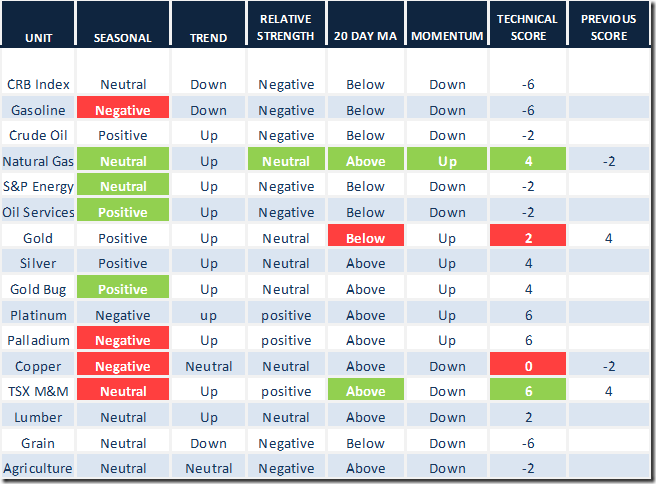

Daily Seasonal/Technical Commodities Trends for July 28th 2016

Green: Increase from previous day

Red: Decrease from previous day

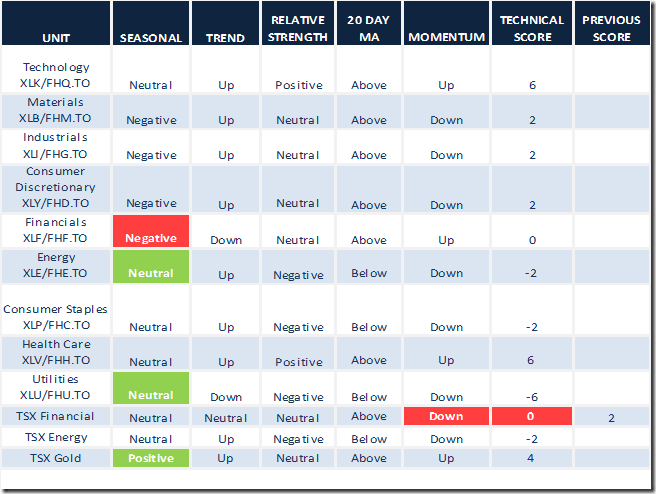

Daily Seasonal/Technical Sector Trends for March July 28th 2016

Green: Increase from previous day

Red: Decrease from previous day

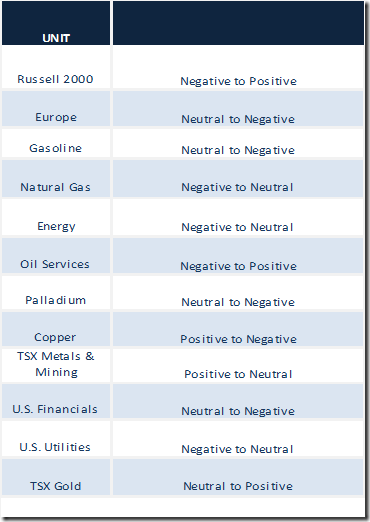

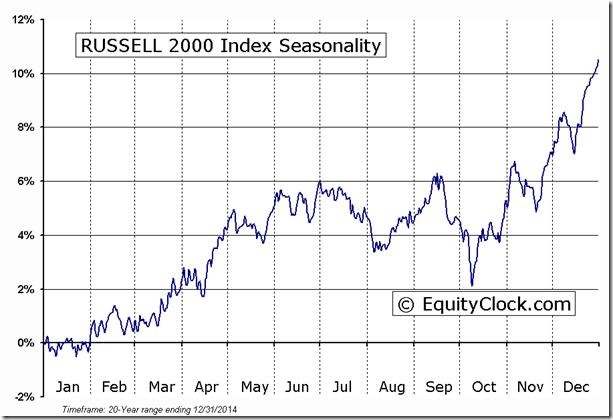

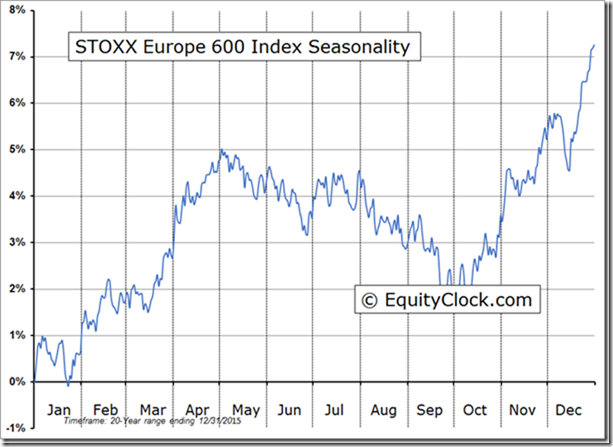

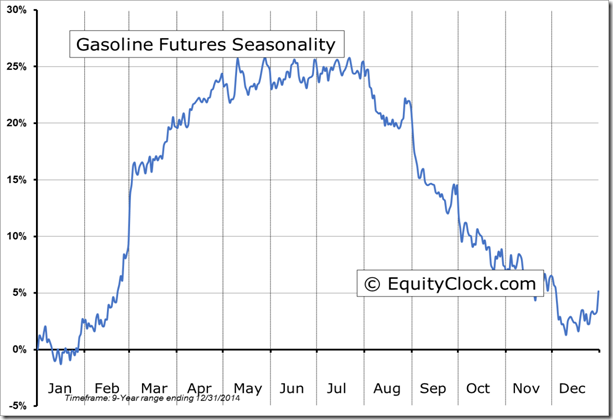

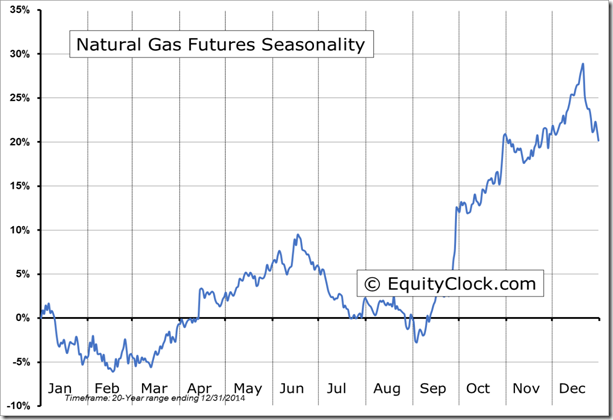

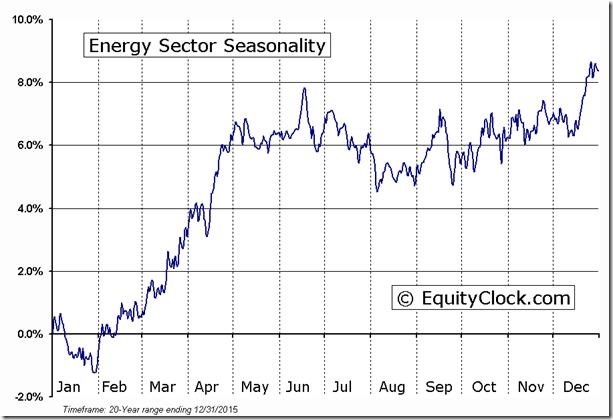

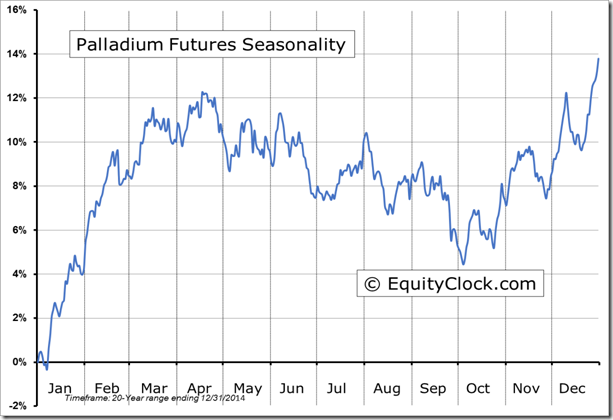

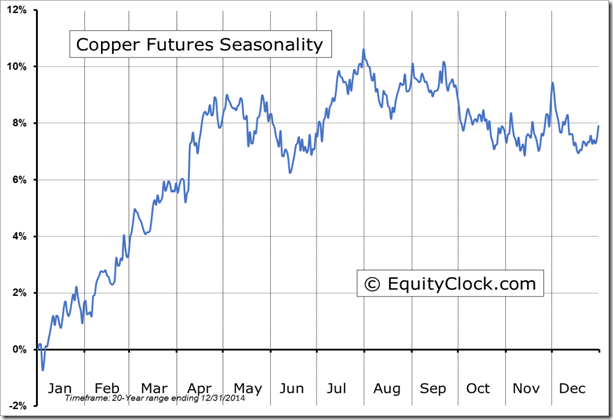

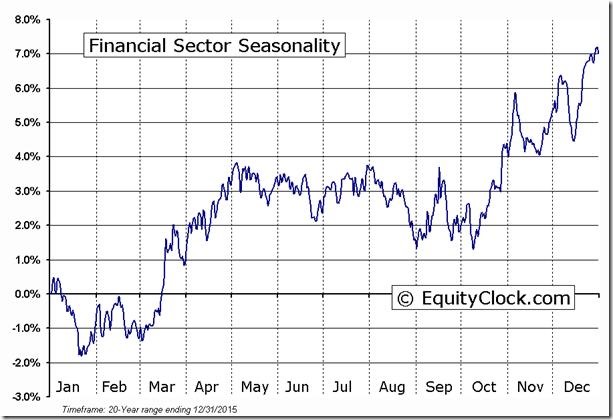

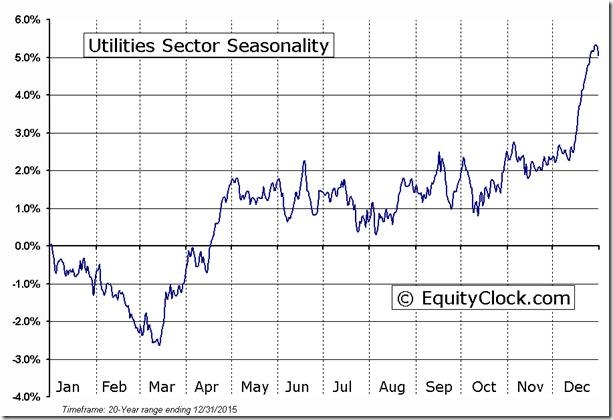

Seasonality Changes at the End of July

Historically, the end of July has been an important inflection point for many equity markets, commodities and sectors. Following is a summary:

Following are the seasonality charts:

S&P 500 Momentum Barometer

The Barometer added 1.00 (1.33%) to 76.20. It remains intermediate overbought and trending down.

TSX Composite Momentum Barometer

The barometer added 0.86 (1.26%) to 69.10 yesterday. It remains intermediate overbought and trending down.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca