by Don Vialoux, Timingthemarket.ca

Editor’s Note: Tech Talk will appear tomorrow (July 1st) but not on Monday (July 4th)

Observations

World equity markets recovered from oversold levels. The recovery triggered a recovery in short term momentum indicators for a wide variety of equity markets, commodities and sectors. News after the close likely will help at the opening: Most of the major U.S. banks passed their stress tests and were able to announce buy back shares and dividend increases. However, short term strength has returned equity market/commodities/sectors to intermediate overbought levels. Short term strength is providing a renewed opportunity to reduce equity exposure.

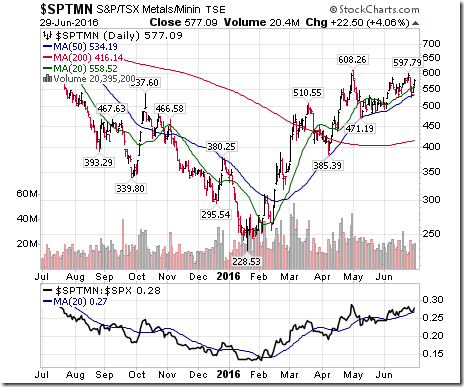

Metals and mining shares and related ETFs continue to surprise with their outperformance. Seasonal influences remain positive until mid-July.

StockTwits Released Yesterday @EquityClock

Benchmarks jump back to test their recent breakdown points.

Technical action by S&P 500 stocks to 10:00: Bullish. Breakouts: $COG, $AIV, $ALL, $HCN, $SPG, $UNH, $AAP

Editor’s Note: After 10:00, five more S&P 500 stocks broke resistance: UA, KSS, CMCSA, LMT and PEG.

iShares Silver $SLV broke above $17.09 extending intermediate uptrend

Editor’s Note: Silver Wheaton, a silver royalty company and TSX 60 company also broke to a new high.

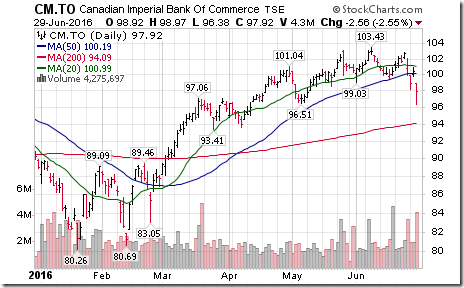

Commerce Bank $CM.CA broke below support at $99.03 and $96.51 following purchase of Private Bancorp

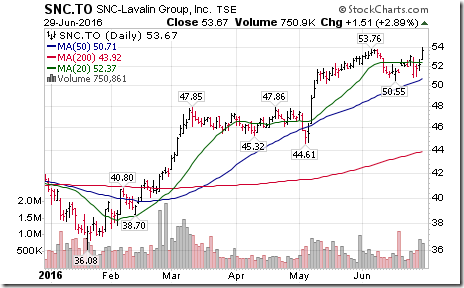

Nice breakout by $SNC.CA above $53.76 to a 2 year high extending intermediate uptrend

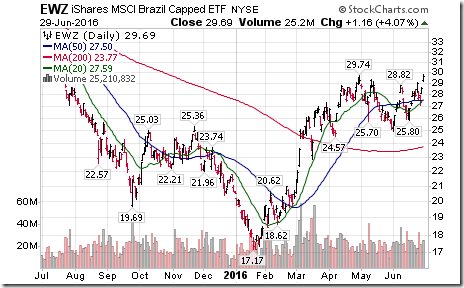

Nice breakout by Brazil iShares $EWZ above $29.74 extending intermediate uptrend prior to start of Olympics.

Expectations for North American equity markets during the second quarter earnings report season

U.S. and Canadian equity indices historically have moved higher during the first two weeks in July. On average during the past 20 years, the S&P 500 Index has gained 0.8% per period and the S&P/TSX Composite Index has gained 0.9% per period. Advances are attributed at least partially to anticipation of improving second quarter earnings results on a year-over-year basis. What about this year?

Anticipation of second quarter results by major U.S. and Canadian equity indices is expected to be muted at best:

Analysts are cautious prior to release of S&P 500 results. Consensus estimates for S&P 500 companies call for an earnings decline on a year-over-year basis of 5.2%. Revenues are expected to slip 0.8%. Weakest sector is expected to be energy. Eighty one S&P 500 companies have issued negative guidance for second quarter results while only 32 companies have issued positive guidance.

Prospects for the 30 Dow Jones Industrial Average companies are slightly better. Sixteen companies are expected to report higher earnings on a year-over-year basis and 14 companies are expected to report lower earnings. On average (median), earnings per share will increase 2.1%. Largest percentage gains are expected to be reported by American Express, Boeing, Caterpillar and IBM. Largest percentage losses are expected to be reported by Apple, Exxon Mobil, General Electric, Goldman Sachs and Procter & Gamble.

Earnings per share by Canada’s largest listed companies also show a mixed picture: 29 companies in the S&P/TSX 60 Index are expected to report higher earnings per share on a year-over-year basis, 28 companies are expected to report lower earnings, one company is expected to report no change and two companies do not provide comparable data. Average (median) company is expected to record a gain of 0.68%. Companies expected to report the highest percent gain include Dollarama, Franco-Nevada, Inter Pipeline and SNC Lavalin. Companies expected to report the highest percent decline include Husky Energy, Imperial Oil, Suncor, Potash Corp and Valeant Pharmaceutical.

Trader’s Corner

Technical scores improved significantly yesterday when short term momentum indicators turned positive.

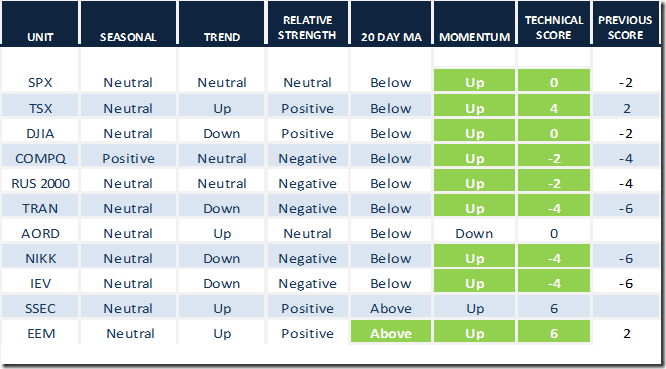

Daily Seasonal/Technical Equity Trends for June 29th 2016

Green: Increase from previous day

Red: Decrease from previous day

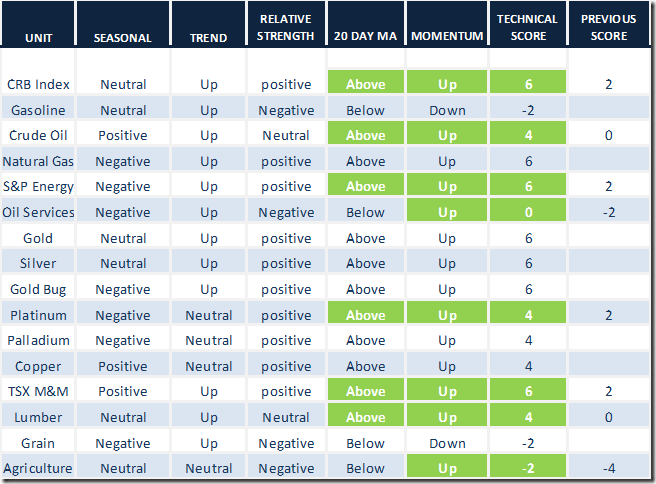

Daily Seasonal/Technical Commodities Trends for June 29th 2016

Green: Increase from previous day

Red: Decrease from previous day

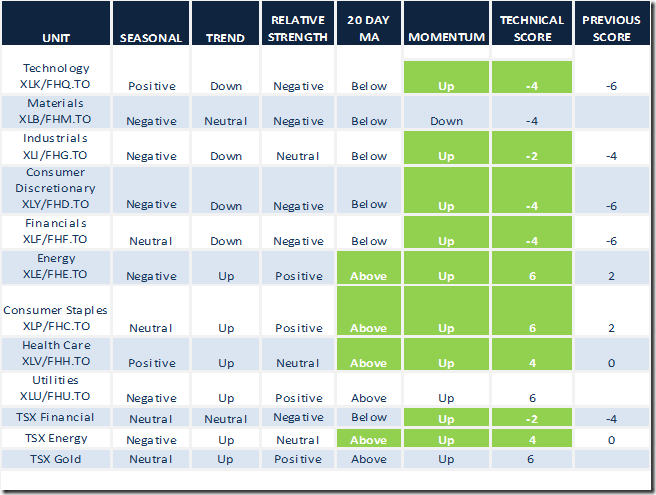

Daily Seasonal/Technical Sector Trends for March June 29th 2016

Green: Increase from previous day

Red: Decrease from previous day

Special Free Services available through www.equityclock.com

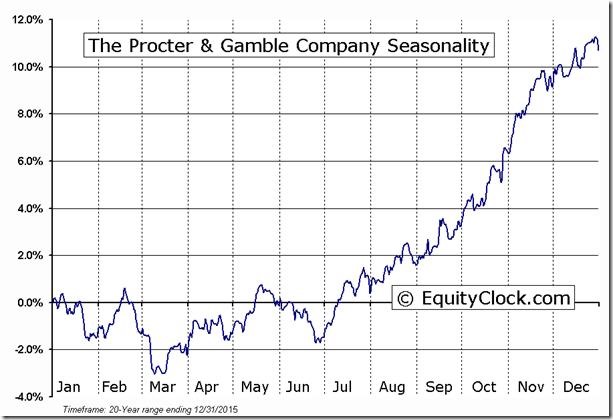

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts. Following are examples:

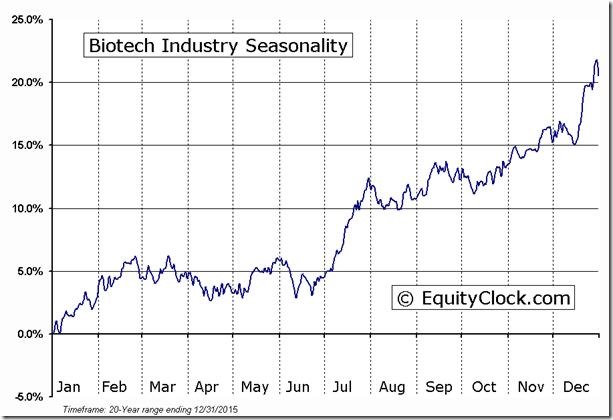

Editor’s Note: Short term momentum indicators for the biotech sector have turned positive at an intermediate support level.

Adrienne Toghraie’s “Trader’s Coach” Column

|

|

Summer Reflections

By Adrienne Toghraie, Trader’s Success Coach

Summer is traditionally a time to vacation, to get away from the normal routine and let your mind, body and spirit relax and refresh. At the end of that vacation it is the best time for a trader to take a time out to reflect on where he is in his trading and his life, where he wants to be and what is between these two positions.

Most of us live our lives because the next day is coming up and we would rather not have to deal with any disruption in our routine. This is the very thing that keeps us from growing. And this is also the reason that people wonder how the bottom fell out of their lives when it does. In order to keep a vibrant status quo as well as grow you need to take time to dust off your business plan from the inside out and do some physical and mental housekeeping.

John’s status quo life

John was a very traditional man. He went to college, worked as an executive of a corporation, got married and had two children. For John once he completed what he felt was expected of him he did not look back. Education was only what was necessary for the job and the family relationship was just enough to keep everyone adequately satisfied. One day John was introduced to trading and he began to have a new set of values for his life. Once he established himself as a trader, he then took on having a mistress, which led to a divorce once discovered. The pain in all of the changes brought John back to the fold of his traditional life. With his second wife, he had another child and life went along without any disruptions for a while.

John had been trading equities with a strategy that was fairly risk-adverse. Once he had his strategy set, he maintained a comfortable income for a few years. Then John’s 401Ks dwindled to nothing, his stress level grew, he became unsure of himself and started making bad choices. During this time he did not take stock of the fact that he was ignoring his family, which led to his wife leaving with their child. John developed colitis that kept him in constant pain. He needed a makeover of his entire life and that is when John came to one of my workshops at a conference.

Here are some of the questions John had to answer when we met for private work along with additional questions for you to answer:

Trading

1. When was the last time you did a periodic review of how you could improve your entry, exit?

2. Are you working on the optimal amount of risk for your strategy?

3. Is it time to start working on another strategy because you have reached a level in trading where you have been consistently earning money?

4. How are you diversifying your capital?

5. Are you stuck at the same level of trading because you have not sought out help to grow?

Physical

1. Do you get a periodic physical exam?

2. Is your diet supporting a healthy you?

3. Are you taking care of any health issues you might have?

4. Are you preventing health issues from possibly occurring?

5. What are you doing physically to maintain your health?

Mental

1. Do you look forward to starting the day and enjoying the process of each moment?

2. Are you living the life that you want?

3. Is trading a joy for you?

4. Do you continue to stretch your mind and your ability to take more risk?

Family

1. Do your family members nurture each other?

2. Do you give quality time to each member of your family?

3. Is home a sanctuary for you?

After your vacation take stock of your life. Then make a commitment to doing whatever is necessary to make your life the best life possible.

Back in the saddle again

John now does a quarterly review of his life and periodically has a one-day in person coaching with me after his summer vacation. He remarried his first wife, and is enjoying the kind of life he did not think possible. His trading is better than ever and he is slim, trim and healthy.

Adrienne’s Free Webinars

Adrienne presents free webinars on the psychology of trading

Email Adrienne@TradingOnTarget.com

S&P 500 Momentum Barometer

The S&P 500 Momentum Barometer added 13.60 (41.21%) to 46.60 yesterday. The Barometer remains in an intermediate downtrend

TSX Momentum Barometer

The TSX Momentum Barometer gained 13.08 (26.86%) to 61.80 yesterday. The Barometer remains in an intermediate downtrend and has returned to an intermediate overbought level.

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca