Bond Market Messages

by Anthony Valeri, Fixed Income and Investment Strategist, LPL Financial

The message from the bond market suggests that the next Federal Reserve (Fed) interest rate hike may not be as big of a threat to bond prices that many investors fear.

Key Takeaways

· The market is only pricing in a 23% chance of a rate hike by July, though Fed messaging continues to point toward a summer hike.

· The yield curve continues to indicate that the bond market is not yet comfortable with more rate hikes.

The message from the bond market suggests that the next Federal Reserve (Fed) interest rate hike may not be as big of a threat to bond prices that many investors fear. Futures are pricing in almost no chance (2%) of a rate hike for this week’s meeting and only a 23% chance for one in July, despite comments from Fed Chair Janet Yellen and other Fed officials that a rate hike is forthcoming. The behavior of the yield curve and the 10-year Treasury indicate that the bond market is sending a message of caution to the Fed, however, and is not convinced that a rate hike is in the best interests of the global economy.

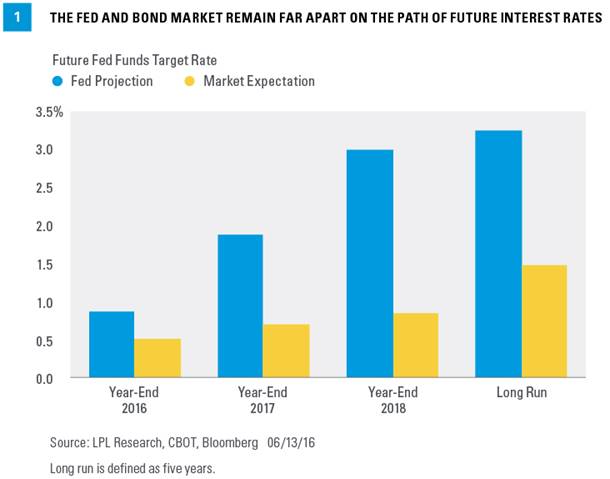

The Fed and bond market remain far apart on the path of future interest rate hikes [Figure 1]. The gap between what the Fed says it will do and what the market expects from the Fed has increased once again after narrowing through the first few months of 2016. The implied overnight lending rate five years from now is a mere 1.5%, implying slightly less than one rate hike per year over the next five years.

Yield Curve Flattening

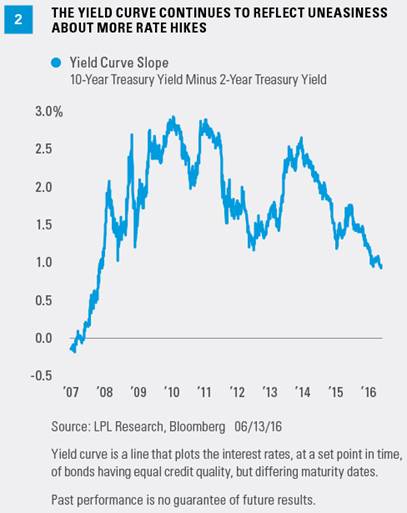

The yield curve is sending a slower economic growth message in response to the prospects of more rate hikes. The yield curve, as measured by the difference between 2- and 10-year Treasury yields, has been hovering near the narrowest levels since late 2007 and is at its “flattest” since just before the recession [Figure 2]. Conversely, when the yield curve steepens (longer-term rates rise more than short-term rates), the bond market is sending a growth signal.

However, the yield curve is not currently in immediate danger of inverting (a precursor to recession); instead, it is just slightly below the 25-year average level of steepness of 1.2%. The fact that 2-year Treasury yields have been increasing more (or in recent weeks, decreasing less) than 10-year Treasury yields indicates that markets believe that a rate hike (which will impact short-term maturities most) will lead to slower growth in the intermediate and long term. This is a sign that the market believes a rate hike may not push the economy into recession, but it may be a headwind for future growth.

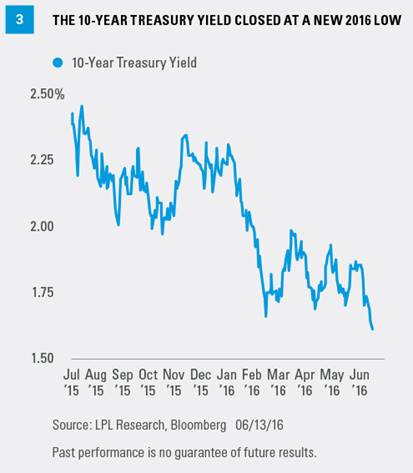

Breakout

The 10-year Treasury yield broke below the low end of a multi-month range last week [Figure 3], another sign of slow economic growth. The flattening of the yield curve is a reflection of lower long-term yields; but because long-term bond yields can be broken down into an economic growth expectation and an inflation expectation, absolute yields send a message in their own right. The break to a new yield low also suggests a view of a sluggish economic growth for the U.S., and that the pace of growth on a global basis remains fragile, especially with Fed rate hikes looming.

Inflation expectations, as measured by Treasury Inflation-Protected Securities (TIPS) pricing, remain near multi-year lows at 1.5%, despite the recent improvement in oil prices—a key driver of inflation expectations. This expected inflation is calculated by subtracting the yield on a conventional Treasury from a comparable TIPS. Bond pricing indicates that looming rate hikes may squash any attempt for higher inflation to take hold.

Insatiable Demand

Investor demand, led by overseas investors, has been insatiable, however, and investors need to take the flatter yield curve and low 10-year Treasury yield with a grain of salt. Extraordinary policies underway in Japan and Europe have led to ultra-low yields (in some cases negative) and spurred demand for U.S. bonds, especially with the European Central Bank’s (ECB) corporate bond purchase program kicking off last week (see last week’s Bond Market Perspectives, “ECB Corporate Purchase Program” for more detail).

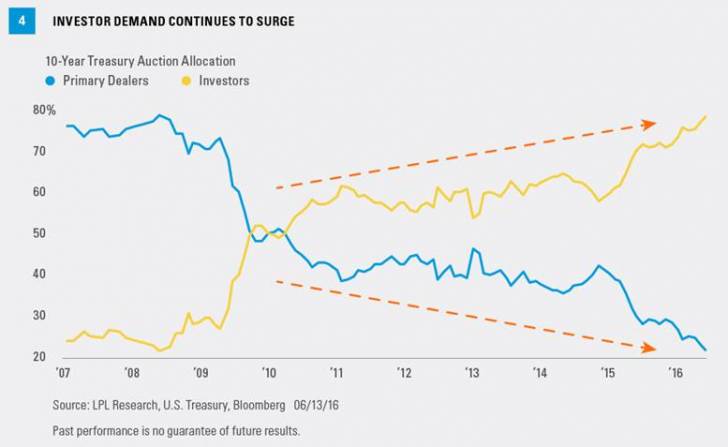

Investor demand at last week’s 10-year Treasury auction reached a new record, leaving bond dealers with a limited inventory of bonds [Figure 4]. Demand at the 30-year auction was also strong and a testament to investors’ need for yield despite potential interest rate risks. Last week’s auction results follow record investor demand at the Treasury’s 2-, 5-, and 7-year auctions two weeks prior.

Furthermore, corporate bond markets have generally been resilient, which run counter to slow growth concerns. True economic worries would translate into weaker corporate bond prices, which, with the exception of market activity for the two trading days ending June 13, 2016, have been absent—but bears watching.

Conclusion

Markets continue to price in a low chance of rate hikes over the next couple of months, though expectations rise to about 60% by the December 2016 meeting; however, Fed speakers continue to point to a more probable hike sometime this summer as long as the trajectory of recent economic data doesn’t deteriorate. Overseas central bank policies cloud the message from the bond market but do not offset it. The broad message from the bond market, as measured by the steepness of the yield curve, the path of the 10-year Treasury yield, and inflation expectations, suggests the Fed should tread cautiously and more rate hikes may be a headwind for the economy.

Important Disclosures

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values and yields will decline as interest rates rise, and bonds are subject to availability and change in price.

Government bonds and Treasury bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate, and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

International debt securities involve special additional risks. These risks include, but are not limited to, currency risk, geopolitical and regulatory risk, and risk associated with varying settlement standards. These risks are often heightened for investments in emerging markets.

This research material has been prepared by LPL Financial.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity.