Following the Money in EM Currency Markets

by Matthew Peterson, Chief Wealth Strategist, LPL Financial

Emerging markets (EM) tantalize investors with the prospects of higher returns; yet the key to these returns may be the value of the U.S. dollar.

Currency movements impact all aspects of international investing, starting with the basic impact of adjusting gains for the change in currency value when determining total returns. However, changes in currency also impact areas like corporate earnings, the ability to repay debts, and the overall economic health of the country.

These impacts are greater for EM investments, where currencies are more volatile and countries are more economically dependent on trade.

The value of EM currencies has depreciated significantly since mid-2011 for many reasons, including a reduction in capital flows into these countries. In turn, this has significantly reduced the return on EM investments to U.S. investors. The trend of EM currency devaluation appears to be turning; if the reversal continues, and if capital flows into EM countries resume, both debt and equity investments in these regions may be very attractive.

FOLLOWING THE MONEY Emerging market countries tend to be very dependent on capital flows to finance trade and budget deficits and to bolster investment. Money flows into EM countries for a number of reasons. Multinational companies, which set up manufacturing facilities to take advantage of cheaper labor and better access to EM consumers, are one source of investment. Investors focused on long-term growth purchase shares of companies to diversify their portfolios and seek another source of gains.

Shorter-term investors often engage in the “carry trade,” borrowing money in low- yielding currencies — like the Japanese yen and U.S. dollar — to buy higher-yielding, but riskier fixed income assets from EM countries.

Capital flows into and out of EM countries are important for several reasons. Unlike richer countries, most EM countries don’t generally have enough internal savings to finance their growth (China is the major exception). Without external financing, they may not be able to build out infrastructure basic needs like transportation or power generation. More developed countries may need to import capital to build factories to produce goods necessary for both domestic consumption and exports. Yet, if a country has capital inflows too fast, it can result in an unwanted appreciation of its currency, making its exports more expensive than competitors. Like Goldilocks, EM countries need capital flows to be just right. Over time, the relationship between capital flows and currency can be tenuous; many factors influence currency. Yet, despite the conventional wisdom that “correlation does not prove causation,” we cannot help but remark that the current outflow from EM countries came just as their currencies were collectively declining.

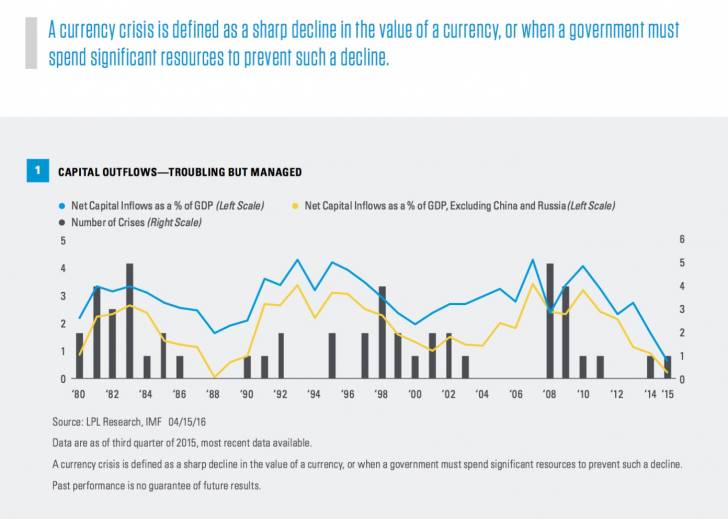

Since 2010, flows into EM countries have declined, recently turning negative

Capital flows relative to gross domestic product (GDP) is the best way to measure this, as an outlier in a larger economy could otherwise distort the data. The International Monetary Fund (IMF) also examined the same data, separating out Russia (because of the sanctions imposed on it in 2014) and China (due to its large size and rapid growth), but there is very little difference between these two and the remaining countries.

Another important consideration is that capital outflows are often connected with a currency crisis.

A currency crisis is defined as a sharp decline in the value of a currency, or when a government must spend significant resources to prevent such a decline. The most recent outflow from EM has not coincided with a currency crisis (or other financial crisis).

The inherent instability in EM is one reason investors limit their allocation to the asset class, regardless of how attractive the fundamentals may be. Like so many aspects of international economics, the relationship between cause and effect is often circular. Many economists suggest that the reason EM countries have been able to withstand sharp changes to capital flows is because their currencies are able to adjust to current conditions. Prior to the EM crisis of the late 1990s and early 2000s, many EM countries had currencies that were pegged to the U.S. dollar. Today, very few countries do. Even China has abandoned its dollar peg for a more globally diverse basket of currencies.

Read/Download the complete report below:

Weekly Economic Commentary 04182016