The Commodities Crash: A Supply-Side Perspective

by Janet Zhang, via CFA Institute

2015 was brutal for commodities. Even worse, they took another plunge at the start of 2016.

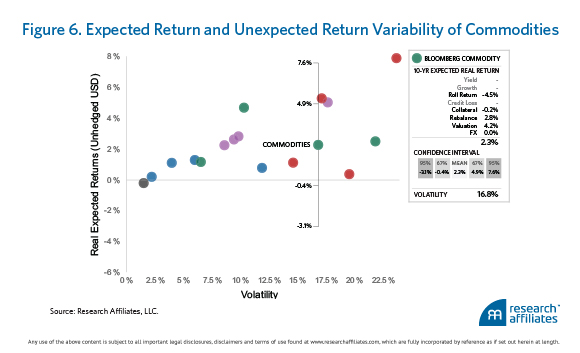

The Bloomberg Commodity Index, which covers a wide range of natural resources, dropped to its lowest level since June 1999. The collapse in commodity prices happened across the board, from crude oil to iron ore, coal, and industrial metals. Unfortunately, there is little sign of stability or recovery: Oil and iron ore prices dipped even further in December. As a result, mining stocks took a beating, and ratings on mining bonds were downgraded.

Weakening demand from China receives most of the blame for the tumbling prices. China was the main driving force behind the rising commodity prices, its fixed-asset investment growing at an average of 25% from 2003 to 2011. The high investment growth was led by property investment and related heavy industries, the biggest drivers of demand for commodities. In 2015, property investment and construction slumped due to market saturation after years of overbuilding. Since China accounts for half of global base metal and bulk commodity consumption, the slowdown was thought to be disastrous.

The real curse for commodity prices, however, is on the supply side. The last decade’s commodities boom has led to irrational investment in new projects. China’s demand for iron ore and coal declined only this year, but commodity prices have been dropping since 2011. These price declines reflect concerns about a persistent surplus as mining firms continue to expand supply. Global iron ore production is expected to have increased by 100 million tons in 2015 despite the declining demand from China, and further increases are expected over the next two years.

Therefore, it was the aggressive increase in supply that most influenced commodities prices, and the prices will not stop falling until a supply-side adjustment occurs. The good news is that we have witnessed some progress on this front. Low commodities prices have forced many of the smaller producers out of the market. Some large mining companies have already announced asset sales and output cuts. Last month, the global mining conglomerate Anglo American announced it will sell or shut down 60% of its mines — cutting 85,000 jobs — and will pay no dividend for at least 18 months. Rio Tinto will cut its capital spending again, already down by US$13.5 billion over the last three years, to US$5 billion in both 2015 and 2016. Glencore, a huge coal producer, announced it will cut coal production at an Australian mine in 2016.

China will play a key role in this process. In fact, China itself is the largest producer of many of the world’s commodities, including coal and aluminium. Coal production fell 3.7% in the first 11 months of 2015. Aluminium and nickel producers are lowering production. Wuhan Iron and Steel Group declared in December it will cut more than 6,000 employees before the end of February.

The supply cut, however, will be marginal. Large companies are reluctant to cut operational capacity and will seek more inventive ways to keep operations going. Some of them will even take advantage of the low prices to increase production and gain more market share. For example, Rio Tinto plans to expand one of the world’s largest copper mines. Oil production from OPEC countries accelerated in November. China’s nonferrous metal production rose 7.5% from January through November of last year. Local governments in China will postpone the elimination of oversupply by supporting state-owned enterprises for fear of large-scale unemployment.

Looking ahead, the price outlook remains gloomy for commodity producers and, according to some experts, it isn’t going to get better any time soon. Until the supply is curbed to match the weakening demand, it never will.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©iStockphoto.com/FrankRamspott

This post was originally published at the CFA Institute's Enterprising Investor blog.