Tech Talk for Monday December 14th 2015

by Don Vialoux, Timingthemarket.ca

Weekly GlobeInvestor Comment

Column is entitled, “How to take advantage of a Fed Fund hike”. Authored by Don and Jon Vialoux.Following is a link:

Economic News This Week

November Consumer Prices to be released at 8:30 AM EST on Tuesday are expected to remain unchanged (0.5% year-over-year) versus a gain of 0.2% in October. Excluding food and energy November CPI is expected to increase 0.2% (2.0% year-over-year) versus a gain of 0.2% in October.

December Empire Manufacturing Index to be released at 8:30 AM EST on Tuesday is expected to recover to -5.8 from -10.7 in October

Canada’s November Existing Home Sales to be released at 9:00 AM EST on Tuesday are expected to increase 5.0% versus a gain of 3.2% in October.

November Housing Starts to be released at 8:30 AM EST on Wednesday are expected to increase to 1,140,000 from 1,060,000 in October

November Capacity Utilization to be released at 9:15 AM on Wednesday is expected to slip to 77.4% from 77.5% in October. November Industrial Production is expected to slip 0.1% versus a decline of 0.2% in October.

FOMC Decision on the Fed Fund rate to be released at 2:00 PM EST on Wednesday is expected to see the Fed Fund rate increase 0.25%.

Weekly Initial Jobless Claims to be released at 8:30 AM EST on Thursday are expected to slip to 275,000 from 282,000 last week.

December Philadelphia Fed Index to be released at 8:30 AM EST on Thursday is expected to slip to 1.5 from 1.9 in November.

November Leading Economic Indicators to be released at 10:00 AM EST on Thursday are expected to increase 0.1% versus a gain of 0.6% in October.

Canada’s November Consumer Price Index to be released at 8:30 AM EST on Friday is expected to increase 0.1% (1.5% year-over-year) versus a gain of 0.1% in October. Excluding food and energy, November CPI is expected to remain unchanged (2.3% year-over-year) versus a gain of 0.1% in October (2.1% year-over-year).

Earnings News This Week

Wednesday: Oracle

Thursday: Carnival, General Mills, Red Hat

Friday: Blackberry, Darden, Lennar

The Bottom Line

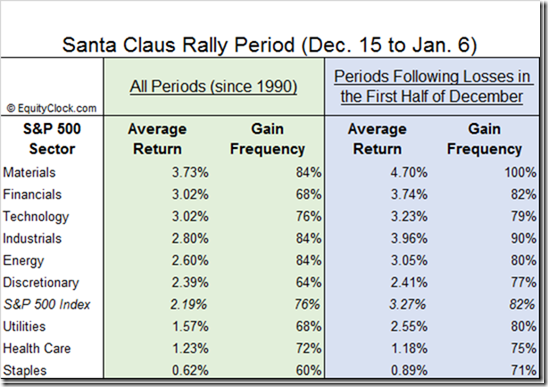

Another wild week for North American equity indices last week! Look for more of the same this week, but with a different spin. Volatility early this week focuses on the Federal Reserve’s decision in the Fed Fund rate on Wednesday. Thereafter, the stage is set for a classic Santa Claus rally. A study near the end of this report identifies the sectors that will benefit the most: Materials, Financials, Industrials and Technology are at the top of the list. All have a history of positive seasonal trends at this time of year. Technical signs of an intermediate peak in the U.S. Dollar Index, the positive impact on equity markets by an El Nino weather event and anticipation of a return to earnings and revenue growth beyond the release of fourth quarter results are bonus factors that are unique this year. The stage is set for an intermediate recovery in North American equity markets starting later this week and continuing into spring.

Equities

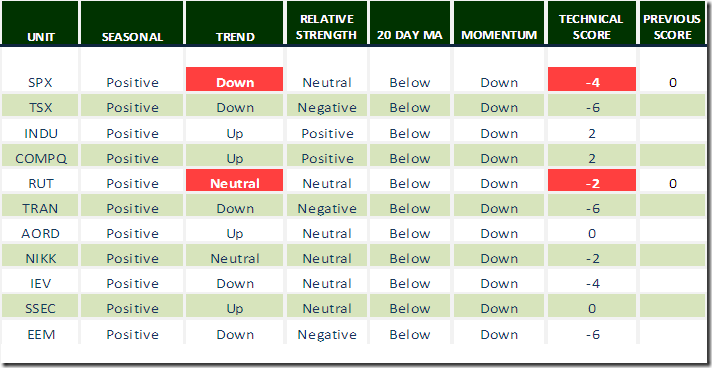

Daily Seasonal/Technical Equity Trends for December 11th 2015

Green: Increase from previous day

Red: Decrease from previous day

Calculating Technical Scores

Technical scores are calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

Higher highs and higher lows

Intermediate Neutral trend: Score 0

Not up or down

Intermediate Downtrend: Score -2

Lower highs and lower lows

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of 0.0 or higher. Conversely, a short position requires maintaining a technical score of 0.0 or lower.

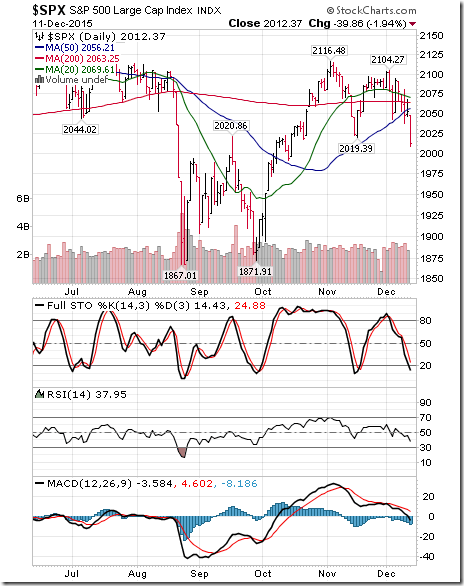

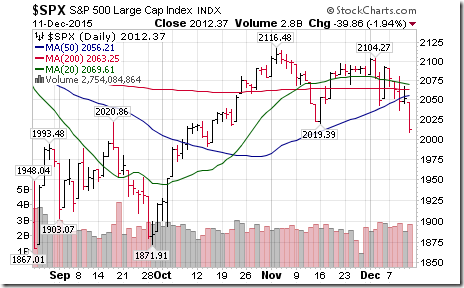

The S&P 500 Index plunged 79.32 points (3.79%) last week. Trend changed to down from up on a move on Friday below support at 2,019.39. The Index fell below its 20 day moving average. Short term momentum indicators are trending down and are oversold, but have yet to show signs of bottoming.

Percent of S&P 500 stocks trading above their 50 day moving average plunged to 28.80% from 65.80%. Percent is intermediate oversold and trending down, but has yet to show signs of bottoming.

Percent of S&P 500 stocks trading above their 200 day moving average dropped last week to 38.20% from 52.60%. Percent is trending down and is oversold, but has yet to show signs of bottoming.

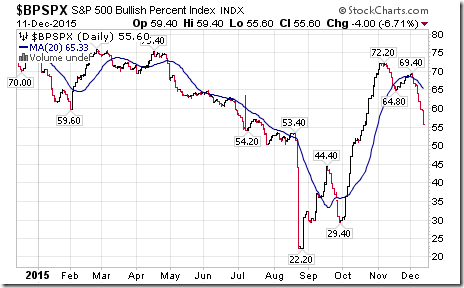

Bullish Percent Index for S&P 500 stocks dropped last week to 55.60% from 66.40% and remained below its 20 day moving average. The Index has established an intermediate downtrend.

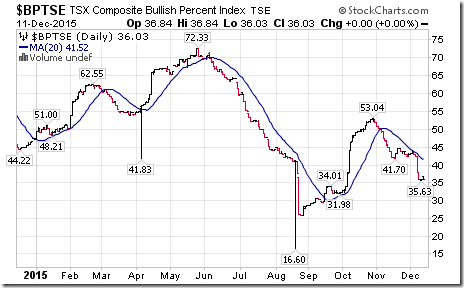

Bullish Percent Index for TSX stocks dropped last week to 36.03% from 42.51% and remained below its 20 day moving average. The Index continues in an intermediate downtrend.

The TSX Composite Index plunged 568.82 points (4.26%) last week. Intermediate trend changed to down from up on breaks through support at 13,030.46 and 12,964.12 (Score: -2). Strength relative to the S&P 500 Index turned negative (Score: -2). The Index remains below its 20 day moving average (Score: -1). Short term momentum indicators are trending down and are oversold, but have yet to show signs of bottoming (Score: -1). Technical score fell last week to -6 from 0.

Percent of TSX stocks trading above their 50 day moving average dropped last week to 23.89% from 37.65%. Percent continues an intermediate downtrend and is oversold, but has yet to show signs of bottoming.

Percent of TSX stocks trading above their 200 day moving average dropped last week to 20.24% from 30.36%. Percent is in an intermediate downtrend, but has yet to show signs of bottoming.

The Dow Jones Industrial Average plunged 592.42 points (3.26%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index changed to positive from neutral. The Average fell below its 20 day moving average. Short term momentum indicators are trending down and are oversold, but have yet to show signs of bottoming. Technical score remained at 2 last week.

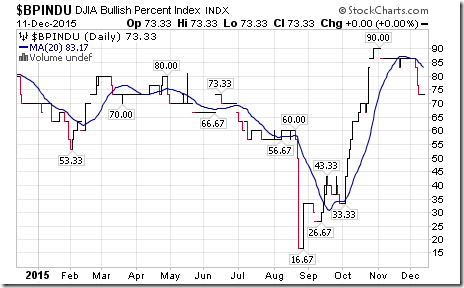

Bullish Percent Index for Dow Jones Industrial Average dropped last week to 73.33% from 83.33% and remained below its 20 day moving average. The Index is intermediate overbought and trending down.

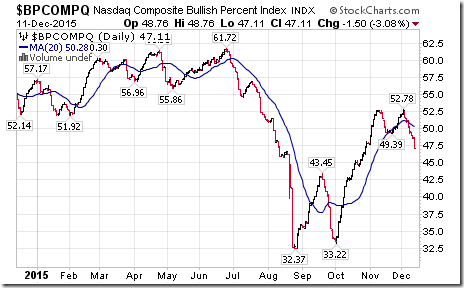

Bullish Percent Index for NASDAQ Composite stocks dropped last week to 47.11% from 51.17% and remained below its 20 day moving average. The Index has established an intermediate downtrend.

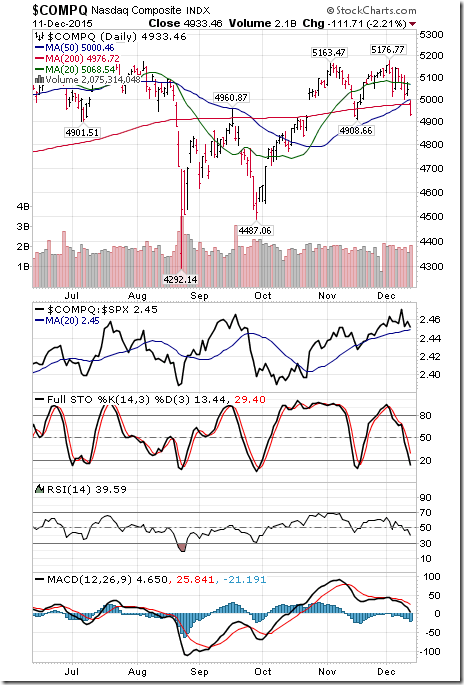

The NASDAQ Composite Index plunged 208.81 points (4.06%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remains positive. The Index fell below its 20 day moving average. Short term momentum indicators are trending down and are oversold, but have yet to show signs of bottoming. Technical score slipped to 2 from 4.

The Russell 2000 Index plunged 59.79 points (5.05%) last week. Intermediate trend changed to neutral from up on a move below 1140.76. Strength relative to the S&P 500 Index remained neutral. The Index moved below its 20 day moving average. Short term momentum indicators are trending down and are oversold, but have yet to show signs of bottoming. Technical score fell last week to -2 from 2.

The Dow Jones Transportation Average plunged 430.19 points (5.41%) last week. Intermediate trend changed to down from neutral on a move below 7640.88. Strength relative to the S&P 500 Index remains negative and is oversold, but has yet to show signs of bottoming. The Average remains below its 20 day moving average. Technical score dropped to -6 from -4

The Australia All Ordinaries Composite Index dropped 122.90 points (2.36%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remains neutral. The Index remains below its 20 day moving average. Short term momentum indicators are trending down and are oversold, but have yet to show signs of bottoming. Technical score remained the same at 0.

The Nikkei Average dropped 274.00 points (1.40%) last week. Intermediate trend remains neutral. Strength relative to the S&P 500 Index remains neutral. The Average remains below its 20 day moving average. Short term momentum indicators are trending down and are oversold, but have yet to show signs of bottoming. Technical score last week remained at -2.

iShares Europe 350 plunged $1.84 (4.42%) last week. Intermediate trend changed to down from neutral on a move below $40.43. Strength relative to the S&P 500 Index remains neutral. Units fell below their 20 day moving average. Short term momentum indicators are trending down and are oversold, but have yet to show signs of bottoming. Technical score dropped last week to -4 from 0

The Shanghai Composite Index fell 90.41 points (2.56%) last week. Intermediate trend remains up. Strength relative to the S&P 500 Index remains neutral. The Index remains below its 20 day moving average. Short term momentum indicators are trending down. Technical score remained last week at 0.

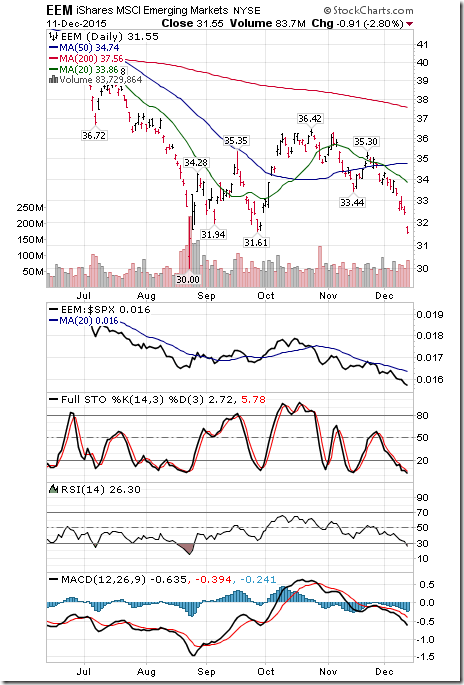

Emerging Markets iShare plunged $2.33 (6.88%) last week. Intermediate trend changed to down from up on a move below $33.44. Strength relative to the S&P 500 Index remains negative. Units remain below their 20 day moving average. Short term momentum indicators are trending down are oversold, but have yet to show signs of bottoming. Technical score dropped last week to -6 from -2.

Currencies

The U.S. Dollar Index dropped 0.78 (0.79%) last week. Intermediate trend remains up. The Index remains below its 20 day moving average. Short term momentum indicators are trending down. An intermediate peak likely was reached at 100.60.

The Euro gained 1.11 (1.02%) last week. Intermediate trend remains down. The Euro remains above its 20 day moving average. Short term momentum indicators are trending up.

The Canadian Dollar fell another US 1.97 cents (2.63%) last week. Intermediate trend changed to down on a move below 74.31. The Canuck Buck remains below its 20 day moving average. Short term momentum indicators are trending down.

The Japanese Yen added 1.51 (1.86%) last week. Intermediate trend remains down. The Yen moved above its 20 day moving average. Short term momentum indicators are trending up.

Commodities

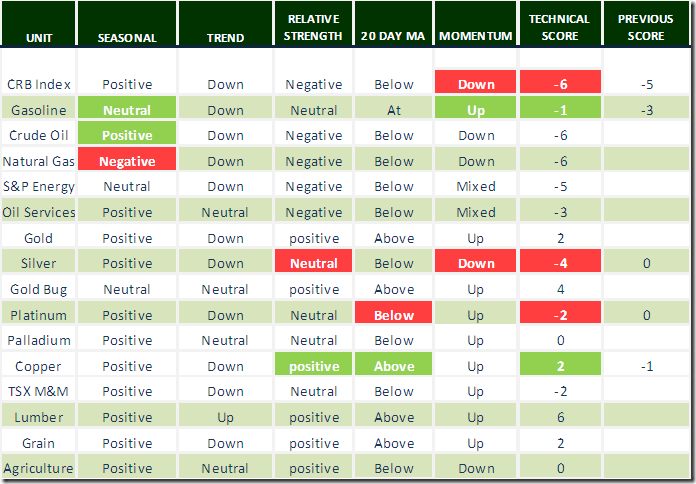

Daily Seasonal/Technical Commodities Trends for December 11th 2015

Green: Increase from previous day

Red: Decrease from previous day

The CRB Index plunged 8.38 points (4.57%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. The Index remains below its 20 day moving average. Short term momentum indicators are trending down. Technical score slipped to -6 from -5.

Gasoline added $0.01 per gallon (0.79%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains neutral. Gas recovered to its 20 day moving average. Short term momentum indicators are trending up. Technical score improved to -1 from -3.

Crude Oil plunged $4.35 per barrel (10.88%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. Crude remains below its 20 day moving average. Short term momentum indicators are trending down. Technical score remained at -6.

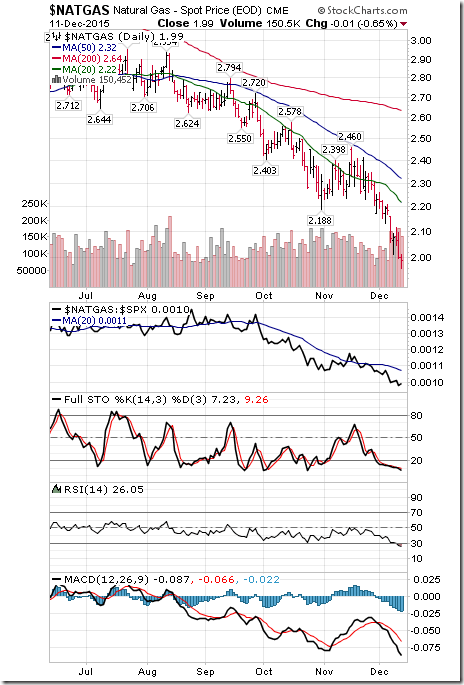

Natural Gas dropped another $0.20 per MBtu (9.13%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. “Natty” remains below its 20 day moving average. Short term momentum indicators are trending down. Technical score remains at -6.

The S&P Energy Index dropped 30.80 points (6.50%) last week. Intermediate trend remained down. Strength relative to the S&P 500 Index remains negative. The Index remains below its 20 day moving average. Short term momentum indicators are mixed. Technical score improved to -5 from -6.

The Philadelphia Oil Services Index dropped 10.08 points (5.94%) last week. Intermediate trend remained neutral. Strength relative to the S&P 500 Index remains negative. The Index remains below its 20 day moving average. Short term momentum indicators are mixed. Technical score improved to -3 from -4.

Gold slipped $8.40 per ounce (0.77%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index r changed to positive from neutral. Gold moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved to 2 from 0.

Silver dropped $0.65 per ounce (4.47%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index changed to neutral from positive. Silver moved below its 20 day moving average. Short term momentum indicators are trending down. Technical score dropped last week to -4 from 2. Strength relative to gold turned negative.

The AMEX Gold Bug Index dropped 4.95 points (4.08%) last week. Intermediate trend remains neutral. Strength relative to the S&P 500 Index remains positive. The Index remains above its 20 day moving average. Short term momentum indicators are trending up. Technical score remained at 4. Strength relative to Gold remained positive.

Platinum dropped $36.90 per ounce (4.19%) last week. Trend remains down. Strength relative to S&P 500 remained neutral. PLAT fell below its 20 day moving average.

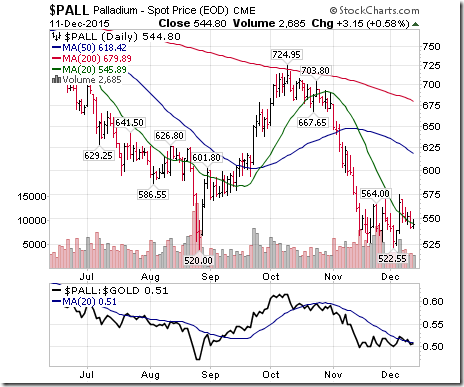

Palladium fell $22.05 (3.89%) last week. Trend remains neutral. Strength relative to the S&P 500 Index and Gold remained neutral. PALL moved below its 20 day moving average. Short term momentum indicators are trending up. Technical score dipped last week to 0 from 2

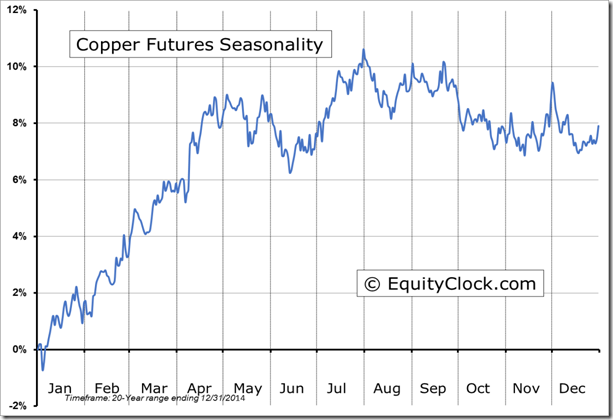

Copper gained $0.04 per lb. (1.92%) and has started to show signs of bottoming. Intermediate trend remains down. Strength relative to the S&P 500 Index turned positive on Friday. Copper moved above its 20 day moving average on Friday. Short term momentum indicators are trending up. Technical score improved last week to 2 from 0.

The TSX Metals and Mining Index dropped 25.32 points (7.22%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index improved to neutral from negative. The Index remains below its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to -2 from -4.

Lumber gained $8.70 (3.45%) last week. Intermediate trend changed to up on a move above $265.00. Relative strength turned positive. Momentum indicators are trending up.

The Grain ETN dropped $0.56 (1.75%) last week. Trend remains down. Relative strength remained positive. Units remained above their 20 day moving average. Short term momentum indicators are trending up. Technical score remained last week at 2

The Agriculture ETF dropped $1.20 (2.47%) last week. Intermediate trend remains neutral. Strength relative to the S&P 500 Index turned positive. Units remain below their 20 day moving average. Short term momentum indicators are trending down. Technical score slipped to 0 from 1

Interest Rates

Yield on 10 year Treasuries fell 13.6 basis points (2.47%) last week. Intermediate trend remains up. Units fell below their 20 day moving average. Short term momentum indicators are trending down.

Conversely, price of the long term Treasury ETF gained $3.18 (2.64%) last week. Units remain above their 20 day moving average.

Other Issues

The VIX Index vaulted 9.47 (63.94%) last week. Intermediate trend changed to up on a move above 20.67%. The Index moved above its 20, 50 and 200 day moving averages.

Technical action by S&P 500 stocks last week was definitely bearish. 100 S&P 500 stocks broke support and 10 broke resistance. Energy and Financial stocks dominated the list of breakdowns. Look for additional breakdowns early this week followed by a reversal by the end of the week.

Economic data this week is expected to confirm slow, but steady economic growth in the U.S. Data will be sufficient to prompt the Fed to increase the Fed Fund rate for the first time in a decade. As indicated in the GlobeInvestor article, the increase in the Fed Fund rate will set the stage for a significant recovery in North American equity markets over the next three months.

A recovery in North American equity markets during the next three months corresponds to another phenomenon, the positive El Nino effect on weather, industrial production and equity prices until at least the end of February.

The Santa Claus rally is scheduled to start on December 16th. Equity markets are deeply short term and intermediate oversold. A recovery bounce after tax loss selling pressures are relieved is lining up nicely this year.

Earnings news is quiet this week. The focus is on Oracle on Lennar.

Consensus from FactSet shows that fourth quarter earnings per share by S&P 500 companies on a year-over-year basis will fall 4.4%, up from 4.3% last week. Fourth quarter revenues are expected to decline 2.9%. 83 S&P 500 companies have issued negative earnings guidance for the fourth quarter while 26 companies have issued positive guidance. Prospects beyond the fourth quarter turn positive when the negative impact of a strong U.S. Dollar Index will have less influence. Year-over-year earnings per share are expected to increase 1.7% in the first quarter and 7.9% for 2016. Year-over-year revenues are expected to increase 2.9% in the first quarter and 4.4% for 2016. Question: When will investors begin to anticipate gains by earnings and revenues following their current downtrend? Probably when difficult fourth quarter reports are released in late January accompanied by positive guidance! Stay tuned!

Sectors

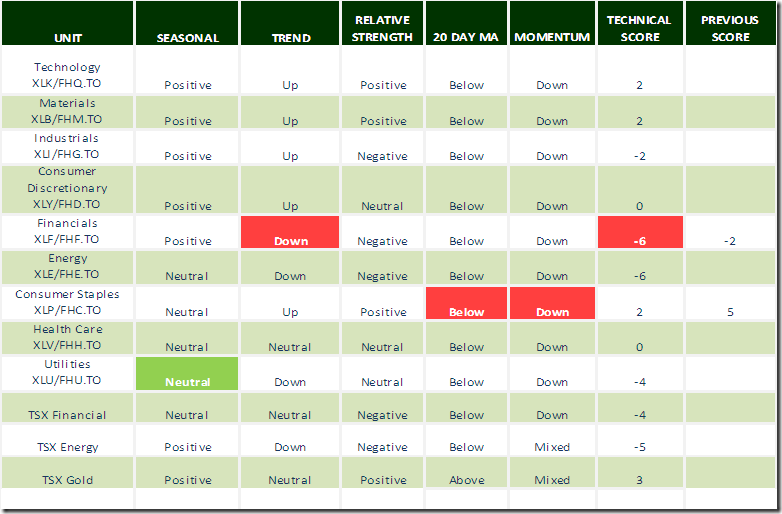

Daily Seasonal/Technical Sector Trends for December 11th 2015

Green: Increase from previous day

Red: Decrease from previous day

StockTwits Released on Friday @equityclock

Want to be a winner in the upcoming Santa Claus rally? Buy the losers.

Technical action by S&P 500 stocks to 10:00 AM: Bearish. 20 S&P 500 stocks broke support (including 6 financial and 5 material stocks).

Editor’s Note: Another 9 S&P 500 stocks broke support after 10:00 AM: VIAB, MO, VLO, MHFI, DVA, ROP, ORCL,WU, SCHW

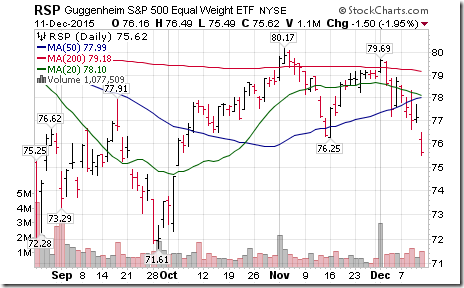

Equally weighted S&P 500 ETF $RSP broke support at $76.25 to establish an intermediate downtrend.

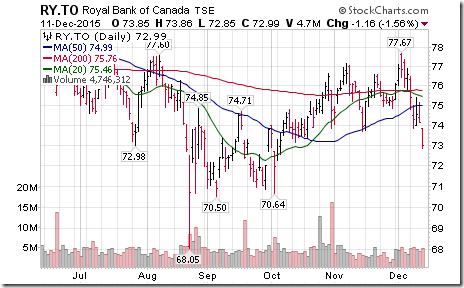

Royal Bank broke support at $73.68. Next support is at $70.64.

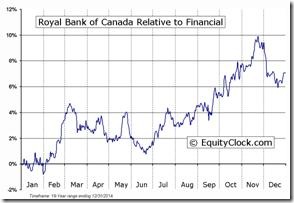

‘Tis the season for weakness in Royal Bank relative to other Cdn. financial stocks.

The S&P500 Index broke support at 2,019.39.

Russell 2000 Index broke support at 1140.76

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.