SIA Weekly: The Case of Magna's Tremendous Rise

For this week's Equity Leaders Weekly, we will examine how our Relative Strength process handled the tremendous rise of Magna Intl Inc. over the past 6 years.

Magna Intl Inc. (MG.TO)

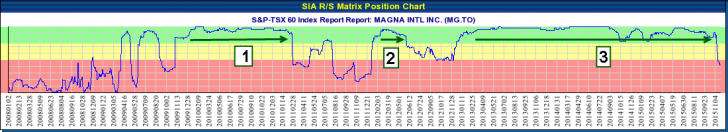

Magna has had a tremendous run since 2009 and has shown periods of significant relative strength vs its peer group within the SIA TSX60 Report. In fact, there were 3 periods over this timeframe where Magna Intl ranked within the Top 5 stocks in this report. The first period lasted 13 months before hitting our sell signals. The second period lasted 5 months before hitting our sell signals. And the third period lasted over 2.5 years before hitting our sell signals. If you utilized a strategy whereby you purchased Magna as soon as it moved within the Top 5 position and held until it hit our sell signals, the returns were as follows:

Period 1: +64%

Period 2: -8%

Period 3: +121%

So many investors think the key to successful investing is to get in at the bottom and to sell the top. How many investors have experienced devastating losses as a result of this type of thinking? Trying to time the bottom and time the top is one of the main reasons investors fail to reach their goals and objectives. For some reason investors believe the lower risk trade is to buy after a stock has started to decline? What they fail to understand is that selling pressure is exceeding buying pressure and to go against this downtrend before it is over is a dangerous game of "chicken" you are playing with the market. Aligning your purchases with the strength in the market is the lower risk trade because you are putting yourself on the same side as the market. Buying strength and selling weakness aligns your buy and sell decisions with the market and increases your probability of success!

Click on Image to Enlarge

Magna Intl Inc. (MG.TO)

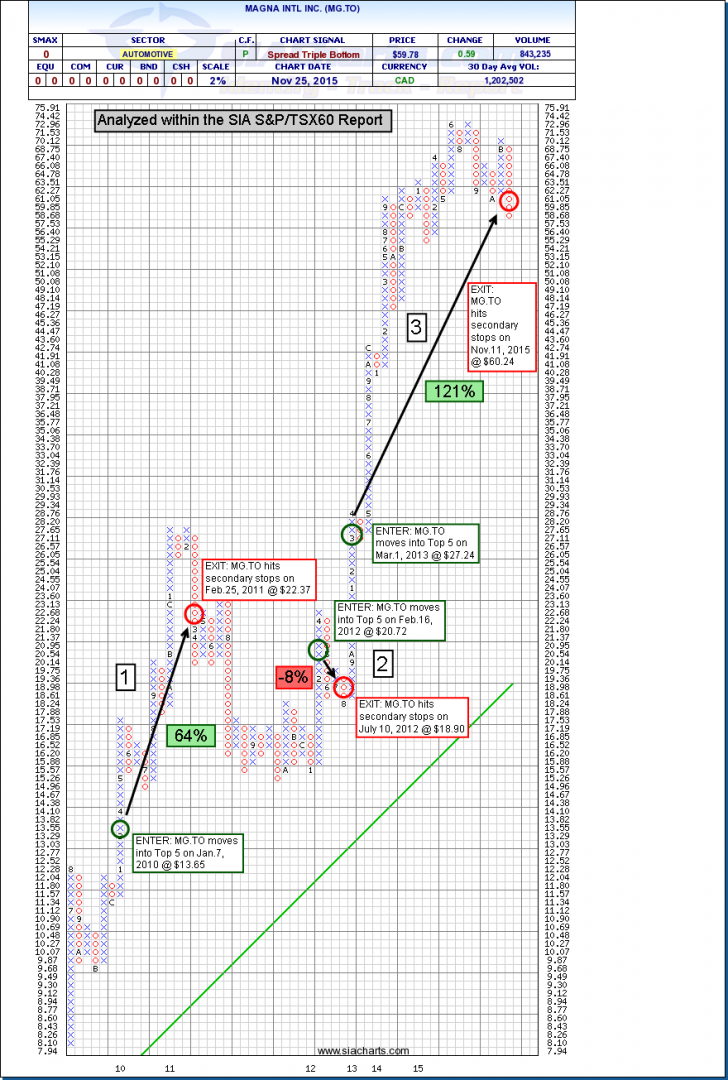

The PnF Chart of Magna illustrates the relative strength entry and exit points using the SIA S&P/TSX60 Report. This chart has been adjusted for dividends and the recent 2 for 1 stock split.

1. Magna moved into the Top 5 position within the Favoured Zone on Jan.7, 2010 @ $13.65 and hit our secondary stops within the Neutral Zone on Feb.25, 2011 @ $22.37 for a return of +64%.

2. Then Magna moved into the Top 5 position within the Favoured Zone on Feb.16, 2012 @ $20.72 and hit our secondary stops within the Neutral Zone on July 10, 2012 @ $18.90 for a return of -8%.

3. Finally, Magna moved into the Top 5 position within the Favoured Zone on Mar.1, 2013 @ $27.24 and hit our secondary stops within the Neutral Zone on Nov.11, 2015 @ $60.24 for a return of +121%.

Not every trade is a winner, however, when the market moves against you the prudent risk management approach is to cut your losses short as we did in Period #2. Successful investing is not about achieving more winning trades than losing trades, but rather effectively managing the magnitude of your winning trades vs the magnitude of your losing trades!

For a more in-depth analysis on the relative strength of the equity markets, bonds, commodities, currencies, etc. or for more information on SIACharts.com, you can contact our customer support at 1-877-668-1332 or siateam@siacharts.com.

Click on Image to Enlarge

SIACharts.com specifically represents that it does not give investment advice or advocate the purchase or sale of any security or investment. None of the information contained in this website or document constitutes an offer to sell or the solicitation of an offer to buy any security or other investment or an offer to provide investment services of any kind. Neither SIACharts.com (FundCharts Inc.) nor its third party content providers shall be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon.