Rates fell, so why did Canadian preferreds lose 20%?

by Corey Hoffstein, Newfound Research

Summary

- Duration is a common metric for analyzing interest rate sensitivity.

- Painting incredibly broad strokes, higher duration asset classes tend to lose more value when rates rise than lower duration asset classes.

- Duration may be a moving target, especially in alternative income asset classes (e.g. REITs, MLPs, preferreds, et cetera)

For years, investors have found themselves between a rock and a hard place. The rock has been the zero interest rate policy environment, making income generation a difficult prospect. The hard place is the seemingly ever-impeding Fed rate hike.

Investors may have run out of time though, as the walls that were slowly closing in on them may be finally ready to crush them with the highly probable Fed rate hike in December.

Some investors may look towards asset classes with lower duration, foregoing income to manage risk. Other investors may look towards high income asset classes - like MLPs, REITs, preferreds, et cetera - in hopes that the variety of risk factors they are exposed to can diversify the interest rate risk.

As we’ve written about in the past, duration can be misleading and naïvely moving to “shorter” durations may not be enough to avoid losses in rising rate environments.

At Newfound, we’ve advocated for the actively risk-managed use of alternative income asset classes. We believe this approach may allow investors to continue to generate total return in the form of high income without necessarily exposing themselves to the full brunt of rate sensitivity.

Of course, as anyone invested in REITs in 2013 or MLPs over the last year will tell you, these asset classes are not without their risks.

Perhaps most confusingly, however, is that the duration of these asset classes is not necessarily as straight forward as traditional fixed income.

At a theoretical level, we would expect these asset classes to all have positive duration. After all, as rates rise, the income stream from these asset classes loses value in today’s dollars.

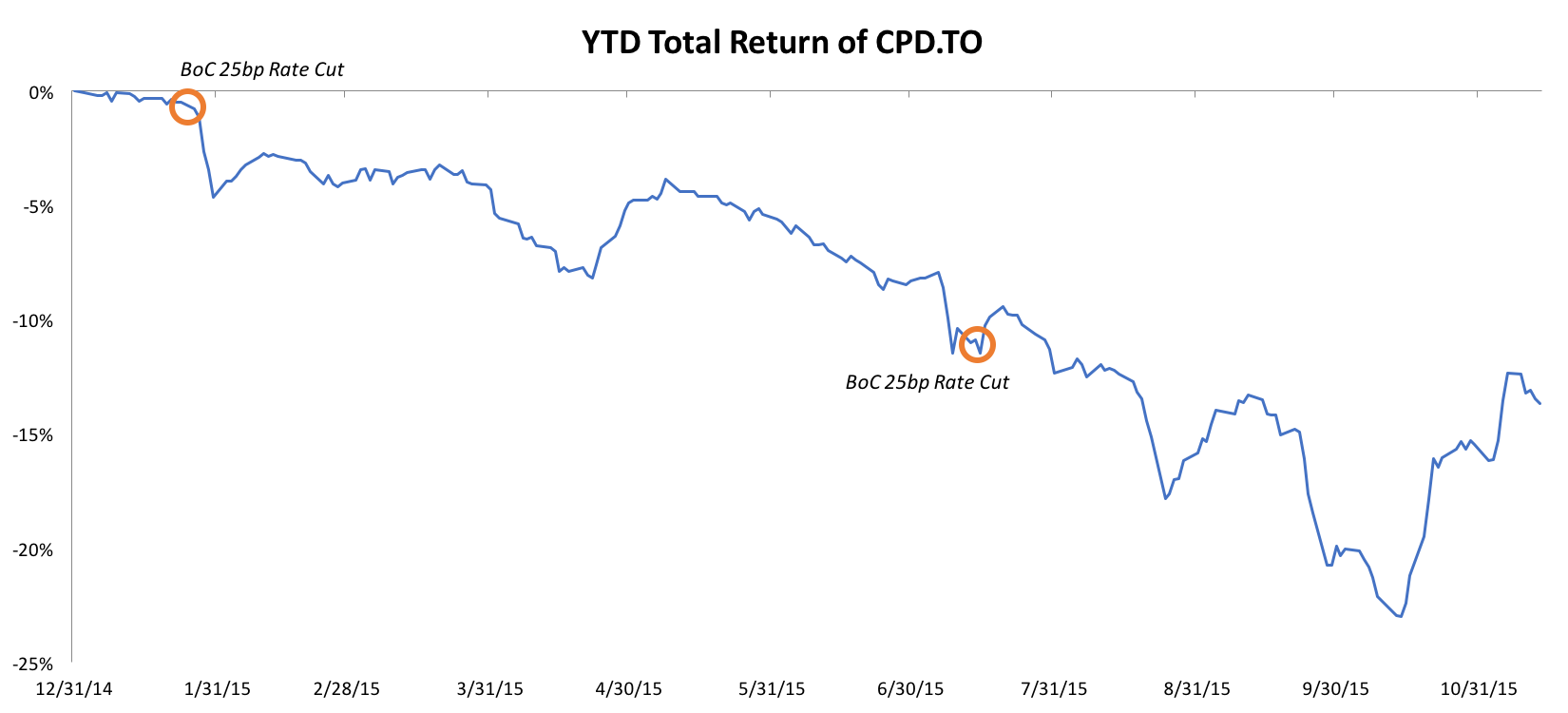

So why, then, did preferreds in Canada fall by as much as -22.75% in the last 12 months despite the fact that the Bank of Canada cut its benchmark overnight interest rates from 1.00% to 0.50% this year.

This isn’t a U.S. dollar thing either. We’re talking about a -22.75% loss from the perspective of Canadian investors holding the iShares S&P/TSX Canadian Preferred Share ETF (CPD.TO).

This absolutely flies in the face of our expectations. So what happened?

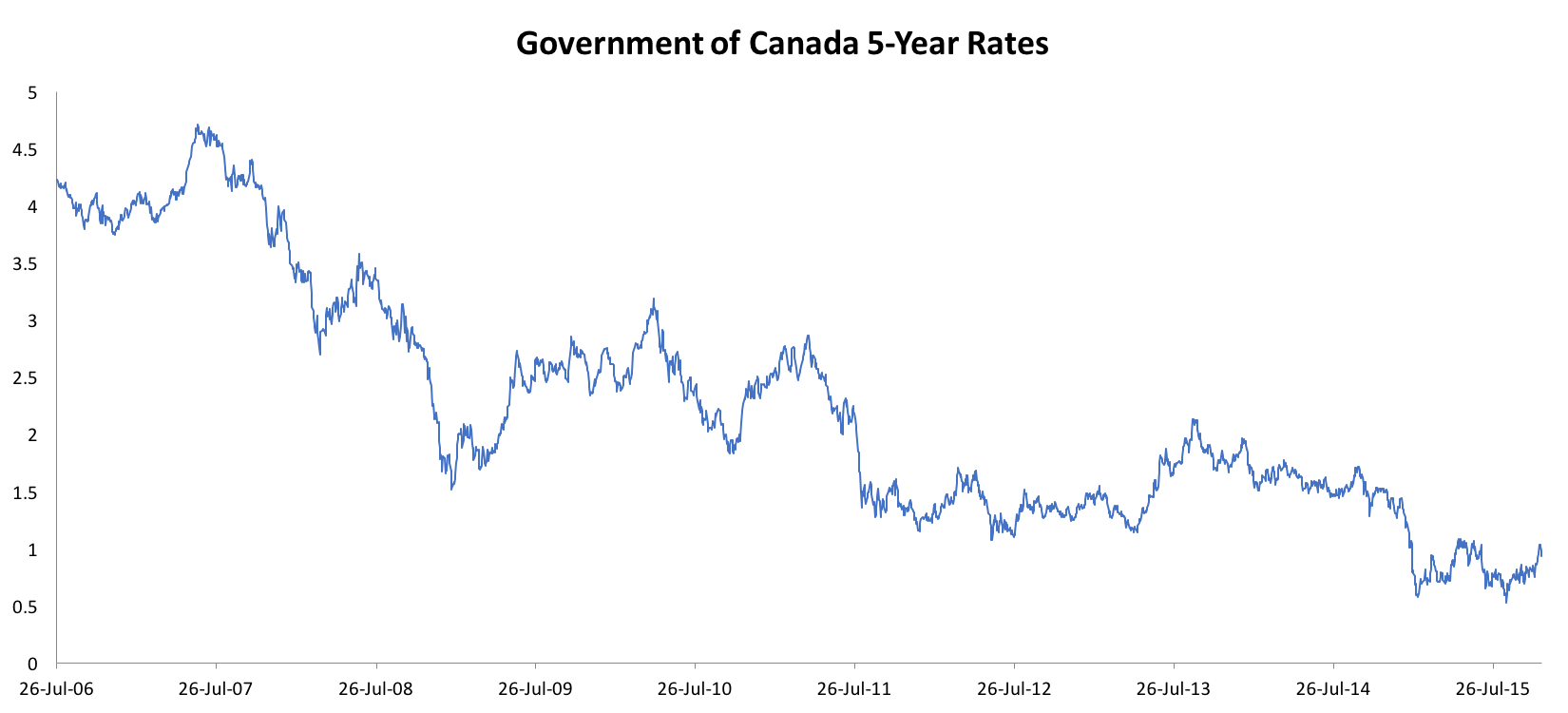

In 2008, a new type of preferred share started to appear. Traditional preferred shares include floating rate, perpetuals and retractables. The new type was called “rate reset.” At the time, prevailing opinion was that despite the fact rates were falling, they’d rebound sooner rather than later. So the new rate reset preferreds would, once every five years, reset their dividend to a spread above the prevailing five-year Government of Canada bond yield.

In a rising rate environment, that would be an attractive feature.

The market agreed. Since 2008, rate resets have ballooned to comprise approximately 60% of the preferred market in Canada.

The problem, of course, is that rates have stayed lower for longer. Not only have they stayed lower for longer, but when the Bank of Canada cut rates again this year, 5-year rates tumbled to near all time lows.

Just in time for a huge swath of preferreds to reset.

So the initial expectation, when these rate reset preferreds were issued, was that “five years later” would be, with fairly decent certainty, a “normal” rate environment.

Instead, “five years later” rolled around and 5-year government bond rates are sitting near all time lows.

So all these preferreds reset and their coupon has been decimated.

Thus we have a situation where declining rates actually hurt broad preferred portfolios. Due to the reset structure and the timing luck of when these resets happen, the broad preferred market ended up with a negative duration.

Sometimes reality is stranger than fiction.

The takeaway, here, is that how alternative income asset classes behave is not always straightforward. Our expectation was that preferreds should have risen in value when the Bank of Canada cut rates this year. Yet they lost significant value.

Without significant insight into the structure of the Canadian preferred market (and the weighted average reset date), few investors could have seen this coming.

Price action, however, may have provided a clue. As investors slowly digested the implications of these resets, and the risk of further Bank of Canada rate cuts, preferreds sold off for several months in a row.

A simple momentum-based model could have been used to flash a warning sign. For example, CPD.TO crossed its 200-day moving average on January 26, 2015. Investors who sold at the close of the next day (January 27th) would have avoided a 22% drawdown.

Momentum is not perfect. We believe, however, that it can be used as a powerful risk management tool – especially for more complicated, alternative income asset classes where rate sensitivity is not necessarily straight forward.

Copyright © Newfound Research