QE is no guarantee of a rising stock market

by Tiho Brkan, The Short Side of Long

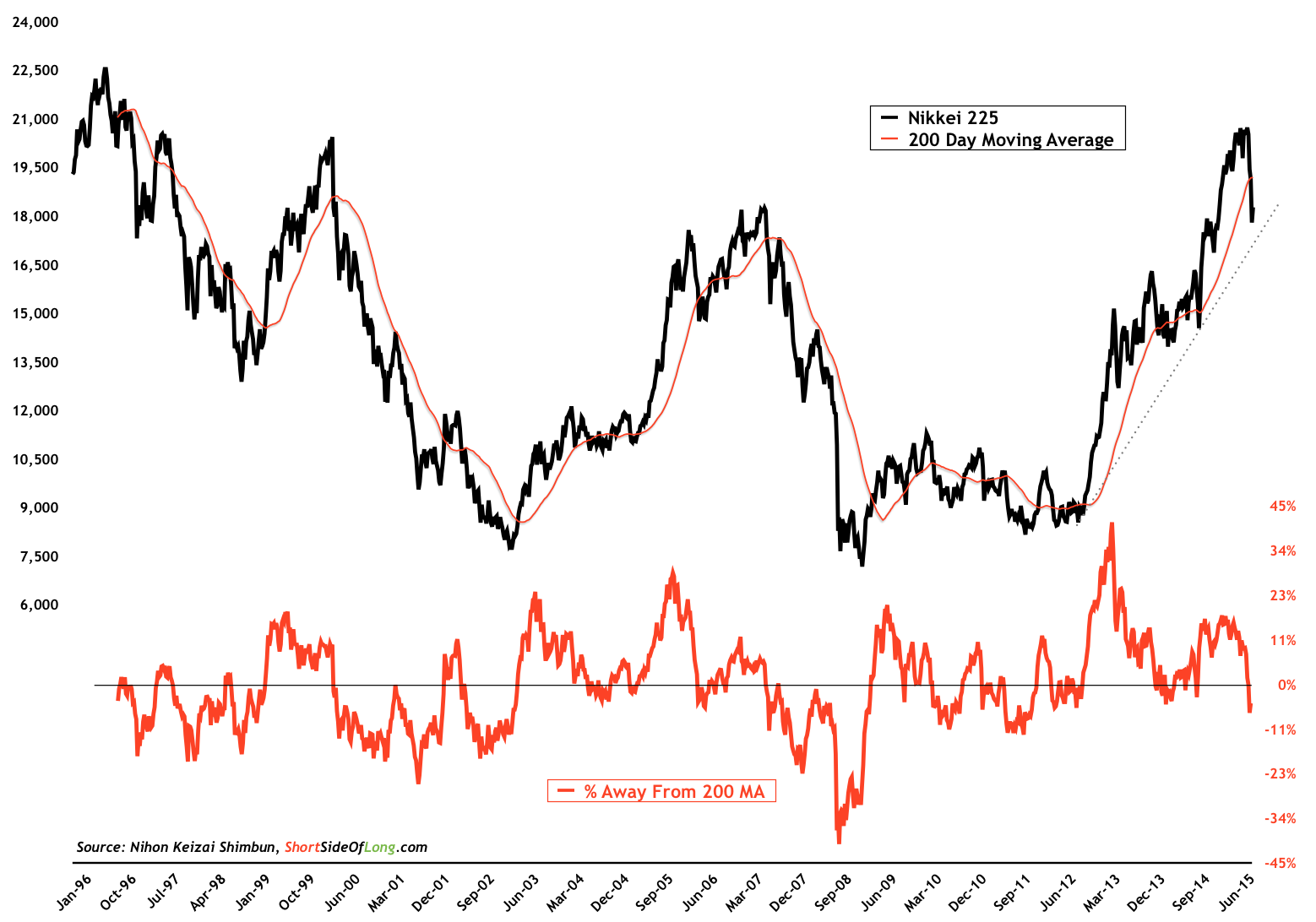

Japanese equities have suffered a 17% crash despite BoJ QE program

Source: Short Side of Long

Despite the fact that both European Central Bank and Bank of Japan have been actively pursuing quantitative easing (QE) programs, both the German and Japanese equities have experienced dramatic declines in recent weeks. Investors are left scratching their heads. Japanese Nikkei 225 has declined over 17% (close to bear market territory) since it peaked at 21,000 despite the fact that BoJ has been printing money like crazy.

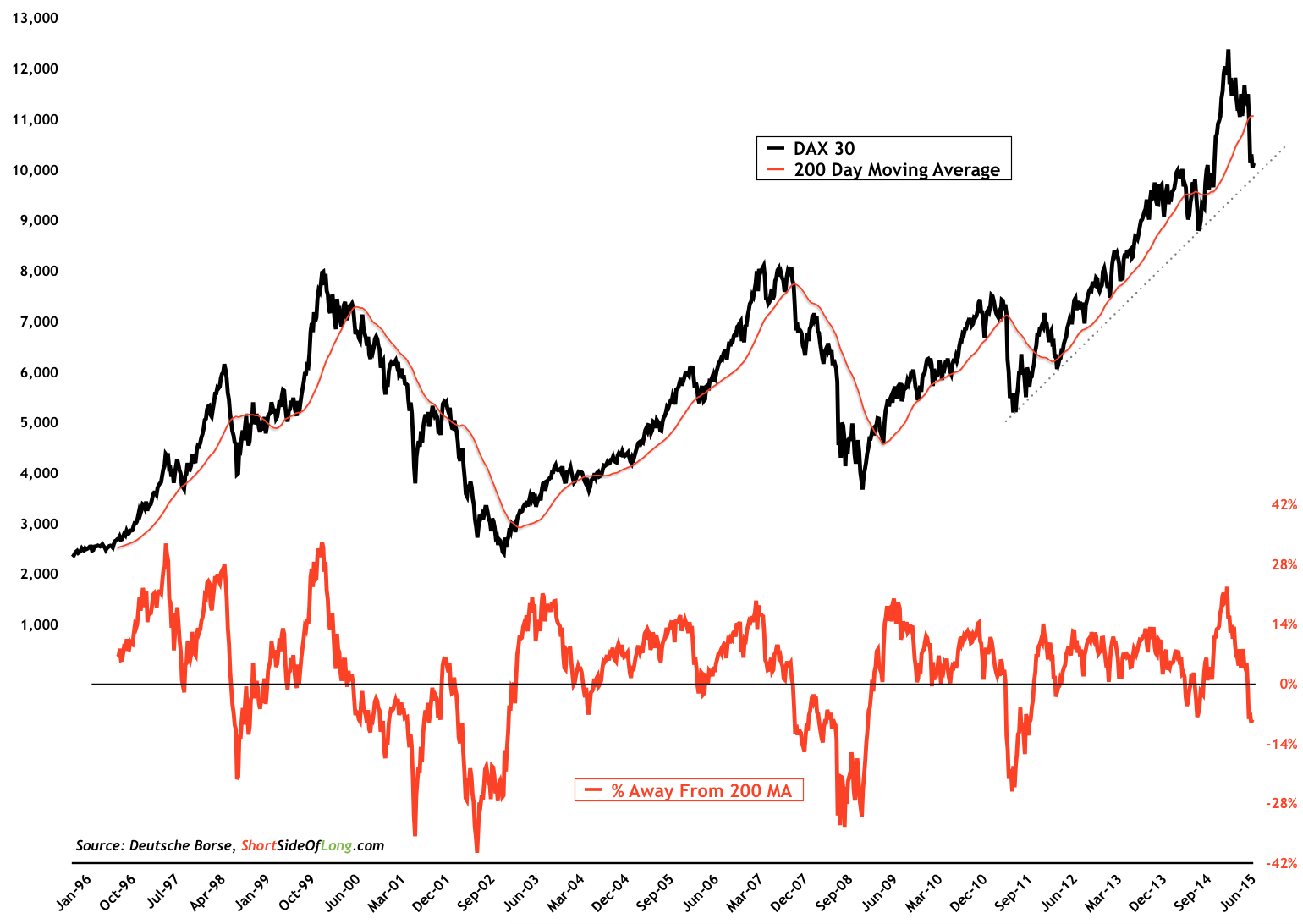

Furthermore, DAX 30 peaked out all the way back in April of 2015, despite ECB’s ongoing QE program. The German stock market has declined almost 25% from peak to trough and given back almost all of the QE gains. This is despite the fact that Mario Draghi is thinking of actually increasing the program.

Evidence seems to be that global QE programs might work temporarily, especially the initial euphoria surrounding the launch of easy monetary conditions. Rising US Dollar tends to be a symptom of tighter monetary conditions globally, that is why Feds desire to rise interest rates overwrites ECB’s and BoJ’s QE programs. In plain English, Federal Reserves policies are a lot more important relative to other central banks.

DAX has been in a downtrend since April & down over 20% despite ECB’s QE

Source: Short Side of Long

Copyright © Tiho Brkan, The Short Side of Long