Robots Do Not Take Vacations and Six Other Facts of Markets

by Mike Harris, Price Action Lab

The robot is the modern slave: no vacation, no coffee break. It is also a good tool to execute a correction during times humans are on vacation. This and other facts are included below.

Fact 1: The last 5-day correction close to -10% occurred in August of 2011. Robots had a party then.

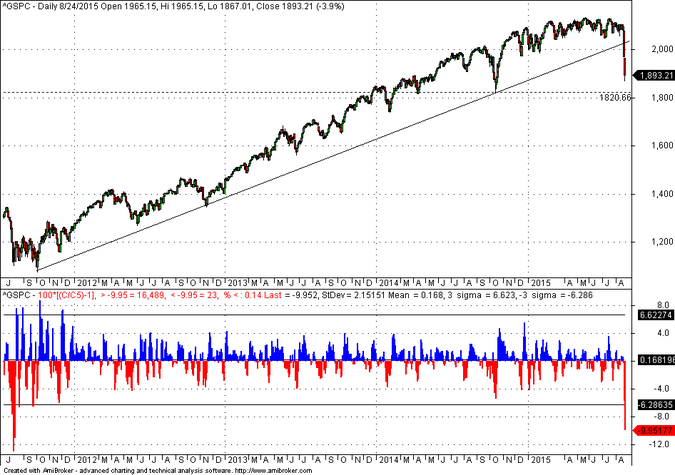

Fact 2: Since 1960, there have been only 23 5-day corrections of more than -9.95% in S&P 500.

These large changes occur rarely.

Fact 3: Robots do not take vacations

If you are a fund manager and you like vacations, then you may want to reconsider. Robots do not take vacations and consider the need to have one as a serious human weakness. Market correction algos may be executed by robots during vacation times because this is when they can create havoc and profit.

Fact 4: In the long-term a 10% corerction is not easily detectable on the charts

It already isn’t if you look at 4-year (about 1,000 daily bars) rolling returns in SPY, as shown below:

The rectangle encloses the rolling 1000-day return of SPY since 2013. The change due to the last 5 days is not even noticeable on the chart.

Fact 5: Uptrends are slow, corrections are fast.

This is primarily due to slow accumulation along uptrends but desire of fast distribution when a correction takes place to secure profits.

Fact 6: Events are excuses for corrections

The market did not sweat when there was high probability of full scale war in Ukraine, Middle East was on fire, the euro was on the verge of collapsing but now cares about speculators in China and whether growth there will fall from 10% to 7%. This is an excuse for a correction combined with Facts 1 and 3.

Fact 7: Corrections are needed for markets to make new highs

Sounds like oxymoron but this is how it is and actually it is a principle of capitalism: you need bubble bursts to get more bubbles. However, this works. Capitalism works because it enforces natural selection: only the fittest survive and progress is made in the future by the stronger ones. Those that blame capitalism for creating bubbles are naive and they never present a sound alternative.

You can subscribe here to notifications of new posts by email.

Charting program: Amibroker

Detailed technical and quantitative analysis of Dow-30 stocks and popular ETFs can be found in our Weekly Premium Report.

© 2015 Michael Harris. All Rights Reserved. We grant a revocable permission to create a hyperlink to this blog subject to certain terms and conditions. Any unauthorized copy, reproduction, distribution, publication, display, modification, or transmission of any part of this blog is strictly prohibited without prior written permission.

Copyright © Michael Harris, Price Action Lab