by Jeffrey Saut, Chief Investment Strategist, Raymond James

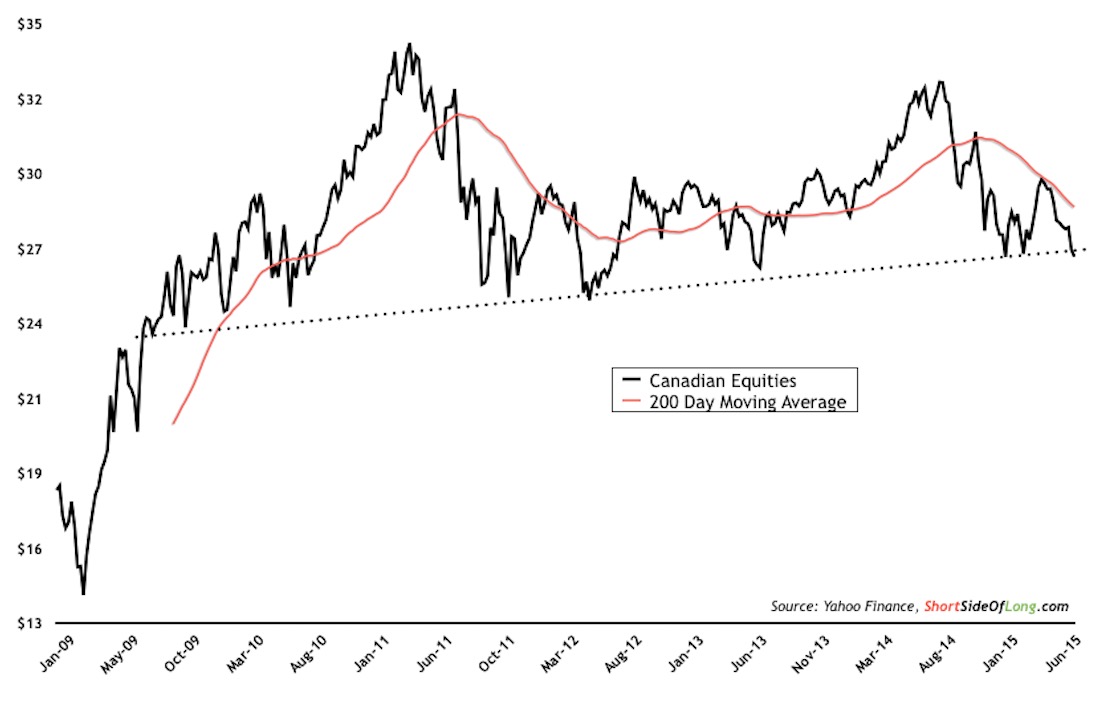

July 6, 2015 – I was in Canada when the summer solstice arrived. I think most of you know that I celebrate the winter solstice every year. Indeed, as I wrote last December 23rd:

Winter officially began last Sunday, with the arrival of the winter solstice. Recall that solstice means "standing-still sun;" and on December 21st at 6:03 p.m. (EST) the sun "stood still" over the southern Pacific Ocean (Tropic of Capricorn). At that time the sun's rays were directly overhead, giving the impression the sun was truly standing still. No one is quite certain how long ago humans began heralding the solstice as a turning point, but a turning point it is: The sun will set a minute or two later each day from here until the summer solstice (June 21st). As always, I paid tribute to this year's "turning point" by facing the sky and screaming at the top of my lungs, which once again caused my neighbors some duress. It is a ritual I began decades ago that was copied from the ancients in a time long, long ago, and a place far, far away.

This year’s summer solstice came on June 21st at 12:38 p.m. (EDT). On that day the Earth’s North Pole was at its maximum tilt to the sun along the Tropic of Cancer (23.5ᴼ north latitude), hereto making the sun appear to be standing still. This too is a turning point for it is typically the longest day of the year. From there the days get shorter until the winter solstice, which is typically the shortest day of the year; or as the French like to say, “The longest night of the year!” Interestingly this year, because of the “leap second,” June 30th was the longest day of the year. While I don’t celebrate the summer solstice, I do use it as a chance to reflect on the first half of the year.

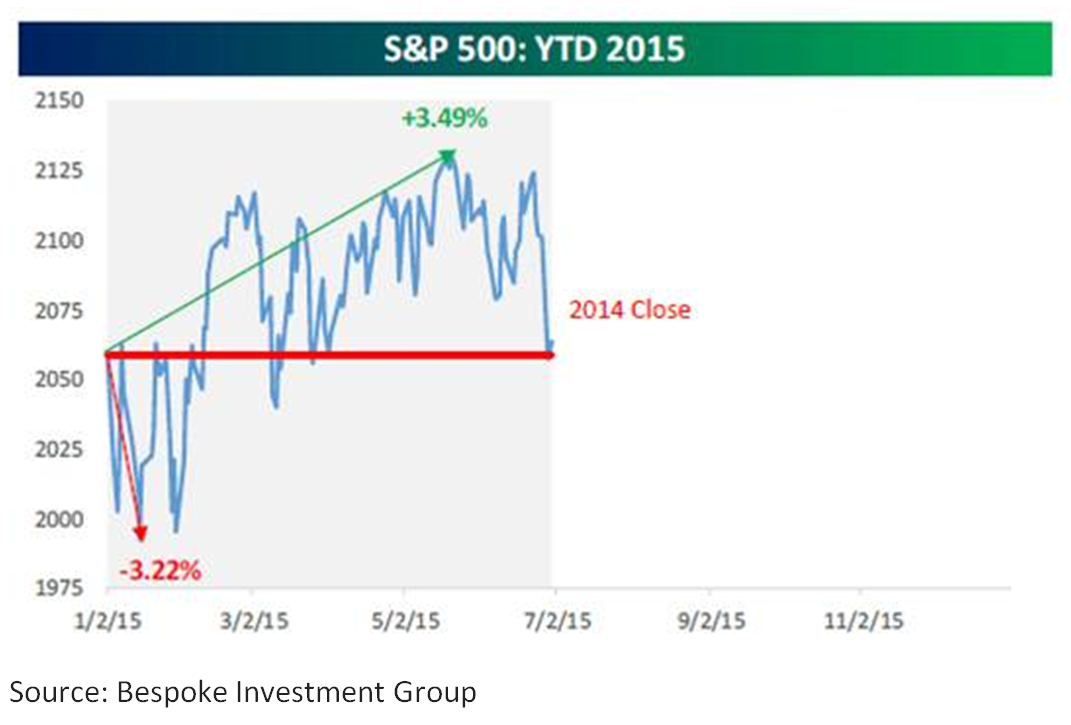

Reflecting on the first half of 2015, while littered with geopolitical events, shows very little upside progress for the S&P 500 (SPX/2076.78). In fact, my notes of more than 50 years show no other time when the SPX was never up or down more than 3.5% year-to-date (YTD). My friends at the eagle-eyed Bespoke Investment Group go me even one better as they write:

“Barring the type of volatility we have been seeing in China over the last few days, 2015 will go down as the first year in the S&P 500’s history where the index was never up or down more than 3.5% YTD on a closing basis during the first half (see chart 1 on page 3). Furthermore, as of this writing (6-30-15), the S&P 500 is up just 5 bps YTD. How’s that for uneventful?”

Bespoke goes on to note:

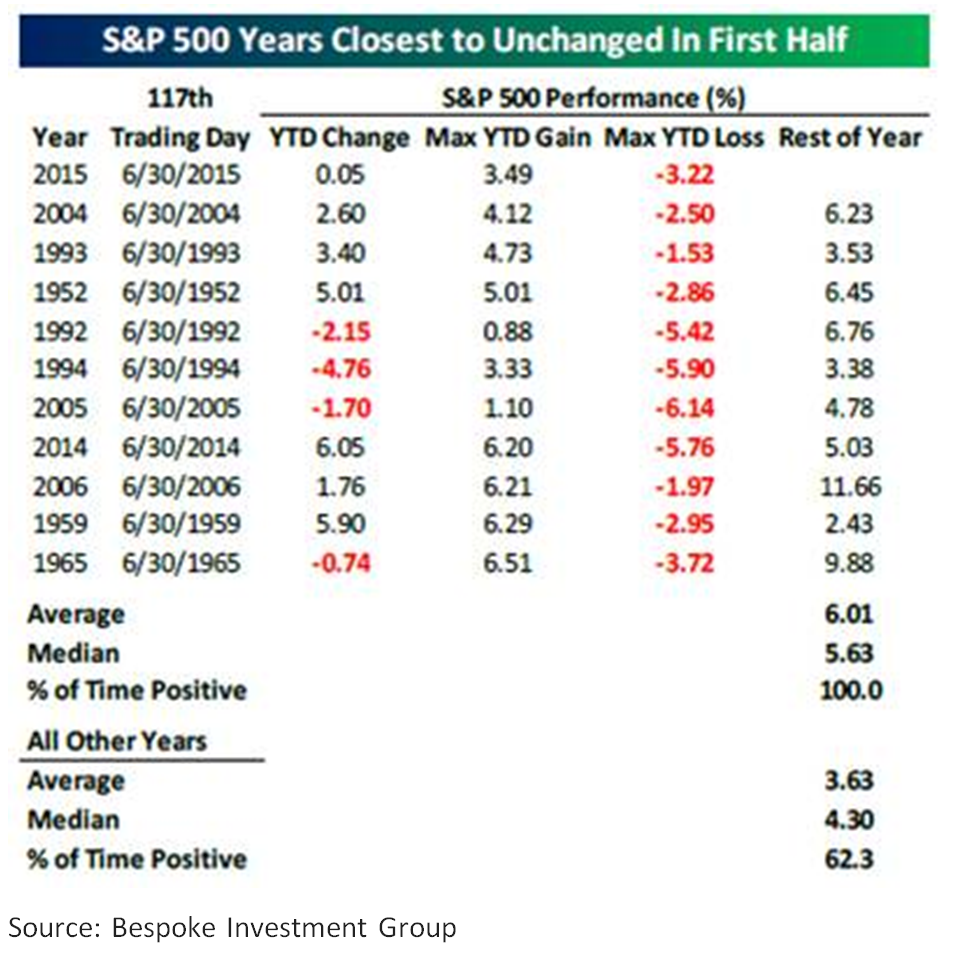

Besides 2015, the only two other years where the S&P 500 was never up or down more than even 5% during the first half of the year were in 2004 and 1993. For each of the years, we have included the S&P 500’s performance during the second half of the year. As shown (in chart 2), in the second half of each of the ten years shown, the S&P 500 traded higher for an average gain of 6.01% (median: +5.63%). The performance for those ten years compares to an average gain of 3.63% (median: +4.30%) with positive returns 62.3% of the time.

Currently, the SPX is up 0.9% YTD. If my friends at Bespoke are right on the historical odds, and the SPX rallies 6.01% in the second half of this year, that would imply 7% improvement for the SPX for this year (0.9% + 6.01% = 7%). Add to that the 2.0% dividend distribution and it yields a potential total return of 9%, which is pretty close to the 10% - 12% total return we anticipated for 2015. Notably, hikes in dividends are surging (1Q15 +15% y/y). We think that a 9%+ return is doable because the economy should get stronger in the back half of the year. Clearly the recent economic statistics support that view. For example, rents are trending higher, housing is picking up and is anticipated to really accelerate in 2016, folks are driving more, real consumer spending is heading higher, Baltic freight rates are up 35%+, well you get the idea. Last week, however, investors turned a deaf ear to such good news, preferring to focus on the trifecta of bad news, namely Greece, China, and Puerto Rico.

Accordingly, the week began with a Monday Melt, leaving the Dow Industrials (INDU/17730.11) off some 350 points and in the process traveling below its 200-day moving average (DMA @17687.25), but the SPX did not, presenting a potential downside non-confirmation. To that point, it’s worth mentioning that the Industrials recaptured their 200-DMA by week’s end. Yet, that was to be expected because Monday’s Dow Dive qualified as a “selling climax” (read: short-term reversal) accompanied by one of the most oversold conditions since the October 15, 2014 bottom where Andrew and I were bullish, and said so in a special strategy call. Tuesday was a day of indecision as participants contemplated Greece. On Wednesday the averages were in “rally mode” sparked by rumors of a Greek debt deal, but Thursday saw an intransigent Angela Merkel until after the Greek referendum, leaving most of the indices I follow flat for the week.

Speaking to the Greek situation, last week I stated that while leaving the EU probably would be the best thing for Greece over the longer term, it would likely be the worst thing for the EU. And for that statement, my email box lit up for an explanation, so here goes. While the history of the Argentine default (2001) suggests “runs” on the banks, the freezing of bank deposits, huge unemployment, riots in the streets, and eventual depression, what if it doesn’t play that way? What if Greece exits the EU, returns to its original currency (the drachma), devalues the drachma, and the Greek economy doesn’t collapse? Even worse for the EU, what if the Greek economy improves noticeably? While that sounds crazy, if it happened it is an outcome the EU cannot afford to occur because Portugal, Spain, and Italy would surely take notice, risking similar moves by those nations. Whatever the long-term result, the near-term course is going to be set by yesterday’s referendum; and, as pretty much everyone expected, it was a “no” vote. That would be “no” to the Eurozone’s bailout offer that would have rained even more austerity on Greece. Said vote has three potential outcomes: 1) the Argentine death spiral; 2) Greece’s creditors reject offering any more debt deals and Greece immediately becomes systemic; or 3) Greece become an idiosyncratic country for a while as another debt deal is worked out with the Eurozone. My sense is that the Eurozone will let Greece “stew” for a few weeks with closed banks, ATMs and capital controls and eventually resurrect talks that lead to another debt extension. Indeed, I think option three is the way it will play, for as mentioned the potential for collateral damage if a Grexit was successful is too serious for the EU to even risk.

The call for this week: When I shut down last night the preopening S&P 500 futures were off about 1.2%, world markets were under pressure, and the euro was being hit hard. If the markets open up that way it will put the SPX at the bottom of its 2040 – 2070 support zone. But this morning that loss has been halved, probably because Greece’s left-wing finance minister has quit and tomorrow there will be a gathering of European leaders. However, I doubt things get fixed that quickly. Nevertheless, recall it was two weeks ago when we said the expansion phase of the market was over and a contraction phase would last into the July 4th holiday. I think we are setting up for a good “buy point” as we go through this bottoming process; stay tuned . . .

P.S.: “No Gort! Klaatu Barada Nikto!!”

Copyright © Raymond James