by Ben Carlson, A Wealth of Common Sense

A few weeks ago I wrote about The Psychology of Sitting in Cash and a reader left a great comment about how he has tried to solve this problem in his own portfolio using the financial crisis as an example:

I limit myself to 10% adjustments monthly, most months I moved about 10% from equities to cash. I did get back in afterwards, at more like 5% a month, and I’ll admit it was hard to buy, but I was driven by the fear of missing the recovery.

I love the idea of placing constraints on yourself as an investor to defeat psychological pitfalls. This individual limited the amout of his portfolio that he could make changes to. I think this type of patient approach is a great way to manage impulse decisions. And the important thing is that this is what works for him. Others utilize different methods, both on themselves and even their employees. The following was described by Frank Portnoy in his book Wait: The Art and Science of Delay:

One hedge fund manager told me that he doesn’t give his junior employees access to real-time price information because they would be glued to their trading screens, like teenagers playing video games. Instead, he sounds like an old-style parent: he wants his employees to read and think. It isn’t easy to find investments that will generate high returns, and they typically don’t pop up in the news.

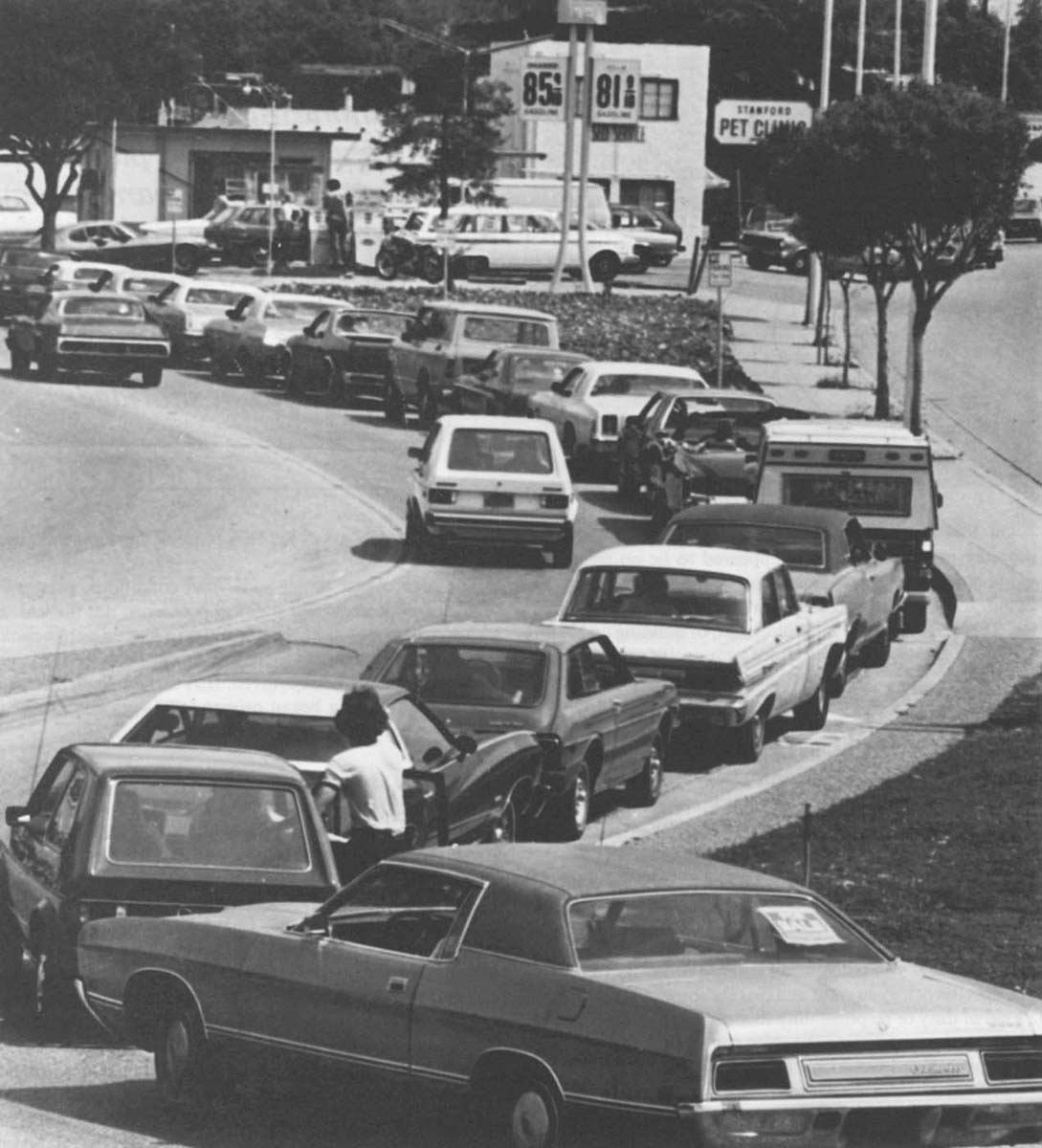

To paraphrase Fred Schwed, there are certain things that can’t be taught, but only learned through experience. Is real-time price information really that important for investors? I don’t recommend that we go back to a time when it was difficult to get real-time data, but I’d venture to guess it has hurt far more people than it’s helped.

When people ask me what I do for a living there are time when I’ll tell them I’m paid to think. Sometimes that thinking leads to taking action. Most of the time it leads to more thinking and no actions taken. It’s easy to confuse activity with results, even if that activity does no good most of the time. But that’s exactly what many investors do who don’t have the proper constraints built into their process.

I’m not suggesting that every investor has to implement these specific constraints to guide their actions. But all investors do have to figure out which constraints to place on themselves based on their past history and personality traits. Everyone has their blind spots. These are a few more examples I’ve seen from others over the years:

- Don’t invest in anything you don’t understand.

- Stay within your circle of competence.

- Never pay more than a certain fee level for investment products.

- Give yourself 5-10% of your portfolio to speculate to appease your gambling instincts.

- No more than a certain percentage invested in any one security or asset class.

- Only look at your portfolio value monthly, quarterly, annually, etc.

- Rebalance on a set calendar schedule or when your allocation weights hit a certain band outside of their target.

- Wait at least a week to implement a new investment decision.

- Talk to an unbiased outside observer about every big portfolio move you’re about to make.

- Actively seek out opposing viewpoints on your current investment stance.

- Keep a decision journal and review before making any new portfolio moves.

- Only allow a certain number of transactions per year.

Now is probably a good time to review your own constraints within your investment plan. Interest rates are low. Stock prices are high. This stage in the cycle can lead people to relax their risk controls and press the issue if they’re not careful.

I’m of the opinion that most investors would be better off making fewer decisions and getting rid of any unnecessary clutter from their portfolios and investment process. Placing constraints on yourself is a great way to do this. The first step is understanding yourself and your own flaws, something that’s not as easy as it sounds, since the easiest person to fool is often yourself.

Source:

Wait: The Art and Science of Delay

Further Reading:

Doing Nothing Is a Decision

Risk Management Always Matters

Louis CK on Risk Management

Copyright © A Wealth of Common Sense