by Ashish Shah and Ivan Rudolph-Shabinsky, AllianceBernstein

Sometime this year, the Federal Reserve will probably raise interest rates for the first time in more than half a decade. That makes bond investors nervous. But it shouldn’t. Those who keep their cool may find that higher rates can work to their advantage.

Bonds, of course, are highly sensitive to interest-rate movements—when rates rise, prices fall. But as bonds mature, their prices drift back toward par. That means investors who sit tight will soon be able to reinvest the coupon income that their portfolios pay in newer—and higher-yielding—bonds. This typically offsets any short-term losses and increases total return.

For investors who rely on their bond portfolios to provide income over a long time period, the sooner rates rise, the better. Put another way: if the duration of your fixed-income portfolio is shorter than the amount of time you plan to invest, you should welcome higher interest rates, not fear them. For more on how this works, have a look at the hypothetical scenario that we detailed in an earlier post.

What’s more, bonds may not lose as much ground as many fear when the Fed finally pulls the trigger. That’s because markets have been expecting the Fed to hike rates this year by about a quarter percentage point for quite some time—and corporate bond prices have adjusted to reflect this. A more aggressive move could rattle the market, but that seems unlikely. In March, Fed Chairwoman Janet Yellen stressed that the central bank intends to move slowly.

Higher Cash Flow, Bigger Benefits

So how can investors maximize growth in a rising-rate environment? By seeking out bonds that generate a high amount of income. The more cash flow your portfolio can deliver, the more you’ll benefit.

For those with high income requirements, this will probably require investing in high yield. In our view, a short-duration high-yield portfolio offers the best opportunity to take advantage of rising rates; the quicker the bonds mature, the faster investors can put the proceeds to work in higher-yielding securities.

Credit Quality Still Matters

Don’t get us wrong: investors shouldn’t myopically chase the highest-yielding bonds on offer. Remember, high-yield securities are more vulnerable to default than investment-grade bonds. And having grown accustomed to low borrowing costs, some high-yield companies may struggle to raise capital as those costs rise, putting their ability to pay their creditors at risk.

But in our view, investors can avoid these pitfalls by steering clear of bonds issued by companies with fragile balance sheets, such as many CCC-rated junk bonds. For companies with sound finances—including many BB- and B-rated high-yield issuers—rising rates are less of a concern. That’s because they tend to go hand-in-hand with a strengthening economy, which is good news for corporate earnings—and the credit quality of most corporate bonds.

Don’t Sell Your Bonds—It’ll Cost You

The biggest mistake investors can make, in our view, is to try to time an interest-rate rise or to sell their bonds just as yields start to move higher. Doing so will only lock in losses—losses that we suspect will be shallow and short-lived. And staying out of the market is an expensive proposition. Even after the Fed hikes rates, the yield on cash will be only slightly above 0%.

There’s another reason why hitting the sell button at the first sign of rising yields could be costly: everyone else might be doing the same thing. As we pointed out in several previous posts, regulatory changes have drained liquidity from global bond markets. With fewer willing buyers, a mass investor exodus could mean a sharp decline in prices and outsized losses for sellers.

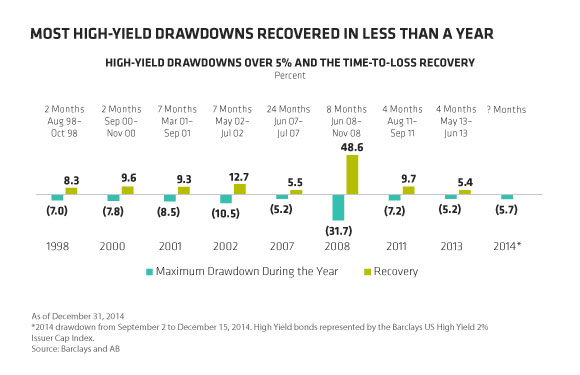

The good news is that these liquidity-driven sell-offs tend to be short-lived. As the following Display shows, US high yield has recovered most big drawdowns—losses of more than 5%—in less than a year. This goes even for periods that include 2008, the year the global financial crisis hit markets hardest. So the investors who keep their cool and stay put are likely to come out ahead.

Bonds are a critical source of income and a useful diversifier of riskier equities. Rising interest rates may cause some short-term volatility, but investors with a multi-year investment horizon are likely to benefit over time as rates rise. The key is patience. It can be a tough lesson—but for bond investors, it’s one worth learning.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Ashish Shah is Director of Global Credit and Ivan Rudolph-Shabinsky is Portfolio Manager—Credit, both at AB (NYSE:AB).

Copyright © AllianceBernstein