by James McGregor, AllianceBernstein

Investors who wanted safety and certainty last year mostly shunned smaller-cap US stocks. As a result, many high-quality names are now on sale. With US growth likely to accelerate in 2015, we think these domestically oriented smaller-cap companies may turn out to be a real bargain.

In a recent post, we established that last year was a tough one for smaller-cap stocks. Global growth concerns caused many investors to seek safety in US Treasuries and less volatile large-cap stocks, which outperformed their smaller peers in 2014.

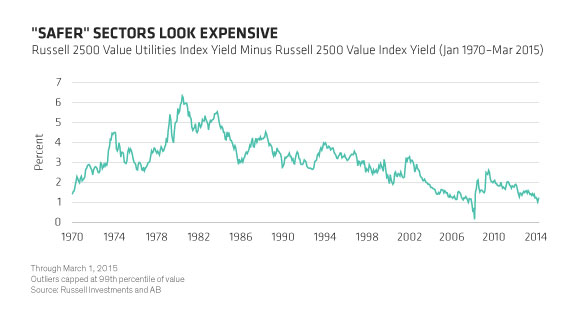

Those who maintained small-cap exposure gravitated to “safer” sectors such as utilities and real estate investment trusts—sectors where companies were likely to deliver more stable earnings and relatively high yields. At a time of high anxiety, that made sense. But it also left stocks from these sectors looking a bit rich. In fact, the spread between the Russell 2500 Value Utilities Index and the Russell 2500 Value Index itself has rarely been tighter (Display 1).

Cheaper and Better

Here’s the good news: plenty of smaller-cap stocks from sectors that investors avoided last year now look more attractive.

Even better, many of the most attractively valued stocks also score high on a number of quality metrics. That makes it possible for an investment manager to construct a portfolio of small- and mid-cap stocks that boast a return on equity superior to that of the Russell 2500 Value but also trade at a discount on a price-to-cash-flow basis.

In other words, quality is on sale.

US Growth Should Be a Tailwind

Of course, it’s true that many of the most attractively valued smaller-cap stocks are cyclical ones whose fortunes tend to rise and fall with the economy. That makes them more volatile and may explain why anxious investors haven’t rushed to embrace them.

Right now, however, the backdrop favors smaller companies. Why? Because the US economy again looks poised to grow at a faster clip than many other developed economies. Likewise, smaller, domestic-oriented firms have opportunities to grow more quickly than their bigger, multinational peers because a larger percentage of their sales are US based.

Why Valuation Matters

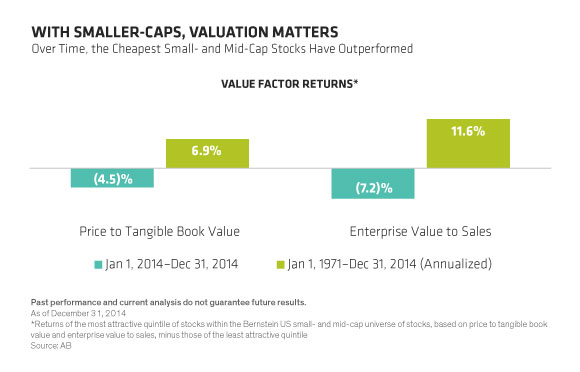

Over the long run, a steady allocation to small- and mid-cap stocks has been a winning strategy. And active managers with the ability to dig more deeply into relative valuations and within the asset class and take a long-term view can add even more value. As Display 2 illustrates, stocks with attractive value characteristics have shown strong historical performance.

In our view, all this provides investors who may have reduced their small-cap exposure last year with the opportunity to reload by adding stocks that are cheaper and better. For bargain hunters, what’s not to love about that?

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

James MacGregor is Chief Investment Officer of US Small- and Mid-Cap Value Equities at AB (NYSE:AB).

Copyright © AllianceBernstein