by Brian Portnoy, Investor's Paradox

In my opinion, one of the least interesting popular philosophical questions is whether the tree that falls in the forest when no one is around to hear it actually makes a sound. Notwithstanding what looks to be an intense metaphysical and scientific debate on the matter, I just don’t get roused by the inquiry.

To me, the answer is easy: Yes. A tree that falls out of earshot makes noise, even if I’m not around to hear it. I get that my eardrums don’t vibrate one bit if I’m not in that particular forest at that particular moment, but if I were, I’d hear and feel the crash. The potential is always there. Essence and experience can each stand alone without defining the other.

The reason this arboreal conundrum popped into my head was motivated by thinking about this current bull market for U.S. equities. It’s well-established that we’re now witnessing (stay tuned for why I carefully chose the verb witness) one of the longest and strongest bull markets in market history.

The data are unambiguous. Since the S&P 500 bottomed in March 2009 at 666, it has more than tripled from there. It is third strongest bull market in past century. At more than 6 years in duration, it is the fourth longest bull market in modern history. By contrast, the average bull market’s duration is 3.8 years.

But there’s a second dimension to this run which is just as consequential for investors’ market experience—and how we choose to make decisions from here. That is the volatility side of the equation. This bull market has been as “quiet” as any in living memory. These have been some of the most tranquil returns ever made.

As a result, my fear is that for many of us, stock market investing doesn’t feel that risky anymore. (Those who watch the market every day could note that intra-day volatility appears to be on the rise lately, thus making things feel more dangerous, but I’m coming at this from a longer-term view.)

Not having heard much noise in years, many of us might be getting complacent, seeking more investment risk than is prudent by piling in to an aging bull market, including chasing 2014′s strong index returns. That includes asking our financial advisors to do something—anything—to help us catch up with the market. No one likes missing a great party.

But for those who need reminding (and at this point many of us do): falling trees—and falling markets—are noisy, sometimes incredibly so.

Let’s provide some perspective and facts. There is a technical definition of volatility, but I like to think about it more colloquially as the “price for admission” to the ride offered by a financial asset. Aiming to generate big returns? Generally, you have to endure a very bumpy ride to get there—with there being no guarantee whatsoever that you will arrive at your destination. Aiming for a modest gains? Your ride is likely to be smoother. The best of both worlds—and the holy grail in investing—is to generate great returns with limited volatility. Alas, that’s very hard to do: there is a generally proportional relationship between potential return and potential volatility.

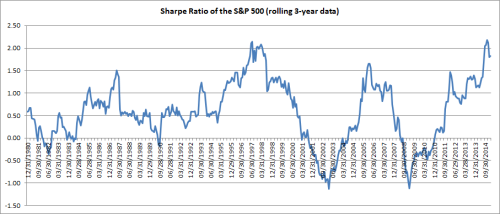

One accepted way to think about risk-adjusted returns is the Sharpe Ratio, a measure of a financial asset’s returns divided by the volatility of that asset and adjusted for the returns on cash over that period. If a stock annualizes at 8% with a 12% a variance around that gain, and cash returns 2% over that time frame, then the Sharpe is about 0.8. (The simple math is: (8/(12-2)) = 8/10 = 0.8.)

A high Sharpe Ratio doesn’t mean you’ve made bigger returns. It only means that whatever returns you’ve achieved, the volatility endured along the way was tolerable or even better.

Which brings us to today’s S&P 500. Take a look at this picture:

What jumps off the page is that the market’s Sharpe Ratio (based on a rolling 3-year measure of returns and volatility) is at a multi-decade high, having peaked at 2.18 in November 2014 and sitting at 1.82 at the end of February 2015. And though the line above looks to track the stock market generally, look closely and you’ll see that previous Sharpe peaks don’t match market peaks. For example, the market’s risk adjusted returns peaked in mid-1997 but the market itself then did not peak until 2000. Same with the February 2006 Sharpe zenith, well before the 2008 crash.

In layman’s terms, risk-adjusted returns for investing in U.S. large cap stocks have never been higher in most of our investing lifetimes. And this is exactly why the stock market has rarely if even “felt” less risky.

It is not normal for the S&P 500 to have a Sharpe of more than 1.0. It’s average across this 35-year sample is 0.58. In fact, it’s not normal for any investment over long periods of time to achieve that level of risk-adjusted returns. Despite efforts by the smartest people in finance, very few can sustain it. It’s just really hard to pull off. Why? Because an awesome ride with a lower price of admission is almost never legitimately possible. (For an extreme comparison, one of Madoff’s feeder fund track records had a Sharpe of 2.73)

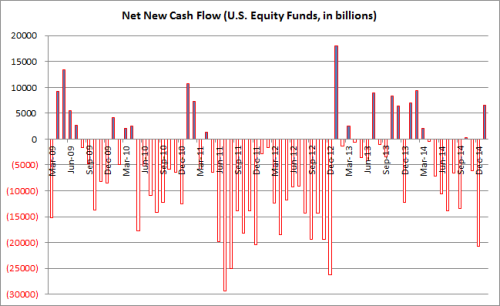

In thinking about how we can now make smart decisions about our portfolios—given how “easy” returns appear to have been lately—a critical part of the story is understanding the extent to which investors have participated in this amazing bull market. The answer, is unfortunately, not very much.

In looking at these ICI data on monthly net flows in or out of domestic equity mutual funds from the March 2009 market bottom, we see a disturbing pattern: for most of this bull run, funds have been in net outflows. Investors have been redeeming, not investing. There was a brief, modest flurry of new inflows in mid-2013 through early 2014, but even last year’s numbers were worse than I anticipated before grabbing the data.

This is why I chose the verb “witness” above as opposed to “participate.” Many of us have been voyeurs of these gaudy market gains; few have actually taken full advantage. One implication of these two graphs combined is that we appear to be at a dangerous inflection point with our portfolios (and in conversations with our financial advisors), a stressful moment that feels betwixt and between where playing neither offense nor defense feels entirely comfortable.

Our forest has never been quieter. And that’s not because the trees are silent when they fall, but that hardly any trees have fallen in years. Will they fall again? Yes. When will they fall again? No one knows. Maybe next week or maybe many years from now. We don’t know.

So ask yourself: Have you stopped listening? I would not recommend it. Risk management is always least wanted when it is most needed.

Photo credit: Steve Polkinghorne

Copyright © Investor's Paradox