by Cam Hui, Humble Student of the Markets

Trend Model signal summary

Trend Model signal: Risk-on

Trading model: Bullish

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. In essence, it seeks to answer the question, "Is the trend in the global economy expansion (bullish) or contraction (bearish)?"

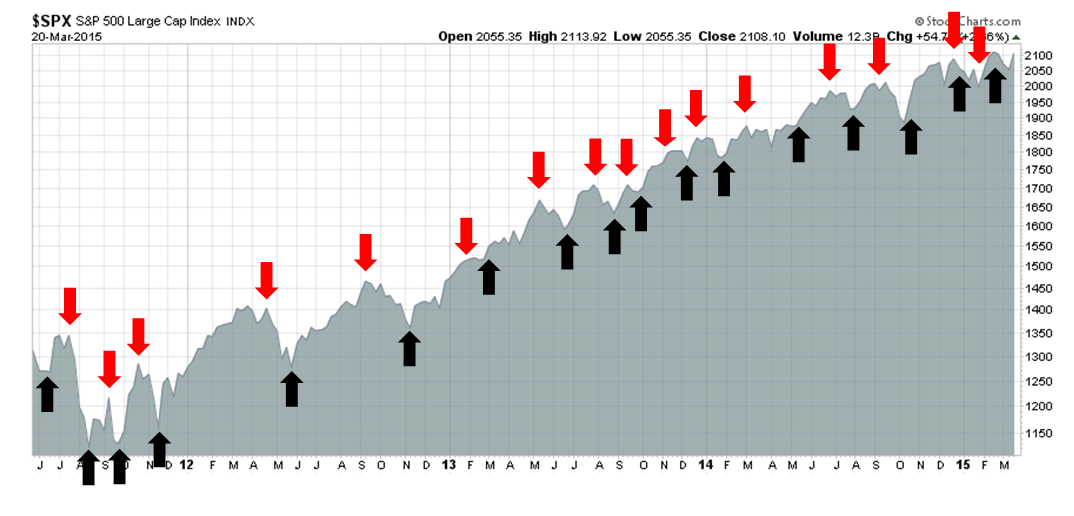

My inner trader uses the trading model component of the Trend Model seeks to answer the question, "Is the trend getting better (bullish) or worse (bearish)?" The history of actual (not backtested) signals of the trading model are shown by the arrows in the chart below. In addition, I have a trading account which uses the signals of the Trend Model. The last report card of that account can be found here.

Update schedule: I generally update Trend Model readings on my blog on weekends and tweet any changes during the week at @humblestudent.

A successful breakout-pullback-breakout pattern

This post will be somewhat shorter than usual, mainly because I feel like I am reiterating many of my comments from the last few weeks. Since mid-February, I have been using 2011 as a rough roadmap for the behavior of the equity market, largely because of the parallels with Greece. I believed that the market would see a series of choppy up and down moves and the pattern would resolve itself with a bullish trend as the political and financial difficulties resolved themselves (see 2011 all over again?).

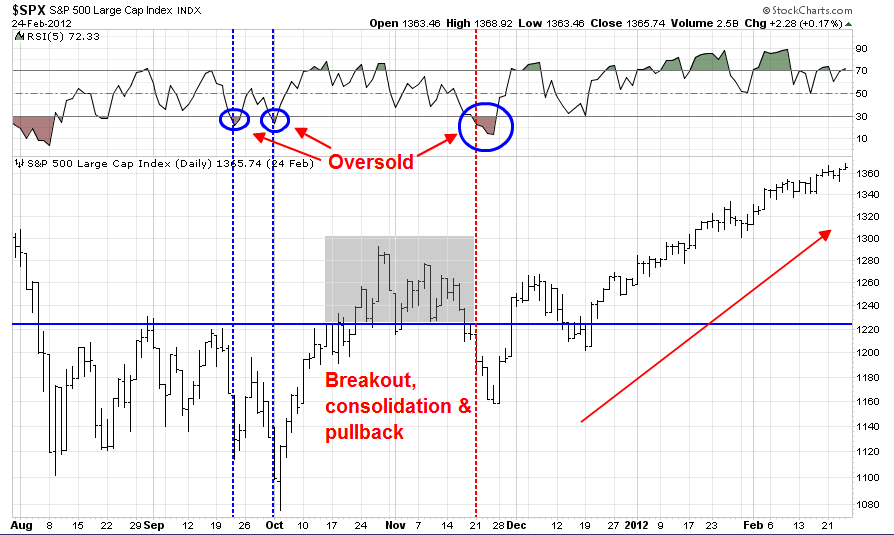

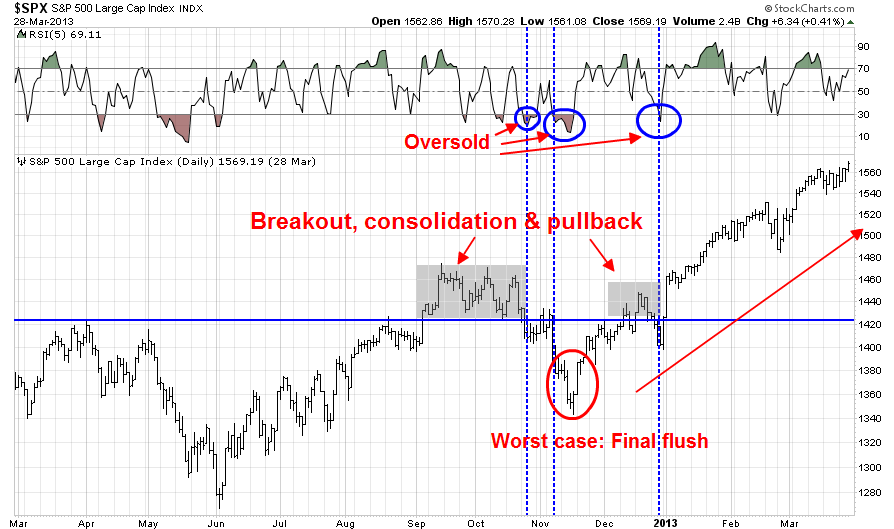

A couple of weeks ago, I brought up the 2011 and 2012 analogy again (see Bullish, but "data dependent"). Once the choppiness ended, the market staged an upside breakout, pulled back and then strengthened again in a classic breakout-pullback-breakout pattern:

As shown by the 2011 chart of the SPX below, the 2011 market was saw much up and down choppy action, which moved the market to an oversold reading on the 5-day RSI (blue vertical lines). It then staged an upside breakout, consolidated sideways and then pulled back below the breakout level. It finally resolved itself by staging a sustained rally after the pullback test (red vertical line).

The market in 2012 also saw a similar breakout, consolidation and pullback episode. Note the instances of short-term oversold readings marked by the vertical lines. In some cases, the market rebounded right away. In another, it required a final flush before seeing a durable bottom.

The breakout-pullback-breakout patterns from 2011 and 2012 appear to be repeating themselves today, which is bullish.

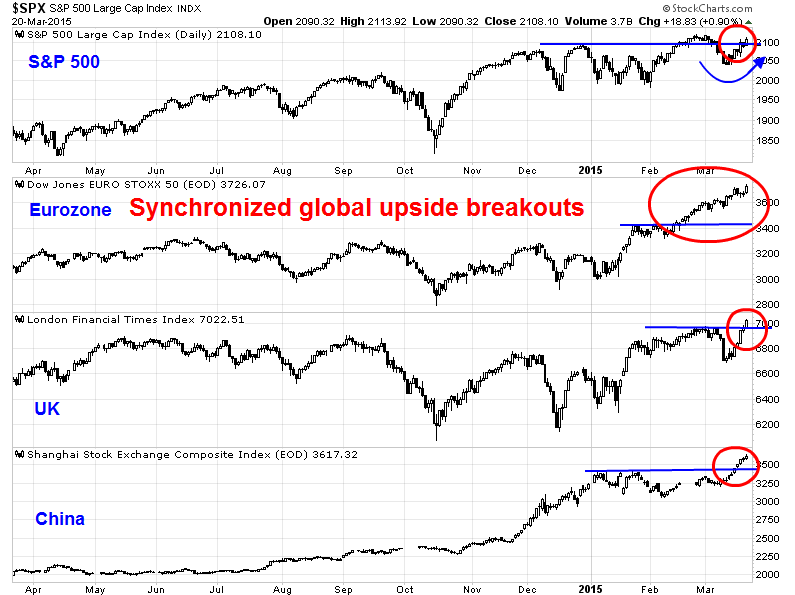

Synchronized global breakouts = Bullish

Further support of the bull case can be seen in synchronized global upside breakouts in major equity market indices. We are seeing upside breakouts in the FTSE 100, a continued uptrend in the Euro STOXX 50 and an upside breakout in the Shanghai Composite. The US market, as measured by the SPX, is somewhat of a laggard in that sense as it has only staged an upside breakout of the old resistance level at about 2093 and it has not tested its all-time highs yet. This kind of across the board global momentum is very bullish.

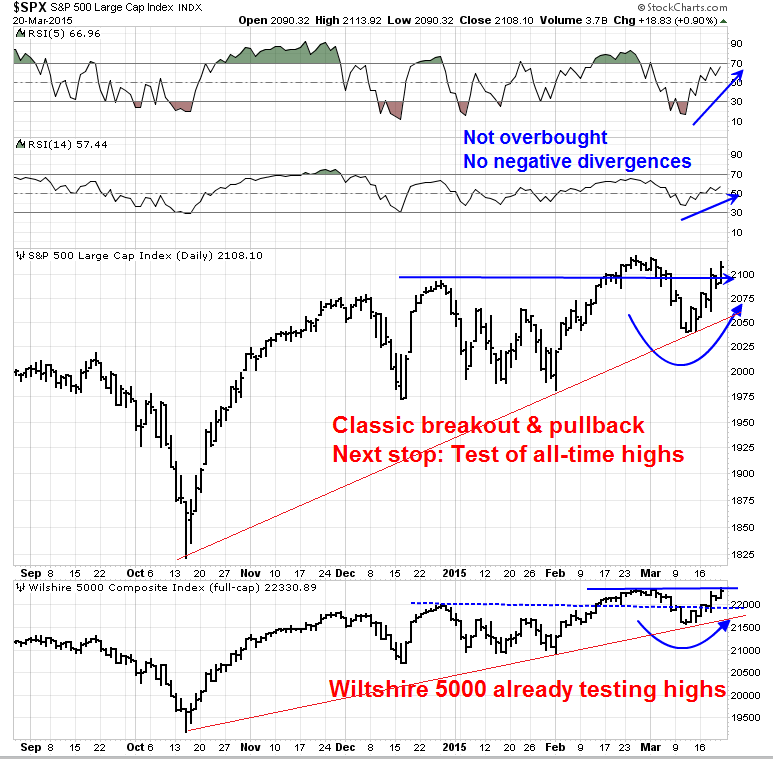

A closer examination of the SPX shows that this index has more room to rally. Neither the 5-day RSI (top panel), which is useful for short-term trading, the 14-day RSI (second panel), which is more useful for spotting intermediate term tops and bottoms, are overbought. Moreover, these indicators are exhibiting positive momentum, which is are confirmations of recent strength.

The SPX, which remains in an uptrend, is also exhibiting a classic breakout-pullback-breakout pattern and the index has rallied above the breakout point as a sign of market strength. Moreover, the more broadly based Wiltshire 5000 also displays the breakout and pullback pattern and moved to test its old highs on Friday.

Signs of a mid-cycle expansion

I have written before that current conditions suggest that the economy is in the mid-cycle phase of an expansion and my views are unchanged (see 4 reasons why this is not a market top), namely.

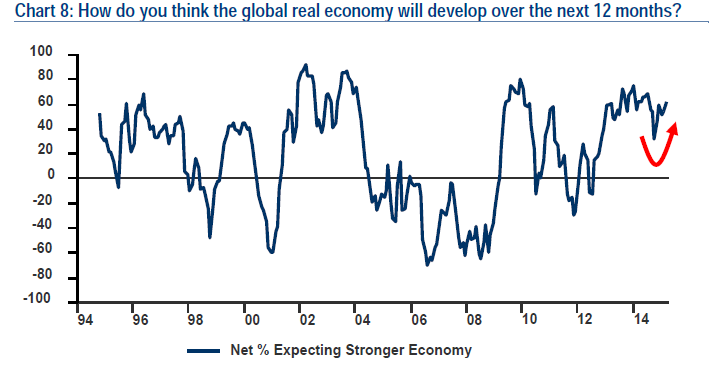

- Fundamental momentum is positive. Forward EPS estimates have stopped falling and they have started to climb again. The latest update from John Butters of Factset confirms the trend that began several weeks ago. As well, this week's monitor of high frequency economic releases from New Deal democrat also shows that the recent economic weakness seen so far seems to be abating. The latest BoAML Fund Manager Survey (FMS) shows that global growth expectations continue to turn up.

- Market leadership points to continued economic growth. A study of sector leadership last week indicated that the market leaders consist of Health Care, NASDAQ and Consumer Discretionary stocks. Defensive sectors such as Consumer Staples and Utilities have been lagging. This is the picture of an economy in the mid-cycle phase of an expansion.

Sentiment supportive of rally

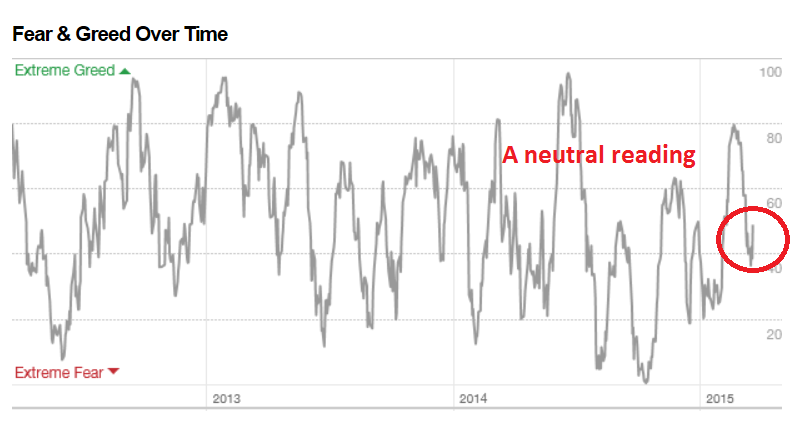

Another bullish factor can be found in the sentiment data. Despite some of my reservations about the construction of the index, the CNN Money Fear and Greed Index is in dead neutral, indicating that sentiment is nowhere near a crowded long reading, which implies that stock prices have further room to run.

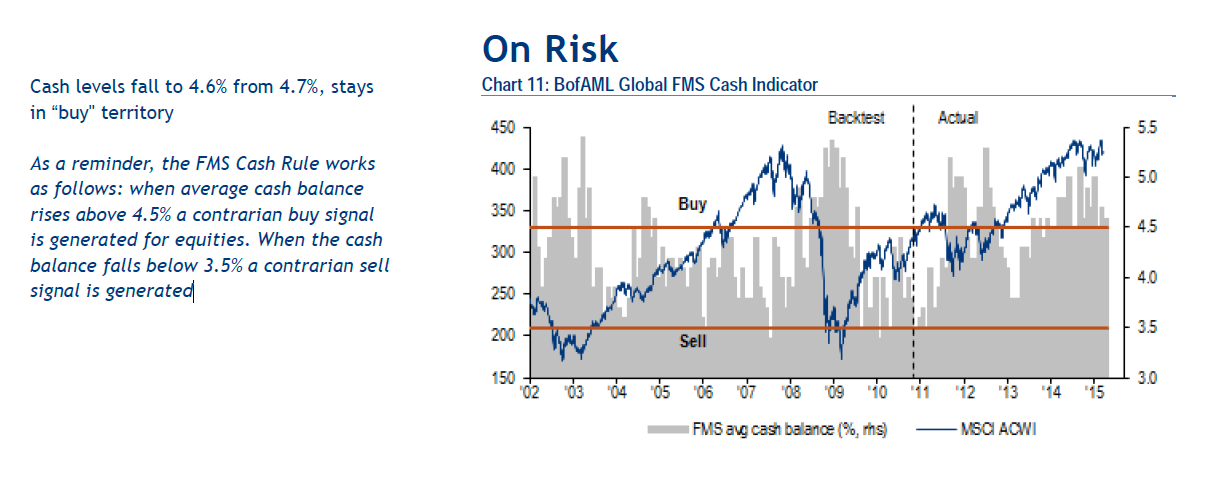

The latest FMS also shows that cash allocations are still a bit on the high side relative to its own history, which suggests that institutional managers could potentially put more money to work in equities.

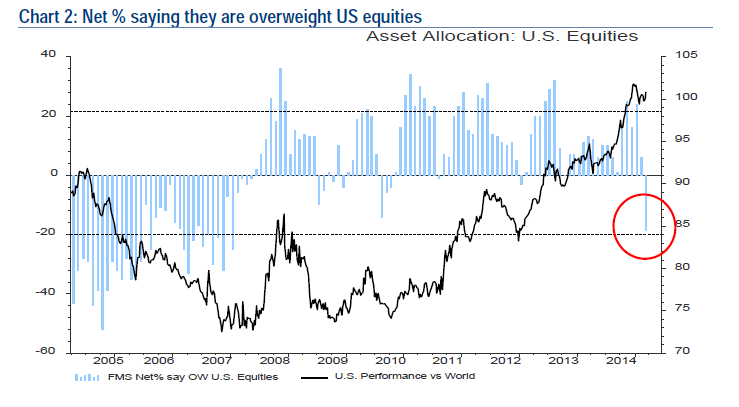

While the FMS shows that managers are overweight equities, the overweight is in eurozone and Japan. Managers have moved to an underweight position in the US, which make the region a contrarian buy:

Take a look at this chart of the relative performance of US stocks compared to the MSCI All-Country World Index. There are three major reasons to be overweight the US equity market. First, it remains in a relative uptrend compared to global stocks. It got ahead of itself in late December and early January and has since retreated from those excesses. Finally, sentiment readings (see above FMS chart) is tilted bearish, which is contrarian bullish.

Path of least resistance is up

In conclusion, I haven't seen such unambiguously bullish readings in such a long time. I suppose that as we get closer to a Fed liftoff on interest rates later this year, US equities could get the jitters and pull back. For now, the path of least resistance for stock prices is up.

My inner investor continues to be overweight stocks. My inner trader is also long, but he is closely watching sentiment and momentum indicators should the SPX test its highs next week, which it will likely do. The market may become short-term overbought at that point and it may be prudent to trim back some long positions, but I don't want to be anticipating model readings. I will be updating any developments on my Twitter account @humblestudent during the week.

Disclosure: Long SPXL, TQQQ

Copyright © Humble Student of the Markets