by Cullen Roche, Pragmatic Capitalism

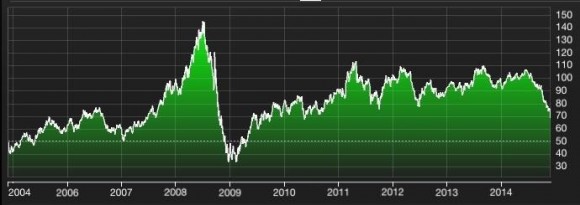

Oil prices have been on an impressive decline in 2014. West Texas Crude is down almost 40% from its peak in June at a price of $108. Looking at the longer-term history of oil prices we can see just how unusual this sort of price decline has been:

That’s right – we’re in the middle of the largest decline since 2008 when the global economy looked like it was collapsing. So, the question is – is it different this time? Is the current hurting the global economy more than it’s helping?

First, I always like to stress that it’s always different this time. If we want to truly understand the current macro environment it’s best to treat it as though it’s always a unique set of circumstances. The global economy is, after all, an evolving and dynamic system with new causes and effects inside of each business cycle.

So, what are the pros and cons behind this decline in oil?

First the good news – some pros:

Consumers Win Big – Lower gas prices are the obvious biggie. Every sustained 1 cent decline in gas prices translates to roughly $1.4B that consumers have to spend on things other than energy consumption so that means that consumers will likely spend much more on other items during the holidays and into early next year. This bodes well for Q4 and Q1 GDP. Of course, this is much bigger than the USA. This will ripple through the entire global economy helping consumers from just about all of the non-petroleum based economies so the impact will be magnitudes larger than the $140B consumption boost from oil prices in the USA.

Consumers Win Big, Part 2 – lower energy prices means inflation will remain that much lower. And that means that central banks are likely to relax even further. This will give them more room to breath on the inflation front which means that they can remain easier for longer. That should help avoid the sort of rate increases that we saw in Europe in 2011 or any other premature actions by Central Banks that might tighten policy and hurt consumption.

Now the bad news – some cons:

Weak Global Demand? – One of the big concerns with falling oil prices is that there’s more going on here than just a supply glut. The bigger concern is that weak demand in Europe, Japan, the USA and China is driving prices lower. Now, over the long-term, the IEA expects emerging markets to drive oil demand much higher, but for now the weak demand from Europe, Japan and the USA continue to dampen prices. There’s no doubt that aggregate demand is low during this recovery so the demand side is a clear driver here. Especially as Japan falls into recession and Europe continues to struggle.

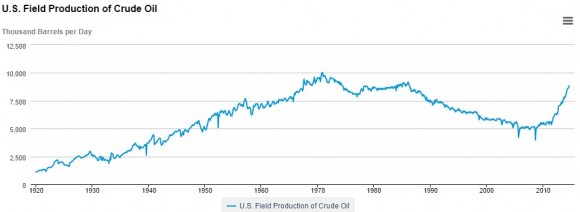

US Shale Producers Get Hurt – One of the big drivers of the supply glut in recent years has been the shale boom in the USA. It’s been widely theorized that the Saudis are trying to reduce the price of oil to hurt the US shale producers. That is, because many of the US shale producers have higher costs of production then the falling prices hurt their margins and profitability. In addition to being heavily indebted, many of the shale producers can’t stomach sustained oil prices in the $60-$70 range.

Global Producers Get Hurt – This is a bigger issue than just US Shale producers. This note from CitiBank breaks down the breakeven prices for many of the largest oil producers. Oil in the $60-$70 range would hurt much of the Saudi competition. Also worrisome is the high level of US debt issued by the shale producers. Energy companies now make up 15% of the high yield market.

OPEC Members Get Hurt – Of course, the breakeven on many OPEC members is also high. State expenses are the big driver here as the oil price boom has led many of the Middle East countries to increase spending as a function of booming oil revenues. This means the decline in prices could put some of these countries in a precarious situation. A sustained oil price decline could cause broader sovereign debt problems in addition to potentially reducing state spending.

Unknown, US Private Investment – The biggest domestic concern is that much of the private investment that has resulted from the US shale boom will be dampened as lower prices reduce margins for many US producers. But the alternative to this is the increasing likelihood of the Keystone Pipeline. With a new Congress coming in 2015 the Republicans have a new argument in favor of the Keystone project. Obama will have his veto pen out, but he risks looking like he’s not standing up for the best interests of US consumers and US corporations if he doesn’t allow the vote to go through. It will make for a very interesting vote when the new Congress brings up the issue.

Overall, the issue in 2014 appears to be more supply side than demand side. The recent OPEC decision made that abundantly clear. The Saudis are not concerned about the current supply glut and likely have their long-term interests in mind hoping that a short-term supply squeeze can hurt some of the competition. This means the current decline in oil prices isn’t a repeat of 2008. This isn’t primarily a demand side issue. Instead, it’s a supply side issue and that means that there’s likely as much benefit from the decline as there is detriment. Of course, the unknown is how this will ripple through the economy in other ways. Will it cause problems at the sovereign level or in the high yield markets? I guess we can only wait and see.

Copyright © Pragmatic Capitalism