by Ben Carlson, A Wealth of Common Sense

Earlier this month the Wall Street Journal posted an excerpt from a letter written by a hedge fund manager to his investors stating the reasons (see also: excuses) he had to close down his fund.

Here’s part of the rant:

Post-2008 monetary policies have rewarded the beta investor who’s gone “all in” on market risk and themes, while punishing harshly the market-neutral, alpha investor who discounts allocations on the basis of value. New paradigms have emerged as a result, defined by binary outcomes of risk-on/risk-off, taper-on/taper-off, win big/lose big. With new innovations of beta-engineering—instruments such as ES-minis, QQQ, dollar-yen carry trade—investors are pursuing en masse too little reward in exchange for too much risk.

This guy offered plenty of excuses with zero accountability — It’s not my fault the market’s not cooperating.

Not all portfolio managers do this, but I’ve heard a number of excuses for underperforming the market over the years. Some of them are actually valid at times. You can’t expect even the best strategies to consistently beat the market year in and year out. The problem for those evaluating active managers comes when you start to hear a pattern of excuses over and over again.

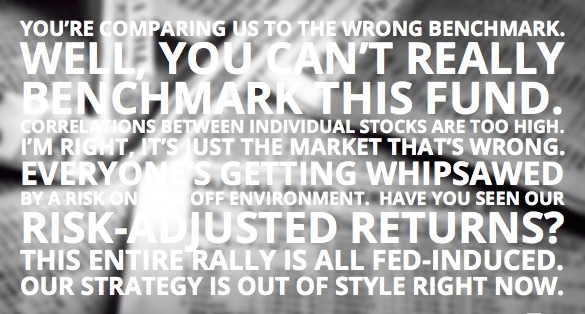

Here’s my list of excuses for underperforming the market:

You’re comparing us to the wrong benchmark.

Well, you can’t really benchmark this fund.

Correlations between individual stocks are too high.

I’m right, it’s just the market that’s wrong.

Everyone’s getting whipsawed by a risk on/risk off environment.

Have you seen our risk-adjusted returns?

This entire rally is all Fed-induced.

Our strategy is out of style right now.

We’re not wrong, we’re just early.

Judge me over the full business cycle.

It’s the high frequency trading.

This is just a minor aberration.

The market isn’t recognizing fundamentals.

This is a low-quality, junk rally.

The market is rigged.

I’m a contrarian.

The weather is messing with economic output.

Here’s what the market should be doing…

I blame the short-sellers.

Valuations are detached from economic reality.

It’s the company’s management that isn’t delivering.

Central bank currency manipulation, plain and simple.

Thanks a lot Obama.

Bernanke/Yellen/Draghi don’t know what they’re doing.

It’s those CNBC anchors talking bad about our stocks.

The market is underestimating the possibility of a 1987 crash.

Hyperinflation is right around the corner.

We’re preparing for a depression-like scenario.

*Thanks to Michael Batnick (@michaelbatnick) for helping me come up with some of these.

Source:

HFT’s ‘Circus Market’ and a ‘Dash for Trash’ – Fund Manager Lets Loose (WSJ)

Further Reading:

Some things you will never hear from a portfolio manager

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Copyright © A Wealth of Common Sense