The Power of Earnings

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James Canada

HIGHLIGHTS

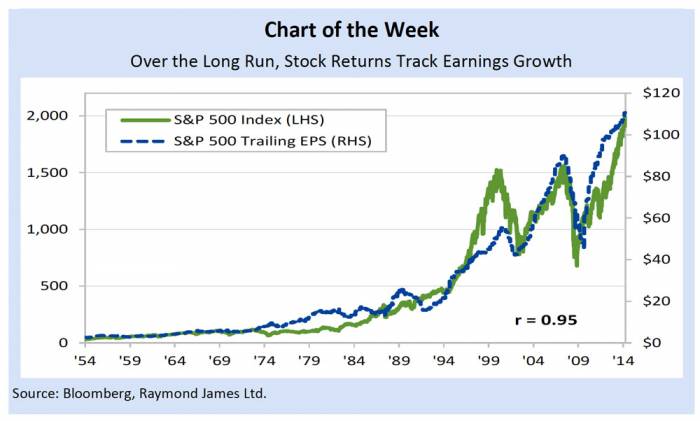

• Over the long term, equity returns are driven by earnings growth. In the short-term however, valuation tends to be the more important driver. In particular, we have found that the first phase of a bull market is largely driven by multiple expansion as investors grow more confident in the economic and stock market recovery.

• But then as multiples rise and the bull market matures, earnings growth becomes more important to returns. We believe the equity markets are transitioning into this second phase, where corporate earnings are likely to take on a more important role.

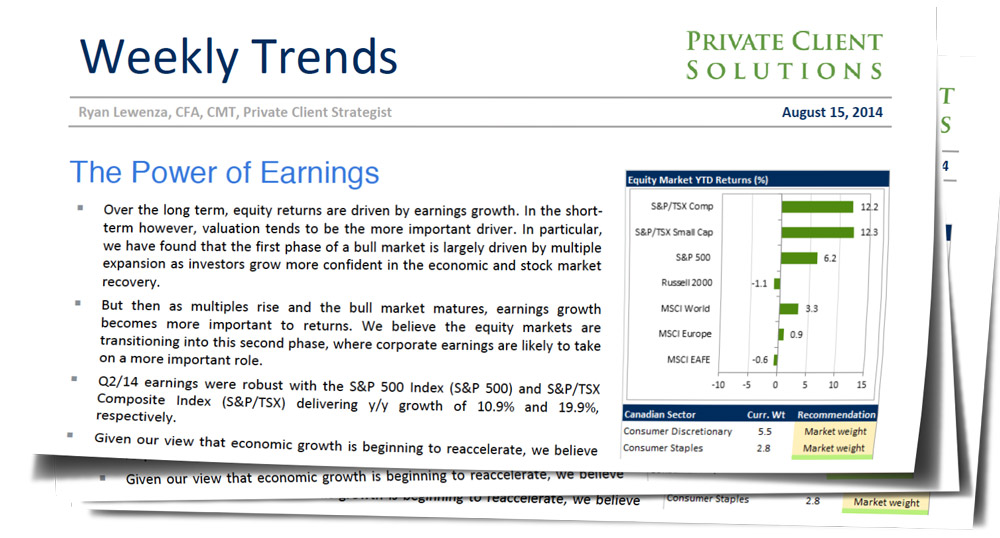

• Q2/14 earnings were robust with the S&P 500 Index (S&P 500) and S&P/TSX Composite Index (S&P/TSX) delivering y/y growth of 10.9% and 19.9%, respectively.

• Given our view that economic growth is beginning to reaccelerate, we believe earnings are set to improve, which could provide the catalyst to the next leg in this bull market.

Read/Download complete report below: