Recent flows data show that investors are starting to sell out of their high yield bond positions. Interest rates are still low, so why the exit? Matt Tucker weighs in.

by Matt Tucker, iShares Head of Fixed Income Strategist, Blackrock

We have written a few times on The Blog about the ongoing effects of the low Fed Funds rate and quantitative easing. They have pushed interest rates down across markets, propelling investors into asset classes such as corporate bonds and emerging market debt in search of yield. One area where we have seen a lot of inflows is high yield bonds, as this sector has offered yields above 5%. Investors have been less concerned about default risk as global defaults fell below 2% and volatility in both stocks and bonds remained low, making high yield investments all the more appealing.

In the past few weeks we have seen some cracks in the high yield picture. Elevated geopolitical risk, an Argentina default and a US jobs report that was weak relative to expectations contributed to the sell-off. The iShares iBoxx $ High Yield Corporate Bond ETF (HYG), which had been trading above $93.50 since February, fell to $92.04 on August 1st before rallying in recent days. From June 30th to August 6th, high yield bond ETFs experienced $3.7 billion of redemptions, and this included shorter maturity high yield funds which had been impervious to previous periods of outflows. Overall, since June 30th, the high yield bond market has lost about 2%.

This decline in prices has pushed credit spreads (the additional yield over US Treasuries) on high yield bonds out by 0.67%, and now spreads have reached more than 4% above US Treasuries for the first time since February this year. Will this bring investors back into the market? It is difficult to say, as the environment for credit risky securities seems to be more favorable than the recent sell-off implies.

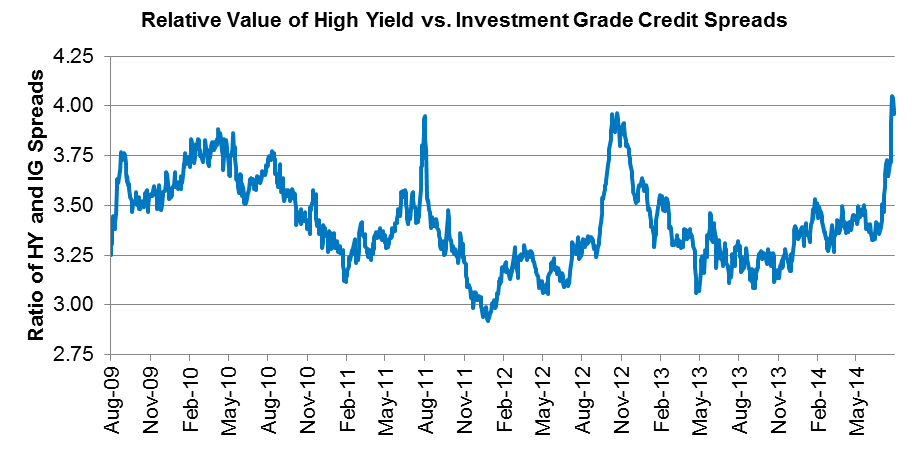

As high yield spreads have widened, they have become more attractive to other fixed income investments. The ratio of high yield to investment grade credit spreads, for example, is now more than 4:1, a level we haven’t seen since October 2012 when the unemployment rate was 7.9%. As the chart below illustrates, this ratio has tended to decline when the 4% level has been breached. Of course the ratio could fall from either a tightening (improvement) of high yield spreads or a widening (worsening) of investment grade spreads. This is the key question, where the recent sell-off was isolated to the high yield market or whether it will spread to investment grade as well.

Source: Bloomberg, Barclays and BlackRock as of 8/7/2014

So what does this mean for investors? We have been neutral on high yield for the past few months as it has offered more income potential than other asset classes. High yield remains a potential source of income in a diversified portfolio, but potential price appreciation is limited. The recent sell-off is also a good reminder to investors of the potential volatility of the asset class. Given current yields, investors have to weigh whether they are being paid enough to take on this volatility and the underlying credit risk. Another consideration is whether recent price movements represent a temporary setback for the high yield market or the beginning of a broader re-pricing of corporate bonds. Given overall economic conditions I doubt that there will be any contagion into investment grade debt. For now, I continue to be neutral on high yield.

Matthew Tucker, CFA, is the iShares Head of Fixed Income Strategy and a regular contributor to The Blog. You can find more of his posts here.

*****

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares ETF and BlackRock Mutual Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any security in particular.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Markit Indices Limited, nor does this company make any representation regarding the advisability of investing in the Funds. BlackRock is not affiliated with Market Indices Limited.

©2014 BlackRock. All rights reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock. All other marks are the property of their respective owners.