by James Picerno, The Capital Spectator

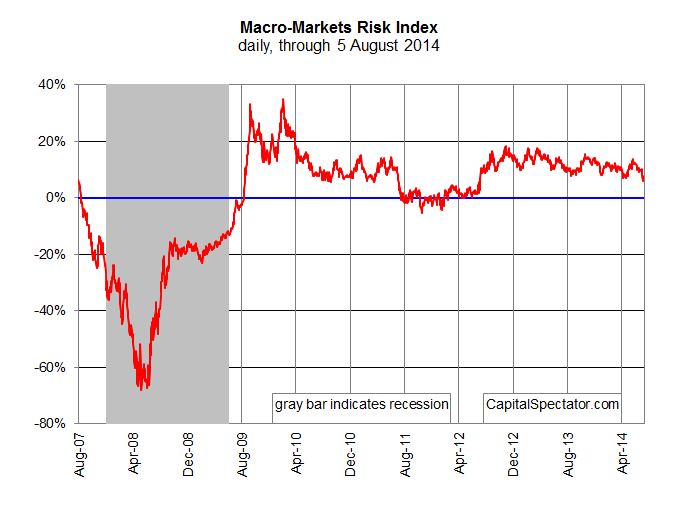

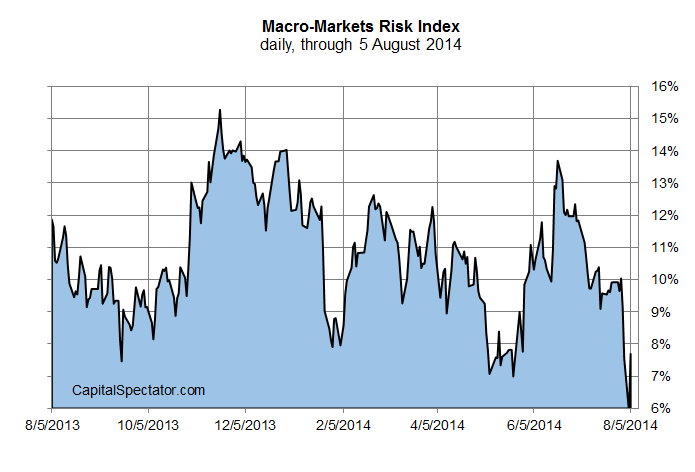

The economic trend for the US remained positive in early August, albeit at a relatively subdued level in comparison with recent history, according to a markets-based estimate of macro conditions. The Macro-Markets Risk Index (MMRI) closed at +7.7% yesterday (August 5), or near the lowest level in two years. The latest reading is also well below MMRI’s recent peak of +13.7% in mid-June of this year. Nonetheless, the persistent run of positive numbers suggests that business cycle risk remains low. A decline below 0% in MMRI would indicate that recession risk is elevated. By comparison, readings above 0% imply that the economy will expand in the near-term future.

MMRI represents a subset of the Economic Trend & Momentum indices (ETI and EMI), a pair of benchmarks that track the economy’s broad trend for signs of major turning points in the business cycle via a diversified set of indicators. (For details about ETI and EMI, see Nowcasting The Business Cycle.) Analyzing the market-price components separately offers a real-time approximation of macro conditions, according to the “wisdom of the crowd.” Why look at market data for insight into economic conditions? Timely signals. Conventional economic reports are published with a time lag. MMRI is intended for use as a supplement for developing perspective on the current month’s economic profile until a complete data set is published.

MMRI measures the daily median change of four indicators based on the following calculations:

• US stocks (S&P 500), 250-trading day % change, plotted daily

• Credit spread (BofA ML US High Yield Master II Option-Adjusted Spread), inverted 250-trading day % change, plotted daily

• Treasury yield curve (10-yr Treasury yield less 3-month T-bill yield), no transformation, plotted daily

• Oil prices (iPath S&P GSCI Crude Oil Total Return Index ETN (OIL)), inverted 250-trading day % change, plotted daily

Here’s how MMRI compares on a daily basis since August 2007:

Here’s a closer look at how MMRI compares on a daily basis over the past year:

Copyright © The Capital Spectator