Gold Market Radar (June 16, 2014)

For the week, spot gold closed at $1,276.89, up $23.64 per ounce, or 1.89 percent. Gold stocks, as measured by the NYSE Arca Gold Miners Index, rose 6.65 percent. The U.S. Trade-Weighted Dollar Index rose 0.25 percent for the week.

Strengths

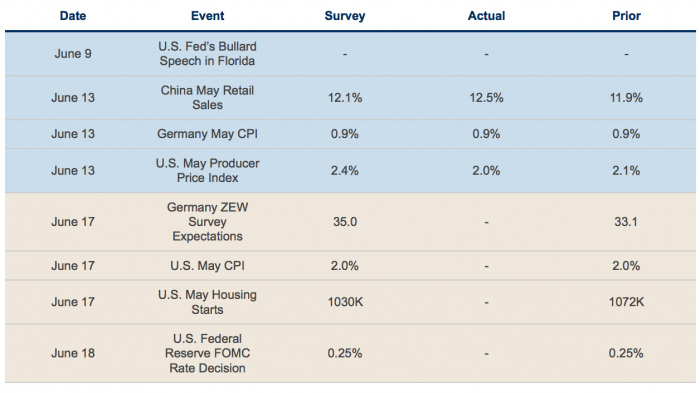

- Gold had one of its best weeks of the year, aided by a slew of data from China on Friday showing that the economy is stabilizing, supported by targeted stimulus measures from Beijing. May retail sales rose 12.5 percent on year, above analyst expectations for a 12.1 percent increase, while industrial output increased 8.8 percent. China, the largest global gold consumer, nearly doubled its first-quarter gold imports relative to the same period last year, according to a recent study by data provider Global Trade Information.

- Dundee Precious Metals rose nearly 17 percent this week following an analyst site visit to its Namibian operations. The impressions from attendees were very positive, and the strong price action this week highlights how misunderstood the stock has been. With its Tsumeb Smelter overhaul now complete and ramping up to full capacity, the financial performance is set to improve sharply, largely thanks to its low cost basis and solid operations.

- Pilot Gold announced results from its drill test of a new porphyry target at its TV Tower Project in Turkey. The drill hole assays show 153 meters of 0.99 gram per tonne gold and 0.39 percent copper. Similarly, TriStar Gold reported drill holes at its Castelo property in Brazil, with assays of 15 meters of 2.16 grams per tonne gold. Lastly, Platinum Group Metals announced a large increase to its inferred resource to a total of 287 million tonnes grading 3.15 gram per tonne 4E (Platinum, Palladium, Rhodium, and Gold).

Weaknesses

- Platinum dropped 1.15 percent for the week while palladium dropped 3.68 percent as investors anticipated an end to the 20-week-long platinum strike in South Africa. The Association of Mineworkers and Construction Union held mass meetings with its members to present the latest wage proposals developed over the last three weeks of talks. The result was neither a total rejection nor a total success, yet miners are not back to work and unlikely to do so as a whole in the next few days. Investors continue to ignore the fact that metal inventories are being depleted quickly, a situation that will not be resolved by ending the strike since it will take a number of months before miners can ramp up operations. As such, a much larger supply deficit should be on everyone’s books for the fall, but it doesn’t look like it is. Both platinum and palladium have strong fundamental prospects, aided by the supply shortfall expected.

- Canada will make it harder for miners to comply with its anticorruption laws after small- and mid-cap miners have been targeted by allegations of corruption of foreign officials. The amendment to the Canada’s Corruption of Foreign Public Officials Act (CFPOA) has increased its maximum jail term to 14 years with no limit on fines and allows for Canadian law enforcement to prosecute Canadian individuals or companies for bribery, regardless of where the alleged bribery took place. A Grant Thornton report shows more than 1 in 4 people have reported having paid a bribe in the last 12 months.

- South African police arrested 20 Sibanye Gold mineworkers this week for allegedly stealing ore at a processing plant west of Johannesburg after a six-month investigation. A spokesman for the country’s anticorruption unit declared this is the largest mass-arrest of mineworkers for gold theft in post-apartheid South Africa.

Opportunities

- Paradigm Capital is pounding the table for gold as the “stars are aligning.” The report highlights the strikingly seasonal aspect of the recent weakness, and expects gold equities “to fly” this summer as the seasonal trade kicks in. Gold stocks are “coiled springs” due to the high beta that lower gold prices cause in the producer’s balance sheets. In addition, ISI in its weekly note to clients argues the package of simulative policies around the world is likely being underestimated, noting that the Bank of Japan and Fed balance sheets over the past five years have increased a stunning $4.5 trillion. To complement, Bank of Montreal Quantitative Strategy argues junior gold stocks have broken above an underperforming trend, stating “[If] no one cares, you should.”

- The royalty companies were the big winners this week, rising anywhere from 5 to 17 percent as they take upon the role senior gold stocks were supposed to do for your portfolio: provide leverage to rising gold prices and better protection on the downside. On the same Paradigm Capital report mentioned above, the analysts quantified the different gold sectors’ beta to the metal. The analysis shows, year-to-date, royalty companies have the highest beta (7.0) to gold upside of any gold sector. In addition, over the last ten years, the superior business model of royalty companies has outperformed all other sectors by a mile, 423 percent versus the 90 percent average.

- Virginia Mines reported it has commenced, or will commence, a series of exploration programs mostly in Quebec as it seeks to discover new mining camps that could replicate its earlier success in Eleonore. Virginia holds a 2.2 to 3.5 percent royalty on Goldcorp’s Eleonore property after it led the efforts to the discovery of what will eventually turn out to be Canada’s largest underground mine.

Threats

- India’s gold consumption may be affected by a slow start to the monsoon season. Much of the country’s farmland depends on rain for their crops due to the lack of irrigation, leaving farmers concerned the late start of the monsoon season may reduce the size of crops. A reduction in crop volumes would be detrimental to the wealth of farmers, which could inhibit gold purchases in the country. In addition, rising oil prices due to the Iraqi conflict are putting pressure on Indian inflation and its current account deficit, as the country imports 80 percent of its crude needs.

- Central bank gold buying is set to decrease according to statistics revealed by the World Gold Council (WGC). According to its outlook, the WGC estimates central bank buying will reach about 300 tonnes this year, about one fourth lower than the 409 tonnes purchased last year. The WGC concludes the lower buying is yet another example of the gold market becoming more dependent on consumers, and less on investors.

- Human rights groups are pushing for urgent reforms to prevent gold from funding conflict in developing nations. According to the U.N. Group of Experts, 98 percent of artisanal gold, worth somewhere between $380 to $500 million per year, was smuggled out of Congo last year alone. This gold is allegedly funding armed actors and corrupt business and political elites.