Schwab Sector Views: Time for Defense?

February 13, 2014

by Brad Sorensen, CFA, Director of Market and Sector Analysis, Schwab Center for Financial Research

Schwab Sector Views reflect a three- to six-month outlook and are appropriate for investors looking for tactical ideas. We typically update our views every two weeks so check back often for the most recent view.

The first six weeks of 2014 have been nothing to cheer about in terms of market performance, with the major indices down anywhere from 5-7% at one point-although they have bounced back lately-and questions about economic growth popping up. Of course, the question investors are likely asking is whether we are at start of a longer-term downtrend or merely a blip in the road. Which side of that debate you come down on will likely determine whether you think it's worth the effort to make tactical shifts in a portfolio.

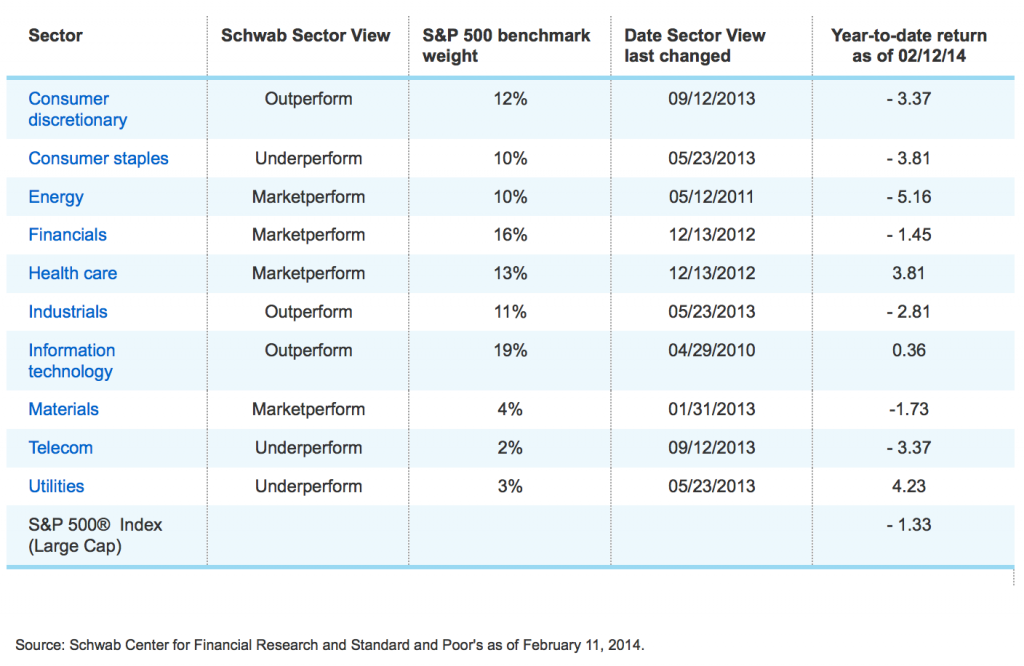

Traditionally, when it appears that the market is in for a sustainable downtrend and that economic growth is slowing or, in the case of a recession, reversing, areas of the market known as the defensive sectors have held up better than those known as cyclicals. The best way to approach this is to think about what areas of the economy are unlikely to be very affected by an economic slowdown. Traditionally, sectors such as utilities, people always need power, health care, people get sick in any economic environment, and consumer staples, the need for toilet paper stays relatively constant, have been considered defensive. Interestingly, thus far in this pullback, only the utilities and health care sectors have held up, as you can see from the table below, while the other two have actually performed worse than the broader market. Likewise, an area that has been traditionally thought of as very sensitive to market and economic swings, technology, has held up better than most, illustrating some of the defensive characteristics we have described before in this publication.

So, back to the question, does recent action warrant a move in tactical positioning? At this point, we believe not. The above mentioned sector performance indicates to us that at this point there isn't a large amount of fear over the potential for a sharp slowdown in economic growth, which would really be the reason to shift positioning in terms of equity allocation. We actually believe that economic growth will accelerate as we go throughout the year, benefitting the more cyclical areas of the economy. Therefore, we are recommending that investors looking to make tactical moves refrain from moving to a defensive position at this point in time and ride out the bumpiness that may continue in the near term. It's not always pleasant, but it can help set up the next sustainable move higher, which we believe is the case this time around.

We strongly suggest looking for more details on all of our specific sector views and information on our outperform and underperform ratings by reading the expanded analysis below, and then making adjustments to portfolios as you see fit. One final note: Our tactical recommendations change quickly at times as we continually monitor economic progress and factors influencing individual sectors, so check back often.

Consumer discretionary: Outperform

Even though the consumer discretionary sector has posted stellar returns over the past year and despite some recent weakness, we continue to believe there will be more upside over the next several months, and are holding our outperform rating on the group. Investors, however, should be prepared for some more bumpiness in the near term, as some more churning is possible and in a potential overall market correction the discretionary sector would likely take a hit. Additionally, the environment may be a bit more challenging than usual as investors try to determine what impact the extreme weather situations over the past couple of months may have on consumer-related areas of the economy.

The American consumer seems to consistently top diminished expectations and show a remarkable resilience in the face of obstacles. Headwinds certainly remain, but the consumer has largely taken these issues in stride, while it appears retailers have been able to manage inventories and keep costs in check, helping to bolster our view of the sector.

And the fundamental picture seems to be improving as well as we’ve seen some of the perceived larger headwinds facing consumers appear to dissipate somewhat. We have seen consumers reduce their debt load, housing strengthen, auto sales improve, which indicates better consumer confidence, and the job market improvement appears to be accelerating to a modest degree. Additionally, some of the fiscal issues that may have impacted the consumer appear to be diminishing as the prospects of another government shutdown in the near-term seem remote, and unlike last year there was no increase in the payroll tax rate at the beginning of the year. Finally, we believe there continues to be some pent-up demand among consumers that have put off purchases. And with the improvement in the housing and the labor markets seeming to bolster consumer confidence, we believe demand will continue to improve in the coming months.

We have long acknowledged the American consumer has shown a remarkable ability to overcome obstacles, and despite some near-term bumps are maintaining our outperform rating on the discretionary sector.

Positive factors for the consumer discretionary sector:

- Inventories remain quite lean. This should provide retailers with some pricing power as activity picks up.

- The Federal Reserve continues to be quite accommodative, despite modestly pulling back on quantitative easing, which could help to support the consumer.

- Global central banks in developed markets appear to be firmly in an easing stance, which could help bolster the consumer.

- The job market, although still somewhat sluggish, appears to be improving at a steady rate, with the December weaker jobs number likely an aberration.

Negative factors for the consumer discretionary sector:

- Credit standards remain tight, although there are signs of easing.

- Uncertainty and increased costs surrounding the Affordable Care Act could dent consumers' ability and willingness to spend.

- Fierce competition in the retailing space appears to be impacting margins, which could grow into problems for stock performance if it gets too severe.

Consumer staples: Underperform

We continue to believe underperformance is the most likely near-term course for the staples group as US economic data continues to indicate growth and investors look to boost return potential and move out the risk spectrum to some degree. We want to note, however, that despite the downturn in the overall market as of late, the staples group has not performed in its traditional defensive way. If economic expectations were to deteriorate substantially, that would likely change, but we don't believe that's the most probable course, leaving us relatively confident in our current rating.

Although a consumer group, in contrast to the discretionary sector, the staples group is considered defensive because it tends to sell items that will be purchased regardless of the economic environment, such as toilet paper and laundry detergent. While this is a positive during tough economic times, it can also be a negative during times of improving economic conditions as consumers don't typically expand their spending on such items as the economy improves—demand tends to stay relatively constant. And with the economic outlook showing signs of brightening further, the more defensive group could continue to be in for a bit of a rough ride.

Additionally, staples companies typically deal with relatively narrow margins, which can make it difficult to rapidly increase profitability and thus support swift growth in stock prices.

Although the majority of fundamentals in the group still seem somewhat decent to us, and despite some recent selling, we believe the group remains somewhat extended and valuations are concerning to us. As such, we believe that an underperform rating is most appropriate.

Positive factors for the consumer staples sector:

- Staples retailers have aggressively cut costs and are attempting to create more perceived value for consumers, which could support sales.

- The defensive consumer staples group could benefit from tighter consumer wallets if consumer confidence takes an unexpected hit.

Negative factors for the consumer staples sector:

- Competition continues to accelerate and is exacerbated by the increasing emergence of low-cost, emerging market production, which could potentially cause pricing power in the group to evaporate by compressing margins and squeezing earnings.

- An acceleration of economic growth would likely cause the staples sector to underperform.

- Numerous central banks are now firmly in easing mode in an effort to stimulate the economy, which could hurt the more defensive sectors.

Energy: Marketperform

Oil prices seem to have stabilized somewhat since the drop seen following the Middle East tensions seen earlier. We believe this will help the energy sector stabilize after having modestly underperformed the overall market over the past couple of months, although volatility in the sector is always possible, resulting in largely marketperformance.

Energy, and especially crude oil, tends to have a large speculative element at times which can make it difficult to focus on the underlying fundamentals, but we believe that's exactly what investors should do. Although there are likely to be many twists and turns, we believe it ultimately comes down to supply and demand factors, influenced largely by the global economic outlook. And right now, the Fed continues to be quite accommodative, notwithstanding the continuing of the tapering process for quantitative easing, but global growth appears to be somewhat in question, with emerging markets largely under pressure as of late. Additionally, improved supplies and still modest demand growth lead us to a relatively balanced picture that we believe will result in performance roughly inline with the overall market. With regard to the supply situation, we believe we could see a bit of a boost as Iran has had some of the international sanctions at least temporarily removed, allowing their oil to return to the market.

We believe the US and Chinese economies will ultimately drive the direction of the sector. To that end, China's near-term response to its economic softening had been almost nonexistent and leadership appears to be more concerned with longer-term structural issues than short-term growth. Alternatively in the US, the Federal Reserve has been extremely aggressive, but its effectiveness appears to be diminishing as time goes on.

Moving past the short-term movements in the energy markets, economic developments seem to be moving more in the direction of supporting the energy sector, despite some recent bumps in the road. The US economy continues to expand at what may be an accelerating rate, Japan's recovery may be gaining traction, and Europe's economic situation continues to be in question but there are signs that the economy is turning around. However, there is also an increase in domestic production that could bring prices lower as US supplies of energy products build.

Longer term, we have a mainly positive outlook for the energy sector and believe an upgrade opportunity may present itself in the not too distant future. Developing countries will almost certainly continue to need more fuel, demand will likely continue to grow but we also note that supplies are increasing as well leaving us with a relatively neutral view for at least the time being.

Positive factors for the energy sector:

- Developing nations will likely need more energy as they improve their infrastructures and modernize their economies.

- Global central banks in the developed world appear to generally have an easing bias, which could help the more cyclical sectors such as energy.

Negative factors for the energy sector:

- Supplies could increase dramatically with a renewed commitment to exploration and technological improvements. We've already seen new discoveries and existing fields produce more oil than originally projected.

- Conservation efforts and new technology could impact the growth in demand for energy products.

Financials: Marketperform

The performance of the financial sector has been impressive over the past year, modestly outpacing the general market, but we continue to believe that chasing the earlier outperformance is not the right course of action, especially given the uncertain, and even at times, seemingly punitive regulatory environment, and are sticking with our marketperform rating on the group for the present time.

There are still risks for the group, although we believe the sector's fundamentals and broader macroeconomic developments help to offset some of those risks. A still accommodative Fed provides financial companies with low borrowing rates on money that they can potentially then lend out at higher rates. And although the spread isn't historically large, the possibility for longer-term interest rates to continue to move higher, while the short end remains anchored by the Fed provides the opportunity for margin expansion. Also, balance sheets of consumers and companies appear to be improving. Corporate cash balances are high and household debt as a percentage of disposable income for consumers has fallen. This has enabled banks to gradually reduce the reserves on their balance sheets for loan losses. And the continued, although slowing, improvement in the housing market should, in our view, bolster financials as they are able to get foreclosed homes off their balance sheets more quickly, although mortgage demand has softened due to the increase in rates over the past several months.

We still have concerns, and chief among them as mentioned above is the regulatory environment. Regulations that limit trading financial institutions can do for themselves, which has been a major profit driver for some companies, remain a concern for us. In fact, the debit card fee limit imposed by the Federal Reserve was found to be too high, a court decision that has the potential to impact lucrative revenue stream. And already-instituted new capital requirements restrict the amount of money banks can lend, limiting profit potential for many of them. Additionally, uncertainty remains over the impact of Dodd-Frank regulations that have been decided on, while there are still more decisions to come.

We maintain relative confidence in the ability of the financial industry to reshape itself and adjust to the changing environment as it has done so many times, but are watching developments in Washington carefully to determine what our next move may be.

Positive factors for the financials sector:

- Most financial institutions have paid back government loans and are increasing share buybacks and dividend payments, illustrating their growing health and stability.

- Recent delinquent loan estimates have decreased among credit card companies, indicating improving balance sheets.

- Lending standards have loosened somewhat, which could help loan volume grow.

- Businesses could increase borrowing, as they take advantage of low rates and look to spend on projects they’ve been . postponing in light of economic and fiscal uncertainty.

Negative factors for the financials sector:

- Rising interest rates could dampen demand for mortgages, which could impact profits in certain areas of the financial sector.

- Government intervention, such as new limits on certain fees that can be charged, has already started to affect the financial industry and could hold back performance for the foreseeable future.

- A new round of foreclosure uncertainty or a push by the Federal government to again loan to higher risk borrowers could pose problems for the financial sector.

Health care: Marketperform

We've liked the health care sector for some time as the fundamentals of the group have remained attractive to us but admit to missing a good move in the group as we remained concerned about the uncertain political environment and the area continues to face political headwinds, leading us to maintain our marketperform rating. Health care continues to be at the center of much political discussion. However, implementing the numerous provisions of the Affordable Care Act still remains under debate and seem to change on a relatively frequent basis—causing some additional volatility in the group.

Containing costs remains a high-profile issue and increased government involvement could mean a more challenging environment for at least some of the space. Until we get a better handle on what impact the current negotiations have on the economy as a whole and the health care sector specifically, we believe a marketperform rating is appropriate.

But it's also important to remember that the political aspect is only one piece to the puzzle and that investors should also look to the overall fundamental picture. In our view, these fundamentals look good as valuations remain decent despite the recent run, balance sheets are solid, the group has good dividend yields, and the overall cost structure appears to have been much improved. And while the fight in Washington is largely on how to pay for health care, there seems to be little debate that there is an increasing demand for health care products and services, which is typically a good sign for an industry.

Finally, we believe the health care sector provides both growth and defensive characteristics, which can be attractive to investor, leading to our relatively positive view of the sector and the possibility that it may regain its outperform rating in the near future.

Positive factors for the health-care sector:

- The aging population could provide a boon for the industry as an increasing number of Americans require more extensive drug treatments and medical care.

- Americans are increasingly obese, which results in a greater need for medical attention due to the myriad of health issues that coincide with obesity.

- Balance sheets in the health-care sector remain flush with cash, boosting the possibility of higher dividend payments, share-enhancing stock buybacks, and mergers and acquisitions.

Negative factors for the health-care sector:

- Government regulation will likely continue to increase during the coming years as an aging population demands intervention in order to theoretically lower their out-of-pocket health-care costs.

- The current and fiscal situation in Washington creates continued uncertainty regarding the group.

- Medicare spending could be reduced as the government seeks to reduce the deficit, which could hurt some of the health care sector.

Industrials: Outperform

Although the global manufacturing picture still appears a bit murky to us at the present time, we continue to believe in our recommendation on the group of outperform. The national ISM Manufacturing Index remained in territory depicting expansion but weakened quite a bit from the previous month. As usual, however, we suggest not paying too much attention to any one number, especially given the weather situation in the US lately, and we believe the trend will return to upward in the near future. Additionally, Europe remains weak but there are some encouraging signs as governments appear to be shifting off of some of the more onerous austerity policies that could help to boost growth and the ECB is finally being more aggressive, while Japan's situation appears to be improving. This somewhat disjointed, but potentially improving picture leads us to believe that an outperform rating is appropriate.

We have concerns, but they are slowly being balanced out as Europe is apparently out of their recession and has made progress on their debt crisis, despite recent flare-ups, China's growth is slow relative to history but they appear to be making structural improvements, India's bureaucracy remains troubling although there are nascent signs of reforms, and US political concerns appear to have lessened as a budget agreement was reached, likely taking the possibility of another government shutdown off the table. We believe corporations have been cautious, but the investment picture appears to be brightening.

We also continue to watch fiscal austerity measures around the world, which could dampen growth in the industrials arena, but as mentioned above do appear to be dialed down at least somewhat, painting a potentially positive picture for industrial stocks.

Positive factors for industrials:

- Corporate balance sheets remain relatively cash rich, which could help push management to invest in new, more-efficient equipment to help offset production losses due to layoffs.

- Lending standards, while still tight, have started to loosen, which should help boost capital spending.

- Inventories in much of the manufacturing area appear relatively low, leading to the possibility of a demand-inspired rebuilding phase.

- Countries are now considering undoing some of their more stringent austerity-related policies, which could help to boost economic activity and demand for industrial goods.

Negative factors for industrials:

- Access to credit remains limited in many cases—among smaller businesses, for example—which tends to dampen spending plans.

- Fiscal austerity, if maintained, could result in slower economic growth and decreased demand for industrial products.

Information technology: Outperform

We've seen signs of a perk up in the relative performance of the tech sector, and we continue to believe that the sector is poised to outperform and reward those investors who are patient. The innovation and entrepreneurial spirit that seems to pervade the tech sector are factors that are sometimes difficult to quantify but make us excited about the future of the sector and push us to have an outperform view on the group.

With large cash balances, increasing dividend payments, solid management in many cases and tight inventory controls, the tech sector appears far more stable than it was in the late-1990s environment that so many still remember. We've been touting this stability as one of the reasons to stick with the group and in fact the sector has outperformed during the past couple of downturns in the market, including the current one, illustrating some of the tech defensiveness we've seen developing. We believe those who remain invested in tech will continue to be rewarded with outperformance in the coming months.

The fundamentals of the group also appeal to us. Companies that have underinvested in technological improvements during the past couple of years appear to be at the point where they need to upgrade equipment. Such investments are typically attractive because they tend to increase companies' efficiency and productivity at all levels.

As a result, companies can produce more with fewer workers—as we're seeing with relatively high productivity numbers but still-high unemployment readings—which allows them to cut back on costs and potentially expand margins.

Additionally, balance sheets in the sector appear solid, with large cash balances and relatively low debt. This enables the group to increase dividends and pursue mergers and acquisitions that might help performance as competition is removed and expenses consolidated. We believe this also helps provide stability to the group, which in turn gives it a certain level of defensiveness mentioned above, contrary to its high-beta history.

Positive factors for information technology:

- Growth in business investment in technology is now outpacing growth in total business investment.

- Real tech investment has been below trend for several years, which could bode well for the future of the sector as spending returns to more normal levels.

- We're starting to see banks loosen lending standards, which could slowly help revive capital investments.

Negative factors for information technology:

- Increasing global competition, especially in areas with low labor costs, will likely continue to compress profit margins.

- We see signs that companies remain hesitant to increase capital spending.

Materials: Marketperform

The materials sector performance has improved modestly as investors seem to be recognizing the improving global economic picture we believe is developing. This is a trend we believe will continue and that marketperformance is the most likely course over the next several months. However, there is still uncertainty surrounding global economic growth with a still tepid at best European environment , Chinese growth that has slowed based on the past several years, and a likely stronger US dollar longer-term that dampens profitability from abroad. With aggressive responses from central banks and a reduction in austerity measures around the world having the potential to improve some of these issues, we are watching the materials group closely, but we continue to believe marketperform is the best place to be at the present time.

Accommodative monetary policy, as we are now seeing in most developed of the globe, has typically been a positive for the materials sector as growth expectations increase. These actions have not resulted in a surge in growth so far, however, but we view these as signs that important central banks around the world are starting to come over to the Fed’s view of bolstering growth. Additionally, we are starting to see a new potentially positive phenomenon as some indebted governments have scaled back on their austerity plans, and are focusing a little more on generating economic growth. This could provide a bit of a tailwind behind the materials sector, warranting a marketperform rating, with an eye toward another upgrade should global improvement take hold .

Positive factors for the materials sector:

- Developing countries continue to need more natural resources to support their infrastructure building.

- Global central banks in the developed world are now largely in easing mode, which should help to support economic activity and the materials sector.

- Some austerity measures seem to be easing, which could help to stimulate growth.

Negative factors for the materials sector:

- Chinese demand for processed commodities might be slowing as technological advances and a build-out of production facilities allow the country to produce more of its own materials. China recently transitioned from a net importer to a net exporter of steel.

- Wage costs are rising in the materials sector as we’ve seen skilled labor shortages in certain segments of the market.

- US dollar strength could undermine the results in the materials sector.

Telecommunications: Underperform

The telecom sector has become increasingly concerning to us and we have been justified with that concern and continue to rate the group at underperfrom. The yield provided by the sector, and traditionally defensive nature of the group, can make it attractive to investors in an environment where income is difficult to come by. But as we've seen recently, when interest rates start to rise, the telecom sector could suffer.

The telecom sector has lost some of its traditional defensive appeal, in our opinion, given that the group has moved much of its business model from the seemingly stable, regulated fixed-line business to the more variable, consumer-dependent wireless arena, while also dealing with an onslaught of competition from a variety of sources. And although consumers are increasingly demanding more wireless services, which could boost revenues, costs remain elevated which could make profitability more difficult.

Generally, many investors apparently do still view telecom as defensive, seeing the remaining fixed-line business as a cushion against variable revenues in less certain times. Additionally, dividend yields in the space have been relatively attractive to income-hungry investors. But we are seeing wage costs, which had been under control, start to rise, while announcements of increases in capital expenditures could reduce margins, causing us some increasing concern.

Competition for increasingly budget-conscious consumers remains fierce, and telecom certainly hasn't been immune to bargain-hunting shoppers, as evidenced by declining pricing power in the space. We're watching developments in this area especially closely given that new products still seem to be enticing consumers to spend, but we wonder how many times the sector can draw from that well.

In contrast to the technology sector, companies in the telecom sector have a lot of debt on their balance sheets, so we continue to view the group with caution as interest rates continue to rise, and we feel comfortable sticking with our lower rating on this group for the time being.

Positive factors for the telecommunications sector:

- Wireless demand appears to be increasing as more communication and media devices move to the wireless arena, although some of that movement is likely to take away from fixed-line revenue.

- The higher dividends typically paid by telecom companies have attracted investors tired of paltry fixed-income yields. But the yield advantage these companies have over the market appears to be diminishing as interest rates have crept higher.

Negative factors for the telecommunications sector:

- Consumer spending on telecom compared to total spending is now falling, which has typically coincided with underperformance for the sector.

- Net profit margins are declining for the telecom sector as competition squeezes margins.

- Capital expenditures in the telecom space are rising as companies look to improve and expand their networks, which could be a burden on profitability in the near future.

- The telecom sector has the highest debt-to-equity ratio of any nonfinancial sector. That could hurt the group in this time of tight credit.

Utilities: Underperform

We have been concerned about stock valuations in the utilities sector for some time as investors chased the relatively higher yields, and we cut the rating to underperform from marketperform. With the underperformance we've seen, valuations have become less of a concern, but we continue to believe the most likely course for the utilities sector in the next several months is more underperformance. Recently, the downturn in interest rates appears to have contributed to some recent outperformance by the group, which we think will be a relatively temporary situation.

The Fed appears to be attempting to make riskier assets more attractive through extremely loose monetary policy, which we believe will make the utilities sector increasingly unattractive to investors. Additionally, should interest rates continue to creep higher with stronger economic growth, the yield characteristics of the utilities sector may become less attractive, leading us to believe an underperform rating is most appropriate.

Certainly, if the economic situation deteriorates, the utilities sector could benefit from a search for perceived safer assets. Additionally, an improving housing market could result in an increase in electricity needs in developing areas, and we’re seeing signs that may be occurring as housing starts have started to creep higher. But we believe these potential positives don't outweigh our concerns and the sentiment shift among investors we believe is now occurring.

Positive factors for the utilities sector:

- Dividend-paying stocks remain attractive as long as yields on conservative fixed-income products remain relatively low. And should economic prospects decline more than currently expected, defensive, dividend-paying stocks could become even more attractive.

Negative factors for the utilities sector:

- Utilization rates of electric and gas utilities have moved down modestly while production has spiked, indicating a potential oversupply issue that could pressure margins.

- Capacity growth has been rising, which has been a sign of underperformance for the sector in the past.

- Accelerating economic growth would likely make the defensive utilities sector less attractive.

- Interest rates should trend higher, making the yield-heavy utilities sector potentially less attractive.

About Schwab Sector Views

Schwab Sector Views were developed by Charles Schwab & Co., Inc.'s ("Schwab's") Investment Strategy Council. Schwab Sector Views are Schwab's outlook on the 10 broad sectors as classified by the widely recognized Global Industry Classification Standard groupings. The GICS structure comprises sectors, industry groups, industries and subindustries. Schwab Sector Views are at the sector level. While Schwab Equity Ratings and Schwab Industry Ratings utilize a disciplined approach that evaluates all stocks (Schwab Equity Ratings) or all industries (Schwab Industry Ratings) in the same manner, Schwab Sector Views uses analytical techniques and methods that vary from sector to sector.

Explanation of columns in the table: The benchmark weights are provided for reference and represent each sector's market capitalization weight in its index.

Schwab Sector Views represent our current outlook on each particular sector. All investors should be well-diversified across all sectors. However, investors who want to tactically overweight or underweight particular sectors may want to consider our three- to six-month relative performance outlook reflected in this column. These views refer only to the domestic equity portion of investors' portfolios.

How should I use Schwab Sector Views?

Investors should generally be well-diversified across all sectors, at or near the respective sector market capitalization weights relative to the overall market (benchmark). However, investors who want to make tactical shifts to those weights with a goal of outperforming the overall market can consider the Schwab Sector Views as a resource. Schwab clients can also use the Stock Screener or Mutual Fund Screener to help identify buy and/or sell stock or mutual fund candidates in particular sectors that they may be underweighted or overweighted in their portfolios.

How to use Schwab Sector Views in conjunction with Schwab Equity Ratings

Sector diversification is an important building block in portfolio construction. Schwab Sector Views are expressed in terms of outperform, marketperform and underperform, and can be particularly helpful in evaluating and monitoring your portfolio composition. Schwab Sector Views can be useful in screening new stock purchases and in identifying portfolio holdings for possible sale. A review of sector weights coupled with individual stock concentration should be a critical measure of equity portfolio diversification. Schwab Equity Ratings provide an objective and powerful approach for helping you select and monitor stocks.

Was this helpful?

15 voted this helpful.3 voted this not helpful.

Subscribe:

Subscribe to Emails (clients only) Subscribe via RSS Download the On Investing® iPad® App

Important Disclosures

Schwab Sector Views do not represent a personalized recommendation of a particular investment strategy to you. You should not buy or sell an investment without first considering whether it is appropriate for you and your portfolio. Additionally, you should review and consider any recent market news.

The Institute for Supply Management (ISM) Manufacturing Index is an index based on surveys of more than 300 manufacturing firms by the Institute of Supply Management. The ISM Manufacturing Index monitors employment, production inventories, new orders and supplier deliveries.

Indexes are unmanaged, do not incur management fees, costs and expenses, and cannot be invested in directly. The table indicates returns based on gross returns. If commissions and other costs are deducted, the performance would be lower. Past performance is no guarantee of future results.

The GICS was developed by and is the exclusive property of Morgan Stanley Capital International Inc. and Standard & Poor's. GICS is a service mark of MSCI and S&P and has been licensed for use by Charles Schwab & Co., Inc.

The Schwab Center for Financial Research is a division of Charles Schwab & Co., Inc.

Diversification strategies do not assure a profit and do not protect against losses in declining markets.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

Thumbs up / down votes are submitted voluntarily by readers and are not meant to suggest the future performance or suitability of any account type, product or service for any particular reader and may not be representative of the experience of other readers. When displayed, thumbs up / down vote counts represent whether people found the content helpful or not helpful and are not intended as a testimonial. Any written feedback or comments collected on this page will not be published. Charles Schwab & Co., Inc. may in its sole discretion re-set the vote count to zero, remove votes appearing to be generated by robots or scripts, or remove the modules used to collect feedback and votes.