Submitted by Caleb McMillan of the Ludwig von Mises Institute of Canada,

Photo: Source

Neil Macdonald of the CBC recently did an investigative piece on central bankers and what they’re doing to the world’s economies. Mark Carney was featured heavily. He told Macdonald, “there is no secret cabal orchestrating things,” despite CBC’s own findings earlier in the program. Central bankers around the world meet in Basel, Switzerland for secretive meetings. Of course, central banks have – and have always had – enormous power that remained more-or-less hidden until 2008. A paradigm shift is occurring where a large number of people (particularly young people) are questioning their assumptions. Some of them are even beginning to read economists like Ludwig von Mises and Murray Rothbard. The “economics” of central bankers can now be revealed for what it truly is: statistical propaganda. Not only is the “Keynesian school” of economics unsound – the entire social science is bunk. Only the Austrian tradition can explain economic phenomena in such a way that makes common sense, scientific. Carney is asking us to trust him. This cannot be done. He is not speaking truth; he is speaking nonsense.

Who is Mark Carney?

Mark Carney: Bank of Canada governor, soon-to-be Bank of England governor. He was born in the Northwest Territories 48 years ago. He graduated from the University of Alberta in Edmonton before studying economics at Harvard and getting his master’s and doctorate from Oxford. He spent 13 years with Goldman Sachs in London, Tokyo, New York and Toronto. He then worked for the Department of Finance under both the Liberal and Conservative governments. He joined the Bank of Canada as a deputy governor before moving on into the top position. This was in 2007, just in time for the bursting of US housing bubble. Like every other central banker in the wake of the crisis, Mark Carney lowered interest rates and helped governments bail out large institutions.

What makes Carney unique is that he bumped up rates by a percent in 2010. Hardly a radical reversal, but it is something the US Federal Reserve has yet to accomplish. Carney got away with it because, at the time, Canadians were not as heavily indebted. The “boom” was still in its infancy. Carney still threatens to raise interest rates, but nobody believes him. All he does is give verbal warnings to Canadians that “taking advantage” of low rates is a bad idea. Despite all those educational institutions under his belt, Mark Carney does not understand human action.

Now he is bailing himself out from Canada’s certain crash and heading across the pond to lead the Bank of England. An already depressed economy, Britain won’t be any better under Carney’s rule alas he dismantles the Bank or at the very least raises interest rates to astronomical levels. Carney won’t do either of those things though because Mark Carney is a Keynesian. That is, the work of John Maynard Keynes influence his decision-making in macroeconomic analysis. This ideological view of society and its economic structure is one where no capital structure exists. Absurd given that nearly all consumer goods need some kind of input of capital stock. Keynesians also have a peculiar view on scarcity – a view that makes no economic sense whatsoever.

Economics

The public tend to have an unfavourable view of economics and economists – and for good reason. “Economics” is as dismal as it sounds; making economic sense is a whole other ball game. For Mark Carney, “economics” resembles something like physics and history. Although Carney would probably concede to the notion that an economy needs entrepreneurs and capital accumulation, his ideology assumes inherent failures in this process that must be corrected by state intervention. In actuality, it is state intervention that inhibits entrepreneurship, savings and investment. Therefore the Bank of Canada publishes nonsense. Their CPI indexes and growth estimates are results of computer models that produce the results they expect. Lately, this method has been failing as economies stagnate where the BoC’s arithmetic predicts growth.

Mark Carney’s economic methodology mimics the “hard” sciences like physics and chemistry. But economics is not a mathematical discipline; it involves agents who have free-will. Making economic sense requires understanding praxeology. Praxeology is the scientific study of human action. It is empirical but not in the sense of quantitative data. Praxeology begins with what we know is true and broadens its horizon through deductive reasoning. Instead of making a hypothesis of what we don’t know and then using empirical testing to validate the hypothesis, praxeology begins with what we do know – such as individuals act on purpose and value is subjective – to build logical constructs. The axioms – and the deductive reasoning built from them – are not trying to “prove” a hypothesis. They are true because of human language and the semiotic sign-systems we use to communicate and validate what’s real. Therefore the logical constructs in praxeological economics don’t need empirical testing since they can be traced to their irrefutable origin.

The Austrian tradition studies economics as understood through praxeology. This method has a long history, starting with the Late Scholastics and revived later by Austrians such as Carl Menger, Eugen Böhm-Bawerk and Ludwig von Mises. It survived the 20th century by a small group of Americans before exploding worldwide via the internet. With this school comes a deeper understanding of how we know. Human perception is a filter of information – five senses experiencing infinite possibilities. Language is crucial for understanding ideas. When individuals communicate we are quickly guessing and making decisions. Guessing if the words correspond to an objective reality and whether to choose those words. The process happens so fast that most of us are unaware of it; we do it instinctively.

Generations of state education have perverted the language to a degree that knowledge from logic is questionable, open to interpretation or deemed utterly unscientific. Bureaucratic schooling demotes common sense to the lowest common denominator. Mark Carney is a product of this conditioning but with a more intellectually rigorous indoctrination from Harvard and Oxford. It’s quite possible that he truly believes in what he’s doing.

Austrian Capital Theory

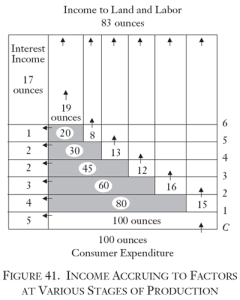

The Austrian School of Economics could in some cases also be called capital-based macroeconomics. Building from the irrefutable axioms that individuals act, value is subjective and the assumption that leisure is valuable good – the Austrians can build an entire framework on the structure of production and interest rates. The most clearest example I’ve ever come across is from Murray Rothbard’s Man, Economy & State. Particularly Figure 41:

This figure is showing an “evenly-rotating economy,” a logical construct where certain things are assumed as to make economic principles more clear. In this economy, Mark Carney would experience reality as if every day were the same as the last. Risk, opportunity and uncertainty cease to exist. People still act – there is interest income, income to land and labour and consumer expenditure. But it is a closed system; everything behaves like clockwork.

On the right-hand side of the figure there are numbers ascending 1-6 starting with C. C is consumption, above it is the first-stage of production, then the second, third, etc. etc. Whereas C may be a nicely cooked t-bone steak, the stages of production are the process in which a cow becomes a steak on your plate. The cow is at the top, 19 ounces of gold to land and labour.

At each stage of production, a capitalist is purchasing capital goods (the shaded blocks) to be transformed by land and labour (the white blocks with numbers 8, 13, 12, 16, 15). For example, at the 1st stage of production a capitalist is purchasing t-bone steaks for 80 ounces, using 15 ounces worth of land and labour to cook it and collecting 5 ounces in interest. 80 + 15 + 5 = 100 ounces, which is what consumers spend on the product. If we trace the t-bone steak back to its nature-given resource we find cows. The capitalist at the fifth stage of production buys a cow for 20 ounces, earns 1 ounce in interest by investing in the 8 ounces (land and labour) required to butcher the cow and sell it to the next capitalist for 30 ounces. At each stage of production, value is added to the goods. This value is determined by the consumers willing to spend 100 ounces on cooked t-bone steak each period.

In Man, Economy & State, Murray Rothbard constructs sound economics step-by-step. Prices, he shows, are determined by individual valuations. This process is evident in this construct which has features to it that are not accidental. 83 ounces to land and labour and 17 ounces in interest equal the 100 ounces on consumer expenditure. While in the real world of uncertainty these price ratios would be constantly changing – the reality of human action keeps the economy heading in the direction of this stationary economy. However the evenly-rotating economy will never arrive due to people’s ever-changing valuations and actions.

Keynesian Logic

Mark Carney’s low interest rates are messing up the production structure. If the Bank of Canada analysed Figure 41, they’d conclude that GDP every period is 100 ounces and driven completely by consumer spending. If the economy were in a slump, the BoC would report that GDP is 100% consumer spending therefore we need consumers to drive us out of recession. But how do they get that GDP figure? By comparing consumption to net investment, where Y= 100 ounces, Y=C+I+G+(X – M).

In this economy, the Keynesian framework would tell central bankers that there’s no investment and that everything is driven purely by consumption. But that’s not true. Consumption is 100 ounces each period, but 318 ounces are being invested. There are 418 ounces spent each period, only 100 are directed to consumption.

Keynesians, if they are intellectually honest, must take this absurdity further. It takes six stages of production to get to this consumer good, but Keynesians would say everybody should consume as much as they can and that will grow the economy. But if all those capitalists at those various stages said “okay, let’s consume more,” and they went to buy t-bone steaks instead of reinvesting, that would a) push up the price of t-bone steaks, and b) create a shortage of t-bone steaks since the capitalists didn’t bother replenishing their capital stocks.

A Keynesian may argue, “but this is good; higher prices entice producers. Bigger, final demand.” But this is nonsensical. There aren’t more goods to go around just because people are spending more. There can only exist what’s actually been produced. If more buyers enter the market and push up the price, we won’t have more goods, just higher prices.

But won’t that stimulate production? No, it can’t because the capitalists invested less in production and more in consumption. There is no way around the physical reality of scarcity. The Keynesian solution is to dilapidate the capital structure by diverting resources out of gross investment and into consumption. Sometimes people change their preferences and consume more in the present and less in the future. This naturally changes interest rates and businesses adjust accordingly. When Mark Carney manually lowers interest rates, he’s leading you to believe that we can get a free lunch.

Carney’s Fallacies Exposed

Neil Macdonald sat down to interview Mark Carney for his CBC report. Although the full interview has yet to be released, it’s evident from excerpts that Mark Carney did not like Macdonald’s reasoning.

Carney says, “There is a logic to some of your questioning which is that wouldn’t it be better if interest rates were really high? … You wanna talk unintended consequences, I’ll give you the intended consequences of that scenario which is let’s get interest rates back to historic levels, so that the money you saved and the return on that in your bank account is going to commence with what you expected.” In other words, let’s make it so your money isn’t losing its purchasing power. Carney continues, “and we have double unemployment in this country, hundreds of thousands of people losing their homes, their businesses because we have deflation.”

Mark Carney’s ideology is illogical: An economy with high unemployment can be fixed by printing money because mass unemployment and mass inflation never occur together. The 1970?s pretty much ended this Keynesian argument until the ’08 crisis revived the monster. The paradox of high unemployment with high inflation is corrected by changing how governments and banks measure inflation. No longer defined by the money supply, inflation in Canada is defined by the Consumer Price Index. A collection of prices of goods chosen by central bankers. Naturally, food and energy prices are excluded. The bias is blatant.

Mark Carney has no capital theory. The effect on savings in a low interest rate environment is to him, “a distributional implication.” Interest rates are an objective expression of individual time preferences – not tools to be wielded. It’s true, high rates will cause immediate recession if not depression, but this is temporary and necessary as the malinvestments liquidate and labour and capital find more productive uses. When savers are no longer punished, economic growth can occur.

In additional footage of his CBC interview, Mark Carney reveals that he really has no idea what he’s talking about. For example: The US Government issues bonds to finance their massive debt. Increasingly, only the Fed is willing to buy them. So the US Federal Reserve is the bond market. They might as well print money and mail a cheque to everyone. But according to Carney, this is a monetary stimulus where the Fed buys all the bonds to encourage investors to go into something risky. Without risk, says Carney, economies don’t grow. “You find risk in lending money to corporates or buying their shares,” he says, “or… by investing in another country.” He doesn’t elaborate much further, simply stating that, “that’s how economies grow and that’s the process by which central banks are trying to restart real growth in the economy.”

The financial crisis, according to Carney, was not a result of a government and central banking interventions. Carney thinks that money – “created in the private sector” – collapsed. By creating new money central banks are merely “leaning into” this collapse of money that threatened a repeat of the Great Depression. When Macdonald asks about central banks causing asset bubbles through quantitative easing, Carney answers in the affirmative. He says, “those are intended consequences, not unintended consequences.”

Conclusion

Mark Carney has no scientific backing to justify his actions. He is in a position that is dangerous and should not exist in a free society. Money is a commodity; not magic wand created by state decree. Is there an exit strategy for the Bank of Canada? What is Mark Carney’s plan to get England out of depression? It looks as if he isn’t too worried. Carney believes that everything depends on how governments act. “People can elect governments that do what they want,” says Carney. Funny, coming from the head of an institution that is supposed to remain independent of government influence.